Sterile Medical Packaging Market by Material (Plastics, Metal, Glass, Others), Type (Thermoform Trays, Bottles, Vials & Ampoules, Blister & Clamshells, Others), Application (Surgical Instruments, Pharmaceutical, Others) - Forecast to 2025

Updated on : April 01, 2023

Sterile Medical Packaging Market

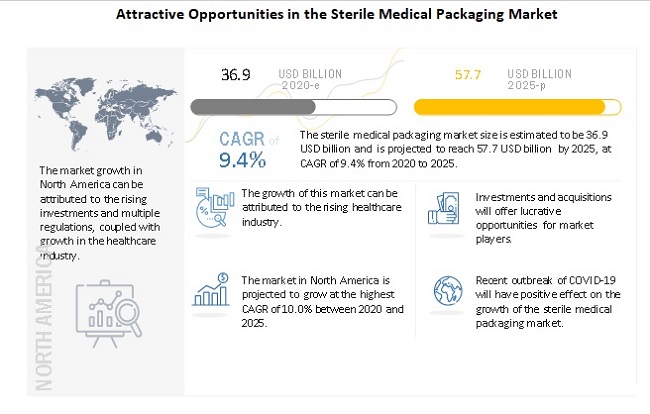

The global sterile medical packaging market was valued at USD 36.9 billion in 2020 and is projected to reach USD 57.7 billion by 2025, growing at a cagr 9.4% from 2020 to 2025. Increasing investment, coupled with growth in the healthcare industry across the globe, is expected to drive the growth of the market. The recent outbreak of Covid-19 is expected to have a positive impact on the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Sterile Medical Packaging Market

The recent outbreak of COVID-19 and its rapid spread across the world has led to economic disruption. The increasing outbreak of various infectious and communicable diseases and viruses such as COVID-19, flu, tuberculosis, and SARS has led to improved hygiene in medical devices intending to prevent any contamination or spread of disease in patients. This leads to an increase in the demand for sterile medical packaging. The demand for medical supplies, masks, devices, syringes, etc. is rising, leading to an increased demand for their primary and secondary packaging.

Sterile Medical Packaging Market Dynamics

Driver: High consumption rate of sterile medical packaging in healthcare and pharmaceutical industries

The sterile medical packaging market is witnessing growing demand from the healthcare industry. The use of plastics and paper & paperboard offers advantages, such as low weight, recyclability, and longevity. Sterile medical packaging also helps protect from damage caused by environmental conditions, such as moisture during transit, leading to a rise in demand from the medical sector. Properties such as microbial barrier make sterile medical packaging the perfect choice in the healthcare industry where it is used for the packaging of medical devices and pharmaceutical products.

The sterile medical packaging market has a positive outlook due to increasing health awareness and growing concerns for infection control. It is convenient to handle sterile medical packaging products, which drive its demand. The rising consumer income level will move consumer preference toward increased spending on healthcare services, which in turn will support the growth of sterilized medical packaging products. These products require sterile packaging to withstand moisture and other environmental influences that may affect pharmaceutical products.

The aging population around the world is increasing, leading to health issues, which require assistance from the medical sector, driving the demand for sterile medical packaging. Diseases, such as diabetes and high blood pressure are common among the aging population. To offer better living, the healthcare industry advances technology, which requires sterile medical packaging to prevent further infection, which may lead to deterioration of consumer health.

Restraint: Stringent regulations

Stringent regulations regarding specifications and materials used by manufacturers in packaging are expected to restrain market growth. Compliance with regulations is necessary as the smallest defect in the packaging may contaminate the product and ultimately risk the life of a patient. It will also negatively impact the manufacturer’s profit. Healthcare packaging requires control over moisture, light barriers, and childproofing. The packaging used for health care products and devices helps in creating a sterile barrier for the device and protects its functionality. However, the technical process required for such packaging is tedious and time-consuming. The FDA has several standards for sterilization validation, such as for radiation validation, consensus standard ISO 11137. Complying with such standards requires specialized skills, time, resources, and money, which restrains the growth of sterile medical packaging. Gaps in quality and process failures can lead to the deterioration of a patient’s health and drug shortages, ultimately affecting public health.

Opportunities: Developing new sustainable packaging options

Industry changes, such as the introduction of new regulatory initiatives and the rising cost of healthcare, have encouraged manufacturers to develop new packaging options. Moreover, growing concerns regarding the use of plastic for the packaging of medical products and its impact on human health and the environment have also driven manufacturers to develop sustainable packaging options that are safe and secure. In order to reduce the cost pressure and at the same time maintain the integrity of product packages, manufacturers are considering sustainable packaging solutions that require less material and energy to manufacture a package, reduce transportation costs, and offer extended shelf life to the product.

