Telehealth & Telemedicine Market by Component (Software & Services (RPM, Real-Time), Hardware (Monitors)), Delivery (On-Premise, Cloud-Based), Application (Teleradiology, Telestroke, TeleICU), End User (Provider, Payer) & Region - Global Forecast to 2027

Updated on : February 06, 2023

The global telehealth & telemedicine market in terms of revenue was estimated to be worth $87.2 billion in 2022 and is poised to reach $285.7 billion by 2027, growing at a CAGR of 26.6% from 2022 to 2027. Growth in the telehealth and telemedicine market is mainly driven by factors such as the rising geriatric and medically underserved (especially rural) populations, the increasing need to expand healthcare access, the growing prevalence of chronic diseases and conditions, a shortage of physicians, advancements in telecommunications, the rising level of government support, and cost-benefits of telehealth solutions. However, regulatory disparities in different regions, increasing usage of social media for care provision and possibility of fraud may restrain the market growth to certain extent over the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact On The Telehealth & Telemedicine Market

The COVID-19 pandemic has had a stressful impact on the economy as well as the population worldwide. The pandemic, however, offered a pool of opportunities in the telehealth and telemedicine market, owing to its capability of minimizing exposure and ensuring the safety of caregivers and physicians. Owing to its several advantages, especially in routine care and conditions where services do not require direct one-on-one interaction, telemedicine can be a powerful monitoring and coordination mechanism to ensure appropriate use of provider facilities. Telemedicine technology, with its growing applications across the entire healthcare system, serves to be a strength for the industry. However, with the large immediate increase in usage, telehealth companies could face challenges in handling loads and may face technical problems and IT crashes, which would require sophisticated mobility solutions. Hence, telehealth companies also have a good opportunity to understand and evaluate these challenges and tackle such situations.

Telehealth & Telemedicine Market Dynamics

Driver: Advancements in telecommunications

Advancements in telecommunications have enabled uninterrupted communication between patients and healthcare providers by successfully integrating medical devices and ICT to deliver healthcare over long distances. Advancements in IT have provided the industry with an ever-expanding array of options like more stable broadband networks, mobile devices with advanced cameras for defined images, HD videoconferencing, and digital health records. This has generated huge opportunities for healthcare providers. For instance, implementing 5G technologies in the healthcare sector helps limit transmission times by avoiding network delays and quickly transferring data for store-and-forward services. Such technologies help expedite operations for many firms. Such advancements in technology have also supported improvements in remote monitoring, patient compliance, and, subsequently, the quality of life. They have helped expand telehealth and telemedicine capabilities and ensured growing demand among patients and providers.

Opportunity: Use of blockchain

The need for blockchain technology in the healthcare industry has become increasingly evident, especially due to the COVID-19 outbreak. Governments, techies, and entrepreneurs are now looking at leveraging blockchain technology in the healthcare industry to help solve the spread of the virus. Despite the convenience of telemedicine, this technology raises potential security concerns. If the virtual connection between a doctor and the patient is not secure, the location, data, and other sensitive patient information may be leaked. The privacy risks associated with telemedicine mostly stem from the lack of security controls over data collection, use, and sharing. Blockchain applications enable secure, immutable, and anonymous transactions across networks to mediate mutually agreed-upon interactions between parties. This distributed ledger technology can help facilitate a more efficient way to transfer data effectively and communicate across organizations. Blockchain also allows medical records to be stored in secure, fragmented systems containing large amounts of data and information, enabling providers to store a complete patient history and securely encrypt medical data. Furthermore, providers could create a private network for their blockchain and only invite patients directly. Thus, market players are taking initiatives to leverage the power of blockchain in telehealth to facilitate the secure exchange of patient data.

Restraint: Regulatory variations across regions

There are significant state-to-state and inter-country variations in laws and policies governing telehealth and telemedicine practices and a lack of specifications. For example, different states in the US represent a mixed scenario, with different guidelines for obtaining patient consent before a telemedicine visit. Variations in the eligibility criteria for the delivery of telemedicine services, differences in requirements on disclosing provider credentials, and different reimbursement parameters further impact the market growth. Moreover, different countries find it difficult to deploy telehealth or telemedicine provisions jointly due to the lack of a unified and defined legal framework or guidelines to implement these practices. In addition, there are legal restrictions on the cloud-based transfer of medical data across international borders. In many countries, the protected health information (PHI) of patients cannot be moved out of their country of origin. These regulatory barriers restrict the market for telehealth and telemedicine; they will continue to remain a restraint unless unified laws are implemented to ensure smooth and streamlined operations.

