Technical Insulation Market by Product Type (Flexible, Rigid, MMF), Application (Heating & Plumbing, HVAC, Refrigeration, Industrial Process, Acoustic), End-use (Industrial & OEM, Energy, Transportation, Commercial), and Region - Global Forecast to 2024

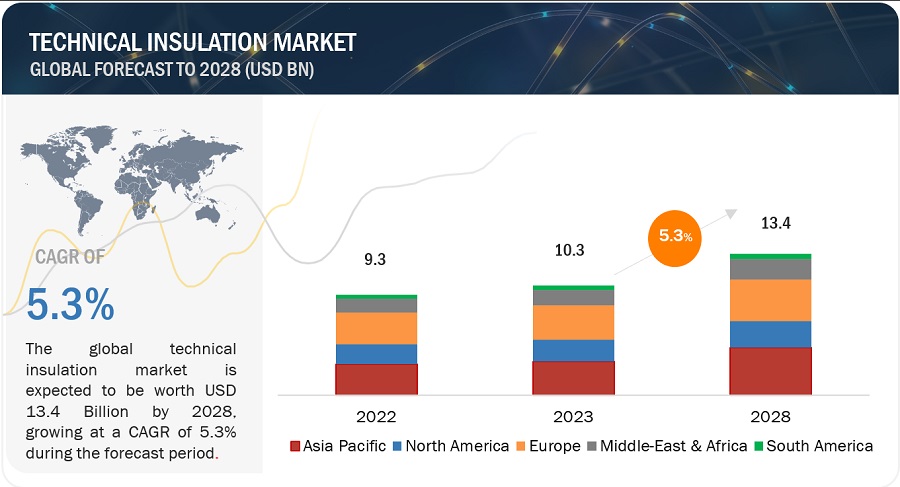

[191 Pages Report] The technical insulation market size is projected to grow from USD 7.6 billion in 2019 to USD 9.2 billion by 2024, at a CAGR of 4.0%, during the forecast period. The presence of stringent regulations regarding insulation of equipment and pipes and growing demand in the oil & gas sector are driving the technical insulation market.

Industrial & OEM segment is projected to be the fastest-growing end-use industry in the technical insulation market during the forecast period.

Industrial & OEM end-use industry dominated the overall technical insulation market in 2018. The market in this segment is driven by the need to conserve energy in industrial plants by increasing the efficiency of plants. Low thermal conductivity, low water absorption, effective noise reduction, and corrosion resistance are the other properties of insulation materials required for technical insulation. These factors are responsible for the growth of the industrial segment in the technical insulation market.

The man-made mineral fibers are projected to account for the largest share, by product type, during the forecast period.

Man-made mineral fiber can be subsegmented into stone wool, fiberglass, cellular glass, calcium silicate, microporous insulation, aerogel, and vacuum insulated panels. This segment is projected to register the highest CAGR, in terms of value, between 2019 and 2024. This is because these man-made mineral fibers are used in pipes at a maximum temperature of 1,148 0F (620°C) as they are fire resistant. They have high compression resistance and can fit properly in a pipe section. They help to maintain optimal temperatures of both hot and cold pipes. They also help in condensation control. They are also a noise dampener and thus are used in the acoustic insulation systems.

APAC is expected to account for the largest technical insulation market share during the forecast period

The APAC technical insulation market is segmented as China, India, South Korea, Japan, Australia, and Rest of APAC. APAC is projected to continue its dominance over the market till 2024. Increasing population and urbanization in the region are the major reasons for the growth of technical insulation market in the region. Chinas emergence as a global manufacturing hub has resulted in an increase in the demand for insulation in commercial spaces and industrial & OEM segment. Cheap labor and easy availability of raw materials boost the production of insulation products in the region.

