Sustainable Aviation Fuel (SAF) Market by Fuel Type (Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas to Liquid), Biofuel Manufacturing Technology (FT-SPK, HEFA-SPK, ATJ-SPK, HFS-SIP, CHJ), Biofuel Blending Capacity, Platform, Region (2021-2030)

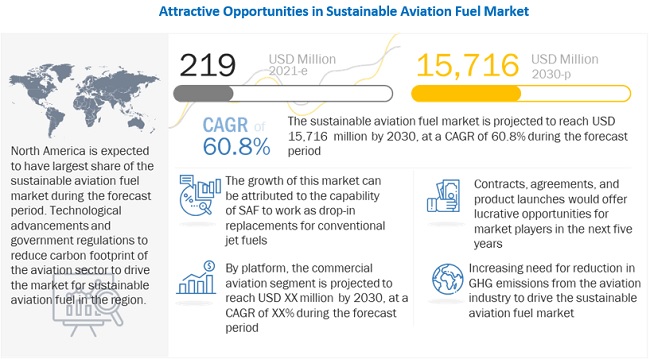

[256 Pages Report] The Sustainable Aviation Fuel (SAF) Market is projected to grow from USD 219 million in 2021 to USD 15,716 million by 2030, at a CAGR of 60.8% during the forecast period.

The aviation industry is keen on bringing down the carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. The alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, adoption of sustainable aviation fuels such as e-fuels, synthetic fuels, green jet fuels, biojet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation. In addition, airlines across the entire aviation industry are expanding their commercial fleets, due to rise in air travel These large and growing fleets are propelling the demand for the SAF as a near to mid-term solution for reducing GHG emissions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Sustainable Aviation Fuel (SAF) Market

COVID-19 has taken a colossal toll on the world’s economic activity, with individuals, organizations, governments, and businesses having to adapt to the challenges of the crisis. Air travel restrictions across various regions for both domestic and international flights have led to inactive fleets across the globe. Like many other sectors, the Sustainable Aviation Fuel Industry is also disproportionately impacted by the COVID-19 pandemic due to delays in the production activities across various industries. In addition, many older, less efficient airplanes that are parked as part of the contraction will not return to service. However, much of the industry will likely defer in acquiring new aircraft containing technology improvements until demand is stronger, the solvency of the carriers is assured, and the price of jet fuel exerts pressure to add fuel-saving evolutionary technologies to the fleet

Sustainable Aviation Fuel Market Dynamics:

Driver: Increasing need for reduction in GHG emissions in aviation industry

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. SAF gives an impressive reduction of up to 80% in CO2 emissions over the lifecycle of the fuel compared to fossil jet fuel, depending on the sustainable feedstock used, production method, and the supply chain to the airport. According to the IATA fact sheet, SAF will be an eligible option for aircraft operators to meet their obligations under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). In 2016, the UN’s International Civil Aviation Organization (ICAO) agreed on a Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) to reduce CO2 emissions from international aviation with a pilot phase from 2021–2023, followed by a first phase from 2024–2026.

Restraint: Inadequate availability of feedstock and refineries to meet SAF production demand

The biological and non-biological resources such as oil crops, sugar crops, algae, waste oil, etc., are the raw materials that play an important role in the entire production chain of alternative aviation fuels such as synthetic fuels, e-fuels, and biojet fuels. The demand for sustainable aviation fuel can come to a standstill due to the inadequate supply of raw materials required for its production. Also, limitations of refineries that play a major role in the proper utilization of these feedstocks add to the delay of the overall process of SAF production. The low availability of fuel also becomes a hurdle for the blending capacity of the fuel, leading to less efficiency.

Opportunity: Drop-in capability of SAF increases its demand to reduce carbon footprint

Sustainable aviation fuel, when blended with petroleum-based fuel, is fully fungible drop-in fuels. These fuels are also known as synthetic fuels, renewable jet fuels, e-fuels, green fuels, conventional biojet fuel, and alternative jet fuels depending on the processes, technological pathways and feedstocks used in the production. These fuels are not treated differently than current fuels from petroleum and can use the airport fuel storage and hydrant systems, saving money on infrastructure costs. The continuous efforts to use existing depreciated equipment and infrastructure or co-processing with other streams can potentially be an approach to reducing capital costs. A drop-in fuel is deemed to be equivalent to conventional jet fuel and can be used in current engines and infrastructure without any modifications. These requirements are essential for safety, general usage, and reduction of carbon footprint in the aviation industry.

Challenge: High cost of SAF increases operating cost of airlines

The airlines cannot meet their self-imposed targets for reducing GHG emissions based on engine and flight improvements alone—they need SAF. Fuel cost is a significant fraction of operating costs. SAF, even though made from the waste and the feedstocks that are available for very low cost, requires advanced and expensive technological pathways. SAF is more expensive than petro-jet, given that new production capacity has to be deployed. SAF will not be widely available because production capacity will be built to contracts, not as a commodity, at least in the first decade or so. New biofuel factories take time and money to build, driving up the price of their offtake once they get online and hampering their ability to reach the critical mass of profitability.

