Temperature Sensor Market by Product Type (Thermocouples, RTDS, Thermistors, Temperature Sensor ICS, Infrared, and Fiber Optic Temperature Sensors), Output, Connectivity, End-User Industry, & Region - Global Forecast to 2028

Updated on : March 03, 2023

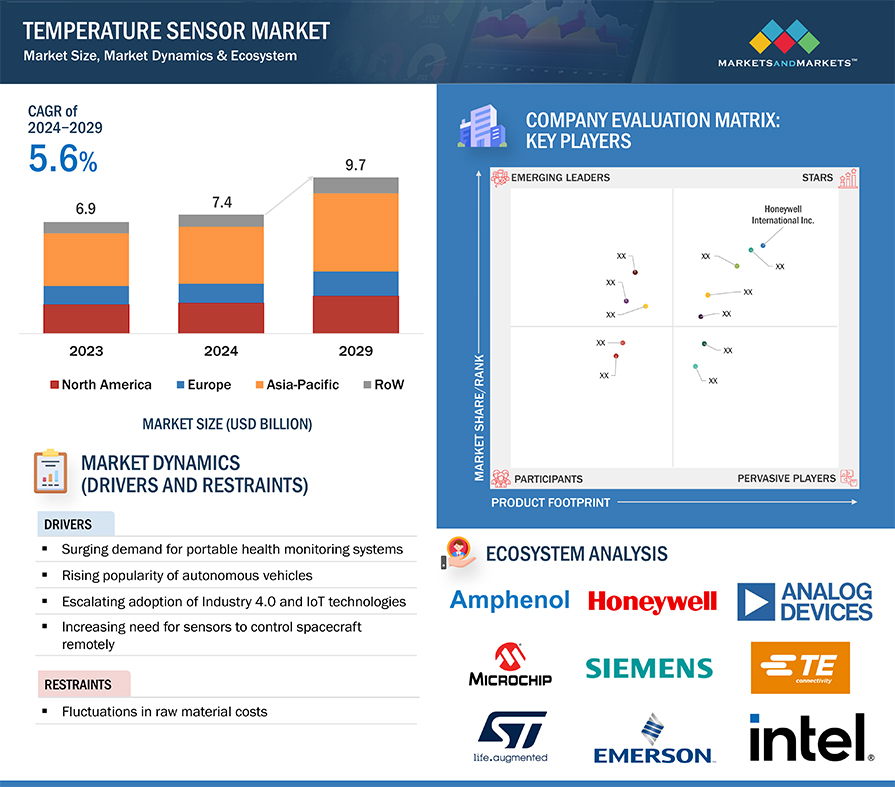

[277 Pages Report] The Temperature Sensor Market report share is estimated to be USD 5.9 billion in 2021 and expected to reach USD 8.0 billion by 2028, at a CAGR of 4.5% from 2021 to 2026..

The increasing demand for temperature sensors, in industries such as oil and gas, consumer electronics and healthcare is driving the growth of the market.Furthermore, most working environments require variable sensing ranges and resolutions, and factory floor environments can be dirty, making it difficult to differentiate between humans and other robots. There are strict regulations as well as stiff penalties surrounding robotic safety. Manufacturers are adopting sensing technology before the robots are installed to ensure compliance and create a safe environment for workers leading to higher demand for temperature sensors.However, high initial cost involved with the implementation of advanced sensorsis expected to restraint temperature sensors industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Temperature Sensor Market Dynamics

Drivers: Increasing penetration of temperature sensors in advanced & portable healthcare equipment

The growing demand for advanced and portable healthcare equipment is driving the Temperature Sensor Market. With the onset of technologies like advanced patient monitoring systems and portable health monitoring systems, the demand for temperature sensors is on the rise. Factors such as the rising geriatric population, deteriorating lifestyle, and growing viral infections are expected to further increase the demand for portable healthcare devices. Temperature sensors are used in wearable healthcare devices to offer the continuous monitoring of patients’ health. The increasing popularity of portable and wearable healthcare devices acts as a major driving factor for the growth of the Temperature Sensor Market.

Restraints: High initial cost involved in advanced sensors

Manufacturers in Temperature Sensor Market require raw materials such as cobalt, nickel, manganese, iron alloy, and copper. These manufacturers depend on third-party suppliers to procure these materials. High volatility in the prices of these raw materials and the lack of continuous availability of supply have a significant impact on the profitability of temperature sensor manufacturers. Fluctuations in the raw material prices are attributed to volatile global economyand availability of raw material, trade tariffswars, other political events, increase in global demand, natural disasters, and the volatility in foreign currency exchange rates. Furthermore, an increasingly competitive global marketplace depicts the high cost of quality inspection. Consequently, quality must be an integral element of the manufacturing process, necessitating the process is under control, either through constant monitoring using appropriate sensors or by withdrawing the product for inspection at intermediate manufacturing stages. Hence, high initial costs are expected to have an adverse effect on the manufacturing and logistics of temperature sensors.

Opportunities: Increasing trend of wearable devices

Wearable devices are used for tracking several biometric parameters, such as heartbeat and body temperature. The adoption of wearable devices is increasing rapidly with a growing number of end-users seeking such technologies to improve their fitness and overall health. Currently, 1 in 6 people own and use a wearable device, and this adoption trend is expected to grow in the coming years. This rising demand and growing health consciousness among individuals are expected to create growth opportunities for the players in the Temperature Sensor Market.

Challenges: Continuous price reductions and intense competition among manufacturers

Price competition has always remained a serious issue in the Temperature Sensor Market. Temperature sensor manufacturers recognize the growth potential in emerging economies, such as India and China, and resort to low pricing to penetrate these markets.While the widespread application of temperature sensors in HVAC systems and consumer electronic devices leads to increased shipments of these sensors, the sales growth is significantly restrained by price erosion. This is partially a result of the intense competition among the rising number of sensor manufacturers, which leads to rapid innovation in new temperature sensors. The easy availability of technology further adds pressure on the already fragmented Temperature Sensor Market and creates intense competition among the manufacturers.