Key Market Players

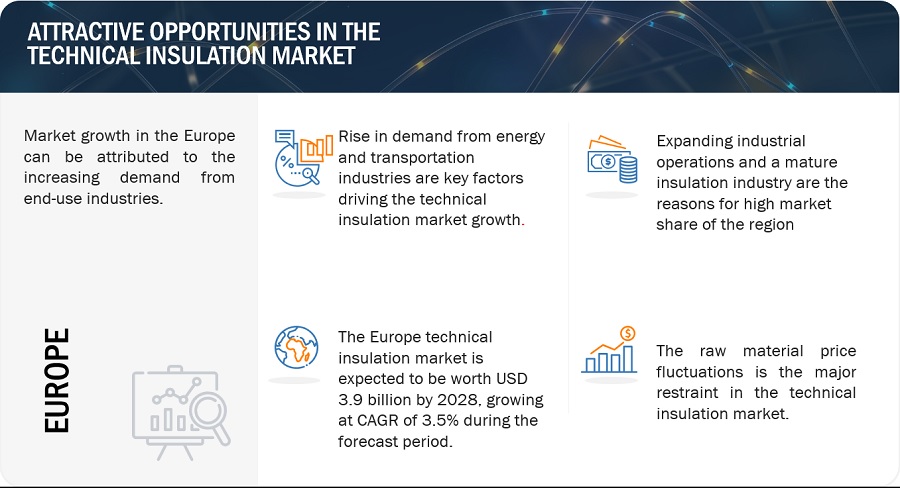

Zotefoams Plc (UK), Owens Corning (US), Kingspan Group Plc (Ireland), ETEX Group SA (Belgium), Rockwool International A/S (Denmark), Recticel NV/SA (Belgium), Morgan Advanced Materials plc (UK), Armacell International S.A. (Luxembourg), Aspen Aerogels, Inc. (US), Knauf Insulation (Germany), LISOLANTE K-FLEX S.P.A. (Italy), Johns Manville (US), Saint-Gobain ISOVER (France), NMC SA (Belgium), Palziv Inc. (Israel), Unifrax I LLC (US), Durkee (Wuhan) Insulation Material Co., Ltd. (China), Huamei Energy-Saving Technology Group Co., Ltd. (China), Wincell Insulation Material Co., Ltd (China), and INTEREP SAS (France) are some of the players operating in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Million) |

|

Segments |

Product Type, Application, and End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Zotefoams Plc (UK), Owens Corning (US), Kingspan Group Plc (Ireland), ETEX Group SA (Belgium), Rockwool International A/S (Denmark), Recticel NV/SA (Belgium), Morgan Advanced Materials plc (UK), Armacell International S.A. (Luxembourg), Aspen Aerogels, Inc. (US), Knauf Insulation (Germany), LISOLANTE K-FLEX S.P.A. (Italy), Johns Manville (US), Saint-Gobain ISOVER (France), NMC SA (Belgium), Palziv Inc. (Israel), Unifrax I LLC (US), Durkee (Wuhan) Insulation Material Co., Ltd. (China), Huamei Energy-Saving Technology Group Co., Ltd. (China), Wincell Insulation Material Co., Ltd (China), and INTEREP SAS (France). |

This research report categorizes the technical insulation market based on product type, application, end-use industry, and region.

Based on Product Type, the technical insulation market has been segmented as follows:

- Flexible Foam

- Rigid Foam

- Man-made Mineral Fiber

Based on Application, the technical insulation market has been segmented as follows:

- Heating & Plumbing

- HVAC

- Refrigeration

- Industrial Processes

- Acoustic

Based on End-use Industry, the technical insulation market has been segmented as follows:

- Industrial & OEM

- Energy

- Transportation

- Commercial Buildings

Based on Region, the technical insulation market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In November 2017, the company set up its first rockwool factory in Romania. The expansion helped to cater to the growing demand for rockwool insulation material. Also, in November 2017, the company acquired Flumroc AG, a rockwool manufacturer in Switzerland. This helped the company to strengthen its product portfolio.