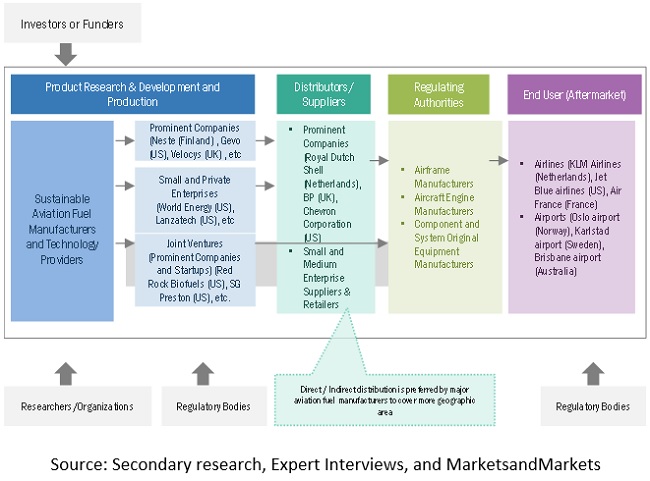

Sustainable Aviation Fuel Market Ecosystem

Prominent companies that provide sustainable aviation fuel, private and small enterprises, technology providers, distributors/suppliers/retailers, and end customers (airlines and airports) are the key stakeholders in the SAF Fuel Market ecosystem. Investors, funders, academic researchers, distributors, service providers, and airport and aerodrome authorities serve as major influencers in the sustainable aviation fuel (SAF) market.

To know about the assumptions considered for the study, download the pdf brochure

The biofuel segment is estimated to lead the sustainable aviation fuel (SAF) market in 2020

Typically, biofuel, hydrogen fuel and power to liquid fuel are the SAF types. Based on fuel type, the biofuel segment of the sustainable aviation fuel market is accounted for the largest share during the forecast period. The production of biojet fuel is expected to scale up rapidly in the coming decade due to rapid developments in technological pathways to commercialize the use of alternative jet fuel. Countries such as Norway, the Netherlands, and the UK are contributing significantly to the long-term sustainability plans by funding biojet fuel infrastructure.

The 30% to 50% segment is expected to grow at the highest CAGR during the forecast period

Based on biofuel blending capacity, the sustainable aviation fuel is segmented into below 30%, 30% to 50%, and above 50%. The 30% to 50% segment of the sustainable aviation fuel market is expected to grow at the highest CAGR during the forecast period. The moderate blend capacity, drop-in facility in existing fuel systems, supply logistics infrastructure, and aircraft fleet allow to minimize the overall cost and cater to the volume demands from commercial and military aviation. In addition, with the growing research & development in the technological pathways, helps to improve the blending capacity of the renewable aviation fuel with the traditional aviation fuel.

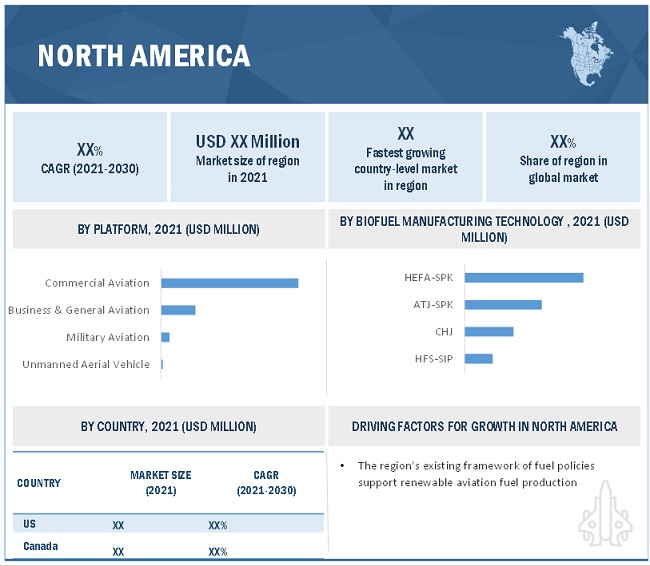

North Americais expected to grow at the highest CAGR during the forecast period

North America is expected to grow at the highest CAGR during the forecast period. To cater to the need for of reduction in carbon footprints due to increasing air traffic and air passengers, the countries such as the US and Canada in North America are focused on various initiatives to utilize the renewable aviation fuel. With supportive policies and initiatives to decarbonize aviation emissions, the North American market is deemed to be one of the strong demand centers for sustainable aviation fuel. The number of SAF initiatives taken by countries within the region such as US and Canada are Commercial Aviation Alternative Fuel Initiative (CAAFI), Midwest Aviation Sustainable Biofuels Initiative (MASBI), and Canada’s Biojet Supply Chain Initiative, among others.

Key Market Players

The Sustainable Aviation Fuel Companies are dominated by a few globally established players such as Neste (Finland), Fulcrum BioEnergy (US), LanzaTech (US), World Energy (US), TotalEnergy (US) among others. These key players offer various products and services such as biofuel, synthetic fuel, efuels, green fuel, and hydrogen fuel, in order to curb the GHG emissions from the aviation and other industrial sectors such as automotive, marine, chemical etc. The startup companies in the sustainable aviation fuel market include Preem (Sweden), OMV (Austria), Atmosfair (Germany), Wastefuel (US), Prometheus Fuels (US) Red Rocks Biofuel (US), Northwest Advanced Biofuels (Austria).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2030 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Fuel Type, By Biofuel Manufacturing Technology, By Biofuel Blending Capacity, By Platform, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, Latin America |

|

Companies covered (SAF Producers) |

Neste (Finland), Fulcrum BioFuels (US), LanzaJet (US), World Energy (US), TotalEnergy (France) among others |

|

Start-up Companies covered (SAF Producers) |

Red Rock Biofuels (US), SG Preston Company (US), Sundrop Fuels, Inc. (US), Preem (Sweden) Hypoint, Inc. (US), and ZeroAvia, Inc. (US). |

This research report categorizes the sustainable aviation fuel based on fuel type, biofuel manufacturing technology, biofuel blending capacity, platform, and region.