Non contact temperature sensors will have the highest growth in the coming years

The non-contact temperature sensors segment is projected to growt at a higher rate compared to contact temperature sensors segment during 2021 to 2028.The high growth rate of non-contact temperature sensors is attributed to their ability to measure the surface temperature of an object or body without any physical contact between the sensor and the observed object. The non-contact temperature sensors are prominently used for small, moving, and inaccessible objects, sources, or devices. Asia Pacific and RoW regions observed the highest demand for non-contact temperature sensors, due the the large consumer electronics, healthcare and oil and gas industry present in these regions.

Oil and gas industryholds the second largest share in the Temperature Sensor Market

The oil and gas segment is projected to register a CAGR of 3.7% during the forecast period. Oil and gas industry is heavily reliant on different sensors to measure, analyse record and share the different parameters for safety and proper functioning of the equipment and workers. Temperature monitoring sensors are one of the key sensors implemented by this industry. These sensors are used to measure, andanalysetempearutres of various equipment and environment. It is expected that the implementation of temperature sensors in the oil and gas industry will continue to grow over the forecast period allowing the industry to hold a prominent position in the Temperature Sensor Market.

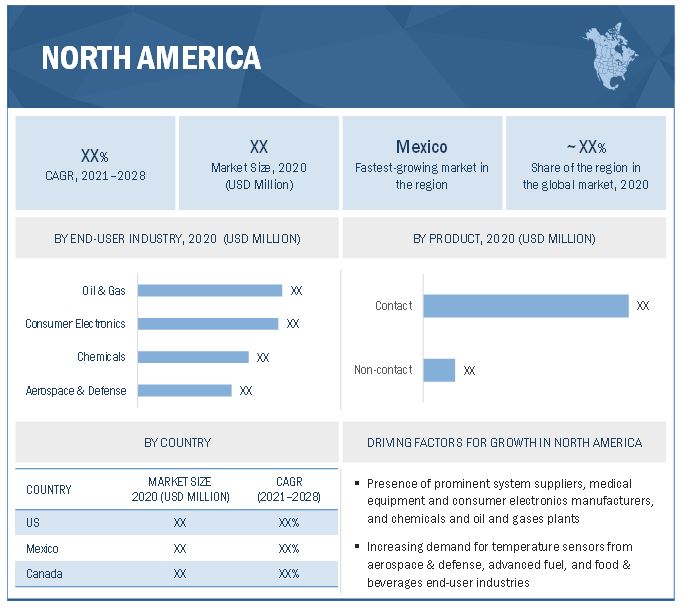

North America is a the second largest region for the Temperature Sensor Market

North America accounts for ~27% share of the Temperature Sensor Market in 2020. The key contributors in North America are US, .Canada, and Mexico with US holding the dominant share within the region. The presence of large number of player in the region along with strong trade relations with other regions allows North America to hold a prominent share of the Temperature Sensor Market. Industries such as consumer electronics, healthcare, chemical, automotive, oil and gas, and energy and power attribute to the high demand for temperature sensors in the US.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Temperature Sensor Companies was dominated by,Honeywell International Inc. (US), TE Connectivity Ltd. (Switzerland), Texas Instruments Incorporated (US), Endress+Hauser Management AG (Switzerland), and Siemens AG (Germany), Maxim Integrated (US), Emerson (US), ABB (Switzerland), NXP (US), and Kongsberg (Norway).

Temperature Sensor Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 5.9 Billion |

| Revenue Forecast in 2028 | USD 8.0 Billion |

|

Market size available for years |

2018–2028 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021–2028 |

|

Growth Rate |

4.5% |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Market Leaders |

|

| Key Market Driver | Increasing penetration of temperature sensors in advanced & portable healthcare equipment |

| Key Market Opportunity | Increasing trend of wearable devices |

| Largest Growing Region | North America |

| Largest Market Share Segment | Non-contact temperature sensors |

| Highest CAGR Segment | Oil and gas industry |

This report categorizes the Temperature Sensor Market based on product type, output, connectivity, end-user industry, and region

Based on Product Type, the Temperature Sensor Market been Segmented as follows:

-

Contact Temperature Sensors

- Thermocouples

- Resistive Temperature Detectors

- Thermistors

- Temperature Sensor ICs

- Bimetallic Temperature Sensors

-

Non-contact Temperature Sensors

- Infrared Temperature Sensors

- Fiber Optic Temperature Sensors

Based on Output, the Temperature Sensor Market been Segmented as follows:

- Digital

- Analog

Based on Connectivity, the Temperature Sensor Market been Segmented as follows:

- Wired

- Wireless

Based on End-user Industry, the Temperature Sensor Market been Segmented as follows:

- Chemicals

- Oil & Gas

- Consumer Electronics

- Energy & Power

- Healthcare

- Automotive

- Metals & Mining

- Food & Beverages

- Pulp & Paper

- Advanced Fuel

- Aerospace & Defense

- Glass

- Others (water & wastewater treatment, cement, telecommunications, and agriculture)

Based on Geography, the Temperature Sensor Market been Segmented as follows:

- Introduction

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (RoAPAC)

-

Rest of the World (RoW)

- South America

- Middle East & Africa

Recent Developments

- In March 2022, Sensirionlaunched its fourth-generation temperature sensor series: the STS4x. The digital sensor offers highly accurate measurements and offers industry-leading lead times. It is also available in different accuracy classes and is currently represented by the STS40. It offers features such as enhanced signal processing, three distinctive I2C addresses and communication speeds of up to 1 MHz.

Frequently Asked Questions (FAQ):

Which are the keyindustries in temperature sensor market? How largeis the opportunity for their growth in the developing economies during the forecast period?

The key industries in temperature sensor marketare consumer electronics, food and beverages, and healthcare. It is expected to boost the demand for temperature sensor marketleading to USD 8,035 million opportunity till 2028.

Which are the keyplayersin the temperature sensor market? What are their major strategies to strengthen their market position?

