TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 TESTING, INSPECTION, AND CERTIFICATION MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

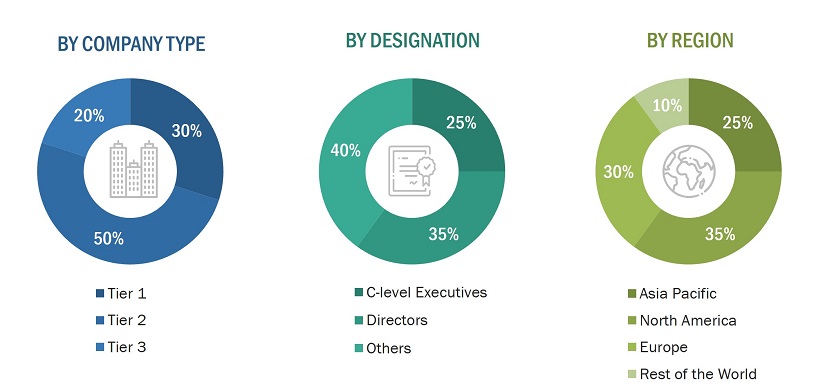

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 TESTING, INSPECTION, AND CERTIFICATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Participants

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

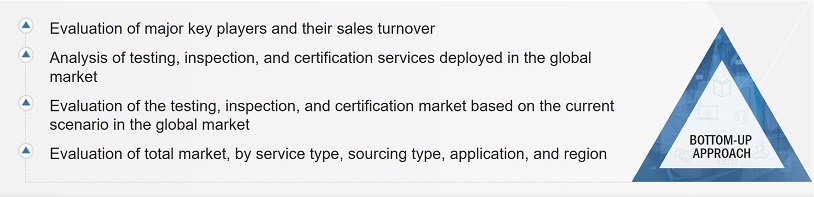

2.2 MARKET SIZE ESTIMATION

FIGURE 3 TESTING, INSPECTION, AND CERTIFICATION MARKET: MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to determine market size using bottom-up analysis

FIGURE 4 TESTING, INSPECTION, AND CERTIFICATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to determine market size using top-down analysis

FIGURE 5 TESTING, INSPECTION, AND CERTIFICATION MARKET: TOP-DOWN APPROACH

2.2.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND-SIDE): BOTTOM-UP ESTIMATION, BY APPLICATION AND REGION

2.2.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS, BY REGION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.5.3 RECESSION IMPACT ASSESSMENT: TESTING, INSPECTION, AND CERTIFICATION MARKET

TABLE 2 TESTING, INSPECTION, AND CERTIFICATION MARKET: IMPACT OF RECESSION ON END-USER VERTICALS

3 EXECUTIVE SUMMARY (Page No. - 58)

3.1 TESTING, INSPECTION, AND CERTIFICATION MARKET: IMPACT OF RECESSION

FIGURE 9 TESTING, INSPECTION, AND CERTIFICATION MARKET: PRE- AND POST-RECESSION SCENARIO ANALYSIS, 2019–2028 (USD MILLION)

FIGURE 10 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 11 CONSUMER GOODS AND RETAIL APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 GROWTH OPPORTUNITIES IN TESTING, INSPECTION, AND CERTIFICATION MARKET

FIGURE 14 ASIA PACIFIC REGION TO EMERGE AS A LUCRATIVE GROWTH AVENUE FOR TIC SERVICES

4.2 TESTING, INSPECTION, AND CERTIFICATION MARKET: CONSUMER GOODS AND RETAIL APPLICATION, BY TYPE

FIGURE 15 ELECTRICAL AND ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE

FIGURE 16 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE

FIGURE 17 TESTING SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY REGION

FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 TESTING, INSPECTION, AND CERTIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Stringent government regulations to ensure product safety and environmental protection

5.2.1.2 Rising need for interoperability testing due to IoT deployment

5.2.1.3 Increasing trade in counterfeit & defective pharmaceutical products

5.2.1.4 Growing focus on manufacturing high-quality products

FIGURE 20 TESTING, INSPECTION, AND CERTIFICATION MARKET: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Complexities associated with government authorities for global standards

5.2.2.2 High cost of TIC services due to geographical diversity

FIGURE 21 TESTING, INSPECTION, AND CERTIFICATION MARKET: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising focus on digitalization to improve customer experience

5.2.3.2 Increasing importance of food safety & hygiene

5.2.3.3 Growing adoption of AI and ML worldwide

FIGURE 22 TESTING, INSPECTION, AND CERTIFICATION MARKET: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Low adoption rate of innovative technologies

FIGURE 23 TESTING, INSPECTION, AND CERTIFICATION MARKET: CHALLENGES

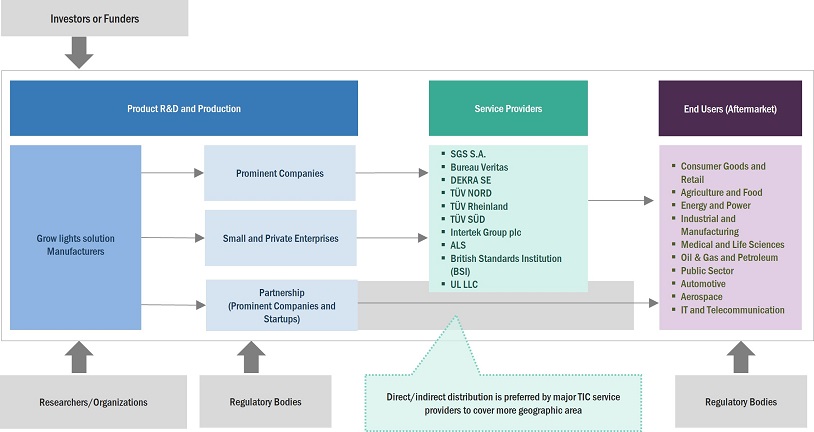

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 TESTING, INSPECTION, AND CERTIFICATION MARKET: VALUE CHAIN ANALYSIS

