Stem Cell Therapy Market by Type (Allogeneic, Autologous), Cell Source (Adipose Tissue-derived MSC, Bone Marrow, Placenta/Umbilical Cord), Therapeutic Application (Musculoskeletal, Wounds, Surgeries, Cardiovascular, Neurological) & Region - Global Forecast to 2027

Updated on : April 17, 2023

The global stem cell therapy market in terms of revenue was estimated to be worth $257 million in 2022 and is poised to reach $558 million by 2027, growing at a CAGR of 16.8% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is driven mainly by factors such as robust funding for stem cell research, an increase in the number of cell therapy production facilities that have GMP certification, and growth in the number of clinical trials associated with stem cell therapies. The surge in the expanding number of clinical trials is further triggered by the COVID-19 pandemic, with a vast number of clinical trials studying the potential of stem cell therapies in the treatment of SARS-CoV-2 infection.

To know about the assumptions considered for the study, Request for Free Sample Report

Stem Cell Therapy Market Dynamics

Driver: Availability of funding for stem cell research

Stem cell research funding has strengthened in the past few years, attributed to the need for novel therapeutic interventions in patients with cardiovascular, neurological, and autoimmune disorders. The NIH funding for stem cell research reached its highest peak in 2018 and has shown a year-on-year growth of more than 5% in the stem cell research funding each year. This trend is expected to continue with the increase in funding initiatives announced in 2021. For instance, in September 2021, the California Institute for Regenerative Medicine granted a grant of USD 31 million to Stanford Research for launching first-in-human trials of stem cells in the treatment of heart failure, stroke, and spinal cord tumours.

Restraint: Ethical concerns related to embryonic stem cells

Studies exploring the therapeutic potential of embryonic stem cells (ESC) are associated with various ethical issues attributed to the destruction of human embryos. Lack of proper federal policies that define what can be funded in embryo-based stem cell research or therapy development may restrain the market's expansion in the future to a certain extent. In addition, the complexities of regulations in this area require federal guidelines that can support researchers, scientists, and pharmaceutical companies to develop ESC therapy and further facilitate its commercialization.

The allogeneic stem cell therapy accounted for the largest share of the stem cell therapy market

The market is segmented into allogeneic and autologous stem cell therapies based on type. The allogeneic stem cell therapy segment accounted for the largest share of this market. Comparatively fewer complications are associated with the development and manufacturing of allogeneic stem cell therapies, which is the key attributive reason for their largest share in the market. This has also led to an increase in the number of clinical trials regarding the development of allogeneic stem cell therapies, making it the fastest growing segment during the forecast period.

The adipose tissue-derived stem cell segment dominated the stem cell therapy market.

Based on cell source, the market is segmented into adipose tissue-derived MSCs (mesenchymal stem cells), placental/umbilical cord-derived MSCs, bone marrow-derived MSCs, and other sources. In 2021, the adipose tissue-derived stem cells segment dominated stem cell therapy with the highest revenue share, which was attributed to the growing adoption of these MSCs across different therapeutic indications. Their adoption is propelled by associated advantages such as simple isolation procedures, minimally invasive methods used to ease the harvesting procedure, and a comparatively better capacity for proliferation.

The musculoskeletal disorders segment has generated highest revenue in the stem cell therapy market.

Based on therapeutic application, the market is segmented into musculoskeletal disorders, cardiovascular diseases, wounds and injuries, neurological disorders, surgeries, inflammatory and autoimmune diseases, and other therapeutic applications. The musculoskeletal disorders therapeutic application segment generated the highest revenue in 2021. The high prevalence of musculoskeletal disorders such as osteoarthritis, along with growing demand for regenerative medicine in orthopaedic and sports medicine applications, is the key contributing factor to the revenue of this share.