The temperature sensor marketwas dominated by Honeywell International Inc. (US), TE Connectivity Ltd. (Switzerland), Texas Instruments Incorporated (US), Endress+Hauser Management AG (Switzerland), and Siemens AG (Germany).

The major strategies adopted by the top 5 players in the temperature sensor marketincluded product launches and developments, collaborations and acquisitions

Which are the leading countries in thetemperature sensor market?

By 2026, APAC market is expected to grow at the highest CAGR. China, India, South Korea, and Japan are the significant contributors to the growth of the temperature sensor market in APAC region. The temperature sensor market in APAC region is expected to be driven by the evolving automotive, medical, and industrial manufacturing companies and the rising demand for temperature sensors from overseas markets of North America and Europe. Furthermore, North America is expected to hold the largest market share of the temperature sensor market by 2026.

North America is one of the most technologically advanced markets for temperature sensors owing to the presence of prominent system suppliers as well as large chemicals, oil & gas, healthcare, and food & beverage companies in the region.

Which industry is expected to witness highdemand for temperature sensor marketduring the forecast period?

Consumer electronics is a major industry with growing demand for temperature sensors. The industry is likely to continue holding the largest market share during the forecast period owing to the growing adoption of temperature sensors in consumer electronics, including smartphones, PCs, laptops, tablets, and other smart home appliances. The implementation of temperature sensors in newwe devices is also leading the the higher demand.

How COVID-19 impacted the penetration of temperature sensor market?

The consumer electronics industry also felt the impact of the pandemic due to disrupted supply chains, but the rapid growth in the smartphone and smart wearable devices supported the growth of the temperature senros market. The healthcare industry also witnessed significant demand for thermometers, MRI machines, and imaging diagnostics equipment, which have temperature sensors installed in them. Therefore, the healthcare industry is likely to account for a significant share of the temperature sensor market during the pandemic as well as after its impact subsides.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 TEMPERATURE SENSOR MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 TEMPERATURE SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN TEMPERATURE SENSOR MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE GENERATED FROM PRODUCTS IN MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 FORECASTING ASSUMPTIONS

2.7 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

TABLE 2 EVALUATION CRITERIA

2.7.1 VENDOR INCLUSION CRITERIA

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 9 TEMPERATURE SENSOR MARKET (USD MILLION)

FIGURE 10 BY END-USER INDUSTRY, CONSUMER ELECTRONICS ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

FIGURE 11 BY PRODUCT TYPE, CONTACT TEMPERATURE SENSORS ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 12 BY OUTPUT, DIGITAL SEGMENT HELD LARGER MARKET SHARE THAN ANALOG SEGMENT IN 2020

FIGURE 13 BY CONNECTIVITY, WIRED SEGMENT HELD LARGER MARKET SHARE THAN WIRELESS SEGMENT IN 2020

FIGURE 14 MARKET, BY REGION, 2020

3.10 IMPACT ANALYSIS OF COVID-19 ON MARKET

FIGURE 15 MARKET SIZE, PRE- AND POST-COVID-19 SCENARIOS

TABLE 3 MARKET, BY SCENARIO, 2019–2028 (USD MILLION)

3.1.1 PRE COVID-19 SCENARIO

3.1.2 POST COVID-19 SCENARIO

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 ATTRACTIVE OPPORTUNITIES IN TEMPERATURE SENSOR MARKET

FIGURE 16 INCREASING PENETRATION OF TEMPERATURE SENSORS IN ADVANCED AND PORTABLE HEALTHCARE EQUIPMENT DRIVES GROWTH OF MARKET

4.2 MARKET, BY PRODUCT TYPE

FIGURE 17 BY CONTACT TEMPERATURE SENSORS, THERMOCOUPLES SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY OUTPUT

FIGURE 18 BY OUTPUT, DIGITAL SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY END-USER INDUSTRY

FIGURE 19 BY END-USER INDUSTRY, CONSUMER ELECTRONICS TO HOLD LARGEST SHARE OF MARKET BY 2028

4.5 MARKET, BY REGION

FIGURE 20 APAC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 IMPACT OF CHALLENGES AND RESTRAINTS ON TEMPERATURE SENSOR MARKET

5.2.1 DRIVERS

FIGURE 22 IMPACT OF DRIVERS ON MARKET

5.2.1.1 Increasing penetration of temperature sensors in advanced & portable healthcare equipment

5.2.1.2 Growing demand for temperature sensors in automotive sector

FIGURE 23 AUTOMOTIVE SALES, BY VEHICLE TYPE, 2019 VS 2020 (MILLION UNITS)

5.2.1.3 Industry 4.0 & rapid factory automation

5.2.1.4 Deployment of temperature sensors in space applications

5.2.2 RESTRAINTS

FIGURE 24 IMPACT OF RESTRAINTS ON MARKET

5.2.2.1 High initial cost involved in advanced sensors

5.2.3 OPPORTUNITIES

FIGURE 25 IMPACT OF OPPORTUNITIES ON MARKET

5.2.3.1 Increasing trend of wearable devices

FIGURE 26 GLOBAL WEARABLE MARKET SHIPMENT, 2018 VS 2022 (MILLION UNITS)

5.2.3.2 Rising inclusion of temperature control systems in food safety management

5.2.3.3 Supportive government initiatives & funding for IoT projects that require temperature sensors

TABLE 4 GOVERNMENT FUNDING PLANS FOR INTERNET OF THINGS

5.2.4 CHALLENGES

FIGURE 27 IMPACT OF CHALLENGES ON MARKET

5.2.4.1 Stringent performance requirements for advanced applications

5.2.4.2 Continuous price reductions and intense competition among manufacturers

5.3 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

5.4 ECOSYSTEM

FIGURE 29 SENSORS ECOSYSTEM

TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

5.5 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 30 REVENUE SHIFT IN MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 OVERVIEW OF PORTER’S FIVE FORCES ANALYSIS OF TEMPERATURE SENSOR MARKET (2020)

