Steel Fiber Market by Type (Hooked, Straight, Deformed, Crimped), Application (Concrete, Composite, Refractories), Manufacturing Process (Cut Wire/Cold Drawn, Slit Sheet, Melt Extract), and Region - Global Forecast to 2023

The steel fiber market is projected to reach USD 2.52 billion by 2023, at a CAGR of 4.0%. Steel fiber is defined as a distinct, short length of steel that can be randomly and quickly mixed in fresh concrete. Steel fibers are available in hooked, crimped, straight, deformed, or other forms. The selection of the type of steel fiber depends on the specific application. Proper mixing of steel fiber is essential in reinforced concrete. If steel fibers are not evenly distributed in the concrete mixture, the resulting reinforced concrete will lack strength. Proper mixing of the steel fiber is necessary to impart toughness and tensile properties to the reinforced concrete.

Also, the market size of the steel fiber market is projected to be 1,127.2 kilotons by 2023 with a CAGR of 4.0%. The key drivers identified for the steel fiber market are growing infrastructure and supportive government policies. The restraining factor identified is the replacement of steel fibers with synthetic fibers in specific applications and increasing cost. The market for steel fiber is competitive and is mainly dominated by established players. The setting up of a manufacturing unit requires high investment, which makes the entry of new players difficult. The threat of substitutes is high. Some substitute materials are available, which can match steel fibers, in terms of performance and cost.

By application, the concrete reinforcement segment is expected to lead the market.

The market for steel fiber is segmented based on application into concrete reinforcement, composite reinforcement, refractories, and others. The other segment includes vaults, filters, and material plastics. The demand for steel fiber is high in the concrete reinforcement application. The ability to provide high tensile strength to reinforced concrete has led to the increasing demand for steel fiber in the concrete reinforcement application.

By type, the hooked segment is projected to account for the largest share during the forecast period.

The hooked segment will dominate the steel fiber market during the forecast period. Hooked steel fiber is used in concrete reinforcement, which is further used in hydraulic structures, airport and highway paving, industrial floor, refractory concrete, bridge decks, shotcrete linings, and explosion resistant structures. This steel fiber type is affordable and readily available due to its huge demand. Hooked steel fiber substantially enhances initial crack strength and also provides post- crack strength. They form stronger joints, which results in low maintenance.

By manufacturing process, the cut wire/ cold drawn sector is expected to lead the market.

The cut wire/ cold drawn manufacturing process is used widely for manufacturing steel fiber at the global level. In this process, the material is drawn at room temperature. The products manufactured through this process have a polished finish, improved mechanical properties, improvised machining characteristics, and uniform dimensional tolerance. The cold drawn manufacturing process is more accurate and has a better surface finish than hot extruded parts. For this manufacturing process, inexpensive materials can be used for strength requirements. This process is mainly used for manufacturing hooked steel fiber.

APAC to register the highest CAGR during the forecast period.

The steel fiber market has a broad scope of growth in the APAC region. The steel fiber market in APAC is segmented into China, India, Japan, South Korea, Australia & New Zealand, and the Rest of APAC. China, India, and Japan are the fast-growing economies in the region that contribute to the growth of the market. There are multiple large steel fiber manufacturers, which are present in the APAC region, such as Nippon Seisen, Zhejiang Boean Metal Products, Hunan Sunshine Steel Fiber, and Yuthian Zhitai Steel Fiber Manufacturing. The growing construction industry is expected to increase the demand for steel fiber in the region during the forecast period.

Market Dynamics

Driver: Development of infrastructure with supportive government policies

With the development of infrastructure in the emerging and developed economies, the construction of roads and commercial buildings and river banking projects have witnessed tremendous investments. These civil construction projects boost the consumption of steel fiber materials that are durable and cost-effective with long-lasting solutions.

The emerging and developed economies, worldwide, are making significant investments to secure long-term future growth, and their aim toward socio-economic benefits is supporting the growth of the steel fiber market. For example, the Indian government aims to invest in infrastructure projects during 2018–2019. This provides expansion opportunities to companies operating in the steel fiber market and introduces their products as per environmental standards and regulations.