- In April 2018, the company acquired Guangde SKD Rock Wool Manufacture Co. Ltd. (China), a manufacturer of mineral wool. The acquisition helped the company to strengthen its presence in China. In February 2018, the company acquired Paroc Group, a leading producer of mineral wool insulation for building and technical applications in Europe. The acquisition helped the company to broaden its portfolio of technical insulation products.

Key Questions Addressed by the Report

- What is the mid-to-long term impact of the developments undertaken in the industry?

- What are the upcoming trends that will affect the overall insulation industry?

- Which segment has the potential to register the highest market share?

- What is the current competitive landscape in the technical insulation market in terms of new product type, application, end-use industry, with reference to the production and sales?

- What will be the growth prospects of the technical insulation market?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of technical insulation?

How is technical insulation different from traditional insulation?

What are the factors contributing to the final price of technical insulation?

What are some of the macro-indicators that drive the demand for technical insulation?

Which are the key industries driving the technical insulation market?

What are the types of technical insulation?

How is the technical insulation market distributed?

Who are the major manufacturers?

What are some newer technologies/products?

What is the biggest restraint for technical insulation market growth?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in the Technical Insulation Market

4.2 Technical Insulation Market, By Material Type

4.3 Technical Insulation Market, By Application and Key Countries

4.4 Technical Insulation Market, By End-Use Industry

4.5 Technical Insulation Market, Developed vs. Developing Countries

4.6 APAC: Technical Insulation Market

4.7 Technical Insulation Market: Major Countries

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Power and Energy Requirements in Emerging Economies Owing to Rapid Industrialization and Urbanization

5.2.1.2 Stringent Regulations Mandating Use of Insulation Materials for Energy Conservation

5.2.1.3 Growth in Oil & Gas Demand

5.2.2 Restraints

5.2.2.1 Fluctuation in Availability and Prices of Raw Material

5.2.2.2 Low Awareness About Technical Insulation

5.2.3 Opportunities

5.2.3.1 Increased Infrastructure Spending in Emerging Economies

5.2.4 Challenges

5.2.4.1 High Capital Cost and Lack of Skilled Labor for Installation

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Analysis

5.4.1 GDP of Major Economies in Terms of Ppp

5.4.2 Trends and Forecast of Oil Industry and Its Impact on Technical Insulation Market

6 Technical Insulation Market, By Material Type (Page No. - 50)

6.1 Introduction

6.2 Hot Insulation

6.2.1 Excellent Properties of Hot Insulation to Drive the Demand for Technical Insulation Market

6.2.2 Fiberglass

6.2.3 Stonewool

6.2.4 Calcium Silicate

6.2.5 Microporous Insulation

6.2.6 Aerogel

6.2.7 Vacuum Insulated Panel (VIP)

6.3 Cold-Flexible Insulation

6.3.1 Cold-Flexible Insulation Provides Superior Physical and Mechanical Properties

6.3.2 Elastomeric Foams

6.3.3 Ethylene Propylene Diene Monomer (EPDM)

6.3.4 Polyethylene (PE) & Xpe Foams

6.3.5 Polypropylene (PP)

6.3.6 Other Polyolefin (PO) & Extruded Polyolefin (XPO)

6.4 Cold-Rigid Insulation

6.4.1 Usage of Cold-Rigid Insulation in Commercial Buildings to Boost Consumption of Technical Insulation

6.4.2 Polyurethane (Pu/Pur) and Polyisocyanurate (PIR) Foam

6.4.3 Phenolic Foam

6.4.4 Expanded Polystyrene (EPS)

6.4.5 Extruded Polystyrene (XPS)

7 Technical Insulation Market, By Application (Page No. - 57)

7.1 Introduction

7.2 Industrial Processes

7.2.1 Need for Temperature, Noise, and Vibration Control in Industrial Processes Expected to Drive the Technical Insulation Market