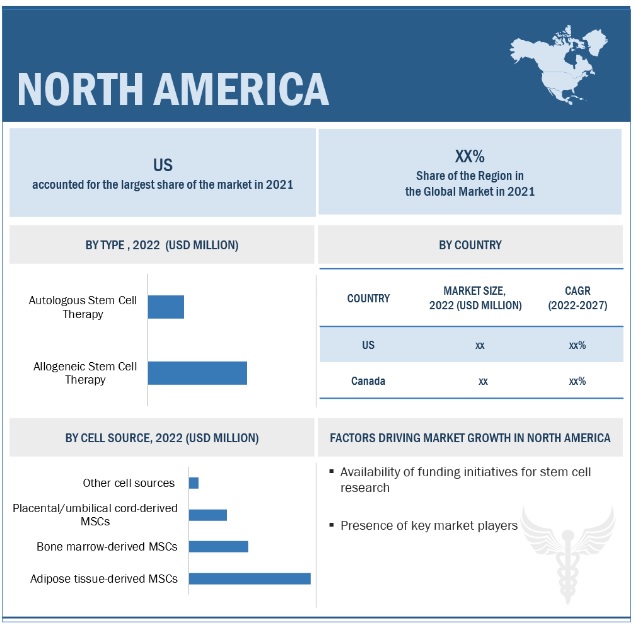

North America was the largest region for stem cell therapy market.

Geographically, the market is segmented into North America, Europe, Asia Pacific, and RoW (the rest of the world). In 2021, the global market was dominated by the North America region, and this dominance is anticipated to continue throughout the forecast period. The US has emerged as the key revenue contributor to this region, with robust public-private funding to develop novel stem cell therapy products.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the stem cell therapy market include Smith+Nephew (UK), MEDIPOST Co., Ltd. (South Korea), Anterogen.Co., Ltd. (South Korea), CORESTEM (South Korea), Pharmicell Inc. (South Korea), NuVasive, Inc. (US), RTI Surgical (US), AlloSource (US), JCR Pharmaceuticals Co., Ltd. (Japan), Takeda Pharmaceutical Company Limited (Japan), Holostem Terapie Avanzate Srl (Italy), Orthofix (US), Regrow Biosciences Pvt Ltd. (India), and STEMPEUTICS RESEARCH PVT LTD. (India).

Stem Cell Therapy Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$257 million |

|

Projected Revenue by 2027 |

$558 million |

|

Revenue Rate |

Poised to grow at a CAGR of 16.8% |

|

Market Driver |

Availability of funding for stem cell research |

|

Market Opportunity |

Growing demand for cell & gene therapies |

This report categorizes the stem cell therapy market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Allogeneic Stem Cell Therapy

- Autologous Stem Cell Therapy

By Cell Source

- Adipose tissue-derived MSCs (mesenchymal stem cells),

- Bone marrow-derived MSCs,

- Placental/umbilical cord-derived MSCs, and

- Other Cell Sources

By Therapeutic Application

- Musculoskeletal Disorders

- Wounds & Injuries

- Cardiovascular Diseases

- Surgeries

- Inflammatory & Autoimmune Diseases

- Neurological Disorders

- Other Therapeutic Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments:

- In July 2022, CORESTEM (South Korea) continued enrolling participants for the Phase 3 clinical trial of NeuroNata-R. This therapy has received conditional approval for treating ALS patients in South Korea

- In September 2020, Stemedica Cell Technologies received investigational new drug (IND) approval from the US FDA for intravenous allogeneic mesenchymal stem cells (MSCs) to treat moderate to severe COVID-19.

- In August 2020, Pluristem Israel) collaborated with Abu Dhabi Stem Cells Center (UAE) to develop stem cell therapies for COVID-19 treatment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global stem cell therapy market?

The global stem cell therapy market boasts a total revenue value of $558 million by 2027.

What is the estimated growth rate (CAGR) of the global stem cell therapy market?

The global market for stem cell therapy has an estimated compound annual growth rate (CAGR) of 16.8% and a revenue size in the region of $257 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 STEM CELL THERAPY MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: GLOBAL MARKET

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF GLOBAL MARKET PLAYERS

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2021

FIGURE 6 AVERAGE MARKET SIZE ESTIMATION, 2021

2.3 GROWTH FORECAST

FIGURE 7 GLOBAL MARKET: CAGR PROJECTIONS (2022–2027)

FIGURE 8 GLOBAL MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 PRIMARY INSIGHTS

FIGURE 11 MARKET VALIDATION FROM PRIMARY EXPERTS

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 12 STEM CELL THERAPY MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY CELL SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY THERAPEUTIC APPLICATION, 2022 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 STEM CELL THERAPY MARKET OVERVIEW

FIGURE 16 INCREASING INVESTMENTS & FUNDING INITIATIVES FOR STEM CELL RESEARCH TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET

FIGURE 17 ALLOGENEIC STEM CELL THERAPY TO COMMAND LARGEST SHARE IN 2021

4.3 NORTH AMERICA: MARKET, BY CELL SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 18 BONE MARROW-DERIVED MSCS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