5.4 TESTING, INSPECTION, AND CERTIFICATION MARKET ECOSYSTEM

TABLE 3 TESTING, INSPECTION, AND CERTIFICATION MARKET: ECOSYSTEM

FIGURE 25 TESTING, INSPECTION, AND CERTIFICATION MARKET: KEY PLAYERS IN ECOSYSTEM

5.5 PRICING ANALYSIS: AVERAGE SELLING PRICE TREND

FIGURE 26 AVERAGE SELLING PRICE (ASP) OF SERVICE TYPES

5.5.1 AVERAGE SELLING PRICE OF CERTIFICATION SERVICES OFFERED BY KEY PLAYERS

FIGURE 27 AVERAGE SELLING PRICE OF KEY PLAYERS FOR CERTIFICATION SERVICES

TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS FOR CERTIFICATION SERVICES (USD)

TABLE 5 ESTIMATION OF EMC TESTING COSTS AT STAGES

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 28 TESTING, INSPECTION, AND CERTIFICATION MARKET: REVENUE SHIFT

5.7 TECHNOLOGY ANALYSIS

5.7.1 SUBSTITUTE TECHNOLOGY

5.7.2 AUTOMATION TESTING TECHNOLOGY

TABLE 6 TESTING, INSPECTION, AND CERTIFICATION MARKET: KEY TRENDS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 TESTING, INSPECTION, AND CERTIFICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 TESTING, INSPECTION, AND CERTIFICATION MARKET: IMPACT OF PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.10 CASE STUDY ANALYSIS

5.10.1 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR A FOOD MANUFACTURING COMPANY

TABLE 10 TÜV SÜD PROVIDES CERTIFICATION AND AUDITING SERVICES FOR MEIJI CO. LTD.

5.10.2 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR A CLEANING AND DISINFECTION SERVICE PROVIDER

TABLE 11 TÜV SÜD PROVIDES CERTIFICATION SERVICES TO PRIMECH HOLDINGS LIMITED

5.10.3 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR ENERGY INDUSTRY

TABLE 12 APPLUS+ RTD IMPROVES FIELD SERVICE DELIVERY FOR ENERGY & POWER WITH LAUNCH OF A MOBILE REACH PLATFORM

5.10.4 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR OFFSHORE WIND ENERGY SYSTEM

TABLE 13 LLOYD’S REGISTER AS AN INDEPENDENT THIRD-PARTY CERTIFYING AUTHORITY FOR SAFE INSTALLATION OF TENNET’S BORWIN GAMMA PLATFORM

5.11 TRADE ANALYSIS

TABLE 14 IMPORT DATA FOR COMPLIANT PRODUCTS, HS CODE: 9018, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 33 COMPLIANT PRODUCTS AND IMPORT VALUES FOR MAJOR COUNTRIES (2017–2021)

TABLE 15 EXPORT DATA FOR COMPLIANT PRODUCTS, HS CODE: 9018, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 34 COMPLIANT PRODUCTS AND EXPORT VALUES FOR MAJOR COUNTRIES (2017–2021)

5.12 PATENT ANALYSIS

FIGURE 35 TESTING, INSPECTION, AND CERTIFICATION MARKET: NUMBER OF PATENTS GRANTED (2013–2022)

FIGURE 36 TESTING, INSPECTION, AND CERTIFICATION MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED (2013–2022)

TABLE 16 TESTING, INSPECTION, AND CERTIFICATION MARKET: LIST OF KEY PATENTS (2020–2022)

5.13 KEY CONFERENCES AND EVENTS (2023–2025)

TABLE 17 TESTING, INSPECTION, AND CERTIFICATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

TABLE 18 TESTING, INSPECTION, AND CERTIFICATION MARKET: REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE (Page No. - 97)

6.1 INTRODUCTION

FIGURE 37 TESTING, INSPECTION, AND CERTIFICATION MARKET: SERVICE TYPE

TABLE 23 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

FIGURE 38 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 24 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

6.2 TESTING

6.2.1 RISING REQUIREMENT FOR MEDICAL DEVICE TESTING TO FUEL MARKET

6.3 INSPECTION

6.3.1 SURGE IN DEMAND FOR ESSENTIAL COMMODITIES TO DRIVE MARKET

6.4 CERTIFICATION

6.4.1 RISING NEED FOR PRODUCT MARKETABILITY TO SUPPORT MARKET

6.5 OTHERS

7 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE (Page No. - 103)

7.1 INTRODUCTION

FIGURE 39 TESTING, INSPECTION, AND CERTIFICATION MARKET: BY SOURCING TYPE

TABLE 25 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

FIGURE 40 IN-HOUSE SOURCING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 26 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

7.2 IN-HOUSE SERVICES

7.2.1 HIGH UTILIZATION IN MINING AND LIFE SCIENCE APPLICATIONS TO DRIVE MARKET

7.3 OUTSOURCED SERVICES

7.3.1 HIGH-QUALITY ASSURANCE AND COST-EFFICIENCY TO FUEL MARKET

8 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION (Page No. - 107)

8.1 INTRODUCTION

TABLE 27 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

FIGURE 41 CONSUMER GOODS AND RETAIL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 28 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

