Switchgear Market by Insulation (Gas-insulated Switchgears, Air-insulated Switchgears), Installation (Indoor, Outdoor), Current (AC, DC), Voltage (Low (up to 1 kV), Medium (2–36 kV), High (Above 36 kV), End User and Region - Global Forecast to 2027

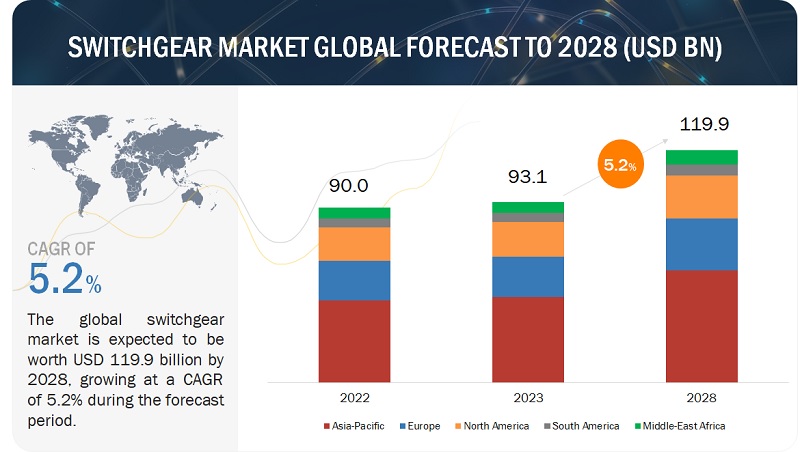

The switchgear market in terms of revenue was estimated to be worth $90.9 billion in 2022 and is projected to reach $120.1 billion by 2027, growing at a CAGR of 5.7% during the forecast period. New regulations to reduce/limit the power blackouts and strengthen the power distribution networks are creating a market for power sector equipment. The equipment to make smarter decisions by providing real-time data to reveal problems and improvement opportunities is the major factor driving the market of Switchgears.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Switchgear Market

The pandemic was a big disruptor that has created challenges and opportunities for the sector. The impact of COVID-19 has also highlighted the need for better risk management, greater preparedness, and resilience. Switchgear manufacturers continued to face many supply chain constraints, especially in base metals (copper, aluminum, steel), plastics, semiconductors, and transportation services. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the virus, resulted in a significant decline in manufacturing and industrial activity, impacting the switchgear market directly, as it is primarily employed in such industries and manufacturing units.

Switchgear Market Dynamics

Drivers: Increase in renewable energy-based capacity addition

Continuous governmental support in over 130 countries, aggressive net-zero objectives declared by countries accounting for nearly 90% of global GDP, and improved wind and solar PV competitiveness are all driving this expansion. In 2021, about 290 gigawatts (GW) of additional renewable energy capacity was installed, a 3% increase over the already strong growth in 2020. In 2021, solar PV accounted for more than half of global renewable energy expansion, followed by wind and hydropower. Renewable power growth in the European Union is projected to outperform what the existing National Energy and Climate Plans (NECPs) foresee for 2030, according to the trajectory of renewable capacity growth from 2021 to 2026. This pattern supports the goal of achieving the higher targets set out in the "Fit for 55" program. Member nations are implementing bigger auction volumes, firms are contracting for more renewable electricity, and consumers are continuing to install substantial numbers of solar panels, all of which are driving rapid adoption. This scenario will benefit the global switchgear industry as the n\eed for green and clean energy rises.

Restraints: Regulations restricting SF6 gas emissions

SF6 is also classified as a "greenhouse gas" (GHG). SF6 is the most potent GHG in global warming potential among the group of chemicals known as fluorinated gases (GWP). Strict measures have been put in place to limit SF6 emissions, including restrictions on its use. The European Climate Change Programme (ECCP) highlighted SF6 reduction as a crucial component in its GH reduction measures as early as the mid-2000s to achieve the EU's Kyoto Protocol commitments. Some fluorinated gases (F-gases) would eventually be banned in specified applications; the operational controls of systems that employ these gases would be strengthened, and their production and import/export operations limited. Under the 2015 Paris Climate Agreement, these efforts have continued. Most regulations that may eventually govern the use of SF6 deal with the chemically related group of fluorinated gases known as F-gases. This includes both hydrofluorocarbons (HFCs), which have a short lifetime in the atmosphere, and perfluorocarbons (PFCs), which have a long lifetime. More environmentally friendly alternatives have largely replaced HFCs and PFCs. As F-gas rules become more stringent, they will have a greater impact on SF6; this will affect the switchgear market.

Opportunities: Emerging smart technologies and digitalization

The intelligent switchgear business is expanding rapidly with continual advances in infrastructure and production facilities. Smart switchgears, which play an important part in the distribution of energy to industry and residential areas, are one of the sector's most important stimulants. As a result, implementing smart power distribution devices such as smart switchgear is critical for ensuring increased performance, power continuity, and resource optimization while lowering the transmission, operational, and maintenance costs. New smart switchgears are flexible, energy-efficient, and future-proof. They offer update and upgrade solutions with zero downtime; these technologies are expected to grow significantly in the future and provide growth opportunities.