Challenge: Behavioral barriers, healthcare affordability, and the lack of awareness

Behavioral barriers may not be the most obvious restricting factor but still pose significant barriers to telehealth and telemedicine adoption. Physicians and patients often lack familiarity with new practices and do not readily give up existing (conventional) practices. Older people may also refuse to use telehealth and telemedicine services due to unfamiliarity with the technology. The virtual nature of the services may also affect perceptions of telehealth among patients long used to in-person meetings and care provision. Moreover, women, children, and the physically disabled rural populations face additional social and cultural barriers to adapt to new settings. Currently, a low percentage of the population in developing countries depends on telehealth provisions for satisfying medical requirements. This creates a strong need for creating mass awareness about telehealth and telemedicine practices through sustained patient education. This will also help to overcome regional and behavioral barriers.

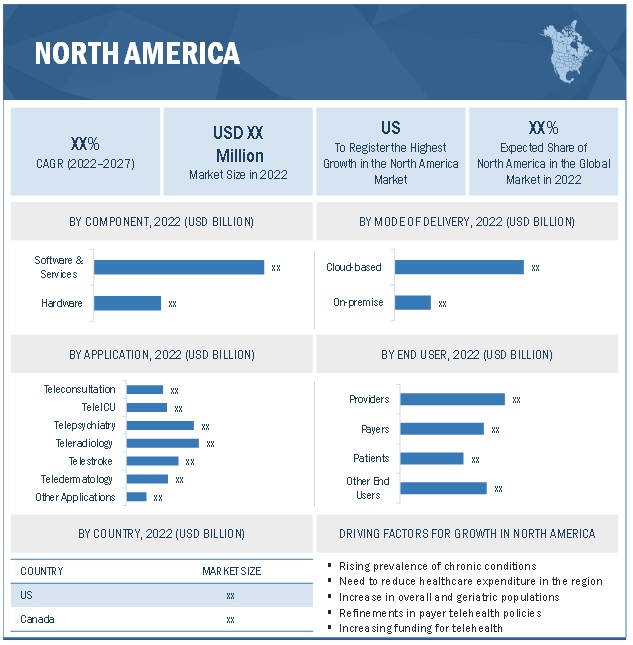

North America accounted for the largest share of the global telehealth & telemedicine market in 2021.

North America dominated the global telehealth and telemedicine market in 2021. The large regional share can be attributed to the factors such as rising prevalence of chronic conditions in the region, the need to reduce healthcare expenditure & improve care quality, increasing overall & geriatric population as well as the availability of funding and support for telehealth. However, the Asia Pacific market is expected to grow at the highest rate over the forecast years, owing to the prevalence of chronic diseases and the overcrowding of hospitals.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the global telehealth market are Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Siemens Healthineers (Germany), Cerner Corporation (US), Teladoc Health (US), American Well (US), Cisco Systems (US), MDLIVE (US), Asahi Kasei Corporation (Japan), AMC Health (US), Iron Bow Technologies (US), Doctor on Demand (US), Medvivo (UK), TeleSpecialists (US), Medweb (US), GlobalMed (US), IMEDIPLUS (Taiwan), VSee (US), Chiron Health (US), Zipnosis (US), ALTEN Calsoft Labs (US), iCliniq (India), Preventice Solutions (US) and Resideo Life Care Solutions (US).

Telehealth Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$87.8 billion |

|

Estimated Value by 2027 |

$285.7 billion |

|

Growth Rate |

Poised to grow at a CAGR of 26.6% |

|

Largest Share Segments |

|

|

Market Segmentation |

By Component, Mode of Delivery, Application, End User and Region |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This research report categorizes the telehealth market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Software & services

- Hardware

By Mode of Delivery

- Cloud-based

- On-premise

By Application

- Teleconsultation

- TeleICU

- Telestroke

- Teleradiology

- Telepsychiatry

- Teledermatology

- Other Applications

By End User

- Providers

- Payers

- Patients

- Other End Users

Recent Developments

- In 2021, Medtronic partnered with Statis Labs Inc.; this distribution partnership helped scale up and expand access to the state-of-the-art Stasis Monitor, a connected care bedside multi-parameter monitoring system, in India.

- In 2020, Koninklijke Philips launched the Avalon CL Fetal and Maternal Pod and Patch for remote monitoring in the US, Europe, Australia, New Zealand, and Singapore to support foetal and maternal monitoring.

- In 2020, Koninklijke Philips formed a collaboration with the American Telemedicine Association (ATA) (US); this collaboration helped increase the adoption of telehealth across acute, post-acute, and home care settings.

- In 2020, BioTelemetry acquired the On-Demand remote patient monitoring (RPM) and coaching platform, operated by Envolve People Care, Inc., which is a Centene Corporation subsidiary. This acquisition expands chronic RPM and coaching solutions to BioTelemetry's current suite of acute care connected health products and services, focusing specifically on diabetes, hypertension, and chronic heart failure.