By fuel type

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

By Biofuel Manufacturing Technology

- Hydroprocessed Fatty Acid Esters and Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK)

- Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK)

- Synthetic Iso-paraffin from Fermented Hydroprocessed Sugar (HFS-SIP)

- Alcohol to Jet SPK (ATJ-SPK)

- Catalytic Hydrothermolysis Jet (CHJ)

By Biofuel Blending Capacity

- Below 30%

- 30% to 50%

- Above 50%

By Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

Recent Developments

- In August 2020, Gevo, Inc. entered into a binding renewable hydrocarbons purchase and sale agreement with Trafigura Trading LLC, a wholly-owned subsidiary of Trafigura Group Pte Ltd. The contract will enable Trafigura to supply SAF to both the US and international customers whose interest is growing in low-carbon jet fuel.

- In June 2020, Hypoint, Inc. was awarded a contract by Urban Aeronautics, Inc., a leader in VTOL aircraft, to provide zero-carbon hydrogen fuel cell technology for the CityHawk eVTOL aircraft.

- In June 2020, Amazon Air secured up to 6 million gallons of sustainable aviation fuel supplied by Shell Aviation and produced by World Energy.

- In December 2019, Neste signed an agreement with KLM to supply its SAF for the flights from Amsterdam Airport Schiphol. This agreement allowed Neste to join KLM’s corporate biofuel program that aims to reduce CO2 emissions of business travel on KLM flights by 100%.

- In December 2019, World Energy collaborated with Shell and Air France to supply its SAF for the flights from San Francisco. This collaboration between Air France, World Energy, and Shell exemplifies the rise in demand for SAF.

Frequently Asked Questions (FAQ):

Who are the winners and startups in the sustainable aviation fuel market?

Include Neste (Finland), Fulcrum BioEnergy (US), LanzaTech (US), World Energy (US), TotalEnergy (US) are some of the winners in the market. Preem (Sweden), Red Rock Biofuels (US), OMV (Austria), Atmosfair (Germany), Wastefuel (US) are some of the startups in the market

What is the COVID-19 impact on sustainable aviation fuel manufacturers?

COVID-19 has impacted the sustainable aviation fuel producers and suppliers by the delay in the approval processes of existing technologies to produce SAF. In addition, due to the financial losses incurred by airlines and airports admist of COVID-19, there is uncertainty in the adoption rate of the sustainable aviation fuel.

What are some of the technological advancements in the market?

Technology is one of the most promising options for reducing emissions and includes improved engine technologies, aircraft design, new composite lightweight materials, and the use of biofuels, green fuel, efuels, synthetic fuels, renewable jet fuel that have significantly lower lifecycle GHG emissions than conventional fuel. In addition, the advancements in the technological pathways to increase the blend capacity and commercialize the biofuels is contributing to the growth of the market.

What are the factors driving the growth of the market?

Increasing need for reduction in GHG emissions in aviation industry, Increasing air passengers traffic, High fuel efficiency of sustainable aviation fuel are some of the key factors driving the growth in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

2.1.1 RESEARCH FLOW

FIGURE 1 RESEARCH DESIGN

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Breakdown of primary interviews

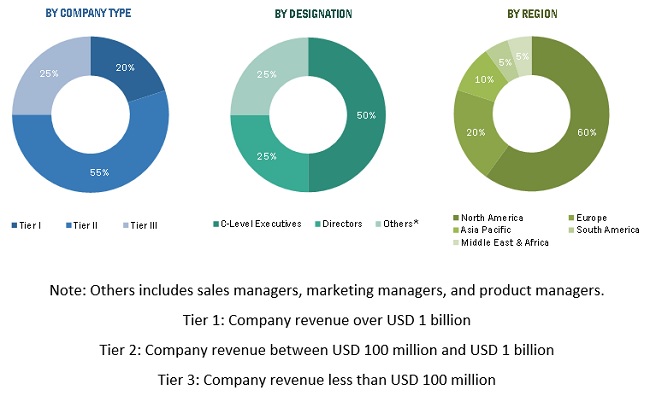

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY INTERVIEWEES DETAILS

2.2 DEMAND- AND SUPPLY-SIDE INDICATOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.1.1 Adoption rate of SAF by airlines and airports due to stringent regulations

2.2.1.2 Increase in air traffic across the globe

2.2.1.3 Development of technological pathways and high blending capacity approvals

2.2.2 COVID-19 IMPACT ON SUSTAINABLE AVIATION FUEL MARKET

2.3 MARKET-SIZE ESTIMATION

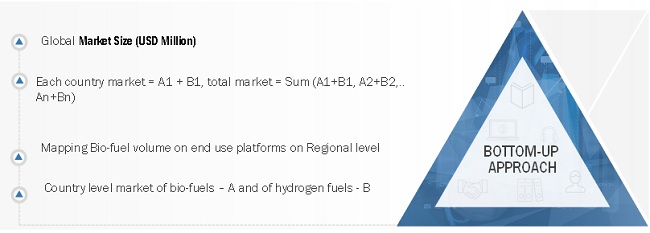

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY SIDE)

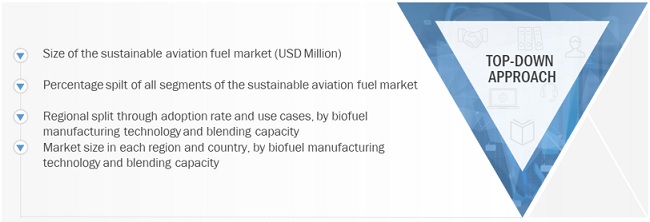

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.5 GROWTH RATE ASSUMPTIONS

2.5.1 INSIGHTS FROM INDUSTRY EXPERTS

2.6 ASSUMPTIONS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 6 BIOFUEL SEGMENT PROJECTED TO LEAD THE MARKET DURING FORECAST PERIOD