7.3 Heating & Plumbing

7.3.1 Technical Insulation Mainly Used for Insulating Heating & Plumbing Systems to Ensure Safety

7.4 HVAC

7.4.1 Excellent Acoustic and Thermal Performance of Technical Insulation Materials to Drive Consumption in HVAC Segment

7.5 Acoustic

7.5.1 Increasing Need for Sound Control in Pipes and Ducts Expected to Drive the Technical Insulation Market

7.6 Refrigeration

7.6.1 Good Water Vapor Transmission and Low Water Absorption Characteristics Boosting the Demand in Refrigeration Application

8 Technical Insulation Market, By End-Use Industry (Page No. - 63)

8.1 Introduction

8.2 Industrial & Oem

8.2.1 Need for Energy Conservation in Industrial Facilities and Oems Drives the Technical Insulation Market

8.3 Energy

8.3.1 Oil & Gas

8.3.1.1 Increase in Demand for Energy in Emerging Economies Driving the Technical Insulation Market in Oil & Gas Sector

8.3.2 Petrochemical

8.3.2.1 Rising Demand for Petrochemicals in Various Industries Driving the Consumption of Technical Insulation

8.3.3 Others

8.4 Transportation

8.4.1 Automotive

8.4.1.1 Growing Demand for Technologically Advanced Vehicles to Drive the Technical Insulation Market

8.4.2 Aerospace

8.4.2.1 Increasing Demand for Fuel-Efficient Aircraft to Spur the Demand for Technical Insulation

8.4.3 Marine

8.4.3.1 Need for Heat and Fire Protection in Boats and Ships to Drive the Technical Insulation Market

8.5 Commercial Buildings

8.5.1 Technical Insulation in Commercial Buildings Saves Cost and Provides Thermal Comfort

9 Technical Insulation Market, By Region (Page No. - 71)

9.1 Introduction

9.2 Europe

9.2.1 Russia

9.2.1.1 Growth of the Industrial Sector Fueling Demand in Major End-Use Industries

9.2.2 Germany

9.2.2.1 Investments in Chemical & Petrochemical Industry Driving the Technical Insulation Market

9.2.3 UK & Ireland

9.2.3.1 Public and Commercial Building Sectors to Exhibit Growth in the Country

9.2.4 France

9.2.4.1 Transition to Clean Economy Using Renewable Energy Expected to Boost the Demand for Technical Insulation

9.2.5 Benelux

9.2.5.1 Free International Labor Market Benefits the Industrial Sectors of Benelux Countries

9.2.6 Nordic Countries

9.2.6.1 Significant Oil & Gas Production Drives the Demand for Technical Insulation

9.2.7 Central Europe East

9.2.7.1 Strong Industrial Sector Driving Technical Insulation Market in the Region

9.2.8 Spain

9.2.8.1 Growth of Concentrated Solar Power Generation Expected to Drive the Technical Insulation Market

9.2.9 Central Europe North

9.2.9.1 Government Initiatives on Development of Chemical & Petrochemical Sector are Fueling the Market

9.2.10 Italy

9.2.10.1 Growing Investments in Petrochemical Industry Fueling Demand for Technical Insulation

9.2.11 Balcanic Countries

9.2.11.1 Huge Demand From Oil & Gas Industry to Drive the Market

9.2.12 Switzerland

9.2.12.1 Increasing Demand for Technical Insulation From Hydroelectricity and Nuclear Power Sectors

9.2.13 Austria

9.2.13.1 Growth of Industrial Sector in Newer Eu Countries Driving the Austrian Chemical Industry

9.2.14 Rest of Europe

9.3 APAC

9.3.1 China

9.3.1.1 Rapid Economic Growth is the Main Driver of Technical Insulation Market in China

9.3.2 Japan

9.3.2.1 Rise in Export of Chemical-Based Products Expected to Drive the Technical Insulation Market

9.3.3 India

9.3.3.1 Growing Urban Population Expected to Drive the Market in Commercial Buildings Sector

9.3.4 South Korea

9.3.4.1 Increase in Export of Petrochemicals and Electronics Propelling the Consumption of Technical Insulation

9.3.5 Australia

9.3.5.1 Lng Supply Contracts With Other Economies Driving the Technical Insulation Market

9.3.6 Rest of APAC

9.4 North America

9.4.1 US

9.4.1.1 US Leads the Demand for Technical Insulation in North America

9.4.2 Canada