Restraint: Synthetic fibers replacing steel fibers in certain applications

Steel fibers and synthetic fibers have entirely different properties. For airport runways, steel fibers are used, but for individual projects, synthetic fibers are also used. The use of synthetic fibers in airport runways reduces the chances of damaging the airplane tires. Also, certain disadvantages are associated with steel fibers, such as variation in concrete strength and corrosion.

Opportunity: Growing infrastructure in developing countries

Steel fiber finds applications mainly in the infrastructure segment, which is growing in developing countries such as India, China, Brazil, and South Africa. The construction of roads, airport runways, bridges, and canals and other infrastructural projects are increasing, providing opportunities in the steel fiber market growth in these emerging economies. Also, concrete reinforcement, majorly used in construction, will also boost the growth of the steel fiber market. Europe is one of the fastest-growing markets for steel fibers, with numerous infrastructural developments taking place across the region.

Challenge: Difficulty in processing

Steel fibers are manufactured in various diameters according to the requirement. The process of making steel fiber having small diameters is difficult and time-consuming, as the diameter of the steel fiber ranges from 0.001–1.00 mm. In addition, the diameter of these films varies with application. Lesser the diameter of the steel fiber more is the strength of the steel fiber. Manufacturing steel fiber with smaller diameter requires more time, resulting in increasing the overall cost of processing and making the product more expensive. Therefore, steel fibers having less diameter have lower demand.

Steel Fiber Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Million (USD), Kilotons |

|

Segments covered |

Type, Application, Manufacturing Process, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Key market players including, |

The research report categorizes the Steel Fiber Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Type,

- Hooked

- Straight

- Deformed

- Crimped

- Others (glued & irregular)

By Application,

- Concrete reinforcement

- Composite reinforcement

- Refractories

- Others (vaults, filters, and material plastic)

By Manufacturing process,

- Cut Wire/cold drawn

- Slit sheet

- Melt extract

- Mill extract

- Modified cold drawn wire

By Region,

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

-

APAC

- China

- Japan

- India

- Australia & New Zealand

- South Korea

-

Latin America

- Brazil

- Mexico

- Argentina

-

MEA

- Saudi Arabia

- UAE

- South Africa

Key Market Players in Steel Fiber Market

Arcelor Mittal (Luxembourg), Bekaert (Belgium), Fibrometals (Romania), Nippon Seisen (Japan).

Recent Developments

- In August 2017, Arcelor Mittal announced a USD 1 billion three-year investment program for Mexico. After this investment program, the optimized production will be of 5.3 million tons per year.

- In August 2014, Bekaert established a steel plant equipped with mode technology for the manufacturing of steel fiber, under the brand, Dramix. This expansion helped the company cater to increasing demand from the infrastructure and construction industries in Latin America.

- In June 2014, Bekaert has entered into a sales & distributing joint venture with Maccaferi, (Zola Predosa, Italy) on a worldwide basis, except in mainland China & Hong Kong, Argentina, Brazil, Peru, Paraguay, Uruguay. This development has helped the company promote its steel fiber products in underground construction applications.

Critical questions the report answers:

- Which region is the largest and fastest-growing market for steel fiber?

- What are the major strategies adopted by leading market players?

- What are the manufacturing processes used for manufacturing steel fiber?

- How will the market drivers, restraints, and future opportunities affect market dynamics?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of Steel Fiber Market?

With the development of infrastructure in the emerging and developed economies, the construction of roads and commercial buildings and river banking projects have witnessed tremendous investments. These civil construction projects boost the consumption of steel fiber materials that are durable and cost-effective with long-lasting solutions.

How is Steel Fiber different from others?

Steel fiber possesses numerous properties, such as good tensile strength, better crack resistance, improved fatigue strength, higher resistance to spalling, durability, longer useful working life, greater fatigue endurance properties, impact resistance and many other characteristics. Using steel fibers help in delivering significant cost savings, together with reduced material volume, rapid construction, and reduced labor cost.

What are the driving factors of the steel fiber market?

The 3D printing construction’s potential for mass customization and enhanced architectural flexibility, reduction in health & safety risks and also reduction in accidents act as the driving factors for the market.

Why steel fiber processing is difficult?