For instance, in November 2019, Amcor invested over USD 11 million in the all-new multi-layer cast extrusion technology that produces a film of up to 11-layers to create safe, durable, and cost-efficient medical device packaging. This technology supports medical device customers to meet ever-increasing regulatory demands, make important material cost savings, and continue to ensure the sterility of their devices at the point of use.

Challenges: Maintaining medical packaging integrity

Testing of medical packaging is done to determine the sterility of products and their shelf life. A microbial barrier for medical products is essential during the entire value chain. Maintaining the integrity of the medical package during storage, handling, and distribution becomes a challenge for manufacturers. Maintaining device sterility is critical to protect the patient and prevent the transmission of disease. The efficacy of sterile medical packaging is also evaluated after its exposure to environmental conditions, posing a challenge for suppliers. Integrity of sterile packaging is generally caused due to damage or vibrations during transportation and storage.

Factors, such as humidity and aging may compromise the package integrity of the product. Hence, manufacturers are responsible for assigning an accurate shelf life to the product and ensure that the packaging material chosen is appropriate for the intended sterilization method, storage, transportation, and end-use. Maintaining the integrity of sterile medical packaging in such conditions and remaining affordable at the same time has become a challenge for manufacturers.

The pharmaceutical & biological segment is expected to lead the sterile medical packaging market during the forecast period.

Based on application, the pharmaceutical biological application is projected to lead the sterile medical packaging market. The growth of this segment can be attributed to the growing healthcare industry and the advent of new healthcare medicines. Technological advancements have optimized and integrated the sterile packaging process of pharmaceutical products and made it more capital-intensive. This process reduces the risk of contamination. The processing and packaging of pharmaceutical & biological products goes through various inspections, quality checks and ensures that they adhere to regulatory compliances about the drug contents and the material used in packaging.

The thermoform trays segment is expected to lead the sterile medical packaging market during the forecast period.

Based on type, the thermoform trays segment is projected to record the highest CAGR. These are versatile and easy to transport because of their low weight. Thermoformed trays are manufactured from plastics, come in a wide variety of shapes and sizes, and are equipped for internal use. Plastic trays have a highly versatile style of packaging design as the plastics used for trays can be molded to form different shapes by the thermoforming process. This versatility makes them advantageous for everything. Semi-rigid and flexible are two types of thermoform trays used in the healthcare industry.

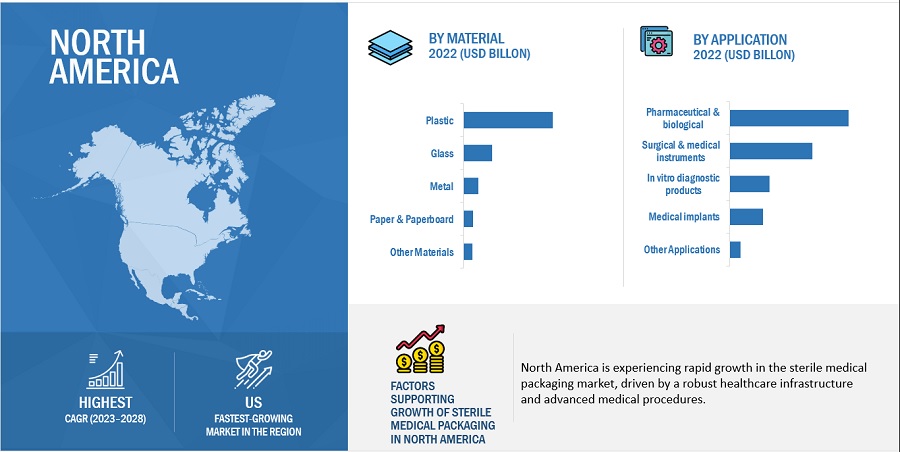

The plastic segment is expected to account for the largest share of the sterile medical packaging market during the forecast period

The plastic sterile medical packaging segment is expected to lead the sterile medical packaging market. this growth can be attributed to its high consumption and increasing demand from end-users. Plastic polymers, such as HDPE, polyester, and polypropylene are used extensively in the manufacturing of bottles, vials & ampoules, and pre-filled syringes in the sterile medical packaging market.

North America is projected to be the largest consumer of the sterile medical packaging market

Based on the region, the sterile medical packaging market is segmented into Asia Pacific, the Middle East & Africa, North America, Europe, and South America. Among these, North America accounted for the largest share and is expected to witness the highest growth during the forecast period. This growth can be attributed to multiple regulations that are imposed by the FDA, which, in turn, is driving the demand for sustainable and high-quality products in this region. Moreover, owing to the presence of many major players and stringent FDA regulations, the market has become very competitive in the region.