9.4.2.1 Abundant Availability of Feedstock is Boosting the Demand for Technical Insulation

9.4.3 Mexico

9.4.3.1 Governments Clean Energy Initiative is Expected to Propel Demand for Technical Insulation

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Refinery Integration Activities Expected to Drive the Technical Insulation Market

9.5.2 UAE

9.5.2.1 Oil & Gas Exploration Activities Likely to Boost the Market

9.5.3 Turkey

9.5.3.1 Growth in Commercial Construction Activities to Fuel Consumption of Technical Insulation

9.5.4 South Africa

9.5.4.1 Growing Urbanization and Industrialization Influencing the Technical Insulation Market in South Africa

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Growing Consumption of Electricity is Supporting the Growth of Technical Insulation Market in Brazil

9.6.2 Peru

9.6.2.1 Development in Downstream Activities to Strengthen the Oil & Gas Industry in the Country

9.6.3 Colombia

9.6.3.1 Oil & Gas Exploration Activities Likely to Drive the Technical Insulation Market in Colombia

9.6.4 Rest of South America

10 Competitive Landscape (Page No. - 131)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Market Ranking Analysis

10.6 Competitive Scenario

10.6.1 Investment & Expansion

10.6.2 New Product Development/Launch

10.6.3 Acquisition

10.6.4 Contract & Agreement, Joint Venture, and Partnership

11 Company Profiles (Page No. - 142)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Rockwool International A/S

11.2 Saint-Gobain Isover

11.3 Owens Corning

11.4 Knauf Insulation

11.5 Kingspan Group PLC

11.6 Armacell International S.A.

11.7 L'isolante K-Flex S.P.A.

11.8 Morgan Advanced Materials PLC

11.9 Etex Group Sa

11.10 Aspen Aerogels, Inc.

11.11 Zotefoams PLC

11.12 Johns Manville

11.13 Recticel Nv/SA

11.14 NMC SA

11.15 Palziv Inc.

11.16 Unifrax I LLC

11.17 Durkee (Wuhan) Insulation Material Co., Ltd.

11.18 Huamei Energy-Saving Technology Group Co., Ltd.

11.19 Wincell Insulation Material Co., Ltd

11.20 Interep Sas

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 185)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (146 Tables)

Table 1 Technical Insulation Market Snapshot, 2019 vs. 2024

Table 2 GDP of Major Economies, in Terms of Ppp, 20142023 (USD Million)

Table 3 Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 4 Hot Insulation: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 5 Cold-Flexible Insulation: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 6 Cold-Rigid Insulation: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 7 Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 8 Industrial Processes: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 9 Heating & Plumbing: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 10 HVAC: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 11 Acoustic: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 12 Refrigeration: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 13 Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 14 Industrial & Oem: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 15 Energy: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 16 Oil & Gas: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 17 Petrochemical: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 18 Others: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 19 Transportation: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 20 Automotive: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 21 Aerospace: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 22 Marine: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 23 Commercial Buildings: Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 24 Technical Insulation Market Size, By Region, 20172024 (USD Million)

Table 25 Europe: Technical Insulation Market Size, By Country, 20172024 (USD Million)