FIGURE 7 FT-SPK SEGMENT PROJECTED TO LEAD THE DURING FORECAST PERIOD

FIGURE 8 30% TO 50% SEGMENT EXPECTED TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 MILITARY AVIATION EXPECTED TO HAVE SECOND HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN SUSTAINABLE AVIATION FUEL MARKET

FIGURE 10 DEMAND FOR CO2 AND GHG EMISSION REDUCTION WILL DRIVE THE MARKET

4.2 SAF MARKET, BY REGION

FIGURE 11 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.3 ASIA PACIFIC SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY

FIGURE 12 CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.4 SAF MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY

FIGURE 13 HEFA-SPK SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.5 SUSTAINABLE AVIATION FUEL MARKET, BY REGION

FIGURE 14 MIDDLE EAST TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 SUSTAINABLE AVIATION FUEL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need for reduction in GHG emissions

FIGURE 16 COMPARISON OF CLIMATE IMPACT FROM HYDROGEN PROPULSION AND SYNFUEL, 2050

5.2.1.2 Increasing air passenger traffic

FIGURE 17 CO2 EMISSIONS, BY AIRCRAFT TYPE AND RANGE, 2018

5.2.1.3 High fuel efficiency of SAF

5.2.2 RESTRAINTS

5.2.2.1 Inadequate availability of feedstock and refineries to meet SAF production demand

5.2.2.2 Price difference between SAF and conventional jet fuels

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for SAF by airlines across the globe

TABLE 3 AIRPORTS HAVING SUSTAINABLE AVIATION FUEL BLENDING AND SUPPLY FACILITY

5.2.3.2 Drop-in capability of SAF increases its demand to reduce carbon footprint

5.2.3.3 Government initiatives such as tax reduction on aviation fuel

5.2.4 CHALLENGES

5.2.4.1 Increased cost of SAF increases operating cost of airlines

5.2.4.2 Inconsistency in techno-economic analysis (TEA) and lifecycle analysis (LCA)

5.2.4.3 Huge investments required in approval and certification of SAF

5.2.4.4 Large quantity of SAF must be produced to increase fuel blends

5.3 RANGES AND SCENARIOS

FIGURE 18 IMPACT OF COVID-19 ON THE MARKET: GLOBAL SCENARIOS

5.4 IMPACT OF COVID-19 ON SUSTAINABLE AVIATION FUEL MARKET

FIGURE 19 IMPACT OF COVID-19 ON SAF MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to December 2021

TABLE 4 KEY DEVELOPMENTS IN THE SAF Fuel MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to December 2021

TABLE 5 KEY DEVELOPMENTS IN THE SUSTAINABLE AVIATION FUEL MARKET 2020-2021

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SAF MARKET

FIGURE 20 REVENUE SHIFT IN SUSTAINABLE AVIATION FUEL MARKET

5.6 TARIFF AND REGULATORY LANDSCAPE

TABLE 6 POLICIES AND MEASURES FOR INTRODUCTION OF SUSTAINABLE AVIATION FUEL

5.7 AVERAGE SELLING PRICE TREND

TABLE 7 AVERAGE SELLING PRICE: AVIATION FUEL

5.8 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: SUSTAINABLE AVIATION FUEL MARKET

5.8.1 FEEDSTOCK PRODUCERS AND TRADERS

5.8.2 SAF TECHNOLOGY PROVIDERS

5.8.3 SAF PRODUCERS

5.8.4 OEMS AND REGULATION AUTHORITIES

5.8.5 SAF DISTRIBUTORS

5.8.6 AIRPORTS AND AIRLINES

5.9 SUSTAINABLE AVIATION FUEL MARKET ECOSYSTEM

5.9.1 PROMINENT COMPANIES

5.9.2 PRIVATE AND SMALL ENTERPRISES

5.9.3 END USERS

FIGURE 22 SAF MARKET ECOSYSTEM MAP

TABLE 8 SUSTAINABLE AVIATION FUEL MARKET ECOSYSTEM

5.10 TECHNOLOGY ANALYSIS

5.10.1 IMPROVED ENGINE TECHNOLOGIES AND AIRCRAFT DESIGN

5.10.2 NEW COMPOSITE LIGHTWEIGHT MATERIALS

5.10.3 HYBRID ELECTRIC PROPULSION

5.10.4 ELECTRO FUELS

5.11 USE CASE ANALYSIS

5.11.1 OFFTAKE AGREEMENTS

5.11.2 SUNFIRE E-CRUDE TO PRODUCE E-FUEL

5.11.3 CHEMICAL PLANT BY INERATEC GMBH FOR POWER-TO LIQUID TECHNOLOGY

5.11.4 GREEN PROPELLANT INFUSION

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 SUSTAINABLE AVIATION FUEL MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 KEY SAF MARKET: PORTER’S FIVE FORCE ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 DEGREE OF COMPETITION

5.13 VOLUME DATA

TABLE 10 SUSTAINABLE AVIATION FUEL OFFTAKE AGREEMENTS PER FUEL PRODUCER (2015-2021).