To know about the assumptions considered for the study, download the pdf brochure

Sterile Medical Packaging Market Players

Companies such as Amcor Limited (Australia), Dupont De Nemours, Inc. (US), 3M Company (US), West Pharmaceutical Services, Inc. (US), and Sonoco Products Company (US) are the major players in the sterile medical packaging market. These players have been adopting strategies such as contracts, expansion, new product launches, acquisitions, and agreements that have helped them expand their businesses in untapped and potential markets.

Sterile Medical Packaging Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (Million units) and Value (USD Million) |

|

Segments covered |

Application, Type, Material, and Region |

|

Regions covered |

North America, Europe, Asia Pacific and Rest of World |

|

Companies covered |

Amcor Limited (Australia), Dupont De Nemours, Inc. (US), 3M Company (US), West Pharmaceutical Services, Inc. (US), and Sonoco Products Company (US) are some of the leading companies considered for the study. |

This report categorizes the sterile medical packaging market based on application, type, material, and region.

Based on the application:

- Pharmaceutical & biological

- Surgical & medical instruments

- In vitro diagnostic products

- Medical implants

- Others

Based on Type:

- Thermoform trays

- Sterile bottles & containers

- Vials & ampoules

- Pre-fillable inhalers

- Sterile closures

- Pre-filled syringes

- Blister & clamshells

- Bags & pouches

- Wraps

- Others

Based on Material:

- Plastics

- Metals

- Glass

- Paper & paperboard

- Others

Based on region:

- North America

- Europe

- Asia Pacific

- Rest of World

Recent Developments

- In June, 2019, Amcor completed the acquisition of Bemis. This strategic combination establishes Amcor as the global leader in consumer packaging with a comprehensive global footprint, scale in every region, and industry-leading R&D capabilities.

- In September 2017, DuPont announced the introduction of DuPont Tyvek 40L medical packaging, a new class of Tyvek for medical packaging applications that provides a cost-effective option for protecting lightweight, low-risk devices..

- In October 2019, 3M completed the acquisition of Acelity, Inc. and its KCI subsidiaries worldwide. Acelity is a leading global medical technology company focused on advanced wound care and specialty surgical applications marketed under the KCI brand. This acquisition accelerated 3M as a leader in advanced wound care, which is a significant and growing market segment.

- In February 2020, West Pharmaceutical Services launched two line extensions, including its AccelTRA Select EU configurations available in Ready-to-Sterilize (RS) and Ready-to- Use (RU) steam for customers needing a high-performing elastomer and regulatory support in North America, as well as its AccelTRA ready-to-sterilize (RTS)/ready-to-use (RTU) components product line with the RTS option available now for customers needing a high-performing elastomer and lead-time program support outside North America

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 STERILE MEDICAL PACKAGING: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 MARKET DEFINITION AND SCOPE

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primary interview

2.2.2.3 Key industry insights

2.3 ASSUMPTIONS

2.4 LIMITATIONS

2.5 MARKET ENGINEERING PROCESS

2.5.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5.2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.6 BASE NUMBER CALCULATION

2.6.1 SUPPLY SIDE APPROACH

FIGURE 4 APPROACH 1

FIGURE 5 APPROACH 2

2.7 FORECAST NUMBER CALCULATION

3 EXECUTIVE SUMMARY (Page No. - 32)

TABLE 1 STERILE MEDICAL PACKAGING MARKET SNAPSHOT

FIGURE 6 PLASTIC STERILE MEDICAL PACKAGING SEGMENT TO LEAD THE MARKET

FIGURE 7 PHARMACEUTICAL & BIOLOGICAL APPLICATION TO GROW AT THE HIGHEST CAGR BETWEEN 2020 AND 2025

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN THE STERILE MEDICAL PACKAGING MARKET

FIGURE 8 GROWTH OF THE HEALTHCARE INDUSTRY DRIVING THE STERILE MEDICAL PACKAGING MARKET

4.2 STERILE MEDICAL PACKAGING MARKET, BY APPLICATION

FIGURE 9 PHARMACEUTICAL & BIOLOGICAL APPLICATION TO GROW AT THE HIGHEST RATE DURING FORECAST PERIOD

4.3 STERILE MEDICAL PACKAGING MARKET, BY REGION

FIGURE 10 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE OF STERILE MEDICAL PACKAGING MARKET IN 2019

4.4 STERILE MEDICAL PACKAGING MARKET, BY MATERIAL AND COUNTRY

FIGURE 11 PLASTIC STERILE MEDICAL PACKAGING AND US LED STERILE MEDICAL PACKAGING MARKET IN NORTH AMERICA IN 2019

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

FIGURE 12 EVOLUTION OF THE STERILE MEDICAL PACKAGING MARKET

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing health awareness

5.2.1.2 Growing demand from healthcare industry

5.2.1.3 Increasing aging population

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Developing new sustainable packaging options