Challenges: High temperature, arc flashing, and over pressure during operation

The energy released during an electrical defect when current passes through the air between two live conductors, generating a short circuit, is an arc flash. An arc flash normally produces only a brief flash of light before harmlessly extinguishing itself in a domestic situation. Voltages and currents are much higher in a commercial or industrial setting, so electrical breakdowns often release more energy. As a result, an arc flash frequently results in a tremendous explosion accompanied by scorching heat, toxic chemicals, blinding light, deafening noise, and massive pressure waves.

Market Map

To know about the assumptions considered for the study, download the pdf brochure

The gas-insulated switchgears segment by insulation is expected to grow at the highest CAGR from 2022 to 2027

Based on the insulation, the gas-insulated switchgears is estimated to be the fastest-growing market from 2020 to 2027. They are deployed in various industries, serving different needs at varying voltage levels. GIS uses sealed enclosures filled with sulfur hexafluoride (SF6) or a mixture of SF6 and other insulating gases. Continuous current and interrupting ratings for GIS are typically limited to 3,000 A and 40 kA. These switchgears have a higher upfront cost than AIS but offer better efficiency, protection, less maintenance, and less space. Hence, utilities are increasingly using them in substations. Also, rising electrification, especially in the developing and newly industrialized regions of Asia Pacific, is further fuelling the demand for GIS.

AC segment by current is projected to emerge as the largest segment for switchgear market

Based on the current, AC is projected to hold the highest market share during the forecast period. AC switchgear power systems are used by utilities, industries, businesses, and residential buildings to provide protection, isolation, and control for electrical systems. AC power can travel great distances without a power loss, ultimately allowing for a lower-cost power supply. Much of the power generated by utilities is AC, and hence, it makes the AC segment the dominant one in the switchgear market.

The transmission & distribution utilities by end user is expected to grow at the highest CAGR from 2022 to 2027

By end user, transmission & distribution utilities form the largest end user segment and is expected to grow at the highest CAGR from 2022 to 2027. Transmission & distribution utilities include non-renewable and renewable sources of energy to fulfill the demand for electricity. The increasing adoption of renewal energy sources for power generation makes it necessary to upgrade the current infrastructure to allow easy integration of the electricity generated from renewable sources. Developing countries, especially in the Asia Pacific and South America, are aiming towards achieving 100% electrification and, as a result, are working extensively towards expanding the current infrastructure. These factors are expected to drive the growth of the transmission & distribution utilities.

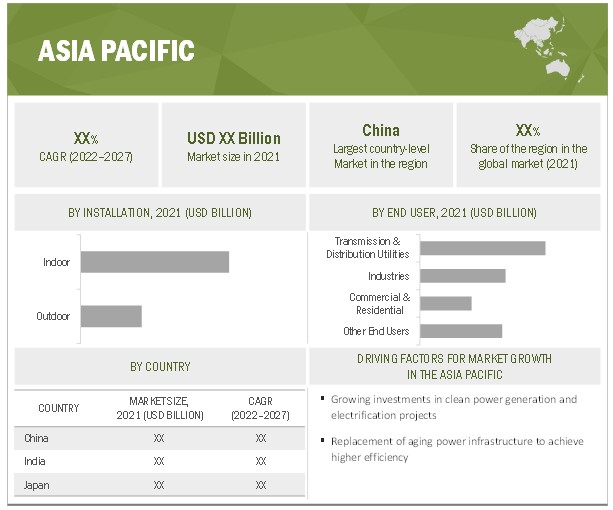

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific region is expected to dominate the switchgear market during the forecast period. According to International Monetary Fund (IMF), the economy of the Asia Pacific region is estimated to grow by 4.9% in the fiscal year 2022. The growth slowdown resulting from the COVID-19 pandemic in 2020 significantly affected the region, which saw its economy decline by ~1.5% in 2020. As a result, the energy demand fell substantially but has rebounded since the lifting of lockdown measures and the full-scale resumption of industrial & manufacturing sectors in the region. Furthermore, the growth of population in the region increases the burden on the housing infrastructure and will compel economies to focus on expanding public housing infrastructure. The continued growth in the Asia Pacific region in almost all major industrial sectors is expected to drive the demand for switchgears during the forecast period.

Key Players

Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Mitsubishi Electric (Japan), General Electric (US), Eaton (Ireland), Legrand (France), Hitachi (Japan), Hyundai Electric (South Korea), Fuji Electric (Japan), and Toshiba (Japan)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market size: |

|

|

Growth Rate: |

5.7% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

By Insulation, By Installation, By Current, By Voltage, and By End User |

|

Geographies Covered: |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Emerging smart technologies and digitalization |

|

Key Market Drivers: |

Increase in renewable energy-based capacity addition |

This research report categorizes the switchgear market based on insulation, installation, voltage, current, end user, and region.