Frequently Asked Questions (FAQ):

What is the projected industry value of the global telehealth market?

The global telehealth market in terms of revenue was estimated to be worth $87.2 billion in 2022 and is poised to reach $285.7 billion by 2027, growing at a CAGR of 26.6% from 2022 to 2027.

What is the estimated growth rate (CAGR) of the global telehealth market for the next five years?

The global telehealth market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.6% from 2022 to 2027.

Which region has the highest growth potential in the telehealth market?

North America dominated the telehealth market, with a share of 59.2% in 2021, while Asia Pacific is expected to register the highest CAGR of 33.7% during the forecast period.

speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY: TELEHEALTH MARKET

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

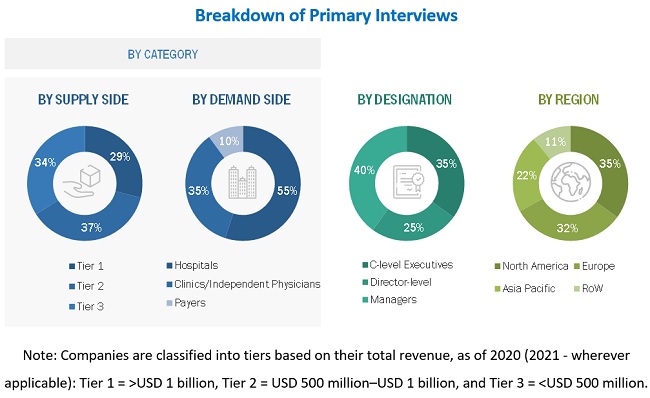

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY CATEGORY, DESIGNATION, AND REGION

2.2.2.1 Primary sources

2.2.2.2 Key insights from primary sources

2.3 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 5 ESTIMATION OF THE MARKET SIZE FOR REMOTE PATIENT MONITORING SOFTWARE & SERVICES THROUGH THE ADOPTION-BASED APPROACH

FIGURE 6 ESTIMATION OF THE MARKET SIZE FOR REAL-TIME INTERACTION SOFTWARE & SERVICES THROUGH THE ADOPTION-BASED APPROACH

FIGURE 7 ESTIMATION OF THE MARKET SIZE FOR STORE-AND-FORWARD SOFTWARE & SERVICES THROUGH THE ADOPTION-BASED APPROACH

FIGURE 8 ESTIMATION OF THE GLOBAL TELEHEALTH MARKET SIZE THROUGH THE ADOPTION-BASED APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 10 TELEHEALTH MARKET ANALYSIS, BY MODE OF DELIVERY (2022)

FIGURE 11 GLOBAL MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027, (USD MILLION)

FIGURE 13 GLBOAL MARKET, BY END USER, 2022 (USD MILLION)

FIGURE 14 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 TELEHEALTH MARKET OVERVIEW

FIGURE 15 SHORTAGE OF PHYSICIANS, RISING PREVALENCE OF CHRONIC CONDITIONS, AND INCREASE IN AGING POPULATION DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY COMPONENT (2021)

FIGURE 16 SOFTWARE & SERVICES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2021

4.3 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 17 TELERADIOLOGY TO DOMINATE THE APPLICATION SEGMENT IN 2022

4.4 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 18 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH IN THE GLBOAL MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 TELEHEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing geriatric population and need to expand healthcare access

TABLE 1 GLOBAL OVERVIEW OF THE RISE IN AGING POPULATION (MILLION)

5.2.1.2 Rising prevalence of chronic conditions and cost-benefits of telehealth

TABLE 2 CHRONIC DISEASES AND THEIR COST BURDEN IN THE US: POTENTIAL FOR SAVINGS

5.2.1.3 Shortage of physicians

5.2.1.4 Advancements in telecommunications

5.2.1.5 Government support and rising awareness

5.2.1.6 Technology adoption in the wake of the COVID-19 pandemic

TABLE 3 TOTAL NUMBER OF CONFIRMED CORONAVIRUS CASES, BY REGION (AS OF JANUARY 7, 2022)