5.2.3.2 COVID-19 impact on end-use industries

5.2.4 CHALLENGES

5.2.4.1 Maintaining medical packaging integrity

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 13 PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 THERMOFORM TRAY SUPPLY CHAIN ANALYSIS

FIGURE 14 THERMOFORM TRAY: SUPPLY CHAIN ANALYSIS

FIGURE 15 THERMOFORM TRAYS MARKET BY POLYMER TYPE- RESIN AND SHEET CONSUMPTION ANALYSIS (USD MILLION AND TONS)

5.4.1 THERMOFORM TRAY WEIGHT, TRIM PERCENTAGE & USAGE

FIGURE 16 AVERAGE THERMOFORM TRAY WEIGHT AND TRIM PERCENTAGE FOR VARIOUS MATERIALS

6 STERILE MEDICAL PACKAGING MARKET, BY MATERIAL (Page No. - 46)

6.1 INTRODUCTION

FIGURE 17 METAL SEGMENT TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 2 STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 3 STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

6.2 PLASTIC

6.2.1 INCREASE IN DEMAND FROM END USERS TO DRIVE THE SEGMENT

FIGURE 18 STERILE MEDICAL PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020 & 2025 (USD MILLION)

TABLE 4 STERILE MEDICAL PLASTIC PACKAGING MARKET SIZE, BY PLASTIC TYPE, 2018–2025 (MILLION UNITS)

TABLE 5 STERILE MEDICAL PLASTIC PACKAGING MARKET SIZE, BY PLASTIC TYPE, 2018–2025 (USD MILLION)

6.2.2 HDPE

6.2.3 POLYESTER

6.2.4 POLYPROPYLENE

6.2.5 PVC

6.2.6 POLYCARBONATE

6.2.7 POLYSTYRENE

6.2.8 OTHERS

TABLE 6 STERILE MEDICAL PACKAGING MARKET SIZE IN PLASTIC SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 7 STERILE MEDICAL PACKAGING MARKET SIZE IN PLASTIC SEGMENT, BY REGION, 2018–2025 (USD MILLION)

6.3 METAL

6.3.1 GROWING DEMAND FOR RECYCLABLE PACKAGING

TABLE 8 STERILE MEDICAL PACKAGING MARKET SIZE IN METAL SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 9 STERILE MEDICAL PACKAGING MARKET SIZE IN METAL SEGMENT, BY REGION, 2018–2025 (USD MILLION)

FIGURE 19 STERILE MEDICAL METAL PACKAGING MARKET SIZE, BY TYPE, 2020 & 2025 (USD MILLION)

TABLE 10 STERILE MEDICAL METAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 11 STERILE MEDICAL METAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.3.2 ALUMINUM FOIL

6.3.3 STAINLESS STEEL

6.4 PAPER & PAPERBOARD

6.4.1 INNOVATIONS IN THE PAPER INDUSTRY DRIVING THE GROWTH

TABLE 12 STERILE MEDICAL PACKAGING MARKET SIZE IN PAPER & PAPERBOARD SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 13 STERILE MEDICAL PACKAGING MARKET SIZE IN PAPER & PAPERBOARD SEGMENT, BY REGION, 2018–2025 (USD MILLION)

6.5 GLASS

6.5.1 NEUTRAL NATURE AND RECYCLABILITY OF GLASS PACKAGING GRIDS

TABLE 14 STERILE MEDICAL PACKAGING MARKET SIZE IN GLASS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 15 STERILE MEDICAL PACKAGING MARKET SIZE IN GLASS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

6.6 OTHERS

6.6.1 INCREASING DEMAND FOR RUBBER CLOSURES TO DRIVE THE SEGMENT

TABLE 16 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER MATERIALS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 17 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER MATERIALS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7 STERILE MEDICAL PACKAGING MARKET, BY TYPE (Page No. - 57)

7.1 INTRODUCTION

FIGURE 20 THERMOFORM TRAYS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 19 STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.2 THERMOFORM TRAYS

7.2.1 GROWING PHARMACEUTICAL INDUSTRY TO DRIVE THE SEGMENT

TABLE 20 STERILE MEDICAL PACKAGING MARKET SIZE IN THERMOFORM TRAYS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 21 STERILE MEDICAL PACKAGING MARKET SIZE IN THERMOFORM TRAYS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.3 STERILE BOTTLES & CONTAINERS