Based on insulation:

- Gas-insulated Switchgears

- Air-insulated Switchgears

- Others

Based on installation:

- Indoor

- Outdoor

Based on voltage:

- Low (up to 1 kV)

- Medium (2–36 kV)

- High (Above 36 kV)

Based on current:

- AC

- DC

Based on end user:

- Transmission & Distribution Utilities

- Industries

- Commercial & Residential

- Other End Users

Based on the region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In January 2022, ABB partnered with Samsung Electronics to provide jointly developed technologies for energy savings, energy management, and smart Internet of Things (IoT) connections for both residential and commercial buildings.

- GE and Hitachi-ABB Power Grids signed a non-exclusive cross-licensing agreement in April 2021 that will enable them to expand their high-voltage equipment line by adopting a game-changing gas alternative to sulfur hexafluoride (SF6). SF6 is an insulating and switching gas commonly used in high-voltage electrical equipment. It is a potent greenhouse gas.

- GE Renewable Energy’s Grid Solutions business was awarded USD 2.6 million in July 2021 through the European Commission’s life climate action program to help fund the development of a sulfur hexafluoride (SF6)-free 245-kilovolt (kV) g3 live tank circuit breaker. The new circuit breaker will use GE's g3 gas technology to achieve the same high-performance and small-dimensional footprint as a typical SF6 circuit breaker.

Frequently Asked Questions (FAQ):

What is the current size of the switchgear market?

The current market size of global switchgear market is estimated to be USD 90.9 billion in 2022.

What is the major driver for switchgear market?

Increase in renewable energy-based capacity addition can be considered as a major driver for the switchgears market.

Which is the largest-growing region during the forecasted period in switchgear market?

Asia Pacific is expected to account for the largest market size during the forecast period. North America accounted for a 47.1% share of the switchgear market in 2021. The countries covered in the region are China, India, Japan, Australia, and the Rest of Asia Pacific. The major end-users for switchgears in the region include power transmission & distribution utilities, industries, commercial & residential sectors, and transportation. The region also has growing shipbuilding and maritime industry. The manufacturing industry in the region is expected to witness further growth in the market due to lower capital and labor costs. The demand for power generation is also witnessing an upward trend with the rising population in China & India. Countries in the Asia Pacific region have lucrative opportunities for switchgears due to the rising energy demand and replacing aging coal-fired power plants & distribution infrastructure with new & smart infrastructure.

Which is the fastest-growing segment, by current, during the forecasted period in switchgear market?

The DC segment is expected to grow at the fastest CAGR during the forecast period. DC switchgears enable the optimum management of power used for powering specific business units of customers and increasing the efficiency of data centers. DC traditionally has been difficult to transmit over longer distances due to the inability to increase or decrease the voltage without converting it to AC; however, this is changing due to the introduction of high-voltage, direct current (HVDC) systems, making it possible to transmit electrical power efficiently over long distances using DC. Also, the contribution of renewables to the electricity mix is increasing at a rapid pace globally due to increased investments in renewable power generation. DC switchgears, as a result, are expected to receive a surge in demand during the forecast period. DC switchgears are also commonly used in railway traction substations, and the electrification of railways presents further opportunities for the growth of the DC switchgear market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 SWITCHGEAR MARKET, BY INSULATION

1.3.2 MARKET, BY INSTALLATION

1.3.3 MARKET, BY VOLTAGE

1.3.4 MARKET, BY CURRENT

1.3.5 MARKET, BY END USER

1.3.6 MARKET, BY REGION

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 SWITCHGEAR MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR SWITCHGEAR

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING THE SUPPLY OF SWITCHGEARS

FIGURE 9 SWITCHGEAR MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 SWITCHGEAR MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC DOMINATED THE MARKET IN 2021

FIGURE 11 AIR-INSULATED SWITCHGEARS SEGMENT TO ACCOUNT FOR A LARGER SHARE BETWEEN 2022 AND 2027

FIGURE 12 INDOOR SEGMENT TO LEAD MARKET, BY INSTALLATION, FROM 2022 TO 2027

FIGURE 13 HIGH (ABOVE 36 KV) SEGMENT TO DOMINATE THE MARKET FROM 2022 TO 2027

FIGURE 14 AC SEGMENT TO HOLD THE LARGEST SHARE OF THE MARKET FROM 2022 TO 2027

FIGURE 15 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT TO HOLD THE LARGEST SHARE OF THE MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SWITCHGEAR MARKET

FIGURE 16 STRENGTHENING OF POWER DISTRIBUTION INFRASTRUCTURE TO DRIVE THE MARKET BETWEEN 2022 AND 2027

4.2 MARKET, BY REGION

FIGURE 17 ASIA PACIFIC MARKET TO EXHIBIT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY END USER AND COUNTRY, 2021

FIGURE 18 TRANSMISSION & DISTRIBUTION UTILITIES AND CHINA HELD THE LARGEST SHARES

4.4 MARKET, BY INSULATION

FIGURE 19 AIR-INSULATED SWITCHGEARS TO ACCOUNT FOR THE LARGEST SHARE, BY INSULATION

4.5 MARKET, BY INSTALLATION

FIGURE 20 THE INDOOR SEGMENT DOMINATES THE MARKET

4.6 MARKET, BY VOLTAGE

FIGURE 21 HIGH (ABOVE 36 KV) SEGMENT TO HOLD THE LARGEST SHARE OF THE MARKET

4.7 MARKET, BY CURRENT

FIGURE 22 AC SEGMENT TO HOLD THE LARGEST SHARE OF THE MARKET

4.8 MARKET, BY END USER

FIGURE 23 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT DOMINATES THE MARKET