TABLE 4 HEALTHCARE IOT: USE CASES

5.2.1.7 Private and public support for COVID-19 management

5.2.2 RESTRAINTS

5.2.2.1 Regulatory variations across regions

TABLE 5 US: STATE-WISE REGULATORY OUTLOOK FOR TELEHEALTH

5.2.2.2 Fraud in telehealth

5.2.2.3 Use of social media

5.2.3 OPPORTUNITIES

5.2.3.1 High utility in combating infectious diseases and epidemics

5.2.3.2 Use of blockchain

5.2.3.3 AI and analytics

5.2.3.4 Virtual assistants

5.2.4 CHALLENGES

5.2.4.1 Inability to ascertain hygiene and cleanliness

5.2.4.2 Behavioral barriers, healthcare affordability, and lack of awareness

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 GLOBAL MARKET: VALUE CHAIN

5.5 ECOSYSTEM ANALYSIS

FIGURE 21 GLOBAL MARKET: ECOSYSTEM

5.6 PRICING & REIMBURSEMENT ANALYSIS

TABLE 6 MEDICARE TELEMEDICINE SERVICES AND HCPCS/CPT CODES

5.7 TECHNOLOGY ANALYSIS

5.7.1 MACHINE LEARNING

5.7.2 ARTIFICIAL INTELLIGENCE

5.7.3 INTERNET OF THINGS

5.7.4 BLOCKCHAIN

5.7.5 CLOUD COMPUTING

5.7.6 DATA ANALYTICS

5.7.7 EXTENDED REALITY

5.8 REGULATORY ANALYSIS

5.8.1 NORTH AMERICA

5.8.2 EUROPE

5.8.3 ASIA PACIFIC

5.8.4 MIDDLE EAST & AFRICA

5.8.5 LATIN AMERICA

5.9 KEY INDUSTRY TRENDS

5.10 OVERVIEW OF USE CASES

TABLE 7 OVERVIEW OF TELEHEALTH USE CASES

6 TELEHEALTH MARKET, BY COMPONENT (Page No. - 92)

6.1 INTRODUCTION

TABLE 8 TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 SOFTWARE & SERVICES

TABLE 9 TELEHEALTH SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 10 TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 REMOTE PATIENT MONITORING

6.2.1.1 Convenience and high utility are driving the demand for remote monitoring services and devices

TABLE 11 REMOTE PATIENT MONITORING SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 NORTH AMERICA: REMOTE PATIENT MONITORING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 EUROPE: REMOTE PATIENT MONITORING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 ASIA PACIFIC: REMOTE PATIENT MONITORING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 ROW: REMOTE PATIENT MONITORING SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 REAL-TIME INTERACTION

6.2.2.1 Synchronous nature and potential to increase healthcare access will drive the growth of this market segment

TABLE 16 REAL-TIME INTERACTION SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 NORTH AMERICA: REAL-TIME INTERACTION SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 EUROPE: REAL-TIME INTERACTION SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 ASIA PACIFIC: REAL-TIME INTERACTION SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 ROW: REAL-TIME INTERACTION SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 STORE AND FORWARD

6.2.3.1 Limited reimbursement scenario may affect market growth

TABLE 21 STORE AND FORWARD SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 NORTH AMERICA: STORE AND FORWARD SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 EUROPE: STORE AND FORWARD SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 ASIA PACIFIC: STORE AND FORWARD SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 ROW: STORE AND FORWARD SOFTWARE & SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 HARDWARE

TABLE 26 TELEHEALTH HARDWARE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 MONITORS

6.3.1.1 Increase in remote monitoring and telemedicine adoption will drive the requirement for monitors

TABLE 28 MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 EUROPE: MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 ASIA PACIFIC: MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 ROW: MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 MEDICAL PERIPHERAL DEVICES

TABLE 33 MEDICAL PERIPHERAL DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.2.1 Blood pressure monitors

6.3.2.1.1 Convenience and growing demand have ensured high growth of this market segment

TABLE 35 BLOOD PRESSURE MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 ROW: BLOOD PRESSURE MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.2 Blood glucose meters

6.3.2.2.1 Growth in the diabetic population will ensure strong demand for blood glucose monitoring

TABLE 40 BLOOD GLUCOSE METERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: BLOOD GLUCOSE METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: BLOOD GLUCOSE METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: BLOOD GLUCOSE METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 ROW: BLOOD GLUCOSE METERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.3 Weight scales

6.3.2.3.1 Increasing prevalence of obesity will ensure strong demand for weight scales

TABLE 45 WEIGHT SCALES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: WEIGHT SCALES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: WEIGHT SCALES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: WEIGHT SCALES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ROW: WEIGHT SCALES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.4 Pulse oximeters

6.3.2.4.1 Rising awareness of self-monitoring and device convenience driving the demand for pulse oximeters

TABLE 50 PULSE OXIMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: PULSE OXIMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: PULSE OXIMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: PULSE OXIMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 54 ROW: PULSE OXIMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.5 Peak flow meters

6.3.2.5.1 Technological advancements and growing awareness are driving the growth of this market segment

TABLE 55 PEAK FLOW METERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: PEAK FLOW METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 EUROPE: PEAK FLOW METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: PEAK FLOW METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 ROW: PEAK FLOW METERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.6 ECG monitors