8.2 CONSUMER GOODS AND RETAIL

8.2.1 PERSONAL CARE AND BEAUTY PRODUCTS

8.2.1.1 Increased manufacturing of beauty products to drive uptake of TIC services

8.2.2 HARD GOODS

8.2.2.1 Advanced technological developments in household appliances to fuel uptake of inspection services

8.2.3 SOFTLINES AND ACCESSORIES

8.2.3.1 Rising focus on consumer satisfaction with provision of high-quality products to drive market

8.2.4 TOYS AND JUVENILE PRODUCTS

8.2.4.1 Adoption of toxicological evaluation testing for product marketability in toys to drive market

8.2.5 ELECTRICAL AND ELECTRONICS

8.2.5.1 Implementation of new hazard-based standards to drive uptake of TIC services

8.2.6 OTHERS

TABLE 29 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CONSUMER GOODS AND RETAIL, BY TYPE, 2019–2022 (USD MILLION)

FIGURE 42 ELECTRICAL & ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE OF CONSUMER GOODS & RETAIL DURING FORECAST PERIOD

TABLE 30 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CONSUMER GOODS & RETAIL, BY TYPE, 2023–2028 (USD MILLION)

8.3 AGRICULTURE AND FOOD

8.3.1 SEEDS AND CROPS

8.3.1.1 Adoption of seed-borne disease testing and viable testing for crop quality assessment to support market growth

8.3.2 FERTILIZERS

8.3.2.1 Advent of digitalized fertilizer services to support market growth

8.3.3 FOOD

8.3.3.1 Increasing demand for certified food products to fuel uptake of testing services

8.3.4 MEAT

8.3.4.1 Rising cases of adulterating meat to fuel uptake of testing services

8.3.5 FORESTRY

8.3.5.1 Stringent regulatory standards for sustainability and environmental protection to drive market

8.3.6 COMMODITIES

8.3.6.1 Focus on agro-commodities testing to support market growth

8.3.7 OTHERS

TABLE 31 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AGRICULTURE AND FOOD, BY TYPE, 2019–2022 (USD MILLION)

TABLE 32 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AGRICULTURE & FOOD, BY TYPE, 2023–2028 (USD MILLION)

8.4 CHEMICALS

8.4.1 ASSET INTEGRITY MANAGEMENT SERVICES

8.4.1.1 Rising need for risk management services to drive market

8.4.2 PROJECT LIFECYCLE SERVICES

8.4.2.1 Demand for pre-shipment inspection services to support market growth

8.4.3 FINISHED PRODUCT SERVICES

8.4.3.1 Utilization of raw material testing in products to support market growth

8.4.4 CHEMICAL FEEDSTOCK SERVICES

8.4.4.1 Adoption of acid & alkaline tests in chemical products to drive market

8.4.5 OTHERS

TABLE 33 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CHEMICALS, BY TYPE, 2019–2022 (USD MILLION)

TABLE 34 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CHEMICALS, BY TYPE, 2023–2028 (USD MILLION)

8.5 CONSTRUCTION AND INFRASTRUCTURE

8.5.1 PROJECT MANAGEMENT SERVICES

8.5.1.1 Digital transformation for new infrastructure to fuel uptake of inspection services

8.5.2 MATERIAL SERVICES

8.5.2.1 Adoption of material testing for quality standards to drive market

8.5.3 CONSTRUCTION MACHINERY AND EQUIPMENT SERVICES

8.5.3.1 Rising focus on safety and efficiency of construction machinery & equipment to drive market

8.5.4 FACILITIES MANAGEMENT AND INSPECTION SERVICES

8.5.4.1 Implementation of maintenance & inspection systems for infrastructure safety to drive market

8.5.5 OTHERS

TABLE 35 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CONSTRUCTION AND INFRASTRUCTURE, BY TYPE, 2019–2022 (USD MILLION)

TABLE 36 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR CONSTRUCTION AND INFRASTRUCTURE, BY TYPE, 2023–2028 (USD MILLION)

8.6 ENERGY AND POWER

8.6.1 ENERGY SOURCES

8.6.1.1 Increasing government incentives on renewable energy projects to drive market

8.6.1.2 Nuclear

8.6.1.3 Wind

8.6.1.4 Solar

8.6.1.5 Alternative fuels

8.6.1.6 Fuel oil & gases

8.6.1.7 Coal

8.6.2 POWER GENERATION

8.6.2.1 Growing focus on achieving optimal energy management to support market growth

8.6.3 POWER DISTRIBUTION

8.6.3.1 Rising need for reliable power distribution to fuel uptake of inspection services

8.6.4 ASSET INTEGRITY MANAGEMENT SERVICES

8.6.4.1 Assurance of technical integrity of assets to fuel uptake of inspection services

8.6.5 PROJECT LIFECYCLE SERVICES

8.6.5.1 Ability to provide sustainable products with adherence to international quality standards to drive market

8.6.6 OTHERS

TABLE 37 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR ENERGY AND POWER, BY TYPE, 2019–2022 (USD MILLION)

TABLE 38 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR ENERGY AND POWER, BY TYPE, 2023–2028 (USD MILLION)

8.7 INDUSTRIAL AND MANUFACTURING

8.7.1 SUPPLIER-RELATED SERVICES

8.7.1.1 Rising need for high-utility performance of machinery & equipment to drive market

8.7.2 PRODUCTION AND PRODUCT-RELATED SERVICES

8.7.2.1 Growing focus on efficient product manufacturing to support market growth

8.7.3 PROJECT-RELATED SERVICES

8.7.3.1 Rising demand for risk management services to drive market

8.7.4 OTHERS

TABLE 39 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR INDUSTRIAL AND MANUFACTURING, BY TYPE, 2019–2022 (USD MILLION)

TABLE 40 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR INDUSTRIAL AND MANUFACTURING, BY TYPE, 2023–2028 (USD MILLION)