FIGURE 19 MARKET DYNAMICS: DRIVERS, OPPORTUNITIES, RESTRAINTS, AND CHALLENGES

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Availability of funding for stem cell research

TABLE 1 ICMR FUNDING FOR STEM CELL RESEARCH, 2019–2021 (USD)

FIGURE 20 STEM CELL RESEARCH FUNDING IN LAST 10 YEARS

TABLE 2 NIH FUNDING FOR CELL-BASED RESEARCH, 2016–2021 (USD MILLION)

5.2.1.2 Increasing GMP certification approvals for cell therapy production facilities

TABLE 3 NEW GMP FACILITIES, 2017-2020

5.2.1.3 Increasing clinical trials for stem cell-based therapies

FIGURE 21 NUMBER OF CLINICAL TRIALS (2015-2020)

FIGURE 22 CLINICAL TRIALS, BY PHASE

5.2.2 RESTRAINTS

5.2.2.1 Ethical concerns related to embryonic stem cells

5.2.2.2 High cost of cell-based research

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of iPSCs as an alternative to ESCs

5.2.3.2 Growing demand for cell & gene therapies

5.2.4 CHALLENGES

5.2.4.1 Technical limitations associated with manufacturing processes

5.3 TECHNOLOGY ANALYSIS

TABLE 4 STEM CELL THERAPIES AND GENE THERAPIES

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF GLOBAL MARKET

5.5 ROLE IN ECOSYSTEM

FIGURE 24 ECOSYSTEM MARKET MAP

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS OF GLOBAL MARKET

TABLE 5 SUPPLY CHAIN ANALYSIS: COMMERCIAL SCALE/KEY MANUFACTURERS

TABLE 6 SUPPLY CHAIN ANALYSIS: PIPELINE/EMERGING MANUFACTURERS

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITION RIVALRY

5.8 REGULATORY LANDSCAPE

5.8.1 NORTH AMERICA

TABLE 7 NORTH AMERICA: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

5.8.2 EUROPE

TABLE 8 EUROPE: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

5.8.3 ASIA PACIFIC

TABLE 9 ASIA PACIFIC: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

5.8.4 REST OF THE WORLD

TABLE 10 ROW: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

5.9 PRICING ANALYSIS

5.9.1 PRICING ANALYSIS

TABLE 11 AVERAGE SELLING PRICES OF KEY PLAYERS

5.9.2 AVERAGE SELLING PRICE TREND – STEM CELL THERAPY TREATMENT

5.10 PATENT ANALYSIS

FIGURE 26 PATENT ANALYSIS OF STEM CELL THERAPIES IN LAST 10 YEARS (2011-2020)

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

5.11.1 STEM CELL THERAPY CONFERENCES (2022–2023)

TABLE 12 STEM CELL THERAPY CONFERENCES (2022–2023)

5.12 DISRUPTIONS & TRENDS IMPACTING CUSTOMERS’ BUSINESSES

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 27 KEY STAKEHOLDERS IN GLOBAL MARKET

FIGURE 28 KEY BUYING CRITERIA FOR END USERS

FIGURE 29 REVENUE SHIFT & NEW POCKET FOR STEM CELL THERAPY COMPANIES

6 STEM CELL THERAPY MARKET, BY TYPE (Page No. - 70)

6.1 INTRODUCTION

TABLE 13 GLOBAL MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 ALLOGENEIC STEM CELL THERAPY

6.2.1 FAVORABLE SCALING UP OF PRODUCTION PROCESSES TO DRIVE SEGMENT

TABLE 14 ALLOGENEIC STEM CELL THERAPY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 15 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 16 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 AUTOLOGOUS STEM CELL THERAPY

6.3.1 LOW RISK OF POST-TREATMENT COMPLICATIONS TO DRIVE SEGMENT

TABLE 18 AUTOLOGOUS STEM CELL THERAPY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 21 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 STEM CELL THERAPY MARKET, BY CELL SOURCE (Page No. - 75)

7.1 INTRODUCTION

TABLE 22 GLOBAL MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

7.2 ADIPOSE TISSUE-DERIVED MSCS

7.2.1 PROPERTIES SUCH AS SIMPLIFIED HARVESTING & EASE OF ISOLATION TO DRIVE MARKET

TABLE 23 GLOBAL MARKET FOR ADIPOSE TISSUE-DERIVED MSCS, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET FOR ADIPOSE TISSUE-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 EUROPE: MARKET FOR ADIPOSE-TISSUE DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 ASIA PACIFIC: MARKET FOR ADIPOSE-TISSUE DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 BONE MARROW-DERIVED MSCS