6.3.2.6.1 Rising incidence of CVD driving the demand for ECG monitors

TABLE 60 ECG MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: ECG MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: ECG MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: ECG MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 64 ROW: ECG MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.7 Other medical peripheral devices

TABLE 65 OTHER TELEHEALTH PRODUCTS OFFERED BY MARKET PLAYERS

TABLE 66 OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ROW: OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 TELEHEALTH MARKET, BY MODE OF DELIVERY (Page No. - 120)

7.1 INTRODUCTION

TABLE 71 TELEHEALTH MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

7.2 CLOUD-BASED MODE OF DELIVERY

7.2.1 CLOUD-BASED SOLUTIONS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 72 CLOUD-BASED TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: CLOUD-BASED TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: CLOUD-BASED TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: CLOUD-BASED TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 ROW: CLOUD-BASED TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 ON-PREMISE MODE OF DELIVERY

7.3.1 ON-PREMISE SOLUTIONS PROVIDE ENHANCED CONTROL OF SOFTWARE AND ALLOW REUSE OF EXISTING INFRASTRUCTURE

TABLE 77 ON-PREMISE TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: ON-PREMISE TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: ON-PREMISE TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: ON-PREMISE TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 ROW: ON-PREMISE TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

8 TELEHEALTH MARKET, BY APPLICATION (Page No. - 126)

8.1 INTRODUCTION

TABLE 82 TELEHEALTH MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 TELECONSULTATION

8.2.1 SHORTAGE OF PHYSICIANS TO DRIVE THE MARKET GROWTH FOR TELECONSULTATION SOLUTIONS

TABLE 83 TELECONSULTATION MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: TELECONSULTATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: TELECONSULTATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: TELECONSULTATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 87 ROW: TELECONSULTATION MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 TELEICU

8.3.1 RISING EMERGENCY VISITS, AGING POPULATION, AND PERSONNEL SHORTAGE IN RURAL AREAS SUPPORTS THE GROWTH OF THIS SEGMENT

TABLE 88 TELEICU MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: TELEICU MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 90 EUROPE: TELEICU MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: TELEICU MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 92 ROW: TELEICU MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 TELEPSYCHIATRY

8.4.1 SHORTAGE OF MENTAL HEALTH PRACTITIONERS AND FAVORABLE REIMBURSEMENT SCENARIO TO DRIVE THE MARKET GROWTH

TABLE 93 TELEPSYCHIATRY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: TELEPSYCHIATRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 EUROPE: TELEPSYCHIATRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: TELEPSYCHIATRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 ROW: TELEPSYCHIATRY MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 TELERADIOLOGY

8.5.1 TELERADIOLOGY TO ACCOUNT FOR THE LARGEST SHARE OF THE TELEHEALTH MARKET DURING THE FORECAST PERIOD

TABLE 98 TELERADIOLOGY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: TELERADIOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: TELERADIOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: TELERADIOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 102 ROW: TELERADIOLOGY MARKET, BY REGION, 2020–2027 (USD MILLION)

8.6 TELESTROKE

8.6.1 RISING STROKE INCIDENCE AND A SHORTAGE OF SPECIALISTS TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 103 TELESTROKE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: TELESTROKE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 EUROPE: TELESTROKE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: TELESTROKE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 107 ROW: TELESTROKE MARKET, BY REGION, 2020–2027 (USD MILLION)

8.7 TELEDERMATOLOGY

8.7.1 WIDE USAGE OF HIGH-END CAMERAS HAVE SIGNIFICANTLY IMPROVED THE DIAGNOSIS OF SKIN DISEASES

TABLE 108 TELEDERMATOLOGY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: TELEDERMATOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: TELEDERMATOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: TELEDERMATOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 ROW: TELEDERMATOLOGY MARKET, BY REGION, 2020–2027 (USD MILLION)

8.8 OTHER APPLICATIONS

TABLE 113 OTHER APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: OTHER APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 115 EUROPE: OTHER APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: OTHER APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 117 ROW: OTHER APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

9 TELEHEALTH MARKET, BY END USER (Page No. - 143)

9.1 INTRODUCTION

TABLE 118 TELEHEALTH MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 PROVIDERS

9.2.1 THE INCREASING NUMBER OF TELE-SPECIALTY SERVICES OFFERED BY PROVIDERS IS EXPECTED TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 119 TELEHEALTH MARKET FOR PROVIDERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET FOR PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 EUROPE: MARKET FOR PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET FOR PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 123 ROW: MARKET FOR PROVIDERS, BY REGION, 2020–2027 (USD MILLION)