TABLE 6 PORTER’S FIVE FORCES ANALYSIS (2020): BARGAINING POWER OF SUPPLIERS HAD HIGH IMPACT ON MARKET

FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

5.6.1 THREAT OF NEW ENTRANTS

FIGURE 33 THREAT OF NEW ENTRANTS HAD MEDIUM IMPACT IN 2020

5.6.2 THREAT OF SUBSTITUTES

FIGURE 34 THREAT OF SUBSTITUTES HAD LOW IMPACT IN 2020

5.6.3 BARGAINING POWER OF SUPPLIERS

FIGURE 35 BARGAINING POWER OF SUPPLIERS HAD HIGH IMPACT IN 2020

5.6.4 BARGAINING POWER OF BUYERS

FIGURE 36 BARGAINING POWER OF BUYERS HAD MEDIUM IMPACT IN 2020

5.6.5 COMPETITIVE RIVALRY

FIGURE 37 COMPETITIVE RIVALRY HAD MEDIUM IMPACT IN 2020

5.7 TARIFF AND REGULATORY LANDSCAPE

5.7.1 TARIFFS RELATED TO TEMPERATURE SENSORS

5.7.2 REGULATIONS RELATED TO SENSORS

5.8 AVERAGE SELLING PRICE ANALYSIS

FIGURE 38 AVERAGE SELLING PRICE OF TEMPERATURE SENSORS

5.9 CASE STUDIES

5.9.1 CONTROLLING TEMPERATURE CONTROL LOOPS IN TOTAL SAFETY

5.9.2 IN-SITU CALIBRATION

5.9.3 TEMPERATURE SENSORS FOR INDUSTRIAL INCINERATORS

5.9.4 TEMPERATURE SENSORS FOR ALUMINUM FOUNDRIES

5.9.5 INDUSTRIAL SUPERVISION IN AGRI-FOOD SECTOR

5.10 KEY INDUSTRY TRENDS IN MARKET

TABLE 7 INNOVATIVE PRODUCT OFFERINGS BY MAJOR PLAYERS

5.11 TECHNOLOGY ANALYSIS

5.11.1 MEMS TEMPERATURE SENSOR

5.11.2 MINIATURE FIBER OPTIC TEMPERATURE SENSOR

FIGURE 39 PATENT ANALYSIS

TABLE 8 NOTICEABLE PATENTS OF TEMPERATURE SENSOR

5.12 TRADE ANALYSIS

TABLE 9 IMPORT DATA OF UNITS FOR THERMOMETERS AND PYROMETERS, NOT COMBINED WITH OTHER INSTRUMENTS (EXCLUDING LIQUID-FILLED THERMOMETERS), BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 40 IMPORT DATA FOR HS CODE 902519 FOR TOP FIVE COUNTRIES IN MARKET, 2016-2020 (USD MILLION)

TABLE 10 EXPORT DATA OF UNITS FOR ARTICLES OF THERMOMETERS AND PYROMETERS, NOT COMBINED WITH OTHER INSTRUMENTS (EXCLUDING LIQUID-FILLED THERMOMETERS), BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 41 EXPORT DATA FOR HS CODE 902519 FOR TOP FIVE COUNTRIES IN MARKET, 2016-2020 (USD MILLION)

6 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE (Page No. - 97)

6.1 INTRODUCTION

FIGURE 42 MARKET (USD MILLION)

TABLE 11 MARKET IN TERMS OF VALUE AND VOLUME, 2018–2020

TABLE 12 MARKET IN TERMS OF VALUE AND VOLUME, 2021–2028

FIGURE 43 MARKET, BY PRODUCT TYPE

FIGURE 44 BY PRODUCT TYPE, NON-CONTACT SEGMENT PROJECTED TO REGISTER HIGHER CAGR THAN CONTACT SEGMENT DURING FORECAST PERIOD

TABLE 13 MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 14 MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

6.2 CONTACT TEMPERATURE SENSORS

TABLE 15 CONTACT MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 16 CONTACT MARKET, BY REGION, 2021–2028 (USD MILLION)

TABLE 17 CONTACT MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 18 CONTACT MARKET IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 19 CONTACT MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 20 CONTACT MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 21 CONTACT MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 22 CONTACT MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 23 CONTACT MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 CONTACT MARKET IN ROW, BY REGION, 2021–2028 (USD MILLION)

FIGURE 45 THERMOCOUPLES ESTIMATED TO LEAD WHILE TEMPERATURE SENSOR ICS PROJECTED TO REGISTER HIGHEST CAGR IN CONTACT MARKET DURING FORECAST PERIOD

TABLE 25 CONTACT MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 26 CONTACT MARKET, BY TYPE, 2021–2028 (USD MILLION)

TABLE 27 CHARACTERISTICS OF DIFFERENT TYPES OF CONTACT TEMPERATURE SENSORS

6.2.1 BIMETALLIC TEMPERATURE SENSORS

6.2.1.1 Bimetallic temperature sensors extensively used in controlling water heating elements in boilers, furnaces, and hot water storage tanks

FIGURE 46 WORKING OF BIMETALLIC TEMPERATURE SENSORS

6.2.2 THERMOCOUPLES

6.2.2.1 Thermocouples accounted for largest share of contact market

6.2.3 RESISTIVE TEMPERATURE DETECTORS

6.2.3.1 Owing to their linearity, stability, and accuracy, RTDs are widely preferred for air conditioning, food processing, and textile production

6.2.4 THERMISTORS

6.2.4.1 Low-cost NTC sensors are used in applications wherein temperature ranges from −40° C to +300° C

6.2.5 TEMPERATURE SENSOR ICS

6.2.5.1 Market for temperature sensor ICs expected to grow at highest CAGR during forecast period

6.3 NON-CONTACT TEMPERATURE SENSORS

TABLE 28 NON-CONTACT MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 NON-CONTACT MARKET, BY REGION, 2021–2028 (USD MILLION)

TABLE 30 NON-CONTACT MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 31 NON-CONTACT MARKET IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 32 NON-CONTACT MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 33 NON-CONTACT MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 34 NON-CONTACT MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 35 NON-CONTACT MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 36 NON-CONTACT MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 NON-CONTACT MARKET IN ROW, BY REGION, 2021–2028 (USD MILLION)