Steel fibers are manufactured in various diameters according to the requirement. The process of making steel fiber having small diameters is difficult and time-consuming, as the diameter of the steel fiber ranges from 0.001–1.00 mm. In addition, the diameter of these films varies with application. Lesser the diameter of the steel fiber more is the strength of the steel fiber. Manufacturing steel fiber with smaller diameter requires more time, resulting in increasing the overall cost of processing and making the product more expensive. Therefore, steel fibers having less diameter have lower demand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

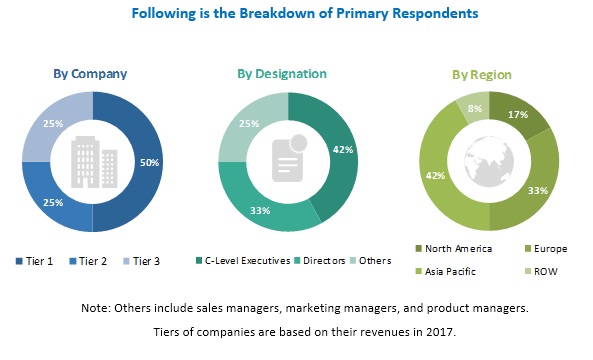

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Steel Fiber Market

4.2 Steel Fiber Market, By Application

4.3 Steel Fiber Market, By Type

4.4 Steel Fiber Market, By Manufacturing Process and Region

4.5 Steel Fiber Market, By Country

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Development of Infrastructure With Supportive Government Policies

5.2.1.2 Superior Properties of Steel Fibers

5.2.2 Restraints

5.2.2.1 Synthetic Fibers Replacing Steel Fibers in Certain Applications

5.2.3 Opportunities

5.2.3.1 Growing Infrastructure in Developing Countries

5.2.4 Challenges

5.2.4.1 Difficulty in Processing

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Steel Fiber Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Hooked Steel Fiber

6.2.1 The Affordability and Easy Availability of Hooked Steel Fiber Drive Its Demand

6.3 Straight Steel Fiber

6.3.1 The Growing Demand for Commercial and Housing Construction is Likely to Propel the Market

6.4 Crimped Steel Fiber

6.4.1 Increasing Construction Activities in China and India are Driving the Demand for Crimped Steel Fiber

6.5 Deformed Steel Fiber

6.5.1 Deformed Steel Fibers Have Low Shrinkage Degree, Which is Boosting their Demand

6.6 Others

7 Steel Fiber Market, By Manufacturing Process (Page No. - 43)

7.1 Introduction

7.2 Cut Wire/ Cold Drawn

7.2.1 Cut Wire/ Cold Drawn is the Most Widely Used ]Manufacturing Process for Steel Fiber

7.3 Slit Sheet

7.3.1 APAC and Europe are the Key Markets for Steel Fiber in the Slit Sheet Segment

7.4 Melt Extract

7.4.1 Increasing Demand for Steel Fiber in Concrete Reinforcement is Driving the Market in This Segment

7.5 Others

8 Steel Fiber Market, By Application (Page No. - 49)

8.1 Introduction

8.2 Concrete Reinforcement

8.2.1 Concrete Reinforcement is the Largest Application of Steel Fiber

8.3 Composite Reinforcement

8.3.1 Stainless Steel Fiber is Widely Used in Composite Reinforcement

8.4 Refractories

8.4.1 High Investments in Manufacturing High Heat-Resistant Flasks Used By Mining and Filtration Industries are Propelling the Market in This Segment