9.3 PAYERS

9.3.1 TELEHEALTH ENABLE PAYERS TO REDUCE PATIENT READMISSIONS AND OVERHEAD COSTS

TABLE 124 TELEHEALTH MARKET FOR PAYERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET FOR PAYERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET FOR PAYERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET FOR PAYERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 128 ROW: MARKET FOR PAYERS, BY REGION, 2020–2027 (USD MILLION)

9.4 PATIENTS

9.4.1 RISING DISEASE PREVALENCE AND THE EMERGENCE OF ADVANCED WEARABLE MONITORS TO SUPPORT THE DEMAND FOR TELEHEALTH SOLUTIONS AMONG PATIENTS

TABLE 129 TELEHEALTH MARKET FOR PATIENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET FOR PATIENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET FOR PATIENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET FOR PATIENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 133 ROW: MARKET FOR PATIENTS, BY REGION, 2020–2027 (USD MILLION)

9.5 OTHER END USERS

TABLE 134 TELEHEALTH MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 136 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 138 ROW: MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 TELEHEALTH MARKET, BY REGION (Page No. - 154)

10.1 INTRODUCTION

TABLE 139 TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: TELEHEALTH MARKET SNAPSHOT

TABLE 140 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 142 NORTH AMERICA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 NORTH AMERICA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 NORTH AMERICA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 146 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Favorable regulations and the availability of funding and support for telehealth to drive the market in the US

TABLE 148 US: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 149 US: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 US: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 US: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 US: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 153 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 154 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing collaborations and efforts to promote the adoption of telehealth to drive market growth in Canada

TABLE 155 CANADA: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 156 CANADA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 CANADA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 CANADA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 CANADA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 160 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 162 EUROPE: TELEHEALTH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 163 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 164 EUROPE: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 EUROPE: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 EUROPE: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 EUROPE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 168 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 169 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rapid digitization of healthcare systems and the rise in the geriatric population are driving market growth

TABLE 170 GERMANY: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 171 GERMANY: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 GERMANY: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 GERMANY: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 GERMANY: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 175 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 176 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Favorable reimbursement and investment scenario for telehealth has supported the market in France

TABLE 177 FRANCE: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 178 FRANCE: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 FRANCE: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 FRANCE: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 FRANCE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 182 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 183 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Need to manage increasing healthcare expenditures and a severe shortage of physicians have boosted the adoption of telehealth

TABLE 184 UK: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 185 UK: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 UK: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 UK: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 UK: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 189 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 190 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Established telehealth and telespecialty practices and high density of aging population drive market growth in Italy

TABLE 191 ITALY: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 192 ITALY: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 ITALY: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 ITALY: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 ITALY: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 196 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 197 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Well-organized and efficient healthcare system indicates opportunities for telehealth adoption

TABLE 198 SPAIN: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 199 SPAIN: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 SPAIN: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 SPAIN: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 SPAIN: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 203 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 204 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 205 ROE: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 206 ROE: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 ROE: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 ROE: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 ROE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 210 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 211 ROE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 23 APAC: TELEHEALTH MARKET SNAPSHOT

TABLE 212 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 213 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 214 ASIA PACIFIC: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 ASIA PACIFIC: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 ASIA PACIFIC: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 217 ASIA PACIFIC: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 218 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 219 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to account for the largest share of the APAC telehealth market

TABLE 220 CHINA: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 221 CHINA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 222 CHINA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 CHINA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 CHINA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 225 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 226 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Universal healthcare coverage, well-established insurance system, and strong infrastructure make Japan a prominent market in APAC

TABLE 227 JAPAN: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 228 JAPAN: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 JAPAN: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 230 JAPAN: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 231 JAPAN: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 232 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 233 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Favorable government policies and high density of rural population to support market growth in India

TABLE 234 INDIA: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 235 INDIA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 236 INDIA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 INDIA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 INDIA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 239 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 240 INDIA: TELEHEALTH MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 The popularity of telehealth is growing in Australia

TABLE 241 AUSTRALIA: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 242 AUSTRALIA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 243 AUSTRALIA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 244 AUSTRALIA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 245 AUSTRALIA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 246 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 247 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 248 ROAPAC: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 249 ROAPAC: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 250 ROAPAC: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 251 ROAPAC: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 ROAPAC: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 253 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 254 ROAPAC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 255 ROW: TELEHEALTH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 256 ROW: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 257 ROW: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 258 ROW: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 ROW: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 260 ROW: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 261 ROW: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 262 ROW: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.1 LATIN AMERICA