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 24 GLOBAL PROPAGATION OF COVID-19

FIGURE 25 PROPAGATION OF COVID-19 CASES IN SELECT COUNTRIES

5.3 MARKET DYNAMICS

FIGURE 26 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Strengthening of power distribution infrastructure

5.3.1.2 Increase in renewable energy-based capacity addition

FIGURE 27 INSTALLED RENEWABLE ENERGY CAPACITY (2016–2021)

5.3.1.3 Increased investment in industrial production

FIGURE 28 GLOBAL GDP GROWTH (2010–2022)

5.3.2 RESTRAINTS

5.3.2.1 Regulations restricting SF6 gas emissions

TABLE 2 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME HORIZON)

5.3.2.2 Slowdown in the residential real estate sector

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging smart technologies and digitalization

5.3.3.2 Growing usage of high-voltage direct current systems

5.3.4 CHALLENGES

5.3.4.1 High temperature, arc flashing, and over pressure during operation

5.3.4.2 High competition from the unorganized sector

5.4 COVID-19 IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SWITCHGEAR PROVIDERS

FIGURE 29 REVENUE SHIFT FOR SWITCHGEAR PROVIDERS

5.6 MARKET MAP

FIGURE 30 MARKET MAP: MARKET

TABLE 3 MARKET: ROLE IN ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS: MARKET

5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.7.2 COMPONENT MANUFACTURERS

5.7.3 SWITCHGEAR MANUFACTURERS/ASSEMBLERS

5.7.4 DISTRIBUTORS (BUYERS)/END USERS

5.7.5 POST-SALES SERVICES

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT-CONNECTED SWITCHGEARS

5.8.2 SF6-FREE SWITCHGEAR

5.9 KEY CONFERENCES & EVENTS IN 2022–2024

TABLE 4 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 TARIFFS, CODES, AND REGULATIONS

5.10.1 TARIFFS RELATED TO SWITCHGEAR

TABLE 5 IMPORT TARIFFS FOR HS 8536 LOW-VOLTAGE PROTECTION EQUIPMENT IN 2019

TABLE 6 IMPORT TARIFFS FOR HS 8535 HIGH-VOLTAGE PROTECTION EQUIPMENT IN 2019

5.11 TRADE ANALYSIS

5.11.1 TRADE ANALYSIS FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS, FOR A VOLTAGE EXCEEDING 1,000 VOLTS

5.11.2 IMPORT SCENARIO

TABLE 7 IMPORT SCENARIO FOR HS CODE: 853590, BY COUNTRY, 2019–2021 (USD)

5.11.3 EXPORT SCENARIO

TABLE 8 EXPORT SCENARIO FOR HS CODE: 853590, BY COUNTRY, 2019–2021 (USD)

5.11.4 TRADE ANALYSIS FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS, FOR A VOLTAGE NOT EXCEEDING 1,000 VOLTS

5.11.5 IMPORT SCENARIO

TABLE 9 IMPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.11.6 EXPORT SCENARIO

TABLE 10 EXPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.11.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.8 CODES AND REGULATIONS RELATED TO SWITCHGEAR

TABLE 15 SWITCHGEAR: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 16 SWITCHGEAR: INNOVATIONS AND PATENT REGISTRATIONS, MAY 2018–APRIL 2022

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS FOR THE SWITCHGEAR MARKET

TABLE 17 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

TABLE 18 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

5.15 BUYING CRITERIA

FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.16 CASE STUDY ANALYSIS

5.16.1 A MIDWEST MUNICIPAL UTILITY IMPROVES THE SAFETY AND RELIABILITY OF ITS DISTRIBUTION SYSTEM BY REPLACING OIL-INSULATED SWITCHGEAR WITH ELASTIMOLD SOLID-DIELECTRIC SWITCHGEAR

5.16.1.1 Problem Statement: April 2022

5.16.1.2 Solution

5.16.2 BECKENRIED MUNICIPAL UTILITY IMPROVES THE SUPPLY AT 1,600 METERS ABOVE SEA LEVEL BY REPLACING WITH EATON SF6-FREE XIRIA E SWITCHGEAR

5.16.2.1 Problem Statement: April 2022

5.16.2.2 Solution

5.16.3 GREYSTONE POWER CORPORATION SWITCHED FROM OIL-INSULATED SWITCHGEAR TO SOLID-DIELECTRIC SWITCHGEAR

5.16.3.1 Problem Statement: April 2021

5.16.3.2 Solution

5.16.4 SUSTAINABLE ELECTRICITY SUPPLY IN THE NETHERLANDS GAASPERDAMMER TUNNEL

5.16.4.1 Problem Statement: April 2021

5.16.4.2 Solution

6 SWITCHGEAR MARKET, BY INSULATION (Page No. - 94)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY INSULATION, 2021 (%)