8.8 MEDICAL AND LIFE SCIENCES

8.8.1 MEDICAL DEVICES

8.8.1.1 Increasing development of innovative medical devices to drive demand for TIC services

8.8.2 HEALTH, BEAUTY, AND WELLNESS

8.8.2.1 Strict regulations and standards for wellness and beauty products owing to public safety to fuel market

8.8.3 CLINICAL SERVICES

8.8.3.1 Adoption of biosimilar testing services for clinical trial management to support market growth

8.8.4 LABORATORY SERVICES

8.8.4.1 Mandates by regulatory bodies for stringent testing of biopharmaceutical products & vaccines to fuel market

8.8.5 BIOPHARMACEUTICAL & PHARMACEUTICAL SERVICES

8.8.5.1 Increasing need for GVP measures following EU mandates to drive market

8.8.6 OTHERS

TABLE 41 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MEDICAL AND LIFE SCIENCES, BY TYPE, 2019–2022 (USD MILLION)

TABLE 42 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MEDICAL AND LIFE SCIENCES, BY TYPE, 2023–2028 (USD MILLION)

8.9 MINING

8.9.1 INSPECTION & SAMPLING SERVICES

8.9.1.1 Strict trade regulations imposed by various countries to support market growth

8.9.2 EXPLORATION SERVICES

8.9.2.1 Increasing exploration activities for sustainable development to support market growth

8.9.3 METALLURGY AND PROCESS DESIGN SERVICES

8.9.3.1 Demand for risk management services during metallurgy assessments to support market growth

8.9.4 PRODUCTION AND PLANT SERVICES

8.9.4.1 Utilization of equipment optimization services for efficient operations to drive market

8.9.5 ANALYTICAL SERVICES

8.9.5.1 Wide applications in mining industry to fuel uptake of testing services

8.9.6 SITE OPERATION AND CLOSURE SERVICES

8.9.6.1 Sustainable process designing services for compliance with social & environmental standards to drive market

8.9.7 PROJECT RISK ASSESSMENT AND MITIGATION SERVICES

8.9.7.1 Adoption of operational monitoring services to support market growth

8.9.8 OTHERS

TABLE 43 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MINING, BY TYPE, 2019–2022 (USD MILLION)

FIGURE 43 EXPLORATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE OF MINING APPLICATION DURING FORECAST PERIOD

TABLE 44 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MINING, BY TYPE, 2023–2028 (USD MILLION)

8.10 OIL & GAS AND PETROLEUM

8.10.1 UPSTREAM SERVICES

8.10.1.1 Increasing field and reservoir safety norms to fuel uptake

8.10.2 DOWNSTREAM SERVICES

8.10.2.1 Increasing safety norms for oil & gas and petroleum products to support market growth

8.10.3 BIOFUELS AND FEEDSTOCK

8.10.3.1 Adoption of biomass fuel testing to support market growth

8.10.4 PETROCHEMICALS

8.10.4.1 Testing of petrochemicals for purity levels to fuel market

8.10.5 ASSET INTEGRITY MANAGEMENT

8.10.5.1 Climate change and environmental concerns to drive market

8.10.6 PROJECT LIFECYCLE SERVICES

8.10.6.1 Adoption of building maintenance services to support market growth

8.10.7 OTHERS

TABLE 45 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR OIL & GAS AND PETROLEUM, BY TYPE, 2019–2022 (USD MILLION)

TABLE 46 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR OIL & GAS AND PETROLEUM, BY TYPE, 2023–2028 (USD MILLION)

8.11 PUBLIC SECTOR

8.11.1 PRODUCT CONFORMITY ASSESSMENT SERVICES

8.11.1.1 Increasing regulations and standards for product testing to support market growth

8.11.2 MONITORING SERVICES

8.11.2.1 Growing importance of maintaining efficient legal frameworks to drive market

8.11.3 VALUATION SERVICES

8.11.3.1 Rising government regulations and trade policies to drive demand for TIC services

8.11.4 OTHERS

TABLE 47 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR PUBLIC SECTOR, BY TYPE, 2019–2022 (USD MILLION)

TABLE 48 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR PUBLIC SECTOR, BY TYPE, 2023–2028 (USD MILLION)

8.12 AUTOMOTIVE

8.12.1 ELECTRICAL SYSTEMS AND COMPONENTS

8.12.1.1 Presence of regulatory standards for safety & quality assurance of electronic components to drive market

8.12.2 ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS

8.12.2.1 Rising investments in electric vehicles and automotive technology to drive market

8.12.3 TELEMATICS

8.12.3.1 Advent of connective technologies in automotive applications to fuel uptake of TIC services

8.12.4 FUELS, FLUIDS, AND EMOLLIENTS

8.12.4.1 Concerns associated with safety & efficiency of fuel-based engines to drive market

8.12.5 INTERIOR & EXTERIOR MATERIALS AND COMPONENTS

8.12.5.1 Adoption of mandatory interior testing in automobiles to fuel uptake of testing services

8.12.6 VEHICLE INSPECTION SERVICES (VIS)

8.12.6.1 Comprehensive inspection of complete vehicle to support market growth

8.12.7 HOMOLOGATION TESTING

8.12.7.1 Implementation of requirements by statutory regulatory bodies to drive market

8.12.8 OTHERS

TABLE 49 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AUTOMOTIVE, BY TYPE, 2019–2022 (USD MILLION)

TABLE 50 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AUTOMOTIVE, BY TYPE, 2023–2028 (USD MILLION)