8.5 Others

9 Steel Fiber Market, By Region (Page No. - 55)

9.1 Introduction

9.2 APAC

9.2.1 APAC: Steel Fiber Market, By Country

9.2.1.1 China

9.2.1.1.1 China is the Fastest-Growing Market for Steel Fiber at the Global Level

9.2.1.2 Japan

9.2.1.2.1 High Demand in Concrete Reinforcement Application is Driving the Market in Japan

9.2.1.3 India

9.2.1.3.1 The Concrete Reinforcement Application is Triggering the Demand for Steel Fiber in India

9.2.1.4 Australia & New Zealand

9.2.1.4.1 Increasing Demand From the Construction Industry is Driving the Steel Fiber Market in Australia & New Zealand

9.2.1.5 South Korea

9.2.1.5.1 Increasing Demand From Construction & Infrastructure Industry is Witnessed in the Country

9.3 Europe

9.3.1 Europe: Steel Fiber Market, By Country

9.3.1.1 Germany

9.3.1.1.1 Germany is the Largest Manufacturer of Steel Fiber in Europe

9.3.1.2 Uk

9.3.1.2.1 There is A High Demand for Hooked and Straight Steel Fibers in the Uk

9.3.1.3 France

9.3.1.3.1 The Use of Steel Fiber for Various Applications in the Construction Industry is Triggering the Market

9.3.1.4 Italy

9.3.1.4.1 Italy has A Diversified Construction and Infrastructure Industry

9.3.1.5 Spain

9.3.1.5.1 Spain is an Emerging Country in the European Steel Fiber Market

9.3.1.6 Russia

9.3.1.6.1 The Increasing Use of Steel Fiber in Various Construction Applications is Driving the Market in the Country

9.4 North America

9.4.1 North America: Steel Fiber Market, By Type

9.4.1.1 US

9.4.1.1.1 US Dominates the Steel Fiber Market in North America

9.4.1.2 Canada

9.4.1.2.1 Growth in Construction Industry is Driving the Market

9.5 Latin America

9.5.1 Latin America: Steel Fiber Market, By Country

9.5.1.1 Brazil

9.5.1.1.1 Brazil Dominates the Steel Fiber Market in Latin America

9.5.1.2 Mexico

9.5.1.2.1 The Market in Mexico is Projected to Witness High Growth

9.5.1.3 Argentina

9.5.1.3.1 Argentina is the Fastest-Growing Steel Fiber Market in Latin America

9.6 MEA

9.6.1 MEA: Steel Fiber Market, By Country

9.6.1.1 Saudi Arabia

9.6.1.1.1 Saudi Arabia is the Fastest-Growing Steel Fiber Market in the MEA

9.6.1.2 UAE

9.6.1.2.1 UAE is A Fast-Growing Steel Fiber Market in the MEA

9.6.1.3 South Africa

9.6.1.3.1 South Africa is A Prominent Steel Fiber Market

10 Competitive Landscape (Page No. - 76)

10.1 Introduction

10.2 Competitive Scenario

10.2.1 Expansion

10.2.2 Joint Venture

11 Company Profiles (Page No. - 78)

(Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View)*

11.1 Arcelor Mittal

11.2 Bekaert

11.3 Fibro Metals

11.4 Nippon Seisen

11.5 Zhejiang Boean Metal Products

11.6 Green Steel Group

11.7 Spajic Doo

11.8 Hunan Sunshine Steel Fiber

11.9 Yutian Zhitai Steel Fiber Manufacturing

11.10 R. Stat

*Details on Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Companies

11.11.1 Stewols India

11.11.2 Precision Drawell

11.11.3 Fibre Zone

11.11.4 Nikko Techno

11.11.5 Nycon

11.11.6 Heng Yang Steel Fiber

11.11.7 Kasturi Metal Composites

11.11.8 M & J International

11.11.9 Bakul Castings

11.11.10 International Steel Wool Corporation

11.11.11 Propex Operating Company

11.11.12 Perfect Solution

11.11.13 Remix Steel Fiber

11.11.14 Intramicron

11.11.15 Sunny Metal

12 Appendix (Page No. - 98)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (65 Tables)

Table 1 Steel Fiber Market Size, 2016–2023

Table 2 Steel Fiber Market Size, By Type, 2016-2023 (USD Million)

Table 3 Steel Fiber Market Size, By Type, 2016-2023 (Kiloton)

Table 4 Hooked Steel Fiber Market Size, By Region, 2016-2023 (Kiloton)

Table 5 Hooked Steel Fiber Market Size, By Region, 2016-2023 (USD Million)

Table 6 Straight Steel Fiber Market Size, By Region, 2016-2023 (Kiloton)

Table 7 Straight Steel Fiber Market Size, By Region, 2016-2023 (USD Million)

Table 8 Crimped Steel Fiber Market Size, By Region, 2016-2023 (Kiloton)

Table 9 Crimped Steel Fiber Market Size, By Region, 2016-2023 (USD Million)

Table 10 Deformed Steel Fiber Market Size, By Region, 2016-2023 (Kiloton)