TABLE 20 MARKET, BY INSULATION, 2020–2027 (USD BILLION)

6.2 AIR-INSULATED SWITCHGEARS

6.2.1 EXPANSION OF GRID INFRASTRUCTURE TO DRIVE THE MARKET FOR AIR-INSULATED SWITCHGEARS

TABLE 21 AIR-INSULATED SWITCHGEARS MARKET, BY REGION, 2020–2027 (USD BILLION)

6.3 GAS-INSULATED SWITCHGEARS

6.3.1 LOWER MAINTENANCE REQUIREMENTS AND SMALLER FOOTPRINT DRIVE DEMAND FOR GAS-INSULATED SWITCHGEARS

TABLE 22 GAS-INSULATED MARKET, BY REGION, 2020–2027 (USD BILLION)

6.4 OTHERS

TABLE 23 OTHER SWITCHGEARS MARKET, BY REGION, 2020–2027 (USD BILLION)

7 SWITCHGEAR MARKET, BY INSTALLATION (Page No. - 99)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY INSTALLATION, 2021

TABLE 24 MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

7.2 INDOOR

7.2.1 INCREASING INVESTMENTS IN THE RENEWABLES SECTOR TO DRIVE THE DEMAND FOR INDOOR SWITCHGEARS

TABLE 25 INDOOR MARKET, BY REGION, 2020–2027 (USD BILLION)

7.3 OUTDOOR

7.3.1 REQUIREMENT FOR HIGH-VOLTAGE SWITCHGEARS DRIVES THE OUTDOOR MARKET

TABLE 26 OUTDOOR MARKET, BY REGION, 2020–2027 (USD BILLION)

8 SWITCHGEAR MARKET, BY VOLTAGE (Page No. - 103)

8.1 INTRODUCTION

FIGURE 37 SWITCHGEAR MARKET, BY VOLTAGE, 2021

TABLE 27 MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

8.2 LOW (UP TO 1 KV)

8.2.1 GROWTH OF THE COMMERCIAL INFRASTRUCTURE SECTOR TO BOOST THE LOW-VOLTAGE MARKET

TABLE 28 MARKET FOR LOW (UP TO 1 KV) VOLTAGE, BY REGION, 2020–2027 (USD BILLION)

8.3 MEDIUM (2–36KV)

8.3.1 INCREASING USE OF MEDIUM-VOLTAGE SWITCHGEAR IN RAILWAYS SUPPORTS MARKET GROWTH

TABLE 29 MARKET FOR MEDIUM (2–36KV) VOLTAGE, BY REGION, 2020–2027 (USD BILLION)

8.4 HIGH (ABOVE 36KV)

8.4.1 STRENGTHENING OF TRANSMISSION AND DISTRIBUTION INFRASTRUCTURE TO DRIVE THE DEMAND FOR HIGH-VOLTAGE (ABOVE 36 KV) SWITCHGEARS

TABLE 30 MARKET FOR HIGH (ABOVE 36 KV) VOLTAGE, BY REGION, 2020–2027 (USD BILLION)

9 SWITCHGEAR MARKET, BY CURRENT (Page No. - 108)

9.1 INTRODUCTION

FIGURE 38 SWITCHGEAR MARKET, BY CURRENT, 2021

TABLE 31 MARKET, BY CURRENT, 2020–2027 (USD BILLION)

9.2 AC

9.2.1 GROWING DEMAND FOR POWER TO DRIVE THE AC MARKET

TABLE 32 AC MARKET, BY REGION, 2020–2027 (USD BILLION)

9.3 DC

9.3.1 GROWING INVESTMENTS IN RENEWABLE POWER GENERATION PLAY A KEY ROLE IN MARKET GROWTH

TABLE 33 DC SWITCHGEAR MARKET, BY REGION, 2020–2027 (USD BILLION)

10 SWITCHGEAR MARKET, BY END USER (Page No. - 112)

10.1 INTRODUCTION

FIGURE 39 MARKET, BY END USER, 2021

TABLE 34 MARKET, BY END USER, 2020–2027 (USD BILLION)

10.2 TRANSMISSION & DISTRIBUTION UTILITIES

10.2.1 GROWING ELECTRIFICATION TO DRIVE THE GROWTH OF THE TRANSMISSION & DISTRIBUTION UTILITIES

TABLE 35 MARKET FOR TRANSMISSION & DISTRIBUTION UTILITIES, BY REGION, 2020–2027 (USD BILLION)

10.3 INDUSTRIES

10.3.1 ECONOMIC GROWTH TO DRIVE THE INDUSTRIES END-USER SEGMENT OF THE MARKET

TABLE 36 MARKET FOR INDUSTRIES, BY REGION, 2020–2027 (USD BILLION)

10.4 COMMERCIAL & RESIDENTIAL

10.4.1 INFRASTRUCTURAL DEVELOPMENTS AND URBANIZATION TO DRIVE THE GROWTH OF THE COMMERCIAL & RESIDENTIAL SEGMENT

TABLE 37 MARKET FOR COMMERCIAL AND RESIDENTIAL, BY REGION, 2020–2027 (USD BILLION)