8.13 AEROSPACE

8.13.1 SERVICES FOR AIRPORTS

8.13.2 SERVICES FOR AVIATION

8.13.3 SERVICES FOR AEROSPACE

8.13.4 AEROSPACE MANUFACTURING SERVICES

8.13.4.1 Implementation of testing and certification services for smooth airplane operations to drive market

8.13.5 AVIATION MANAGEMENT SERVICES

8.13.5.1 High demand for risk & quality management to drive market

8.13.6 OTHERS

TABLE 51 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AEROSPACE, BY TYPE, 2019–2022 (USD MILLION)

TABLE 52 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR AEROSPACE, BY TYPE, 2023–2028 (USD MILLION)

8.14 MARINE

8.14.1 MARINE FUEL SYSTEM AND COMPONENT SERVICES

8.14.1.1 Rising demand for fuel line testing services to drive market

8.14.2 SHIP CLASSIFICATION SERVICES

8.14.2.1 Strict regulations and certification requirements for international trade to support market growth

8.14.3 MARINE MATERIAL AND EQUIPMENT SERVICES

8.14.3.1 Requirement of multiple certification processes to drive market

8.14.4 OTHERS

TABLE 53 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MARINE, BY TYPE, 2019–2022 (USD MILLION)

TABLE 54 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR MARINE, BY TYPE, 2023–2028 (USD MILLION)

8.15 RAILWAY

8.15.1 RAIL CONSTRUCTION AND PRODUCTION MONITORING

8.15.1.1 Adoption of drone technology for inspection of construction and production to fuel uptake of testing services

8.15.2 INFRASTRUCTURE MANAGEMENT

8.15.2.1 Rising investments in railway infrastructure worldwide to drive market

8.15.3 OTHERS

TABLE 55 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR RAILWAY, BY TYPE, 2019–2022 (USD MILLION)

TABLE 56 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR RAILWAY, BY TYPE, 2023–2028 (USD MILLION)

8.16 SUPPLY CHAIN AND LOGISTICS

8.16.1 PACKAGING AND HANDLING

8.16.1.1 Implementation of GDP certification to ensure adoption of TIC services

8.16.2 RISK MANAGEMENT

8.16.2.1 Identification, assessment, and mitigation of risks to drive market

8.16.3 OTHERS

TABLE 57 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR SUPPLY CHAIN AND LOGISTICS, BY TYPE, 2019–2022 (USD MILLION)

TABLE 58 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR SUPPLY CHAIN AND LOGISTICS, BY TYPE, 2023–2028 (USD MILLION)

8.17 IT AND TELECOMMUNICATION

8.17.1 TELECOMMUNICATION AND IT INFRASTRUCTURE EQUIPMENT

8.17.1.1 Stringent product launch standards in various countries to drive market

8.17.2 MODULES AND DEVICES

8.17.2.1 Regulatory requirements for commercialization of products to support market growth

TABLE 59 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR IT AND TELECOMMUNICATION, BY TYPE, 2019–2022 (USD MILLION)

TABLE 60 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR IT AND TELECOMMUNICATION, BY TYPE, 2023–2028 (USD MILLION)

8.18 SPORTS AND ENTERTAINMENT

8.18.1 SPORTS VENUES AND FACILITIES

8.18.1.1 Mandatory safety testing of turfs to drive market

8.18.2 SPORTING GOODS AND PROTECTIVE EQUIPMENT

8.18.2.1 Rising focus on product authenticity to fuel uptake of testing and inspection services

TABLE 61 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR SPORTS AND ENTERTAINMENT, BY TYPE, 2019–2022 (USD MILLION)

TABLE 62 TESTING, INSPECTION, AND CERTIFICATION MARKET FOR SPORTS AND ENTERTAINMENT, BY TYPE, 2023–2028 (USD MILLION)

9 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY REGION (Page No. - 166)

9.1 INTRODUCTION

FIGURE 44 TESTING, INSPECTION, AND CERTIFICATION MARKET: BY REGION

FIGURE 45 INDIA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 46 ASIA PACIFIC REGION PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 63 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 64 TESTING, INSPECTION, AND CERTIFICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

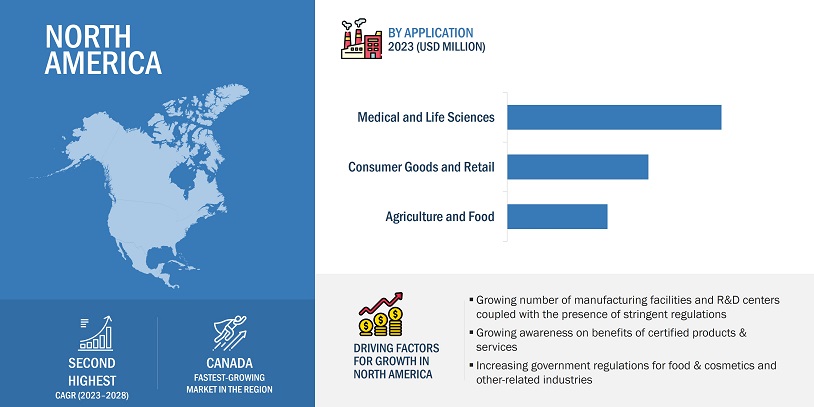

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: RECESSION IMPACT

FIGURE 47 NORTH AMERICA: IMPACT OF RECESSION

FIGURE 48 TESTING, INSPECTION, AND CERTIFICATION MARKET: NORTH AMERICA MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 66 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 67 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 68 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 69 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 70 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 71 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 72 NORTH AMERICA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.2.2 US

9.2.2.1 Increasing investments in innovative next-generation technologies to fuel uptake of testing services

TABLE 73 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 74 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 75 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 76 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 77 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 78 US: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.2.3 CANADA