TABLE 11 SUSTAINABLE AVIATION FUEL OFFTAKE AGREEMENTS PER FUEL PURCHASER (2015-2021)

6 INDUSTRY TRENDS (Page No. - 89)

6.1 INTRODUCTION

6.2 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

6.2.1 SUSTAINABLE AVIATION FUEL USERS GROUP

6.2.2 INITIATIVES BY INTERNATIONAL AIR TRANSPORT ASSOCIATION MEMBERS

6.2.3 COMMERCIAL AVIATION ALTERNATIVE FUELS INITIATIVE

6.2.4 NORDIC & NISA INITIATIVES FOR SUSTAINABLE AVIATION

6.2.5 AIR TRANSPORT ACTION GROUP

6.2.6 INTERNATIONAL CIVIL AVIATION ORGANIZATION

6.2.7 INTERNATIONAL RENEWABLE ENERGY AGENCY

6.3 TECHNOLOGY TRENDS

6.3.1 HYDROTHERMAL LIQUEFACTION

6.3.2 PYROLYSIS

6.4 SUPPLY CHAIN ANALYSIS

6.4.1 MAJOR COMPANIES

6.4.2 SMALL AND MEDIUM ENTERPRISES

6.4.3 END USERS

6.5 EMERGING INDUSTRY TRENDS

6.5.1 ALCOHOL-TO-JET (ATJ)

6.5.2 HYCOGEN

6.5.3 FISCHER-TROPSCH (FT)

6.6 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS

6.7 IMPACT OF MEGATRENDS

6.8 INNOVATION & PATENT REGISTRATION

7 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE (Page No. - 97)

7.1 INTRODUCTION

FIGURE 25 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021 & 2030 (USD MILLION)

TABLE 12 SAF MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 13 MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 14 MARKET, BY FUEL TYPE, 2018-2020 (MILLION LITERS)

TABLE 15 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2030 (MILLION LITERS)

7.2 BIOFUEL

7.2.1 DROP-IN CAPABILITY WITH NO CHANGES IN INFRASTRUCTURE OF AIRCRAFT TO DRIVE DEMAND

7.3 HYDROGEN FUEL

7.3.1 ADVANTAGE OF BEING TRUE ZERO-CARBON SOLUTION TO DRIVE DEMAND

TABLE 16 CURRENT HYDROGEN-POWERED AIRCRAFT DEVELOPMENTS

7.4 POWER-TO-LIQUID

7.4.1 BENEFITS LIKE VERY LOW LIFECYCLE EMISSIONS TO DRIVE FUTURE DEMAND

7.5 GAS-TO-LIQUID

7.5.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE FUTURE DEMAND

8 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY (Page No. - 103)

8.1 INTRODUCTION

FIGURE 26 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021 & 2030 (USD MILLION)

TABLE 17 MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 18 MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 19 MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2018-2020 (MILLION LITERS)

TABLE 20 SAF MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (MILLION LITERS)

8.2 FISCHER TROPSCH - SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

8.2.1 ADOPTION ON COMMERCIAL SCALE FOR PRODUCTION OF SAF TO DRIVE DEMAND

8.3 HYDROPROCESSED ESTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

8.3.1 HIGH EMISSION REDUCTION POTENTIAL TO DRIVE DEMAND

8.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

8.4.1 R&D INITIATIVES TO INCREASE BLEND CAPACITY TO DRIVE DEMAND

8.5 ALCOHOL-TO-JET SPK (ATJ-SPK)

8.5.1 HIGH BLEND CAPACITY TO DRIVE DEMAND

8.6 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8.6.1 REQUIREMENT OF LARGE VOLUMES OF ALTERNATIVE JET FUEL TO DRIVE DEMAND

9 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY (Page No. - 108)

9.1 INTRODUCTION

FIGURE 27 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021 & 2030 (USD MILLION)

TABLE 21 MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 22 MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 23 MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (MILLION LITERS)

TABLE 24 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (MILLION LITERS)

9.2 BELOW 30%

9.2.1 NEED TO DECREASE DEPENDENCY ON PETROLEUM FUELS TO DRIVE DEMAND

9.3 30% TO 50%

9.3.1 NEED FOR REDUCTION OF CARBON FOOTPRINT IN AVIATION SECTOR TO DRIVE DEMAND

9.4 ABOVE 50%

9.4.1 R&D IN TECHNOLOGICAL PATHWAYS TO DRIVE DEMAND

10 SUSTAINABLE AVIATION FUEL MARKET, BY PLATFORM (Page No. - 113)

10.1 INTRODUCTION

10.2 IMPACT OF COVID-19 ON PLATFORMS OF SUSTAINABLE AVIATION FUEL (SAF) MARKET

10.2.1 MOST IMPACTED PLATFORM SEGMENT

10.2.1.1 Commercial aviation

10.2.1.2 Business & general aviation

10.2.2 LEAST IMPACTED PLATFORM SEGMENT

10.2.2.1 Military aviation

TABLE 25 BOEING MILITARY AIRCRAFT DELIVERIES, 2019 VS. 2020

FIGURE 28 SUSTAINABLE AVIATION FUEL MARKET, BY PLATFORM, 2021 & 2030 (USD MILLION)

TABLE 26 MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 27 MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 28 MARKET, BY PLATFORM, 2018-2020 (MILLION LITERS)

TABLE 29 SUSTAINABLE AVIATION FUEL MARKET, BY PLATFORM, 2021-2030 (MILLION LITERS)