10.5.1.1 Legislative changes, aging population, and uneven physician distribution will favor market growth in LATAM

TABLE 263 LATAM: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 264 LATAM: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 265 LATAM: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 266 LATAM: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 267 LATAM: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 268 LATAM: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 269 LATAM: TELEHEALTH MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Healthcare infrastructural development and government initiatives will drive the market in the MEA

TABLE 270 MEA: TELEHEALTH MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 271 MEA: TELEHEALTH SOFTWARE & SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 272 MEA: TELEHEALTH HARDWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 273 MEA: TELEHEALTH MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 274 MEA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 275 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 276 MEA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 221)

11.1 OVERVIEW

FIGURE 24 KEY DEVELOPMENTS OF PROMINENT PLAYERS OPERATING IN THE TELEHEALTH MARKET (2018–2021)

11.2 MARKET RANKING ANALYSIS

FIGURE 25 MARKET RANKING OF COMPANIES OPERATING IN THE TELEHEALTH MARKET (2021)

11.3 MARKET SHARE ANALYSIS

TABLE 277 TELEHEALTH MARKET: DEGREE OF COMPETITION

FIGURE 26 MARKET SHARE ANALYSIS: TELEHEALTH MARKET

11.4 COMPANY EVALUATION QUADRANT (OVERALL MARKET)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PARTICIPANTS

11.4.4 PERVASIVE PLAYERS

FIGURE 27 TELEHEALTH MARKET: COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

11.5 COMPANY EVALUATION QUADRANT FOR EMERGING PLAYERS

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 28 TELEHEALTH MARKET: COMPANY EVALUATION QUADRANT, 2021 (EMERGING PLAYERS)

11.6 COMPETITIVE BENCHMARKING

11.6.1 OVERALL COMPANY FOOTPRINT

TABLE 278 OVERALL COMPANY FOOTPRINT

11.7 COMPANY PRODUCT FOOTPRINT

TABLE 279 COMPANY PRODUCT FOOTPRINT

11.8 COMPANY REGIONAL FOOTPRINT

TABLE 280 COMPANY REGIONAL FOOTPRINT

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES & APPROVALS

TABLE 281 TELEHEALTH MARKET: KEY PRODUCT LAUNCHES & APPROVALS

11.9.2 DEALS

TABLE 282 TELEHEALTH MARKET: KEY DEALS

11.9.3 OTHER DEVELOPMENTS

TABLE 283 TELEHEALTH MARKET: OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 233)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

12.1.1 KONINKLIJKE PHILIPS

TABLE 284 KONINKLIJKE PHILIPS: BUSINESS OVERVIEW

FIGURE 29 KONINKLIJKE PHILIPS: COMPANY SNAPSHOT (2020)

12.1.2 MEDTRONIC

TABLE 285 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 30 MEDTRONIC: COMPANY SNAPSHOT (2020)

12.1.3 GE HEALTHCARE

TABLE 286 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 31 GE HEALTHCARE: COMPANY SNAPSHOT (2020)

12.1.4 CERNER CORPORATION

TABLE 287 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 32 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

12.1.5 SIEMENS HEALTHINEERS AG

TABLE 288 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

FIGURE 33 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2020)

12.1.6 CISCO SYSTEMS

TABLE 289 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 34 CISCO SYSTEMS: COMPANY SNAPSHOT (2021)

12.1.7 ASAHI KASEI CORPORATION

TABLE 290 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

FIGURE 35 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2020)

12.1.8 IRON BOW TECHNOLOGIES

TABLE 291 IRON BOW TECHNOLOGIES: BUSINESS OVERVIEW

12.1.9 AMERICAN WELL

TABLE 292 AMERICAN WELL: BUSINESS OVERVIEW

12.1.10 TELADOC HEALTH

TABLE 293 TELADOC HEALTH: BUSINESS OVERVIEW

FIGURE 36 TELADOC HEALTH: COMPANY SNAPSHOT (2020)