Table 26 Europe: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 27 Europe: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 28 Europe: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 29 Russia: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 30 Russia: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 31 Russia: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 32 Germany: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 33 Germany: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 34 Germany: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 35 UK & Ireland: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 36 UK & Ireland: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 37 UK & Ireland: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 38 France: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 39 France: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 40 France: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 41 Benelux: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 42 Benelux: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 43 Benelux: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 44 Nordic Countries: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 45 Nordic Countries: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 46 Nordic Countries: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 47 Central Europe East: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 48 Central Europe East: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 49 Central Europe East: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 50 Spain: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 51 Spain: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 52 Spain: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 53 Central Europe North: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 54 Central Europe North: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 55 Central Europe North: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 56 Italy: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 57 Italy: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 58 Italy: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 59 Balcanic Countries: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 60 Balcanic Countries: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 61 Balcanic Countries: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 62 Switzerland: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 63 Switzerland: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 64 Switzerland: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 65 Austria: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 66 Austria: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 67 Austria: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 68 Rest of Europe: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 69 Rest of Europe: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 70 Rest of Europe: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 71 APAC: Technical Insulation Market Size, By Country, 20172024 (USD Million)

Table 72 APAC: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 73 APAC: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 74 APAC: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 75 China: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 76 China: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 77 China: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 78 Japan: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 79 Japan: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 80 Japan: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 81 India: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 82 India: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 83 India: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 84 South Korea: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 85 South Korea: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 86 South Korea: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 87 Australia: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 88 Australia: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 89 Australia: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 90 Rest of APAC: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 91 Rest of APAC: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 92 Rest of APAC: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 93 North America: Technical Insulation Market Size, By Country, 20172024 (USD Million)

Table 94 North America: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 95 North America: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 96 North America: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 97 US: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 98 US: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 99 US: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 100 Canada: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 101 Canada: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 102 Canada: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 103 Mexico: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 104 Mexico: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 105 Mexico: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 106 Middle East & Africa: Technical Insulation Market Size, By Country, 20172024 (USD Million)

Table 107 Middle East & Africa: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 108 Middle East & Africa: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 109 Middle East & Africa: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 110 Saudi Arabia: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 111 Saudi Arabia: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 112 Saudi Arabia: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 113 UAE: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 114 UAE: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 115 UAE: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 116 Turkey: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 117 Turkey: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 118 Turkey: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 119 South Africa: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 120 South Africa: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 121 South Africa: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 122 Rest of Middle East & Africa: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 123 Rest of Middle East & Africa: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 124 Rest of Middle East & Africa: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 125 South America: Technical Insulation Market Size, By Country, 20172024 (USD Million)

Table 126 South America: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 127 South America: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 128 South America: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 129 Brazil: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 130 Brazil: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 131 Brazil: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 132 Peru: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 133 Peru: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 134 Peru: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 135 Colombia: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 136 Colombia: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 137 Colombia: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 138 Rest of South America: Technical Insulation Market Size, By Material Type, 20172024 (USD Million)

Table 139 Rest of South America: Technical Insulation Market Size, By Application, 20172024 (USD Million)

Table 140 Rest of South America: Technical Insulation Market Size, By End-Use Industry, 20172024 (USD Million)

Table 141 Investment & Expansion, 20162018

Table 142 New Product Development/Launch, 20162018

Table 143 Acquisition, 20162018

Table 144 Contract & Agreement, Joint Venture, and Partnership, 20162018

Table 145 Major Manufacturing Plants Location

Table 146 Major Manufacturing Plants Location

List of Figures (54 Figures)

Figure 1 Technical Insulation Market: Research Design

Figure 2 Market Size Estimation: Technical Insulation Market

Figure 3 Technical Insulation Market, By Region

Figure 4 Technical Insulation Market, By End-Use Industry

Figure 5 Market Size Estimation: Bottom-Up Approach, By Material Type

Figure 6 Market Size Estimation: Top-Down Approach

Figure 7 Hot Insulation Segment to Account for Largest Share of Overall Technical Insulation Market

Figure 8 Industrial Processes to Be the Largest Application of Technical Insulation Market

Figure 9 Transportation to Be the Fastest-Growing End-Use Industry of Technical Insulation

Figure 10 Europe to Lead the Technical Insulation Market

Figure 11 Emerging Economies to Offer Lucrative Growth Opportunities for Market Players