TABLE 38 NON-CONTACT MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 39 NON-CONTACT MARKET, BY TYPE, 2021–2028 (USD MILLION)

6.3.1 INFRARED TEMPERATURE SENSORS

6.3.1.1 Infrared temperature sensors accounted for larger share of non-contact market

FIGURE 47 WORKING OF INFRARED TEMPERATURE SENSORS

6.3.2 FIBER OPTIC TEMPERATURE SENSORS

7 TEMPERATURE SENSOR MARKET, BY OUTPUT (Page No. - 115)

7.1 INTRODUCTION

FIGURE 48 MARKET, BY OUTPUT

FIGURE 49 BY OUTPUT, DIGITAL SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 40 MARKET, BY OUTPUT, 2018–2020 (USD MILLION)

TABLE 41 MARKET, BY OUTPUT, 2021–2028 (USD MILLION)

7.2 ANALOG

7.2.1 MARKET FOR ANALOG TEMPERATURE SENSORS EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 42 ANALOG MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 ANALOG MARKET, BY REGION, 2021–2028 (USD MILLION)

TABLE 44 ANALOG MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 45 ANALOG MARKET IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 46 ANALOG MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 47 ANALOG MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 48 ANALOG MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 49 ANALOG MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 50 ANALOG MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 51 ANALOG MARKET IN ROW, BY REGION, 2021–2028 (USD MILLION)

7.3 DIGITAL

TABLE 52 DIGITAL MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 DIGITAL MARKET, BY REGION, 2021–2028 (USD MILLION)

TABLE 54 DIGITAL MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 55 DIGITAL MARKET IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 56 DIGITAL MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 57 DIGITAL MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 58 DIGITAL MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 59 DIGITAL MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 60 DIGITAL MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 61 DIGITAL MARKET IN ROW, BY REGION, 2021–2028 (USD MILLION)

7.3.1 SINGLE-CHANNEL DIGITAL TEMPERATURE SENSORS

7.3.1.1 Single-channel digital temperature sensors are compact and have low power consumption

7.3.2 MULTI-CHANNEL DIGITAL TEMPERATURE SENSORS

7.3.2.1 Multi-channel digital sensors can monitor multiple channels, have flexible design, and offer higher accuracy

8 TEMPERATURE SENSOR MARKET, BY CONNECTIVITY (Page No. - 125)

8.1 INTRODUCTION

FIGURE 50 BY CONNECTIVITY, WIRED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 62 MARKET, BY CONNECTIVITY, 2018–2020 (USD MILLION)

TABLE 63 MARKET, BY CONNECTIVITY, 2021–2028 (USD MILLION)

8.2 WIRELESS (WI-FI)

8.2.1 INCREASING GOVERNMENT REGULATIONS FAVORING USE OF SENSORS FOR SAFETY PURPOSES LIKELY TO SPUR DEMAND FOR WIRELESS TEMPERATURE SENSORS

8.3 WIRED

8.3.1 NEED TO ENSURE SECURITY OF ELECTRONIC DEVICES CREATES DEMAND FOR WIRED TEMPERATURE SENSORS

9 TEMPERATURE SENSOR MARKET, BY MATERIAL USED (Page No. - 128)

9.1 INTRODUCTION

9.2 MATERIALS USED IN TEMPERATURE SENSORS

9.2.1 POLYMER

9.2.2 CERAMIC

9.2.3 PLATINUM RESISTANCE TEMPERATURE DETECTORS

9.2.4 NICKEL CHROMIUM/NICKEL ALUMINUM (CODE K)

9.2.5 NICKEL CHROMIUM/CONSTANTAN (CODE E)

9.2.6 IRON/CONSTANTAN (CODE J)

9.2.7 NICKEL MOLYBDENUM-NICKEL COBALT THERMOCOUPLES (TYPE M)

9.2.8 NICROSIL/NISIL (CODE N)

9.2.9 COPPER/CONSTANTAN (CODE T)

9.2.10 OTHERS (COPPER/COPPER NICKEL COMPENSATING FOR “S” AND “R” (CODE U)

10 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY (Page No. - 131)

10.1 INTRODUCTION

FIGURE 51 MARKET, BY END-USER INDUSTRY

FIGURE 52 BY END-USER INDUSTRY, FOOD & BEVERAGES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 MARKET, BY END-USER INDUSTRY, 2018–2020 (USD MILLION)

TABLE 65 MARKET, BY END-USER INDUSTRY, 2021–2028 (USD MILLION)

10.2 CHEMICALS

10.2.1 PROCESSES SUCH AS REFINING, HEAT TRACING, AND INCINERATION REQUIRE TEMPERATURE SENSORS

TABLE 66 TEMPERATURE SENSOR MARKET FOR CHEMICALS END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 67 MARKET FOR CHEMICALS END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 68 MARKET FOR CHEMICALS END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 69 MARKET FOR CHEMICALS END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 70 MARKET FOR CHEMICALS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 71 MARKET FOR CHEMICALS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 72 MARKET FOR CHEMICALS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 73 MARKET FOR CHEMICALS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 74 MARKET FOR CHEMICALS END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 75 MARKET FOR CHEMICALS END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.3 OIL & GAS

10.3.1 OIL & GAS EXPLORATION INVOLVES PREVENTING MOISTURE, OVERHEATING, CORROSION, AND INEFFICIENT FUEL USAGE

TABLE 76 TEMPERATURE SENSOR MARKET FOR OIL & GAS END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 77 MARKET FOR OIL & GAS END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 78 MARKET FOR OIL & GAS END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 79 MARKET FOR OIL & GAS END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 80 MARKET FOR OIL & GAS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 81 MARKET FOR OIL & GAS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 82 MARKET FOR OIL & GAS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 83 MARKET FOR OIL & GAS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 84 MARKET FOR OIL & GAS END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 85 MARKET FOR OIL & GAS END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.4 CONSUMER ELECTRONICS