10.5 OTHER END USERS

TABLE 38 SWITCHGEAR MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD BILLION)

11 SWITCHGEAR MARKET, BY REGION (Page No. - 118)

11.1 INTRODUCTION

FIGURE 40 SWITCHGEAR MARKET SHARE, BY REGION, 2021

FIGURE 41 MARKET IN THE ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 39 MARKET, BY REGION, 2020–2027 (USD BILLION)

11.2 ASIA PACIFIC

FIGURE 42 SNAPSHOT: ASIA PACIFIC MARKET

11.2.1 BY INSULATION

TABLE 40 ASIA PACIFIC: MARKET, BY INSULATION, 2020–2027 (USD BILLION)

11.2.2 BY INSTALLATION

TABLE 41 ASIA PACIFIC: MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

11.2.3 BY VOLTAGE

TABLE 42 ASIA PACIFIC: MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

11.2.4 BY CURRENT

TABLE 43 ASIA PACIFIC: MARKET, BY CURRENT, 2020–2027 (USD BILLION)

11.2.5 BY END USER

TABLE 44 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.2.6 BY COUNTRY

TABLE 45 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

11.2.6.1 China

11.2.6.1.1 Increasing investments in clean power generation to drive the market growth in China

TABLE 46 CHINA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.2.6.2 India

11.2.6.2.1 Rising electrification initiatives in remote parts of India to drive the demand for switchgears

TABLE 47 INDIA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.2.6.3 Japan

11.2.6.3.1 Replacing aging infrastructure to drive the market growth for switchgears in Japan

TABLE 48 JAPAN: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.2.6.4 Australia

11.2.6.4.1 Electrification of the Australian railroad network to drive the demand for switchgears

TABLE 49 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.2.6.5 Rest of Asia Pacific

TABLE 50 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3 EUROPE

FIGURE 43 SNAPSHOT: EUROPE MARKET

11.3.1 BY INSULATION

TABLE 51 EUROPE: MARKET, BY INSULATION, 2020–2027 (USD BILLION)

11.3.2 BY INSTALLATION

TABLE 52 EUROPE: MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

11.3.3 BY VOLTAGE

TABLE 53 EUROPE: MARKET VOLUME, BY VOLTAGE, 2020–2027 (USD BILLION)

11.3.4 BY CURRENT

TABLE 54 EUROPE: MARKET, BY CURRENT, 2020–2027 (USD BILLION)

11.3.5 BY END USER

TABLE 55 EUROPE: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3.6 BY COUNTRY

TABLE 56 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

11.3.6.1 Germany

11.3.6.1.1 Increasing focus on energy efficiency and grid expansion to drive the market growth for switchgears

TABLE 57 GERMANY: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3.6.2 UK

11.3.6.2.1 The growing integration of renewables in the electricity mix to drive the UK market

TABLE 58 UK: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3.6.3 Italy

11.3.6.3.1 Interconnection of grids to drive the market demand for switchgears in Italy

TABLE 59 ITALY: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3.6.4 France

11.3.6.4.1 Growing focus on the addition of renewable energy-based capacity to drive the market growth in France

TABLE 60 FRANCE: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.3.6.5 Rest of Europe

TABLE 61 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.4 NORTH AMERICA

11.4.1 BY INSULATION

TABLE 62 NORTH AMERICA: MARKET, BY INSULATION, 2020–2027 (USD BILLION)

11.4.2 BY INSTALLATION

TABLE 63 NORTH AMERICA: MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

11.4.3 BY VOLTAGE

TABLE 64 NORTH AMERICA: MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

11.4.4 BY CURRENT

TABLE 65 NORTH AMERICA: MARKET, BY CURRENT, 2020–2027 (USD BILLION)

11.4.5 BY END USER

TABLE 66 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.4.6 BY COUNTRY

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

11.4.6.1 US

11.4.6.1.1 Replacement of aging power infrastructure to drive the switchgear market in the US

TABLE 68 US: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.4.6.2 Canada

11.4.6.2.1 The requirement for low-emission power generation and growing investments in renewables to drive the market growth

TABLE 69 CANADA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.4.6.3 Mexico

11.4.6.3.1 Growing investments in strengthening electric power infrastructure to drive the market growth in Mexico

TABLE 70 MEXICO: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 BY INSULATION

TABLE 71 MIDDLE EAST & AFRICA: MARKET, BY INSULATION, 2020–2027 (USD BILLION)

11.5.2 BY INSTALLATION

TABLE 72 MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

11.5.3 BY VOLTAGE

TABLE 73 MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

11.5.4 BY CURRENT

TABLE 74 MIDDLE EAST & AFRICA: MARKET, BY CURRENT, 2020–2027 (USD BILLION)

11.5.5 BY END USER

TABLE 75 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5.6 BY COUNTRY

TABLE 76 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

11.5.6.1 Saudi Arabia

11.5.6.1.1 Favorable government policies supporting the utilization of renewables for power generation to drive the demand for switchgears