7.3.1 HIGH PREVALENCE OF METABOLIC DISORDERS TO DRIVE MARKET

TABLE 27 GLOBAL MARKET FOR BONE MARROW-DERIVED MSCS, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET FOR BONE MARROW-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 EUROPE: MARKET FOR BONE MARROW-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 ASIA PACIFIC: MARKET FOR BONE MARROW-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 PLACENTA/UMBILICAL CORD-DERIVED MSCS

7.4.1 LOWER CHANCES OF IMMUNE REJECTION TO SUPPORT MARKET

TABLE 31 GLOBAL MARKET FOR PLACENTA/UMBILICAL CORD-DERIVED MSCS, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET FOR PLACENTA/UMBILICAL CORD-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 EUROPE: MARKET FOR PLACENTA/UMBILICAL CORD-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: MARKET FOR PLACENTA/UMBILICAL CORD-DERIVED MSCS, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 OTHER CELL SOURCES

TABLE 35 GLOBAL MARKET FOR OTHER CELL SOURCES, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2020–2027 (USD MILLION)

8 STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION (Page No. - 84)

8.1 INTRODUCTION

TABLE 39 GLOBAL MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

8.2 MUSCULOSKELETAL DISORDERS

8.2.1 RISING INCIDENCE OF OSTEOARTHRITIS TO DRIVE MARKET

TABLE 40 GLOBAL MARKET FOR MUSCULOSKELETAL DISORDERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 WOUNDS & INJURIES

8.3.1 GROWING BENEFITS OF ALLOGENEIC-BASED THERAPIES TO SUPPORT MARKET GROWTH

TABLE 44 GLOBAL MARKET FOR WOUNDS & INJURIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET FOR WOUNDS & INJURIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: MARKET FOR WOUNDS & INJURIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET FOR WOUNDS & INJURIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 INFLAMMATORY & AUTOIMMUNE DISEASES

8.4.1 INCREASING CLINICAL TRIALS FOR BONE MARROW-DERIVED MSCS TO SUPPORT MARKET GROWTH

TABLE 48 GLOBAL MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET FOR INFLAMMATORY & INFLAMMATORY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 SURGERIES

8.5.1 GROWING CLINICAL RESEARCH FOR SURGICAL APPLICATIONS TO SUPPORT MARKET GROWTH

TABLE 52 GLOBAL MARKET FOR SURGERIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET FOR SURGERIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: MARKET FOR SURGERIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET FOR SURGERIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 CARDIOVASCULAR DISEASES

8.6.1 RISING DEMAND FOR CVD TREATMENTS TO SUPPORT MARKET GROWTH

TABLE 56 GLOBAL MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

8.7 NEUROLOGICAL DISORDERS

8.7.1 RISING PREVALENCE OF NEUROGENERATIVE DISORDERS TO SUPPORT MARKET GROWTH

TABLE 60 GLOBAL MARKET FOR NEUROLOGICAL DISORDERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

8.8 OTHER THERAPEUTIC APPLICATIONS

TABLE 64 STEM CELL THERAPY FOR OTHER THERAPEUTIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: STEM CELL THERAPY FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 STEM CELL THERAPY MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

TABLE 68 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Rising approvals for stem cell therapy products to drive market

FIGURE 31 NIH FUNDING IN LAST 10 YEARS (2011–2021)

TABLE 73 US: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 74 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 US: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing government focus on targeted stem cell therapy treatment to drive market

TABLE 76 CANADA: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 77 CANADA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 CANADA: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 79 EUROPE: STEM CELL THERAPY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Strong R&D base and growing focus on minimally invasive treatments to drive market

TABLE 83 GERMANY: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Rising adoption of cell-based therapies to drive market

TABLE 86 UK: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 87 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 UK: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Rising healthcare expenditure to support uptake of stem cell therapy products

TABLE 89 FRANCE: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 92 REST OF EUROPE: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Growing geriatric population and rapid regulatory processes to drive market

TABLE 98 JAPAN: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 99 JAPAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 JAPAN: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.4.2 SOUTH KOREA