Table 11 Deformed Steel Fiber Market Size, By Region, 2016-2023 (USD Million)

Table 12 Other Steel Fibers Market Size, By Region, 2016-2023 (Kiloton)

Table 13 Other Steel Fibers Market Size, By Region, 2016-2023 (USD Million)

Table 14 Steel Fiber Market Size, By Manufacturing Process, 2016-2023 (Kiloton)

Table 15 Steel Fiber Market Size, By Manufacturing Process, 2016-2023 (USD Million)

Table 16 Cut Wire/ Cold Drawn Market Size for Steel Fiber, By Region, 2016-2023 (Kiloton)

Table 17 Cut Wire/ Cold Drawn Market Size for Steel Fiber, By Region, 2016-2023 (USD Million)

Table 18 Slit Sheet Market Size for Steel Fiber, By Region, 2016-2023 (Kiloton)

Table 19 Slit Sheet Market Size for Steel Fiber, By Region, 2016-2023 (USD Million)

Table 20 Melt Extract Market Size for Steel Fiber, By Region, 2016-2023 (Kiloton)

Table 21 Melt Extract Market Size for Steel Fiber, By Region, 2016-2023 (USD Million)

Table 22 Steel Fiber Market Size in Others Segment, By Region, 2016-2023 (Kiloton)

Table 23 Steel Fiber Market Size in Others Segment, By Region, 2016-2023 (USD Million)

Table 24 Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 25 Steel Fiber Market Size, By Application, 2016–2023 (USD Million)

Table 26 Steel Fiber Market Size in Concrete Reinforcement Application, By Region, 2016–2023 (Kiloton)

Table 27 Steel Fiber Market Size in Concrete Reinforcement Application, By Region, 2016–2023 (USD Million)

Table 28 Steel Fiber Market Size in Composite Reinforcement Application, By Region, 2016–2023 (Kiloton)

Table 29 Steel Fiber Market Size in Composite Reinforcement Application, By Region, 2016–2023 (USD Million)

Table 30 Steel Fiber Market Size in Refractories Application, By Region, 2016–2023 (Kiloton)

Table 31 Steel Fiber Market Size in Refractories Application, By Region, 2016–2023 (USD Million)

Table 32 Steel Fiber Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 33 Steel Fiber Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 34 APAC: Steel Fiber Market Size, By Type, 2016–2023 (Kiloton)

Table 35 APAC: Steel Fiber Market Size, By Type, 2016–2023 (USD Million)

Table 36 APAC: Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 37 APAC: Steel Fiber Market Size, By Application, 2016–2023 (USD Million)

Table 38 APAC: Steel Fiber Market Size, By Country, 2016–2023 (Kiloton)

Table 39 APAC: Steel Fiber Market Size, By Country, 2016–2023 (USD Million)

Table 40 Europe: Steel Fiber Market Size, By Type, 2016–2023 (Kiloton)

Table 41 Europe: Steel Fiber Market Size, By Type, 2016–2023 (USD Million)

Table 42 Europe: Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 43 Europe: Steel Fiber Market Size, By Application, 2016–2023 (USD Million)

Table 44 Europe: Steel Fiber Market Size, By Country, 2016–2023 (Kiloton)

Table 45 Europe: Steel Fiber Market Size, By Country, 2016–2023 (USD Million)

Table 46 North America: Steel Fiber Market Size, By Type, 2016–2023 (Kiloton)

Table 47 North America: Steel Fiber Market Size, By Type, 2016–2023 (USD Million)

Table 48 North America: Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 49 North America: Steel Fiber Market Size, By Application,2016–2023 (USD Million)

Table 50 North America: Steel Fiber Market Size, By Country, 2016–2023 (Kiloton)

Table 51 North America: Steel Fiber Market Size, By Country, 2016–2023 (USD Million)

Table 52 Latin America: Steel Fiber Market Size, By Type, 2016–2023 (Kiloton)

Table 53 Latin America: Steel Fiber Market Size, By Type, 2016–2023 (USD Million)

Table 54 Latin America: Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 55 Latin America: Steel Fiber Market Size, By Application, 2016–2023 (USD Million)