9.2.3.1 High demand for TIC services in IT & telecommunication applications to drive market

TABLE 79 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 80 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 81 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 82 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 83 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 84 CANADA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.2.4 MEXICO

9.2.4.1 Rising requirement for TIC services in automotive & aerospace to fuel market

TABLE 85 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 86 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 87 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 88 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 89 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 90 MEXICO: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: RECESSION IMPACT

FIGURE 49 EUROPE: IMPACT OF RECESSION

FIGURE 50 TESTING, INSPECTION, AND CERTIFICATION MARKET: EUROPE MARKET SNAPSHOT

TABLE 91 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 92 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 93 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 94 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 95 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 96 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 97 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 98 EUROPE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Implementation of Industry 4.0 in automotive sector to drive uptake of TIC services

TABLE 99 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 100 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 101 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 102 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 103 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 104 GERMANY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.3 UK

9.3.3.1 Rising demand for accessibility testing in retail and food & beverage sectors to fuel market

TABLE 105 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 106 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 107 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 108 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 109 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 110 UK: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.4 FRANCE

9.3.4.1 Growing pharmaceutical industry to fuel demand for TIC services

TABLE 111 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 112 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 113 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 114 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 115 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 116 FRANCE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Rising government efforts for adherence to regulations to support market growth

TABLE 117 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 118 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 119 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 120 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 121 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 122 ITALY: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.6 SPAIN

9.3.6.1 Privatization of aerospace industry to fuel uptake of TIC services

TABLE 123 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 124 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 125 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 126 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 127 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 128 SPAIN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.7 BELGIUM

9.3.7.1 Presence of manufacturing facilities for food & beverage applications to support market growth

TABLE 129 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 130 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 131 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 132 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 133 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 134 BELGIUM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.8 RUSSIA

9.3.8.1 Growth in agricultural production to drive demand for TIC services

TABLE 135 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 136 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 137 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 138 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 139 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 140 RUSSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.9 NETHERLANDS

9.3.9.1 Surge in production of EVs and related components to drive market

TABLE 141 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 142 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 143 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 144 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 145 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 146 NETHERLANDS: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.10 SWITZERLAND

9.3.10.1 Rising import of goods and adherence to special regulations for environmental safety to drive market

TABLE 147 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 148 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 149 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 150 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 151 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 152 SWITZERLAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.3.11 HUNGARY

9.3.11.1 Rising expansion of e-commerce industry to support market growth

9.3.12 POLAND

9.3.12.1 Utilization of technologies such as IoT, cloud computing, and cybersecurity to drive market

9.3.13 BULGARIA

9.3.13.1 Import of machinery and manufacturing equipment to support market growth

9.3.14 SWEDEN

9.3.14.1 Rising focus on introducing ICT-based technologies in automotive industry to support market growth

9.3.15 NORWAY

9.3.15.1 Export of crude oil and petroleum gas to drive demand for TIC services

9.3.16 ROMANIA

9.3.16.1 Rising demand for TIC services in IT and telecommunication applications to drive market

9.3.17 AUSTRIA

9.3.17.1 Advancements in logistics and telecommunications sectors to drive adoption of TIC services

9.3.18 TURKEY

9.3.18.1 Rising investments in development of robotics and AI to drive market

9.3.19 CROATIA

9.3.19.1 Expanding tourism and sports sectors to drive demand for TIC services

9.3.20 IRELAND

9.3.20.1 Introduction of industrial robots to support market growth

9.3.21 GREECE

9.3.21.1 Adoption of inspection services for fishing, mining, and shipping industries to support market growth

9.3.22 CZECH REPUBLIC

9.3.22.1 Strong focus on automotive manufacturing capabilities to drive demand for TIC services

9.3.23 LATVIA

9.3.23.1 Growth in food processing and textile industries to support market growth

9.3.24 DENMARK

9.3.24.1 Rising focus of regulatory bodies on providing high-quality agricultural equipment to drive market

9.3.25 LITHUANIA

9.3.25.1 Adoption of testing services in food processing industry to drive market

9.3.26 ESTONIA

9.3.26.1 Strict norms and import regulations to drive market

9.3.27 PORTUGAL

9.3.27.1 Expansion of manufacturing facilities to drive uptake for TIC services

9.3.28 FINLAND

9.3.28.1 Rising R&D activities in automotive and chemical industries to support market growth

9.3.29 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: RECESSION IMPACT

FIGURE 51 ASIA PACIFIC: IMPACT OF RECESSION

FIGURE 52 TESTING, INSPECTION, AND CERTIFICATION MARKET: ASIA PACIFIC MARKET SNAPSHOT

TABLE 153 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 154 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 155 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 156 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 157 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 158 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 159 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 160 ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Rising demand for TIC services in healthcare sector to support market growth

TABLE 161 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 162 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 163 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 164 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 165 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 166 CHINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Stringent regulatory norms in F&B industry to fuel uptake of testing and inspection services

TABLE 167 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 168 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 169 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 170 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 171 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 172 JAPAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Rising demand for certification services in healthcare and pharmaceuticals to drive market

TABLE 173 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 174 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 175 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 176 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 177 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 178 INDIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Highly established market for export of electronics and medical devices to fuel uptake of TIC services

TABLE 179 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 180 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 181 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 182 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 183 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 184 SOUTH KOREA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.6 AUSTRALIA

9.4.6.1 Stringent regulations in healthcare and mining industries to increase uptake of TIC services

TABLE 185 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 186 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 187 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 188 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 189 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 190 AUSTRALIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.7 SINGAPORE

9.4.7.1 Adoption of innovative technologies for consumer electronics and electrical applications to support market growth