10.4.1 INTRODUCTION OF NEW TECHNOLOGIES EXPECTED TO INCREASE DEMAND FOR TEMPERATURE SENSORS FOR ELECTRICAL AND ELECTRONIC APPLICATIONS

TABLE 86 TEMPERATURE SENSOR MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 87 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 88 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 89 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 90 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 91 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 92 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 93 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 94 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 95 MARKET FOR CONSUMER ELECTRONICS END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.5 ENERGY & POWER

10.5.1 INCREASING NEED FOR RENEWABLE ENERGY GENERATION TO POSITIVELY IMPACT TEMPERATURE SENSOR MARKET

TABLE 96 MARKET FOR ENERGY & POWER END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 97 MARKET FOR ENERGY & POWER END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 98 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 99 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 100 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 101 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 102 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 103 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 104 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 105 MARKET FOR ENERGY & POWER END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.6 HEALTHCARE

10.6.1 THERMISTORS ARE MOSTLY USED FOR DISPOSABLE MEDICAL APPLICATIONS TO PROVIDE ACCURATE AND SENSITIVE MEASUREMENTS

TABLE 106 TEMPERATURE SENSOR MARKET FOR HEALTHCARE END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 107 MARKET FOR HEALTHCARE END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 108 MARKET FOR HEALTHCARE END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 109 MARKET FOR HEALTHCARE END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 110 MARKET FOR HEALTHCARE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 111 MARKET FOR HEALTHCARE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 112 MARKET FOR HEALTHCARE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 113 MARKET FOR HEALTHCARE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 114 MARKET FOR HEALTHCARE END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 115 MARKET FOR HEALTHCARE END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.7 AUTOMOTIVE

10.7.1 WITH RISING CONCERNS ABOUT OCCUPANT COMFORT IN AUTOMOBILES, TEMPERATURE SENSORS ALSO FIND APPLICATION IN AUTOMOTIVE HVAC SYSTEMS

TABLE 116 TEMPERATURE SENSOR MARKET FOR AUTOMOTIVE END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 117 MARKET FOR AUTOMOTIVE END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 118 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 119 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 120 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 121 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 122 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 123 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 124 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 125 MARKET FOR AUTOMOTIVE END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.8 METALS & MINING

10.8.1 IN METALS & MINING END-USER INDUSTRY, TEMPERATURE SENSORS ARE USED FOR VARIOUS APPLICATIONS, SUCH AS MINERAL EXTRACTION, REFINING, AND ENGINE MONITORING

TABLE 126 TEMPERATURE SENSOR MARKET FOR METALS & MINING END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 127 MARKET FOR METALS & MINING END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 128 MARKET FOR METALS & MINING END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 129 MARKET FOR METALS & MINING END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 130 MARKET FOR METALS & MINING END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 131 MARKET FOR METALS & MINING END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 132 MARKET FOR METALS & MINING END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 133 MARKET FOR METALS & MINING END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 134 MARKET FOR METALS & MINING END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 135 MARKET FOR METALS & MINING END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.9 FOOD & BEVERAGES

10.9.1 TEMPERATURE MONITORING AND CONTROL REQUIRED FOR QUALITY ASSURANCE DURING PRODUCTION, STORAGE, AND TRANSIT OF FOOD AND BEVERAGES

TABLE 136 TEMPERATURE SENSOR MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 137 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 138 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 139 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 140 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 141 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 142 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 143 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 144 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 145 MARKET FOR FOOD & BEVERAGES END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.1 PULP & PAPER

10.10.1 TECHNOLOGICAL ADVANCEMENTS IN PULP & PAPER END-USER INDUSTRY ARE LIKELY TO ACCELERATE DEMAND FOR HIGH-TEMPERATURE SENSORS

TABLE 146 TEMPERATURE SENSOR MARKET FOR PULP & PAPER END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 147 MARKET FOR PULP & PAPER END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 148 MARKET FOR PULP & PAPER END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 149 MARKET FOR PULP & PAPER END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 150 MARKET FOR PULP & PAPER END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 151 MARKET FOR PULP & PAPER END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 152 MARKET FOR PULP & PAPER END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 153 MARKET FOR PULP & PAPER END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 154 MARKET FOR PULP & PAPER END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 155 MARKET FOR PULP & PAPER END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.11 ADVANCED FUEL

10.11.1 TEMPERATURE SENSORS WITNESSED INCREASED DEMAND FROM AUTOMOBILES USING DIFFERENT VARIETIES OF FUEL

TABLE 156 TEMPERATURE SENSOR MARKET FOR ADVANCED FUEL END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 157 MARKET FOR ADVANCED FUEL END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 158 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 159 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 160 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 161 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 162 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 163 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 164 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 165 MARKET FOR ADVANCED FUEL END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.12 AEROSPACE & DEFENSE

10.12.1 TYPICAL USES OF TEMPERATURE SENSORS INCLUDE MEASUREMENT OF AIRCRAFT SKIN TEMPERATURE, ENVIRONMENTAL TEMPERATURE, AND SURROUNDING CRITICAL ELECTRONIC COMPONENTS

TABLE 166 TEMPERATURE SENSOR MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 167 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 168 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 169 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 170 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 171 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 172 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 173 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 174 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 175 MARKET FOR AEROSPACE & DEFENSE END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.13 GLASS

10.13.1 TEMPERATURE SENSORS REQUIRED FOR MEASURING HIGH TEMPERATURES DURING GLASS MANUFACTURING

TABLE 176 TEMPERATURE SENSOR MARKET FOR GLASS END-USER INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 177 MARKET FOR GLASS END-USER INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

TABLE 178 MARKET FOR GLASS END-USER INDUSTRY IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 179 MARKET FOR GLASS END-USER INDUSTRY IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 180 MARKET FOR GLASS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 181 MARKET FOR GLASS END-USER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 182 MARKET FOR GLASS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 183 MARKET FOR GLASS END-USER INDUSTRY IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 184 MARKET FOR GLASS END-USER INDUSTRY IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 185 MARKET FOR GLASS END-USER INDUSTRY IN ROW, BY REGION, 2021–2028 (USD MILLION)