TABLE 77 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5.6.2 UAE

11.5.6.2.1 Rapid economic development and the growing demand for power to drive the market growth for switchgears in the UAE

TABLE 78 UAE: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5.6.3 Egypt

11.5.6.3.1 Replacement of power generation infrastructure to drive the growth of the switchgear market in Egypt

TABLE 79 EGYPT: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5.6.4 South Africa

11.5.6.4.1 Growing development projects for wind power plants to drive the market demand for switchgears in South Africa

TABLE 80 SOUTH AFRICA: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.5.6.5 Rest of the Middle East & Africa

TABLE 81 REST OF MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.6 SOUTH AMERICA

11.6.1 BY INSULATION

TABLE 82 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSULATION, 2020–2027 (USD BILLION)

11.6.2 BY INSTALLATION

TABLE 83 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSTALLATION, 2020–2027 (USD BILLION)

11.6.3 BY VOLTAGE

TABLE 84 SOUTH AMERICA: SWITCHGEAR MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

11.6.4 BY CURRENT

TABLE 85 SOUTH AMERICA: SWITCHGEAR MARKET, BY CURRENT, 2020–2027 (USD BILLION)

11.6.5 BY END USER

TABLE 86 SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.6.6 BY COUNTRY

TABLE 87 SOUTH AMERICA: SWITCHGEAR MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

11.6.6.1 Brazil

11.6.6.1.1 Growing demand for power & electrification to drive the demand for switchgears in Brazil

TABLE 88 BRAZIL: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.6.6.2 Argentina

11.6.6.2.1 Rising power demand and government initiatives towards the utilization of renewable energy to drive the switchgear market in Argentina

TABLE 89 ARGENTINA: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

11.6.6.3 Rest of South America

TABLE 90 REST OF SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2020–2027 (USD BILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 154)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 91 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, APRIL 2019–APRIL 2022

12.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 92 SWITCHGEAR MARKET: DEGREE OF COMPETITION

FIGURE 44 SWITCHGEAR MARKET SHARE ANALYSIS, 2021

12.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 45 TOP PLAYERS IN THE SWITCHGEAR MARKET, 2017–2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 46 COMPETITIVE LEADERSHIP MAPPING: SWITCHGEAR MARKET, 2021

12.6 START-UP/SME EVALUATION QUADRANT, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 47 SWITCHGEAR MARKET: START-UP/SME EVALUATION QUADRANT, 2021

12.6.5 COMPETITIVE BENCHMARKING

TABLE 93 SWITCHGEAR MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 94 SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

12.7 SWITCHGEAR MARKET: COMPANY FOOTPRINT

TABLE 95 COMPANY FOOTPRINT: BY VOLTAGE

TABLE 96 COMPANY FOOTPRINT: BY END USER

TABLE 97 BY REGION: COMPANY FOOTPRINT

TABLE 98 OVERALL COMPANY FOOTPRINT

12.8 COMPETITIVE SCENARIO

TABLE 99 SWITCHGEAR MARKET: PRODUCT LAUNCHES, AUGUST 2020–MARCH 2022

TABLE 100 SWITCHGEAR MARKET: DEALS, OCTOBER 2021–APRIL 2022

TABLE 101 SWITCHGEAR MARKET: OTHER DEVELOPMENTS, APRIL 2019–APRIL 2022

13 COMPANY PROFILES (Page No. - 172)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, Other developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 ABB

TABLE 102 ABB: BUSINESS OVERVIEW

FIGURE 48 ABB: COMPANY SNAPSHOT (2021)

TABLE 103 ABB: PRODUCTS OFFERED

TABLE 104 ABB: DEALS

TABLE 105 ABB: OTHER DEVELOPMENTS

13.1.2 GENERAL ELECTRIC

TABLE 106 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 49 GENERAL ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 107 GENERAL ELECTRIC: PRODUCTS OFFERED

TABLE 108 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 109 GENERAL ELECTRIC: DEALS

TABLE 110 GENERAL ELECTRIC: OTHER DEVELOPMENTS

13.1.3 SIEMENS

TABLE 111 SIEMENS: BUSINESS OVERVIEW

FIGURE 50 SIEMENS: COMPANY SNAPSHOT (2021)

TABLE 112 SIEMENS: PRODUCTS OFFERED

TABLE 113 SIEMENS: PRODUCT LAUNCHES

TABLE 114 SIEMENS: DEALS

TABLE 115 SIEMENS: OTHER DEVELOPMENTS

13.1.4 SCHNEIDER ELECTRIC

TABLE 116 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 51 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT (2021

TABLE 117 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 118 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 119 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

13.1.5 EATON

TABLE 120 EATON: BUSINESS OVERVIEW

FIGURE 52 EATON: COMPANY SNAPSHOT (2021)

TABLE 121 EATON: PRODUCTS OFFERED

TABLE 122 EATON: PRODUCT LAUNCHES

TABLE 123 EATON: DEALS

TABLE 124 EATON: OTHER DEVELOPMENTS

13.1.6 MITSUBISHI ELECTRIC

TABLE 125 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 53 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 126 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