9.4.2.1 Favorable government support for stem cell therapy products to support market growth

TABLE 101 SOUTH KOREA: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 102 SOUTH KOREA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 SOUTH KOREA: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising cases of neurodegenerative disorders drive market

TABLE 104 INDIA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 105 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 INDIA: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 107 REST OF ASIA PACIFIC: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 108 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 REST OF ASIA PACIFIC: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 110 REST OF THE WORLD: MARKET, BY CELL SOURCE, 2020–2027 (USD MILLION)

TABLE 111 REST OF THE WORLD: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 122)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

FIGURE 33 STEM CELL THERAPY MARKET: STRATEGIES ADOPTED

10.3 REVENUE SHARE ANALYSIS

10.4 MARKET SHARE ANALYSIS (2021)

10.5 COMPANY EVALUATION QUADRANT (KEY MARKET PLAYERS)

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 36 GLOBAL MARKET: COMPANY EVALUATION QUADRANT FOR APPROVED PRODUCTS (2021)

10.6 COMPETITIVE BENCHMARKING

10.6.1 GLOBAL MARKET: A DETAILED LIST OF STARTUPS/SMES

TABLE 113 GLOBAL MARKET: DETAILED LIST OF STARTUPS/SMES

10.6.2 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS [STARTUPS/SMES)

TABLE 114 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS [STARTUPS/SMES]

10.7 COMPANY EVALUATION QUADRANT (SMES/START-UPS)

10.7.1 PROGRESSIVE COMPANIES

10.7.2 STARTING BLOCKS

10.7.3 RESPONSIVE COMPANIES

10.7.4 DYNAMIC COMPANIES

FIGURE 37 GLOBAL MARKET: COMPANY EVALUATION QUADRANT FOR PRODUCTS UNDER PIPELINE (2021)

10.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 115 COMPANY PRODUCT FOOTPRINT

10.9 COMPANY FOOTPRINT OF MAJOR PLAYERS

TABLE 116 COMPANY REGIONAL FOOTPRINT

10.10 COMPETITIVE SCENARIO

TABLE 117 GLOBAL MARKET: REGULATORY APPROVALS

TABLE 118 STEM CELL THERAPY MARKET: DEALS

11 COMPANY PROFILES (Page No. - 135)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 SMITH+NEPHEW

TABLE 119 SMITH+NEPHEW: BUSINESS OVERVIEW

FIGURE 38 SMITH+NEPHEW: COMPANY SNAPSHOT (2021)

TABLE 120 SMITH+NEPHEW: PRODUCT OFFERINGS

TABLE 121 SMITH+NEPHEW: DEALS

11.1.2 MEDIPOST CO., LTD.

TABLE 122 MEDIPOST CO., LTD: BUSINESS OVERVIEW

FIGURE 39 MEDIPOST CO., LTD: COMPANY SNAPSHOT (2019)

TABLE 123 MEDIPOST CO., LTD: PRODUCT OFFERINGS

TABLE 124 MEDIPOST CO., LTD: PRODUCT APPROVALS

TABLE 125 MEDIPOST CO., LTD: DEALS

TABLE 126 MEDIPOST CO., LTD: OTHERS

TABLE 127 MEDIPOST CO., LTD: REGULATORY APPROVALS AND PATENTS

11.1.3 JCR PHARMACEUTICALS CO., LTD.

TABLE 128 JCR PHARMACEUTICALS CO., LTD: BUSINESS OVERVIEW

FIGURE 40 JCR PHARMACEUTICALS CO., LTD: COMPANY SNAPSHOT (2021)

TABLE 129 JCR PHARMACEUTICALS CO., LTD: PRODUCT OFFERINGS

11.1.4 TAKEDA PHARMACEUTICAL COMPANY LIMITED

TABLE 130 TAKEDA PHARMACEUTICAL COMPANY LIMITED: BUSINESS OVERVIEW

FIGURE 41 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2021)