10.14 OTHERS

TABLE 186 TEMPERATURE SENSOR MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2018–2020 (USD MILLION)

TABLE 187 MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

TABLE 188 MARKET FOR OTHER END-USER INDUSTRIES IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 189 MARKET FOR OTHER END-USER INDUSTRIES IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 190 MARKET FOR OTHER END-USER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 191 MARKET FOR OTHER END-USER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 192 MARKET FOR OTHER END-USER INDUSTRIES IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 193 MARKET FOR OTHER END-USER INDUSTRIES IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 194 MARKET FOR OTHER END-USER INDUSTRIES IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 195 MARKET FOR OTHER END-USER INDUSTRIES IN ROW, BY REGION, 2021–2028 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 181)

11.1 INTRODUCTION

FIGURE 53 GEOGRAPHIC SNAPSHOT: TEMPERATURE SENSOR MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 54 MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 196 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 197 MARKET, BY REGION, 2021–2028 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 55 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 198 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 199 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 200 MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 201 MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

TABLE 202 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2018–2020 (USD MILLION)

TABLE 203 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2028 (USD MILLION)

TABLE 204 MARKET IN NORTH AMERICA, BY OUTPUT, 2018–2020 (USD MILLION)

TABLE 205 MARKET IN NORTH AMERICA, BY OUTPUT, 2021–2028 (USD MILLION)

11.2.1 US

11.2.1.1 US to hold largest market share by 2028 in North America

11.2.2 CANADA

11.2.2.1 Thriving chemicals & petrochemicals and advanced fuel industries fueling market growth in Canada

11.2.3 MEXICO

11.2.3.1 Market in Mexico to grow at highest rate in North America

11.3 EUROPE

FIGURE 56 SNAPSHOT OF TEMPERATURE SENSOR MARKET IN EUROPE

TABLE 206 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 207 MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 208 MARKET IN EUROPE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 209 MARKET IN EUROPE, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

TABLE 210 MARKET IN EUROPE, BY END-USER INDUSTRY, 2018–2020 (USD MILLION)

TABLE 211 MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2028 (USD MILLION)

TABLE 212 MARKET IN EUROPE, BY OUTPUT, 2018–2020 (USD MILLION)

TABLE 213 MARKET IN EUROPE, BY OUTPUT, 2021–2028 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany held largest share of market in Europe in 2020

11.3.2 FRANCE

11.3.2.1 Robust aviation industry supporting growth of market in France

11.3.3 UK

11.3.3.1 Consumer electronics industry generating substantial demand for temperature sensors in UK

11.3.4 ROE

11.3.4.1 Market in RoE to grow at highest rate in Europe

11.4 APAC

FIGURE 57 SNAPSHOT OF TEMPERATURE SENSOR MARKET IN APAC

TABLE 214 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 215 MARKET IN APAC, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 216 MARKET IN APAC, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 217 MARKET IN APAC, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

TABLE 218 MARKET IN APAC, BY END-USER INDUSTRY, 2018–2020 (USD MILLION)

TABLE 219 MARKET IN APAC, BY END-USER INDUSTRY, 2021–2028 (USD MILLION)

TABLE 220 MARKET IN APAC, BY OUTPUT, 2018–2020 (USD MILLION)

TABLE 221 MARKET IN APAC, BY OUTPUT, 2021–2028 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China held largest share of market in

APAC in 2020 201

11.4.2 JAPAN

11.4.2.1 Evolving market for home automation in Japan will boost demand for temperature sensors in coming years

11.4.3 INDIA

11.4.3.1 market in India expected to witness highest CAGR among all countries in APAC

11.4.4 SOUTH KOREA

11.4.4.1 Growing electronics and automotive industries driving demand for market in South Korea

11.4.5 ROAPAC

11.5 ROW

TABLE 222 TEMPERATURE SENSOR MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 223 MARKET IN ROW, BY REGION, 2021–2028 (USD MILLION)

TABLE 224 MARKET IN ROW, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 225 MARKET IN ROW, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

TABLE 226 MARKET IN ROW, BY END-USER INDUSTRY, 2018–2020 (USD MILLION)

TABLE 227 MARKET IN ROW, BY END-USER INDUSTRY, 2021–2028 (USD MILLION)

TABLE 228 MARKET IN ROW, BY OUTPUT, 2018–2020 (USD MILLION)

TABLE 229 MARKET IN ROW, BY OUTPUT, 2021–2028 (USD MILLION)

11.5.1 MEA

11.5.1.1 MEA held larger share of market in RoW

11.5.2 SOUTH AMERICA

11.5.2.1 Growing energy & power and mining industries likely to propel market growth in South America

12 COMPETITIVE LANDSCAPE (Page No. - 207)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY TEMPERATURE SENSOR OEMS

12.3 COMPANY REVENUE ANALYSIS FOR TEMPERATURE SENSOR MARKET, 2020

TABLE 230 TOP FIVE PLAYERS IN MARKET, 2016–2020 (USD BILLION)

FIGURE 58 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016–2020

12.4 MARKET SHARE ANALYSIS, 2020

FIGURE 59 SHARE OF MAJOR PLAYERS IN MARKET, 2020

TABLE 231 MARKET: DEGREE OF COMPETITION

12.5 RANKING OF KEY PLAYERS IN MARKET

FIGURE 60 MARKET: RANKING OF KEY PLAYERS, 2020

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STAR

12.6.2 PERVASIVE

12.6.3 EMERGING LEADER

12.6.4 PARTICIPANT

FIGURE 61 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

12.7 STARTUP/SME EVALUATION QUADRANT

TABLE 232 LIST OF STARTUP COMPANIES IN THE TEMPERATURE SENSOR MARKET

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 62 TEMPERATURE SENSORS MARKET: STARTUP/SME EVALUATION MATRIX, 2020

12.8 TEMPERATURE SENSOR MARKET: COMPANY FOOTPRINT

TABLE 233 FOOTPRINT OF COMPANIES

TABLE 234 APPLICATION FOOTPRINT OF COMPANIES

TABLE 235 PRODUCT FOOTPRINT OF COMPANIES

TABLE 236 REGIONAL FOOTPRINT OF COMPANIES

12.9 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 63 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES & DEVELOPMENTS, COLLABORATIONS, AND ACQUISITIONS – KEY STRATEGIES OF PLAYERS (2017-2021)