7.3.1 RAPID INCREASE IN VIRAL INFECTIONS DUE TO INCREASING POLLUTION LEVELS

TABLE 22 STERILE MEDICAL PACKAGING MARKET SIZE IN STERILE BOTTLES & CONTAINERS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 23 STERILE MEDICAL PACKAGING MARKET SIZE IN STERILE BOTTLES & CONTAINERS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.4 VIALS & AMPOULES

7.4.1 INCREASING CONSUMPTION OF VACCINES, BIOPHARMACEUTICALS, AND INSULIN DRIVING THE GROWTH

TABLE 24 STERILE MEDICAL PACKAGING MARKET SIZE IN VIALS & AMPOULES SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 25 STERILE MEDICAL PACKAGING MARKET SIZE IN VIALS & AMPOULES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.5 PRE-FILLABLE INHALERS

7.5.1 INCREASING AWARENESS FOR EFFECTIVE AND ADVANCED RESPIRATORY DEVICES

TABLE 26 STERILE MEDICAL PACKAGING MARKET SIZE IN PRE-FILLABLE INHALERS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 27 STERILE MEDICAL PACKAGING MARKET SIZE IN PRE-FILLABLE INHALERS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.6 STERILE CLOSURES

7.6.1 GROWING MARKET FOR OVER-THE-COUNTER DRUGS

TABLE 28 STERILE MEDICAL PACKAGING MARKET SIZE IN STERILE CLOSURES SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 29 STERILE MEDICAL PACKAGING MARKET SIZE IN STERILE CLOSURES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.7 PRE-FILLED SYRINGES

7.7.1 INCREASED PRODUCT LIFE SPAN AND MINIMIZED DRUG WASTAGE

TABLE 30 STERILE MEDICAL PACKAGING MARKET SIZE IN PRE-FILLED SYRINGES SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 31 STERILE MEDICAL PACKAGING MARKET SIZE IN PRE-FILLED SYRINGES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.8 BLISTERS & CLAMSHELLS

7.8.1 NEW PRODUCT LAUNCHES BY PHARMACEUTICAL AND MEDICAL DEVICE MANUFACTURERS

TABLE 32 STERILE MEDICAL PACKAGING MARKET SIZE IN BLISTER & CLAMSHELLS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 33 STERILE MEDICAL PACKAGING MARKET SIZE IN BLISTER & CLAMSHELLS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.9 BAGS & POUCHES

7.9.1 INCREASING DEMAND FOR BAGS AND POUCHES FOR VARIETY OF APPLICATIONS IN THE HEALTHCARE SECTOR

TABLE 34 STERILE MEDICAL PACKAGING MARKET SIZE IN BAGS & POUCHES SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 35 STERILE MEDICAL PACKAGING MARKET SIZE IN BAGS & POUCHES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.1 WRAPS

7.10.1 PREVALENCE OF HOSPITAL-ASSOCIATED INFECTIONS

TABLE 36 STERILE MEDICAL PACKAGING MARKET SIZE IN WRAPS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 37 STERILE MEDICAL PACKAGING MARKET SIZE IN WRAPS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

7.11 OTHERS

7.11.1 RISING DEMAND FOR STRIP PACKS IN PHARMACEUTICAL INDUSTRY

TABLE 38 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER TYPES SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 39 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER TYPES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

8 STERILE MEDICAL PACKAGING MARKET, BY APPLICATION (Page No. - 70)

8.1 INTRODUCTION

FIGURE 21 PHARMACEUTICAL & BIOLOGICAL SEGMENT TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 41 STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 PHARMACEUTICAL & BIOLOGICAL

8.2.1 ADVENT OF NEW HEALTHCARE MEDICINES TO DRIVE THE SEGMENT

TABLE 42 STERILE MEDICAL PACKAGING MARKET SIZE IN PHARMACEUTICAL & BIOLOGICAL SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 43 STERILE MEDICAL PACKAGING MARKET SIZE IN PHARMACEUTICAL & BIOLOGICAL SEGMENT, BY REGION, 2018–2025 (USD MILLION)

8.3 SURGICAL & MEDICAL INSTRUMENTS

8.3.1 INCREASE IN POPULATION AND THEIR HEALTHCARE REQUIREMENTS

TABLE 44 STERILE MEDICAL PACKAGING MARKET SIZE IN SURGICAL & MEDICAL INSTRUMENTS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 45 STERILE MEDICAL PACKAGING MARKET SIZE IN SURGICAL & MEDICAL INSTRUMENTS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