10.3 COMMERCIAL AVIATION

10.3.1 GROWING CONCERNS OVER REDUCTION OF CARBON FOOTPRINT IN AVIATION SECTOR IS DRIVING THE SEGMENT

10.4 NARROW-BODY AIRCRAFT (NBA)

10.4.1 HIGH EFFICIENCY IN SHORT-HAUL TRAVEL TO DRIVE THE SEGMENT

10.5 WIDE-BODY AIRCRAFT (WBA)

10.5.1 INCREASING FOCUS OF AIRLINES ON LONG-HAUL ROUTES TO DRIVE THE SEGMENT

10.6 VERY LARGE AIRCRAFT (VLA)

10.6.1 INITIATIVES BY AIRLINES TO DRIVE THE SEGMENT

10.7 REGIONAL TRANSPORT AIRCRAFT (RTA)

10.7.1 RISING DOMESTIC AIR PASSENGER TRAFFIC IN EMERGING ECONOMIES TO DRIVE THE SEGMENT

10.8 MILITARY AVIATION

10.8.1 FIGHTER JETS

10.8.1.1 Growing procurement of fighter jets due to increasing military budgets to drive the segment

10.8.2 TRANSPORT AIRCRAFT

10.8.2.1 Increasing use of transport aircraft in military operations to drive the segment

10.8.3 MILITARY HELICOPTERS

10.8.3.1 Increasing use of helicopters in combat and search & rescue operations to drive the segment

10.9 BUSINESS & GENERAL AVIATION

10.9.1 BUSINESS JETS

10.9.1.1 Rising number of private aviation companies across the globe to drive the segment

10.9.2 COMMERCIAL HELICOPTERS

10.9.2.1 Increasing demand for helicopters in corporate and civil applications to drive the segment

10.9.3 ULTRALIGHT & LIGHT AIRCRAFT

10.9.3.1 Several ongoing projects to develop hydrogen fuel cell aircraft to drive the segment

10.10 UNMANNED AERIAL VEHICLE (UAV)

10.10.1 COMMERCIAL UNMANNED AERIAL VEHICLE

10.10.1.1 Several ongoing projects to develop hydrogen fuel cell aircraft to drive the segment

10.10.2 MILITARY UNMANNED AERIAL VEHICLE

10.10.2.1 Increasing use in defense applications to drive the segment

11 REGIONAL ANALYSIS (Page No. - 123)

11.1 INTRODUCTION

FIGURE 29 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF THE MARKET IN 2021

TABLE 30 SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 31 SAF MARKET, BY REGION, 2021-2030 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 COVID-19 RESTRICTIONS IN NORTH AMERICA

11.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

TABLE 32 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 41 NORTH AMERICA: SAF MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

11.2.3 US

11.2.3.1 Growing concerns over carbon emissions due to increasing air traffic to drive the market

TABLE 42 US: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 43 US: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 44 US: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 45 US: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Innovations focused on lowering carbon footprint to drive market

TABLE 46 CANADA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 47 CANADA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 49 CANADA: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3 EUROPE

11.3.1 COVID-19 RESTRICTIONS IN EUROPE

11.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

TABLE 50 EUROPE: MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 53 EUROPE: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 54 EUROPE: SAF MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 55 EUROPE: SAF MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 58 EUROPE: SAF MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 59 EUROPE: SAF MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Advancements in technological pathways to drive the market

TABLE 60 GERMANY: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 61 GERMANY: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 62 GERMANY: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 63 GERMANY: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3.4 UK

11.3.4.1 Presence of SAF manufacturers to drive the market

TABLE 64 UK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 65 UK: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 66 UK: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 67 UK: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Initiatives on low carbon strategy from global leaders to drive the market

TABLE 68 FRANCE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 69 FRANCE: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3.6 DENMARK

11.3.6.1 Stringent standards for reduction in carbon emissions to drive the market

TABLE 72 DENMARK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 73 DENMARK: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 74 DENMARK: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 75 DENMARK: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3.7 FINLAND

11.3.7.1 Long-term initiatives to advance technologies and produce e-fuels to drive the market

TABLE 76 FINLAND: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 77 FINLAND: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 78 FINLAND: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 79 FINLAND: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 80 REST OF EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 81 REST OF EUROPE: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 82 REST OF EUROPE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 83 REST OF EUROPE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC COVID-19 RESTRICTIONS

11.4.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

TABLE 84 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 87 ASIA PACIFIC: SAF MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 88 ASIA PACIFIC: SAF FUEL MARKET, BY BIOFUEL MANUFACTRUING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 92 ASIA PACIFIC: SAF MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Need to combat climate change due to rising air passenger traffic to drive the market

TABLE 94 INDIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 95 INDIA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 96 INDIA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 97 INDIA: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.4 AUSTRALIA

11.4.4.1 Initiatives for development and introduction of commercial supply chains of SAF to drive the market

TABLE 98 AUSTRALIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 99 AUSTRALIA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 100 AUSTRALIA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 101 AUSTRALIA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.5 SOUTH KOREA

11.4.5.1 Initiatives for low carbon strategy to drive the market

TABLE 102 SOUTH KOREA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 103 SOUTH KOREA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 105 SOUTH KOREA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.6 JAPAN

11.4.6.1 Investments in using blended bio-based and conventional jet fuel to drive the market

TABLE 106 JAPAN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 107 JAPAN: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 108 JAPAN: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 109 JAPAN: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.7 CHINAa

11.4.7.1 Collaborations between Chinese airlines, airframe manufacturers, and biofuel producers to drive the market

TABLE 110 CHINA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 111 CHINA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 112 CHINA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 113 CHINA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.8 SINGAPORE

11.4.8.1 Presence of oil & gas multinationals to drive the market

TABLE 114 SINGAPORE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 115 SINGAPORE: SAF MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 117 SINGAPORE: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.4.9 REST OF APAC