12.9.1 NEW PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 237 MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, 2019–2021

12.9.2 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 238 MARKET: DEALS, 2019–2021

13 COMPANY PROFILES (Page No. - 226)

(Business overview, Products/services/solutions, Recent Developments, Deals, MNM view)*

13.1 KEY PLAYERS

13.1.1 HONEYWELL

TABLE 239 HONEYWELL: BUSINESS OVERVIEW

FIGURE 64 HONEYWELL: COMPANY SNAPSHOT

13.1.2 TE CONNECTIVITY

TABLE 240 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 65 TE CONNECTIVITY: COMPANY SNAPSHOT

13.1.3 TEXAS INSTRUMENTS

TABLE 241 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 66 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

13.1.4 ENDRESS+HAUSER

TABLE 242 ENDRESS+HAUSER: BUSINESS OVERVIEW

FIGURE 67 ENDRESS+HAUSER: COMPANY SNAPSHOT

13.1.5 SIEMENS

TABLE 243 SIEMENS: BUSINESS OVERVIEW

FIGURE 68 SIEMENS: COMPANY SNAPSHOT

13.1.6 MAXIM INTEGRATED

TABLE 244 MAXIM INTEGRATED: BUSINESS OVERVIEW

FIGURE 69 MAXIM INTEGRATED: COMPANY SNAPSHOT

13.1.7 EMERSON

TABLE 245 EMERSON: BUSINESS OVERVIEW

FIGURE 70 EMERSON: COMPANY SNAPSHOT

13.1.8 AMPHENOL

TABLE 246 AMPHENOL: BUSINESS OVERVIEW

FIGURE 71 AMPHENOL: COMPANY SNAPSHOT

13.1.9 WIKA INSTRUMENT

TABLE 247 WIKA INSTRUMENTS: BUSINESS OVERVIEW

13.1.10 DWYER INSTRUMENTS

TABLE 248 DWYER INSTRUMENTS: BUSINESS OVERVIEW

13.2 OTHER COMPANIES

13.2.1 MICROCHIP

13.2.2 KONGSBERG

13.2.3 PYROMATION

13.2.4 ANALOG DEVICES

13.2.5 HANS TURCK

13.2.6 IFM ELECTRONIC

13.2.7 STMICROELECTRONICS

13.2.8 NXP SEMICONDUCTORS

13.2.9 OMEGA ENGINEERING

13.2.10 YOKOGAWA ELECTRIC

13.2.11 MURATA MANUFACTURING

*Details on Business overview, Products/services/solutions, Recent Developments, Deals, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 270)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

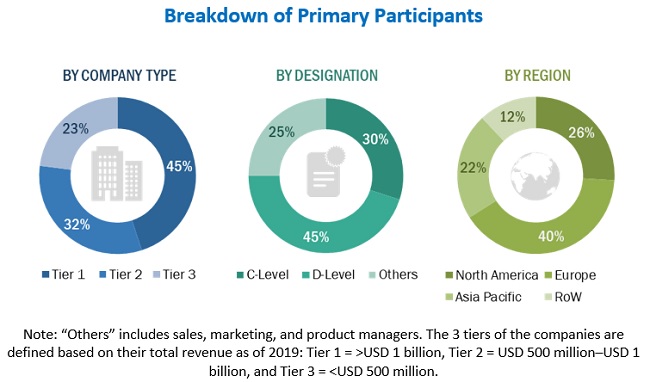

The study involved 4 major activities in estimating the current size of temperature sensor market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the temperature sensor market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the temperature sensor market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the temperature sensor market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the temperature sensor market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the temperature sensor market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the temperature sensor market based on product type, output, connectivity, end-user industry, and region

- To forecast the market, in terms of volume and value, with respect to four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research & development (R&D) activities in the market

- To analyze the impact of COVID-19 on the temperature sensor market and provide market estimates for both pre and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Temperature Sensor Market

I am particularly interested in wireless temperature monitoring in pharmaceuticals and biologicals applications.

Need to understand the scope of temperature sensors market.

Our research group is currently conducting studies on contact thermometry and we need better understandings on the temperature sensor market.

We are looking in to new products developments and the information related to market segmentation for temperature sensor.

I am solution provider and interested in integrated temperature sensors, and I really want to know about the scope and research methodology of the market.

I am a researcher in luminescent molecular thermometers and in our group we frequently cite your organization as a realizable source in terms of sensor market. In order to keep us updated we kindly request a version of the report "Temperature Sensors Market by Product Type".

I am trying to compile a report which outlines the most popular manufacturers of certain electrical components, (see below) over the last 20 years, segmented by global regions and industry. I understand your reports are highly valued as they give future forecasts. I wondered if it would be possible to negotiate a price for the data you have on file (2000-2017) ? List of components: Temperature sensors; pressure sensors; flow meters; level sensors; PLCs; DCSs; valves, actuators and positioners; variable speed drives, agitator controls and electric trace heating.

I am interesting in purchasing this report, however I am unable to purchase it without being able to sense check a number against our own data, to check that the data is accurate and reliable. Would it be possible to gain access to one figure (e.g. China or APAC temperature market size) in order to check this prior to purchasing? I am looking forward to hear from you.

Could you please share the sample pages as I found the content of the report suitable for our internal operations.

Interested in the depth analysis for the Asian temperature sensors market.

We are a small company working on SBIR proposal that require some market information. We do not have the resources to meet your price point but were wondering if you ever worked with small companies like us to provide some segments information of market research at a much lower price point? Thank you so much for your help!

At what extent, downfall in automotive sales will affect temperature sensor demand?