8.4 IN VITRO DIAGNOSTIC PRODUCTS

8.4.1 GROWTH IN THE PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

TABLE 46 STERILE MEDICAL PACKAGING MARKET SIZE IN IN VITRO DIAGNOSTIC PRODUCTS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 47 STERILE MEDICAL PACKAGING MARKET SIZE IN IN VITRO DIAGNOSTIC PRODUCTS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

8.5 MEDICAL IMPLANTS

8.5.1 INCREASING GERIATRIC POPULATION DRIVING THE GROWTH

TABLE 48 STERILE MEDICAL PACKAGING MARKET SIZE IN MEDICAL IMPLANTS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 49 STERILE MEDICAL PACKAGING MARKET SIZE IN MEDICAL IMPLANTS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

8.6 OTHERS

TABLE 50 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER APPLICATIONS SEGMENT, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 51 STERILE MEDICAL PACKAGING MARKET SIZE IN OTHER APPLICATIONS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

9 STERILE MEDICAL PACKAGING MARKET, BY REGION (Page No. - 77)

9.1 INTRODUCTION

TABLE 52 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 22 NORTH AMERICA PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 53 GLOBAL STERILE MEDICAL PACKAGING MARKET, BY REGION, 2018–2025 (MILLION TONS)

TABLE 54 GLOBAL STERILE MEDICAL PACKAGING MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNITS)

TABLE 56 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 58 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 60 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 62 NORTH AMERICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 US to lead the market in North America

9.2.1.2 US sterile medical packaging market, by type

TABLE 63 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 64 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.1.3 US sterile medical packaging market, by application

TABLE 65 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 66 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.1.4 US sterile medical packaging market, by material

TABLE 67 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 68 US: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing demand in the healthcare industry to fuel market growth

9.2.2.2 Canada sterile medical packaging market, by type

TABLE 69 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 70 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.2.3 Canada sterile medical packaging market, by application

TABLE 71 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 72 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.2.4 Canada sterile medical packaging market, by material

TABLE 73 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 74 CANADA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growing medical device production to drive the market

9.2.3.2 Mexico sterile medical packaging market, by type

TABLE 75 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 76 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.3.3 Mexico sterile medical packaging market, by application

TABLE 77 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 78 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.3.4 Mexico sterile medical packaging market, by material

TABLE 79 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 80 MEXICO: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3 EUROPE

FIGURE 24 EUROPE: STERILE MEDICAL PACKAGING MARKET SNAPSHOT

TABLE 81 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNITS)

TABLE 82 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 84 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 86 EUROPE : STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 88 EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Growing aging population and healthcare issues

9.3.1.2 Germany sterile medical packaging market, by type

TABLE 89 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 90 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.1.3 Germany sterile medical packaging market, by application

TABLE 91 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 92 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.1.4 Germany sterile medical packaging market, by material

TABLE 93 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 94 GERMANY: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Increased investments in healthcare sector boosting market growth

9.3.2.2 UK sterile medical packaging market, by type

TABLE 95 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 96 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.2.3 UK sterile medical packaging market, by application

TABLE 97 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 98 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.2.4 UK sterile medical packaging market, by material

TABLE 99 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 100 UK: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 High demand in medical device sector to fuel the market

9.3.3.2 France sterile medical packaging market, by type

TABLE 101 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 102 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.3.3 France sterile medical packaging market, by application

TABLE 103 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 104 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.3.4 France sterile medical packaging market, by material

TABLE 105 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 106 FRANCE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing investments in healthcare sector to drive the market

9.3.4.2 Italy sterile medical packaging market, by type

TABLE 107 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 108 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.4.3 Italy sterile medical packaging market, by application

TABLE 109 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 110 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.4.4 Italy sterile medical packaging market, by material

TABLE 111 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 112 ITALY: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.3.5 REST OF EUROPE

9.3.5.1 Rising healthcare awareness to support market growth

9.3.5.2 Rest of Europe sterile medical packaging market, by type

TABLE 113 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 114 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.5.3 Rest of Europe sterile medical packaging market, by application

TABLE 115 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 116 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.5.4 Rest of Europe sterile medical packaging market, by material

TABLE 117 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 118 REST OF EUROPE: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4 APAC

FIGURE 25 APAC: STERILE MEDICAL PACKAGING MARKET SNAPSHOT

TABLE 119 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNITS)

TABLE 120 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 122 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 124 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 125 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 126 APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China to lead the sterile medical packaging market in the region

9.4.1.2 China sterile medical packaging market, by type

TABLE 127 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 128 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.1.3 China sterile medical packaging market, by application