Table 56 Latin America: Steel Fiber Market Size, By Country, 2016–2023 (Kiloton)

Table 57 Latin America: Steel Fiber Market Size, By Country, 2016–2023 (USD Million)

Table 58 MEA: Steel Fiber Market Size, By Type, 2016–2023 (Kiloton)

Table 59 MEA: Steel Fiber Market Size, By Type, 2016–2023 (USD Million)

Table 60 MEA: Steel Fiber Market Size, By Application, 2016–2023 (Kiloton)

Table 61 MEA: Steel Fiber Market Size, By Application, 2016–2023 (USD Million)

Table 62 MEA: Steel Fiber Market Size, By Country, 2016–2023 (Kiloton)

Table 63 MEA: Steel Fiber Market Size, By Country, 2016–2023 (USD Million)

Table 64 Expansion, 2014–2018

Table 65 Joint Venture, 2014–2018 77

List of Figures (37 Figures)

Figure 1 Steel Fiber Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Steel Fiber Market: Data Triangulation

Figure 5 Concrete Reinforcement Was the Leading Application of Steel Fiber in 2017

Figure 6 Hoooked Steel Fiber to Register Highest Cagr in Overall Steel Fiber Market

Figure 7 Cut Wire/Cold Drawn Manufacturing Process Accounted for the Largest Share of the Overall Market in 2017

Figure 8 China is Expected to Register the Highest Cagr

Figure 9 APAC to Register the Highest Cagr

Figure 10 Growth of Construction Industry Projected to Drive the Steel Fiber Market Between 2018 and 2023

Figure 11 Concrete Reinforcement to Lead the Overall Steel Fiber Market

Figure 12 Hooked Segment to Dominate the Overall Steel Fiber Market

Figure 13 Cut Wire/Cold Drawn Accounted for the Maximum Share of the Steel Fiber Market

Figure 14 China to Register Highest Cagr in the Steel Fiber Market

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Steel Fiber Market

Figure 16 Steel Fiber Market: Porter’s Five Forces Analysis

Figure 17 Hooked Segment to Lead the Steel Fiber Market

Figure 18 Cut Wire/ Cold Drawn to Be the Leading Manufacturing Process for Steel Fiber

Figure 19 APAC to Lead the Market in the Cut Wire/ Cold Drawn Segment

Figure 20 Concrete Reinforcement Application to Dominate the Steel Fiber Market

Figure 21 China to Be the Fastest-Growing Steel Fiber Market

Figure 22 APAC: Steel Fiber Market Snapshot

Figure 23 Europe: Steel Fiber Market Snapshot

Figure 24 North America: Steel Fiber Market Snapshot

Figure 25 Brazil is the Largest Steel Fiber Market in Latin America

Figure 26 UAE to Be the Largest Steel Fiber Market in MEA

Figure 27 Companies Adopted Acquisition as the Key Growth Strategy Between 2014 and 2018

Figure 28 Arcelor Mittal: Company Snapshot

Figure 29 Arcelor Mittal: Swot Analysis

Figure 30 Bekaert: Company Snapshot

Figure 31 Bekaert: Swot Analysis

Figure 32 Fibro Metals: Company Snapshot

Figure 33 Fibro Metals: Swot Analysis

Figure 34 Nippon Seisen: Company Snapshot

Figure 35 Nippon Seisen: Swot Analysis

Figure 36 Zhejiang Boean Metal Products: Swot Analysis

Figure 37 Green Steel Group: Swot Analysis

The study involved four major activities to estimate the current market size for steel fiber market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; fiber reinforced concrete association; regulatory bodies; trade directories; and databases.

Primary Research

The steel fiber market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, users, and regulatory organizations. The demand side of this market is characterized by the development of infrastructure, construction, and textile industries. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the steel fiber market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players in the industry are identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, are determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns are determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the market.

Report Objectives

- To define, describe and forecast the market size of steel fiber market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To estimate the steel fiber market size based on type, application, and manufacturing process

- To analyze significant regional trends in Asia Pacific (APAC), North America, Europe, Latin America, and the Middle East & Africa (MEA) and specific trends in major countries of these regions

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze recent market developments such as expansions and joint ventures in the steel fiber market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe steel fiber market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Steel Fiber Market