12.1.11 AMC HEALTH

TABLE 294 AMC HEALTH: BUSINESS OVERVIEW

12.1.12 TELESPECIALISTS

TABLE 295 TELESPECIALISTS: BUSINESS OVERVIEW

12.1.13 DOCTOR ON DEMAND, INC.

TABLE 296 DOCTOR ON DEMAND, INC.: BUSINESS OVERVIEW

12.1.14 MDLIVE

TABLE 297 MDLIVE: BUSINESS OVERVIEW

12.1.15 GLOBALMED

TABLE 298 GLOBALMED: BUSINESS OVERVIEW

12.1.16 MEDVIVO GROUP LTD.

TABLE 299 MEDVIVO GROUP LTD.: BUSINESS OVERVIEW

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 MEDWEB

12.2.2 VSEE

12.2.3 IMEDIPLUS

12.2.4 CHIRON HEALTH

12.2.5 ZIPNOSIS

12.2.6 ALTEN CALSOFT LABS (A SUBSIDIARY OF ALTEN GROUP)

12.2.7 ICLINIQ

12.2.8 PREVENTICE SOLUTIONS

12.2.9 RESIDEO LIFE CARE SOLUTIONS

13 APPENDIX (Page No. - 287)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the size of the telehealth market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, such as directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the American Telehealth Association (ATA), National Coordinator for Health Information Technology (NCHIT), Center for Connected Health Policy (CCHP), Healthcare Information Management Systems Society (HIMSS), HIMSS Analytics, US Department of Health and Human Services (DHHS), Health Resources and Services Administration (HRSA), Kaiser Family Foundation (KFF), American Medical Association (AMA), European Telecommunications Standards Institute (ETSI), European Committee for Standardization (CEN), Organisation for Economic Co-operation and Development (OECD), Centers for Medicare and Medicaid Services (CMS), Office for National Statistics (ONS), Centers for Disease Control and Prevention (CDC), World Health Organization (WHO), World Bank, Eurostat, Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the telehealth market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organisations operating in the telehealth market. The primary sources from the demand side included healthcare providers, such as hospitals, clinics, and independent physicians, and payers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and the top-down approach (assessment of utilization, adoption, and penetration trends by component, mode of delivery, application, end user, and region).

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the telehealth market.

Objectives of the Study

- To define, describe, and forecast the telehealth market based on component, application, mode of delivery, end user, and region

- to provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges).

- to analyse micromarkets with respect to individual growth trends, prospects, and contributions to the overall telehealth market.

- to analyse opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World

- To profile key players and analyse their market shares and core competencies

- to track and analyse competitive developments such as product launches and approvals, partnerships, agreements, collaborations, and expansions in the overall market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyses market players on various parameters within the broad categories of business and product strategies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of telehealth market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Telehealth & Telemedicine Market

Telehealth Market and Telemedicine Market report also studies the competitive landscape in the market positioning of players, and the key strategies adopted by the leading as well as emerging players to garner a larger share in the market. We not only provide profiles of the major companies but we provide a complete 360 degree competitive mapping by profiling around 20 companies in our DIVE matrix which are categorized as Visionary Leaders, Dynamic Differentiators, Innovative leaders and Emerging Leaders. The companies are analyzed on the basis of business excellence and strength of the product portfolio. The report does include the companies operating in Japan like Philips, GE Healthcare, Asahi Kasei Corporation, we can provide you with the profiles of companies as per your interest under free customization.

Hi Angie, We would try to answer your query:

The global telehealth market is expected to reach 285.7 billion USD by 2027, growing at a compound annual growth rate (CAGR) of 26.6% from 2022 to 2027. The growth of the telehealth market is being driven by a number of factors, including:

1. The increasing adoption of smartphones and other mobile devices.

2. The growing demand for convenient and affordable healthcare services.

3. The rising awareness of the benefits of telehealth, such as improved access to care, reduced wait times, and lower costs.

4. The increasing penetration of the internet and broadband connectivity.

5. The favorable regulatory environment for telehealth.

In Saudi Arabia, the telehealth market is expected to grow at a CAGR of 25.5% from 2022 to 2027. The growth of the telehealth market in Saudi Arabia is being driven by a number of factors, including:

1. The increasing number of chronic diseases, such as diabetes and hypertension.

2. The growing demand for convenient and affordable healthcare services.

3. The rising awareness of the benefits of telehealth.

4. The increasing penetration of the internet and broadband connectivity.

5. The favorable regulatory environment for telehealth.

As of 2022, there are an estimated 100 million users of telehealth globally. This number is expected to grow to 250 million by 2027. The majority of telehealth users are in the United States, followed by Europe and Asia-Pacific.

The most common use of telehealth is for primary care appointments. Other common uses include mental health counseling, chronic disease management, and medication management.

Telehealth has a number of benefits for both patients and healthcare providers. For patients, telehealth can provide convenient, affordable, and accessible healthcare services. For healthcare providers, telehealth can improve access to care, reduce wait times, and lower costs.

The growth of the telehealth market is expected to continue in the coming years. This growth will be driven by the increasing adoption of smartphones and other mobile devices, the growing demand for convenient and affordable healthcare services, and the rising awareness of the benefits of telehealth.

how many users are there globally in the telehealth market?

Which is the fastest growing market of Diagnostic Imaging Market ?

Which is the fastest growing market of Telehealth Market?

Which are the key factors driving the growth of the Global Telehealth Market?

What are the growth estimates for Telehealth Market till 2027?