TABLE 129 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 130 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.1.4 China sterile medical packaging market, by material

TABLE 131 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 132 CHINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4.2 INDIA

9.4.2.1 Increasing demand in the healthcare and pharmaceutical sector to drive the market

9.4.2.2 India sterile medical packaging market, by type

TABLE 133 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 134 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.2.3 India sterile medical packaging market, by application

TABLE 135 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 136 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.2.4 India sterile medical packaging market, by material

TABLE 137 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 138 INDIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Increasing government initiatives to drive the sterile medical packaging market

9.4.3.2 Japan sterile medical packaging market, by type

TABLE 139 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 140 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.3.3 Japan sterile medical packaging market, by application

TABLE 141 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 142 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.3.4 Japan sterile medical packaging market, by material

TABLE 143 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 144 JAPAN: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 High demand from the pharmaceutical industry to drive market

9.4.4.2 Australia sterile medical packaging market, by type

TABLE 145 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 146 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.4.3 Australia sterile medical packaging market, by application

TABLE 147 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 148 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.4 Australia sterile medical packaging market, by material

TABLE 149 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 150 AUSTRALIA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.4.5 REST OF APAC

9.4.5.1 Rest of APAC sterile medical packaging market, by type

TABLE 151 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 152 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.5.2 Rest of APAC sterile medical packaging market, by application

TABLE 153 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 154 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.5.3 Rest of APAC sterile medical packaging market, by material

TABLE 155 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 156 REST OF APAC: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

FIGURE 26 ROW: STERILE MEDICAL PACKAGING MARKET SNAPSHOT

TABLE 157 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNITS)

TABLE 158 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 159 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 160 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 161 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 162 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 163 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 164 ROW: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Increasing demand from application areas in end-use industries

9.5.1.2 Brazil sterile medical packaging market, by type

TABLE 165 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 166 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.1.3 Brazil sterile medical packaging market, by application

TABLE 167 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 168 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.1.4 Brazil sterile medical packaging market, by material

TABLE 169 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 170 BRAZIL: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Growing end-use industries fueling market growth

9.5.2.2 Argentina sterile medical packaging market, by type

TABLE 171 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 172 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.2.3 Argentina sterile medical packaging market, by application

TABLE 173 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 174 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.2.4 Argentina sterile medical packaging market, by material

TABLE 175 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 176 ARGENTINA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Increasing government initiatives to propel market growth

9.5.3.2 South Africa sterile medical packaging market, by type

TABLE 177 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 178 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.3.3 South Africa sterile medical packaging market, by application

TABLE 179 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 180 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.3.4 South Africa sterile medical packaging market, by material

TABLE 181 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 182 SOUTH AFRICA: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

9.5.4 OTHERS

9.5.4.1 Others sterile medical packaging market, by type

TABLE 183 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2015–2021 (MILLION UNITS)

TABLE 184 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.4.2 Others sterile medical packaging market, by application

TABLE 185 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNITS)

TABLE 186 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.4.3 Others sterile medical packaging market, by material

TABLE 187 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNITS)

TABLE 188 OTHERS: STERILE MEDICAL PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 143)

10.1 INTRODUCTION

10.2 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

10.2.1 MARKET RANKING

FIGURE 27 MARKET RANKING OF TOP PLAYERS IN STERILE MEDICAL PACKAGING MARKET

10.3 COMPANY EVALUATION MATRIX

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

FIGURE 28 STERILE MEDICAL PACKAGING MARKET: COMPANY EVALUATION MATRIX, 2019

10.4 SME EVALUATION MATRIX, 2019

FIGURE 29 STERILE MEDICAL PACKAGING MARKET: SME COMPANY EVALUATION MATRIX, 2019

10.5 PRODUCT FOOTPRINT

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE STERILE MEDICAL PACKAGING MARKET

11 COMPANY PROFILES (Page No. - 148)

(Business overview, Products offered, Recent developments, Winning imperatives, Threat from competition, Current Focus and Strategies, SWOT analysis, Right to win & MnM View)*

11.1 AMCOR LIMITED

FIGURE 31 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 32 AMCOR LIMITED: SWOT ANALYSIS

11.2 DUPONT DE NEMOURS, INC.

FIGURE 33 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

FIGURE 34 DUPONT DE NEMOURS, INC.: SWOT ANALYSIS

11.3 3M COMPANY

FIGURE 35 3M COMPANY: COMPANY SNAPSHOT

FIGURE 36 3M COMPANY: SWOT ANALYSIS

11.4 WEST PHARMACEUTICAL SERVICES, INC.

FIGURE 37 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 38 WEST PHARMACEUTICALS SERVICES INC.: SWOT ANALYSIS

11.5 SONOCO PRODUCTS COMPANY

FIGURE 39 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 40 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