TABLE 191 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 192 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 193 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 194 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 195 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 196 SINGAPORE: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.8 THAILAND

9.4.8.1 High growth in telecommunications and aviation industries to fuel uptake

TABLE 197 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 198 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 199 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 200 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 201 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 202 THAILAND: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.9 INDONESIA

9.4.9.1 Stringent regulatory mandates in testing electronic products to drive market

TABLE 203 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 204 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 205 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 206 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 207 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 208 INDONESIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.10 MALAYSIA

9.4.10.1 High production of electronic equipment and manufacturing applications to drive market

TABLE 209 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 210 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 211 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 212 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 213 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 214 MALAYSIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.11 VIETNAM

9.4.11.1 Heavy regulations for cosmetic and beauty product testing to support market growth

TABLE 215 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 216 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 217 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 218 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 219 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 220 VIETNAM: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.12 TAIWAN

9.4.12.1 Thriving automotive and telecommunications applications to support market growth

TABLE 221 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 222 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 223 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 224 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 225 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 226 TAIWAN: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.13 HONG KONG

9.4.13.1 Government regulations for safety mandates to fuel uptake of inspection services

TABLE 227 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 228 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 229 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 230 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 231 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 232 HONG KONG: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.14 BANGLADESH

9.4.14.1 Booming textile industry and stringent rules to ensure manufacturing of high-quality consumer goods to fuel market

TABLE 233 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 234 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 235 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 236 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 237 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 238 BANGLADESH: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.15 PHILIPPINES

9.4.15.1 Rising ICT sector and availability of online product certification to support market growth

TABLE 239 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 240 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 241 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 242 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 243 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 244 PHILIPPINES: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.4.16 REST OF ASIA PACIFIC

TABLE 245 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 246 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 247 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 248 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 249 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 250 REST OF ASIA PACIFIC: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.5 REST OF THE WORLD

9.5.1 REST OF THE WORLD: RECESSION IMPACT

FIGURE 53 REST OF THE WORLD: IMPACT OF RECESSION

FIGURE 54 SNAPSHOT OF TESTING, INSPECTION, AND CERTIFICATION MARKET IN ROW

TABLE 251 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 252 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 253 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 254 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 255 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 256 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 257 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 258 REST OF THE WORLD: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.5.2 BRAZIL

9.5.2.1 Stringent government regulations for healthcare and energy applications to drive market

TABLE 259 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 260 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 261 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 262 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 263 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 264 BRAZIL: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.5.3 ARGENTINA

9.5.3.1 Mutual agreements for import & export of products to drive demand for TIC services

TABLE 265 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 266 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 267 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 268 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 269 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 270 ARGENTINA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.5.4 SAUDI ARABIA

9.5.4.1 Adoption of testing in oil reserves to drive market

TABLE 271 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 272 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 273 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

TABLE 274 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

TABLE 275 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

TABLE 276 SAUDI ARABIA: TESTING, INSPECTION, AND CERTIFICATION MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

9.5.5 UNITED ARAB EMIRATES

9.5.5.1 Growing manufacturing sector to fuel uptake of TIC services

9.5.6 PERU

9.5.6.1 Growth in construction & infrastructure sectors to support market growth

9.5.7 MOROCCO

9.5.7.1 Presence of strict regulations for entry and exit of industrial products to drive market growth

9.5.8 CHILE

9.5.8.1 Mandatory certification of consumer electronics to support market growth

9.5.9 COLOMBIA

9.5.9.1 Growing medical and pharmaceutical markets to fuel uptake

9.5.10 VENEZUELA

9.5.10.1 Growth in oil & gas and petroleum industries to drive market

9.5.11 IRAN

9.5.11.1 Stringent regulations for imported products to fuel uptake of testing services

9.5.12 IRAQ

9.5.12.1 Growth in consumer goods and retail industries to drive market

9.5.13 QATAR

9.5.13.1 Oil & gas sector to fuel uptake of TIC services

9.5.14 OMAN

9.5.14.1 Growth opportunities in telecommunications and agriculture applications to support market growth

9.5.15 BAHRAIN

9.5.15.1 Stringent certification and inspection policies in medical & life sciences sectors to fuel uptake

9.5.16 EGYPT

9.5.16.1 Renewable energy and logistics sectors to drive demand for certification services

9.5.17 SOUTH AFRICA

9.5.17.1 Energy & power applications to drive market

9.5.18 REST OF SOUTH AMERICA, MIDDLE EAST, AND AFRICA

10 COMPETITIVE LANDSCAPE (Page No. - 338)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 277 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

10.3 MARKET SHARE ANALYSIS

FIGURE 55 TESTING, INSPECTION, AND CERTIFICATION MARKET: MARKET SHARE ANALYSIS (2022)

TABLE 278 TESTING, INSPECTION, AND CERTIFICATION MARKET: INTENSITY OF COMPETITIVE RIVALRY

10.4 REVENUE ANALYSIS

FIGURE 56 TESTING, INSPECTION, AND CERTIFICATION MARKET: REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS (2018–2022)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 PERVASIVE PLAYERS

10.5.3 EMERGING LEADERS

10.5.4 PARTICIPANTS

FIGURE 57 TESTING, INSPECTION, AND CERTIFICATION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT (2022)

10.5.5 COMPANY FOOTPRINT

TABLE 279 COMPANY FOOTPRINT

TABLE 280 COMPANY FOOTPRINT, BY APPLICATION

TABLE 281 COMPANY FOOTPRINT, BY REGION

10.6 TESTING, INSPECTION, AND CERTIFICATION MARKET: EVALUATION MATRIX FOR SMES

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 58 TESTING, INSPECTION, AND CERTIFICATION MARKET: EVALUATION QUADRANT FOR STARTUPS/SME (2022)