TABLE 118 REST OF APAC: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 119 REST OF APAC: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 120 REST OF APAC: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 121 REST OF APAC: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 MIDDLE EAST: COVID-19 IMPACT

11.5.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 33 MIDDLE EAST: SAF MARKET SNAPSHOT

TABLE 122 MIDDLE EAST: MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 123 MIDDLE EAST: MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 124 MIDDLE EAST: MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 125 MIDDLE EAST: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 126 MIDDLE EAST: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 127 MIDDLE EAST: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 128 MIDDLE EAST: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 129 MIDDLE EAST: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 130 MIDDLE EAST: MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 131 MIDDLE EAST: MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

11.5.3 UAE

11.5.3.1 New initiatives on sustainability to drive the market

TABLE 132 UAE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 133 UAE: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 134 UAE: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION

TABLE 135 UAE: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.5.4 BAHRAIN

11.5.4.1 Growing concerns over climate change to drive the market

TABLE 136 BAHRAIN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 137 BAHRAIN: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 138 BAHRAIN: MARKET, BY BIOFUEL BLENDING, 2018-2020 (USD MILLION)

TABLE 139 BAHRAIN: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.5.5 QATAR

11.5.5.1 Collaborations between airlines, aircraft & engine manufacturers, oil & gas industry, and research institutes to drive the market

TABLE 140 QATAR: SAF MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 141 QATAR: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 142 QATAR: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 143 QATAR: SAF MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 IMPACT

11.6.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 34 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

TABLE 144 LATIN AMERICA: MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY BIOFUEL MANUFACTRUING TECHNOLOGY, 2018-2020 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY BIOFUEL MANUFACTURING TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY PLATFORM, 2018-2020 (USD MILLION)

TABLE 153 LATIN AMERICA: SAF MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 GHG reduction initiatives to drive the market

TABLE 154 BRAZIL: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 155 BRAZIL: SAF MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 157 BRAZIL: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

11.6.4 MEXICO

11.6.4.1 Aviation biofuel initiatives by the government to drive the market

TABLE 158 MEXICO: SAF MARKET, BY FUEL TYPE, 2018-2020 (USD MILLION)

TABLE 159 MEXICO: MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 160 MEXICO: MARKET, BY BIOFUEL BLENDING CAPACITY, 2018-2020 (USD MILLION)

TABLE 161 MEXICO: MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 188)

12.1 INTRODUCTION

TABLE 162 KEY DEVELOPMENTS OF LEADING PLAYERS IN SUSTAINABLE AVIATION FUEL MARKET BETWEEN 2018 AND 2021

12.2 MARKET SHARE ANALYSIS, 2020

FIGURE 35 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN SUSTAINABLE AVIATION FUEL MARKET, 2021

TABLE 163 DEGREE OF COMPETITION

12.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

FIGURE 36 REVENUE ANALYSIS OF LEADING PLAYERS IN SUSTAINABLE AVIATION FUEL MARKET, 2020

12.4 COMPANY LEADERSHIP MAPPING

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVES

12.4.4 PARTICIPANTS

FIGURE 37 SUSTAINABLE AVIATION FUEL MARKET (GLOBAL) COMPANY EVALUATION MATRIX.

12.5 STARTUPS/SME MATRIX

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 38 SUSTAINABLE AVIATION FUEL MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2020

12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 164 COMPANY FOOTPRINT

TABLE 165 COMPANY APPLICATION FOOTPRINT

TABLE 166 COMPANY REGION FOOTPRINT

12.7 COMPETITIVE SCENARIO

12.7.1 PRODUCT LAUNCHES

TABLE 167 PRODUCT LAUNCHES

12.7.2 DEALS

TABLE 168 DEALS

13 COMPANY PROFILES (Page No. - 202)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

13.2.1 NESTE

TABLE 169 NESTE: BUSINESS OVERVIEW

FIGURE 39 NESTE: COMPANY SNAPSHOT

TABLE 170 NESTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 NESTE: PRODUCT DEVELOPMENTS

TABLE 172 NESTE: DEALS

13.2.2 FULCRUM BIOENERGY

TABLE 173 FULCRUM BIOENERGY: BUSINESS OVERVIEW

TABLE 174 FULCRUM BIOENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 175 FULCRUM BIOENERGY: PRODUCT DEVELOPMENTS

TABLE 176 FULCRUM BIOENERGY: DEALS

13.2.3 LANZATECH

TABLE 177 LANZATECH: BUSINESS OVERVIEWS

TABLE 178 LANZATECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 LANZATECH: DEALS

TABLE 180 LANZATECH: DEALS

13.2.4 WORLD ENERGY

TABLE 181 WORLD ENERGY: BUSINESS OVERVIEW

TABLE 182 WORLD ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 183 WORLD ENERGY: PRODUCT DEVELOPMENTS

TABLE 184 WORLD ENERGY: DEALS

13.2.5 TOTALENERGIES

TABLE 185 TOTALENERGIES: BUSINESS OVERVIEW

FIGURE 40 TOTALENERGIES: COMPANY SNAPSHOT

TABLE 186 TOTAL ENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 187 TOTAL ENERGY: PRODUCT DEVELOPMENTS

TABLE 188 TOTAL ENERGY: DEAL

13.2.6 GEVO

TABLE 189 GEVO: BUSINESS OVERVIEW

FIGURE 41 GEVO: COMPANY SNAPSHOT

TABLE 190 GEVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 191 GEVO: DEAL

13.2.7 SG PRESTON

TABLE 192 SG PRESTON: BUSINESS OVERVIEW

TABLE 193 SG PRESTON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 194 SG PRESTON: DEALS