11.6 STERIPACK LTD.

11.7 WIPAK GROUP

11.8 PLACON CORPORATION

11.9 RIVERSIDE MEDICAL PACKAGING COMPANY LTD

11.10 ORACLE PACKAGING, INC.

11.11 NELIPAK HEALTHCARE PACKAGING LIMITED

11.12 OLIVER HEALTHCARE PACKAGING COMPANY

11.13 ORCHID ORTHOPEDIC SOLUTIONS

11.14 TECHNIPAQ INC.

11.15 MULTIVAC SEPP HAGGENMÜLLER SE & CO. KG

11.16 JANCO INC.

11.17 EAGLE FLEXIBLE PACKAGING

11.18 BERRY GLOBAL INC.

11.19 PROAMPAC LLC

11.20 SELENIUM MEDICAL SAS

11.21 ECOBLISS INDIA PVT. LTD.

11.22 UFLEX LIMITED

11.23 HIMALAYAN PACKAGING INDUSTRIES (P) LTD.

11.24 BILCARE LIMITED

11.25 STERIL MEDIPAC

*Details on Business overview, Products offered, Recent developments, Winning imperatives, Threat from competition, Current Focus and Strategies, SWOT analysis, Right to win & MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 178)

12.1 INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

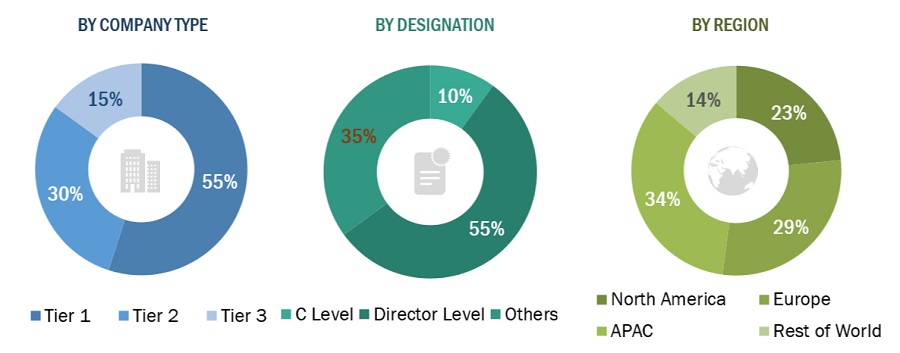

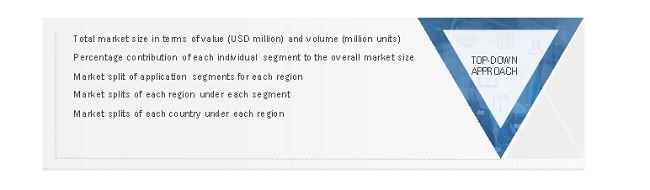

The study involved four major activities in estimating the current size of the sterile medical packaging market. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as directories, and databases, such as D&B Hoovers, Bloomberg, the World Bank, IMF, The World Factbook, Factiva, and other government & private websites and associations related to the medical packaging sector were referred to identify and collect information for this study. Secondary sources include sterile medical packaging manufacturers, annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, associations, regulatory bodies, trade directories, and databases.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary Participants:

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

*Other designations include sales, marketing, and product managers.

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the sterile medical packaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and sterile medical packaging market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall sterile medical packaging market size—using the market size estimation process explained above—the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Market Size Estimation: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the sterile medical packaging market by estimating the production, import, and export of sterile medical packaging at the country level. Based on this number, the consumption of sterile medical packaging across each country was calculated. The market size for each country was multiplied by the ASP of sterile medical packaging for the year 2019, to determine the market size in terms of value (USD billion/million).

For the calculation of a specific market segment, the most appropriate, immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the market segment revenues obtained.

Sales of various companies were identified to calculate the share accounted by these players in the sterile medical packaging market. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and each market size were determined and confirmed.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the energy, automotive, manufacturing, and household appliances industries.

Report Objectives:

- To estimate and forecast the size of the sterile medical packaging market in terms of volume (million units) and value (USD billion)

- To define, describe, and forecast the size of the sterile medical packaging market based on application, type, material, and region

- To forecast the size of various segments of the market based on four major regions—Asia Pacific, North America, Europe, and Rest of World, along with major countries in each region

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, acquisitions, new product developments/launches, and investments in the global sterile medical packaging market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional sterile medical packaging market to the country level by type

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Sterile Medical Packaging Market