TABLE 127 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

TABLE 128 MITSUBISHI ELECTRIC: DEALS

13.1.7 POWELL

TABLE 129 POWELL: COMPANY OVERVIEW

FIGURE 54 POWELL: COMPANY SNAPSHOT (2021)

TABLE 130 POWELL: PRODUCTS OFFERED

13.1.8 HAVELLS

TABLE 131 HAVELLS: BUSINESS OVERVIEW

FIGURE 55 HAVELLS: COMPANY SNAPSHOT (2021)

TABLE 132 HAVELLS: PRODUCTS OFFERED

TABLE 133 HAVELLS: PRODUCT LAUNCHES

13.1.9 BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

TABLE 134 BHEL: BUSINESS OVERVIEW

FIGURE 56 BHEL: COMPANY SNAPSHOT (2021)

TABLE 135 BHEL: PRODUCTS OFFERED

13.1.10 HYUNDAI ELECTRIC

TABLE 136 HYUNDAI ELECTRIC: BUSINESS OVERVIEW

FIGURE 57 HYUNDAI ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 137 HYUNDAI ELECTRIC: PRODUCTS OFFERED

13.1.11 HUBBELL

TABLE 138 HUBBELL: BUSINESS OVERVIEW

FIGURE 58 HUBBELL: COMPANY SNAPSHOT (2021)

TABLE 139 HUBBELL: PRODUCTS OFFERED

13.1.12 FUJI ELECTRIC

TABLE 140 FUJI ELECTRIC: BUSINESS OVERVIEW

FIGURE 59 FUJI ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 141 FUJI ELECTRIC: PRODUCTS OFFERED

TABLE 142 FUJI ELECTRIC: DEALS

TABLE 143 FUJI ELECTRIC: OTHER DEVELOPMENTS

13.1.13 HITACHI

TABLE 144 HITACHI: BUSINESS OVERVIEW

FIGURE 60 HITACHI: COMPANY SNAPSHOT (2020)

TABLE 145 HITACHI: PRODUCTS OFFERED

TABLE 146 HITACHI: PRODUCT LAUNCHES

TABLE 147 HITACHI: DEALS

TABLE 148 HITACHI: OTHER DEVELOPMENTS

13.1.14 LEGRAND

TABLE 149 LEGRAND: BUSINESS OVERVIEW

FIGURE 61 LEGRAND: COMPANY SNAPSHOT (2021)

TABLE 150 LEGRAND: PRODUCTS OFFERED

13.1.15 CG POWER AND INDUSTRIAL SOLUTIONS

TABLE 151 CG POWER AND INDUSTRIAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 62 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT (2021)

TABLE 152 CG POWER AND INDUSTRIAL SOLUTIONS: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 HYOSUNG

13.2.2 LUCY ELECTRIC

13.2.3 TOSHIBA

13.2.4 SÉCHERON

13.2.5 ELEKTROBUDOWA

*Details on Business Overview, Products Offered, Recent Developments, Deals, Other developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 242)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

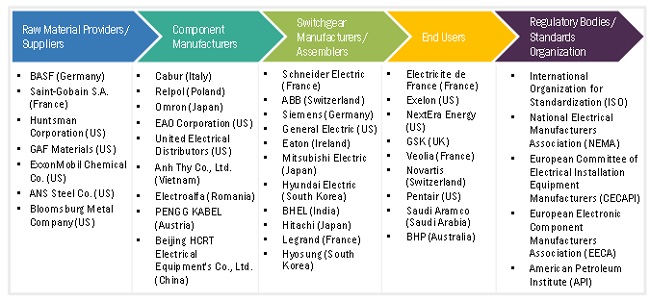

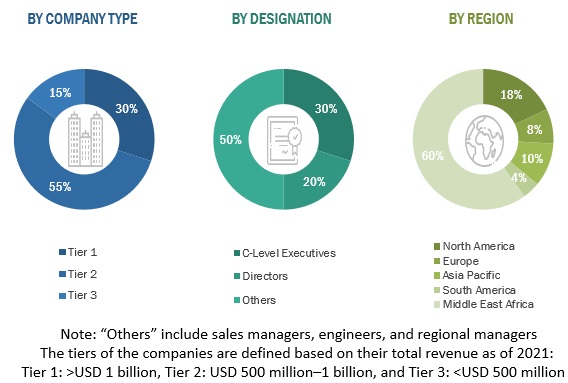

This study involved major activities in estimating the current size of the switchgear market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global switchgear market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The switchgear market comprises several stakeholders, such as component manufacturers, product manufacturers/assemblers, service providers, distributors/end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of Transmission and distribution utilities. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the switchgear market.

- In this approach, the switchgear production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of switchgears.

- Several primary interviews have been conducted with key opinion leaders related to switchgear system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Switchgear Market Size: Bottom-Up Approach

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the switchgear market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the switchgear market by insulation, installation, voltage, current, and end user, in terms of value

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the switchgear market

- This report covers the switchgear market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Switchgear Market

We want a Scorecard for Competitors in the switchgear Market projected forecast should be 2022 to 2030.