13.2.8 VELOCYS

TABLE 195 VELOCYS: BUSINESS OVERVIEW

FIGURE 42 VELOCYS: COMPANY SNAPSHOT

TABLE 196 VELOCYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 197 VELOCYS: DEALS

13.2.9 NORTHWEST ADVANCED BIOFUELS

TABLE 198 NORTHWEST ADVANCED BIOFUELS: BUSINESS OVERVIEW

TABLE 199 NORTHWEST ADVANCED BIOFUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 NORTHWEST ADVANCED BIOFUELS: DEALS

13.2.10 SKYNRG

TABLE 201 SKYNRG: BUSINESS OVERVIEW

TABLE 202 SKYNRG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 203 SKYNRG: DEALS

13.2.11 RED ROCK BIOFUELS

TABLE 204 RED ROCK BIOFUELS: BUSINESS OVERVIEW

TABLE 205 RED ROCK BIOFUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 RED ROCK BIOFUELS: DEALS

13.2.12 AEMETIS

TABLE 207 AEMETIS: BUSINESS OVERVIEW

TABLE 208 AEMETIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 AEMETIS: DEALS

13.2.13 PROMETHEUS FUELS

TABLE 210 PROMETHEUS FUELS: BUSINESS OVERVIEW

TABLE 211 PROMETHEUS FUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 212 PROMETHEUS FUELS: DEALS

13.2.14 WASTEFUEL

TABLE 213 WASTEFUEL: BUSINESS OVERVIEW

TABLE 214 WASTEFUEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 215 WASTEFUEL: DEALS

13.2.15 ALDER FUELS

TABLE 216 ALDER FUELS: BUSINESS OVERVIEW

TABLE 217 ALDER FUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 218 ALDER FUELS: DEALS

13.2.16 SAF+ CONSORTIUM

TABLE 219 SAF+ CONSORTIUM: BUSINESS OVERVIEW

TABLE 220 SAF+ CONSORTIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 221 SAF+ CONSORTIUM: DEALS

13.2.17 PREEM

TABLE 222 PREEM: BUSINESS OVERVIEW

TABLE 223 PREEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 PREEM: DEALS

13.2.18 OMV

TABLE 225 OMV: BUSINESS OVERVIEW

TABLE 226 OMV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 227 OMV: DEALS

13.2.19 BP

TABLE 228 BP: BUSINESS OVERVIEW

FIGURE 43 BP: COMPANY SNAPSHOT

TABLE 229 BP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 230 BP: DEALS

13.3 OTHER PLAYERS

13.3.1 ATMOSFAIR

TABLE 231 ATMOSFAIR: BUSINESS OVERVIEW

TABLE 232 ATMOSFAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.2 PHILLIPS 66

TABLE 233 PHILLIPS 66: BUSINESS OVERVIEW

TABLE 234 PHILLIPS 66: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.3 SUNDROP FUELS

TABLE 235 SUNDROP FUELS: BUSINESS OVERVIEW

TABLE 236 SUNDROP FUELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.4 HYPOINT INC.

TABLE 237 HYPOINT INC.: BUSINESS OVERVIEW

TABLE 238 HYPOINT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.5 ZEROAVIA

TABLE 239 ZEROAVIA: BUSINESS OVERVIEW

TABLE 240 ZEROAVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 249)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The research study conducted on the sustainable aviation fuel market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the SAF Market. The primary sources considered included industry experts from the sustainable aviation fuel (SAF) market as well as raw material providers, sustainable aviation fuel manufacturers, hydrogen fuel and hydrogen fuel cell manufacturers, solution providers, technology developers, alliances, government agencies, aircraft & engine manufacturers and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the sustainable aviation fuel market as well as to assess the growth prospects of the market.

Secondary Research

Secondary sources referred for this research study included International Civil Aviation Organization (ICAO) publications, International Air Transport Association (IATA) publications, International Energy Agency (IEA) publications, International Renewable Energy Agency (IRENA) publications, Nordic Energy Research publications, European Union Aviation Safety Agency (EASA) Boeing, Airbus, Bombardier, and Embraer Market Outlook 2019, General Aviation Manufacturers Association (GAMA); publications, corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, & professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the sustainable aviation fuel market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the sustainable aviation fuel market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the sustainable aviation fuel, renewable aviation fuel, synthetic fuel, green jet fuel, hydrogen fuel, and e-fuels market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Top-Down approach

Data triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the sustainable aviation fuel market on the basis of fuel type, biofuel manufacturing technology, biofuel blending capacity, platform, and region

- To forecast the sustainable aviation fuel (SAF) market based on five regions—North America, Europe, Asia Pacific, the Middle East, —along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the SAF Market

- To analyze and give a pertaining view of the tariff and regulatory landscape adopted by various nations across the globe for initiatives on sustainable aviation fuel

- To strategically analyze emerging technological trends and prospects in the sustainable aviation fuel market

- To analyze micromarkets1 of the SAF Market in terms of the technological trends and prospects

- To analyze the adjacent and connected markets to provide valuable insights for manufacturers and suppliers of sustainable aviation fuel

- To profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze the impact of the COVID-19 pandemic on the sustainable aviation fuel (SAF) market and on various stakeholders in the market

- To provide a detailed competitive landscape of the sustainable aviation fuel market, along with an analysis of business and corporate strategies to track and analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches & developments adopted by key market players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sustainable Aviation Fuel (SAF) Market

Can you provide details of companies which buy and sell Aviation Fuel along with their specific preferences?