Figure 12 Hot Insulation to Be the Largest Segment

Figure 13 Industrial Processes Segment to Account for the Largest Market Share

Figure 14 Industrial & Oem Industry Accounted for the Largest Share in 2018

Figure 15 Technical Insulation Market to Grow at A Faster Rate in Developing Countries

Figure 16 China to Lead the Technical Insulation Market in APAC

Figure 17 India and Brazil to Register the Highest Cagr in the Market

Figure 18 Drivers, Restraints, Opportunities, and Challenges in the Technical Insulation Market

Figure 19 Technical Insulation Market: Porters Five Forces Analysis

Figure 20 Global Oil Production, 2013-2017

Figure 21 Hot Insulation to Be the Largest Material Type in 2019

Figure 22 Industrial Processes to Remain the Largest Application

Figure 23 High Growth in Major End-Use Industries to Drive the Technical Insulation Market

Figure 24 China to Be the Fastest-Growing Technical Insulation Market

Figure 25 Industrial & Oem Segment Accounts for Largest Market Share in Europe

Figure 26 APAC: Technical Insulation Market Snapshot

Figure 27 North America: Technical Insulation Market Snapshot

Figure 28 Saudi Arabia to Be Largest Technical Insulation Market in Middle East & Africa

Figure 29 Increasing Demand From Industrial & Oem Segment to Drive the Technical Insulation Market

Figure 30 Acquisition Was the Key Growth Strategy Adopted By the Market Players Between 2016 and 2018

Figure 31 Global Technical Insulation Market: Competitive Leadership Mapping, 2018

Figure 32 Ranking of Key Players

Figure 33 Rockwool International: Company Snapshot

Figure 34 Rockwool International: SWOT Analysis

Figure 35 Saint-Gobain Isover: SWOT Analysis

Figure 36 Owens Corning: Company Snapshot

Figure 37 Owens Corning: SWOT Analysis

Figure 38 Knauf Insulation: SWOT Analysis

Figure 39 Kingspan Group: Company Snapshot

Figure 40 Kingspan Group: SWOT Analysis

Figure 41 Armacell International: Company Snapshot

Figure 42 Armacell International: SWOT Analysis

Figure 43 L'isolante K-Flex: SWOT Analysis

Figure 44 Morgan Advanced Materials: Company Snapshot

Figure 45 Morgan Advanced Materials: SWOT Analysis

Figure 46 Etex Group: Company Snapshot

Figure 47 Etex Group: SWOT Analysis

Figure 48 Aspen Aerogels: Company Snapshot

Figure 49 Aspen Aerogels: SWOT Analysis

Figure 50 Zotefoams: Company Snapshot

Figure 51 Zotefoams: SWOT Analysis

Figure 52 Johns Manville: SWOT Analysis

Figure 53 Recticel: Company Snapshot

Figure 54 Recticel: SWOT Analysis

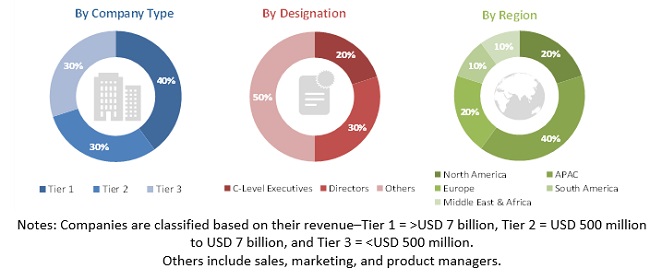

The study involved four major activities in estimating the current market size of technical insulation. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the technical insulation market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The technical insulation market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by the development of the end-use industries, such as industrial & OEM, energy, transportation, and commercial buildings. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the technical insulation market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the estimation processes explained abovethe market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the technical insulation market, in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market based on product type, application, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition and investment & expansion in the technical insulation market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the technical insulation market, by segment

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Technical Insulation Market