TABLE 131 TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCT OFFERINGS

TABLE 132 TAKEDA PHARMACEUTICAL COMPANY LIMITED: EXPANSIONS

TABLE 133 TAKEDA PHARMACEUTICAL COMPANY LIMITED: REGULATORY APPROVALS

11.1.5 ANTEROGEN. CO., LTD.

TABLE 134 ANTEROGEN CO., LTD: BUSINESS OVERVIEW

TABLE 135 ANTEROGEN CO., LTD: PRODUCT OFFERINGS

11.1.6 CORESTEM

TABLE 136 CORESTEM: BUSINESS OVERVIEW

TABLE 137 CORESTEM: PRODUCT OFFERINGS

TABLE 138 CORESTEM: REGULATORY APPROVALS

11.1.7 PHARMICELL CO., LTD.

TABLE 139 PHARMICELL CO., LTD.: BUSINESS OVERVIEW

TABLE 140 PHARMICELL CO., LTD.: PRODUCT OFFERINGS

TABLE 141 PHARMICELL CO., LTD.: DEALS

11.1.8 NUVASIVE, INC.

TABLE 142 NUVASIVE, INC: BUSINESS OVERVIEW

FIGURE 42 NUVASIVE, INC: COMPANY SNAPSHOT (2021)

TABLE 143 NUVASIVE, INC.: PRODUCT OFFERINGS

11.1.9 RTI SURGICAL

TABLE 144 RTI SURGICAL: BUSINESS OVERVIEW

TABLE 145 RTI SURGICAL: PRODUCT OFFERINGS

11.1.10 ALLOSOURCE

TABLE 146 ALLOSOURCE: BUSINESS OVERVIEW

TABLE 147 ALLOSOURCE: PRODUCT OFFERINGS

11.1.11 HOLOSTEM TERAPIE AVANZATE SRL

TABLE 148 HOLOSTEM TERAPIE AVANZATE SRL: BUSINESS OVERVIEW

TABLE 149 HOLOSTEM TERAPIE AVANZATE SRL: PRODUCT OFFERINGS

11.1.12 ORTHOFIX

TABLE 150 ORTHOFIX: BUSINESS OVERVIEW

FIGURE 43 ORTHOFIX: COMPANY SNAPSHOT (2021)

TABLE 151 ORTHOFIX: PRODUCT OFFERINGS

11.1.13 STEMPEUTICS RESEARCH

TABLE 152 STEMPEUTICS RESEARCH: BUSINESS OVERVIEW

TABLE 153 STEMPEUTICS RESEARCH: PRODUCT OFFERINGS

11.1.14 REGROW BIOSCIENCES PVT LTD.

TABLE 154 REGROW BIOSCIENCES PVT LTD: BUSINESS OVERVIEW

TABLE 155 REGROW BIOSCIENCES PVT LTD: PRODUCT OFFERINGS

11.2 OTHER PLAYERS (PRODUCTS IN PIPELINE)

11.2.1 ATHERSYS, INC.

11.2.2 MESOBLAST LTD

11.2.3 BIORESTORATIVE THERAPIES, INC.

11.2.4 PLURISTEM INC.

11.2.5 BRAINSTORM CELL LIMITED.

11.2.6 GAMIDA CELL

11.2.7 VIACYTE, INC.

11.2.8 KANGSTEM BIOTECH

11.2.9 HOPE BIOSCIENCES

11.2.10 CELLULAR BIOMEDICINE GROUP (CBMG)

11.2.11 PERSONALIZED STEM CELLS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 161)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the stem cell therapy market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the global market. The secondary sources used for this study include Some of the key secondary sources referred to for this study include publications from government sources World Health Organization, Organisation for Economic Co-operation and Development, The World Bank, US Census Bureau, International Society for Stem Cell Research (US), National Stem Cell Foundation (US), International Society for Cellular Therapy (ISCT), EuroStemCell, European Society of Gene and Cell Therapy, German Stem Cell Network, Japan Human Cell Society, Chinese Stem Cell Foundation, Brazilian Association of Cell Therapy, Alliance for Regenerative Medicine (ARM)]. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

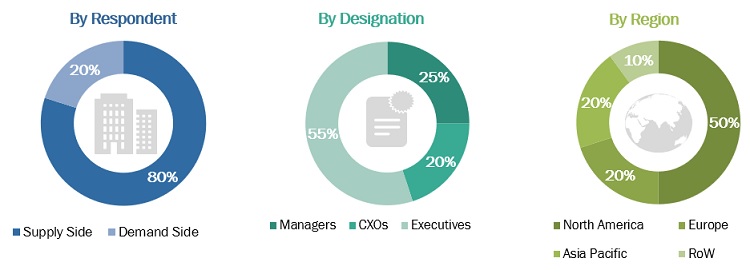

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the stem cell therapy business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the stem cell therapy market based on type, cell source, therapeutic application and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities and trends)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the global market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stem Cell Therapy Market