TABLE 282 TESTING, INSPECTION, AND CERTIFICATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 283 TESTING, INSPECTION, AND CERTIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.7 COMPETITIVE SCENARIO AND TRENDS

10.7.1 TESTING, INSPECTION, AND CERTIFICATION MARKET

10.7.1.1 Product/Service launches

TABLE 284 TESTING, INSPECTION, AND CERTIFICATION MARKET: PRODUCT/SERVICE LAUNCHES (JUNE 2018– DECEMBER 2022)

10.7.1.2 Deals

TABLE 285 TESTING, INSPECTION, AND CERTIFICATION MARKET: DEALS (JULY 2019–JANUARY 2023)

10.7.1.3 Other developments

TABLE 286 OTHER DEVELOPMENTS (JULY 2019–DECEMBER 2022)

11 COMPANY PROFILES (Page No. - 382)

(Business overview, Products/Services offered, Recent developments & MnM View)*

11.1 KEY PLAYERS

11.1.1 SGS S.A.

TABLE 287 SGS S.A.: COMPANY SNAPSHOT

FIGURE 59 SGS S.A.: COMPANY SNAPSHOT

TABLE 288 SGS: PRODUCTS/SERVICES OFFERED

TABLE 289 SGS: PRODUCT/SERVICE LAUNCHES

TABLE 290 SGS: DEALS

TABLE 291 SGS: OTHER DEVELOPMENTS

11.1.2 BUREAU VERITAS

TABLE 292 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 60 BUREAU VERITAS: COMPANY SNAPSHOT

TABLE 293 BUREAU VERITAS: PRODUCTS/SERVICES OFFERED

TABLE 294 BUREAU VERITAS: PRODUCT/SERVICE LAUNCHES

TABLE 295 BUREAU VERITAS: DEALS

TABLE 296 BUREAU VERITAS: OTHER DEVELOPMENTS

11.1.3 INTERTEK GROUP PLC

TABLE 297 INTERTEK GROUP PLC: BUSINESS OVERVIEW

FIGURE 61 INTERTEK GROUP PLC: COMPANY SNAPSHOT

TABLE 298 INTERTEK GROUP PLC: PRODUCTS/SERVICES OFFERED

TABLE 299 INTERTEK GROUP PLC: PRODUCT/SERVICE LAUNCHES

TABLE 300 INTERTEK: DEALS

TABLE 301 INTERTEK: OTHER DEVELOPMENTS

11.1.4 TÜV SÜD

TABLE 302 TÜV SÜD: BUSINESS OVERVIEW

FIGURE 62 TÜV SÜD: COMPANY SNAPSHOT

TABLE 303 TÜV SÜD: PRODUCTS/SERVICES OFFERED

TABLE 304 TÜV SÜD: PRODUCT/SERVICE LAUNCHES

TABLE 305 TÜV SÜD: DEALS

TABLE 306 TÜV SÜD: OTHER DEVELOPMENTS

11.1.5 DNV GL

TABLE 307 DNV GL: BUSINESS OVERVIEW

FIGURE 63 DNV GL: COMPANY SNAPSHOT

TABLE 308 DNV GL: PRODUCTS/SERVICES OFFERED

TABLE 309 DNV GL: PRODUCT/SERVICE LAUNCHES

TABLE 310 DNV GL: DEALS

TABLE 311 DNV GL: OTHER DEVELOPMENTS

11.1.6 TÜV RHEINLAND

TABLE 312 TÜV RHEINLAND: BUSINESS OVERVIEW

FIGURE 64 TÜV RHEINLAND: COMPANY SNAPSHOT

TABLE 313 TÜV RHEINLAND: PRODUCTS/SERVICES OFFERED

TABLE 314 TÜV RHEINLAND: PRODUCT/SERVICE LAUNCHES

TABLE 315 TÜV RHEINLAND: DEALS

TABLE 316 TÜV RHEINLAND: OTHER DEVELOPMENTS

11.1.7 DEKRA SE

TABLE 317 DEKRA SE: BUSINESS OVERVIEW

FIGURE 65 DEKRA SE: COMPANY SNAPSHOT

TABLE 318 DEKRA SE: PRODUCTS/SERVICES OFFERED

TABLE 319 DEKRA SE: PRODUCT/SERVICE LAUNCHES

TABLE 320 DEKRA SE: DEALS

TABLE 321 DEKRA SE: OTHER DEVELOPMENTS

11.1.8 EUROFINS SCIENTIFIC

TABLE 322 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 66 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 323 EUROFINS SCIENTIFIC: PRODUCTS/SERVICES OFFERED

TABLE 324 EUROFINS SCIENTIFIC: PRODUCT/SERVICE LAUNCHES

TABLE 325 EUROFINS SCIENTIFIC: DEALS

11.1.9 APPLUS+

TABLE 326 APPLUS+: BUSINESS OVERVIEW

FIGURE 67 APPLUS+: COMPANY SNAPSHOT

TABLE 327 APPLUS+: PRODUCTS/SERVICES OFFERED

TABLE 328 APPLUS+: PRODUCT/SERVICE LAUNCHES

TABLE 329 APPLUS+: DEALS

TABLE 330 APPLUS+: OTHER DEVELOPMENTS

11.1.10 ALS

TABLE 331 ALS: BUSINESS OVERVIEW

FIGURE 68 ALS: COMPANY SNAPSHOT

TABLE 332 ALS: PRODUCTS/SERVICES OFFERED

TABLE 333 ALS LIMITED: PRODUCT/SERVICE LAUNCHES

TABLE 334 ALS: DEALS

11.1.11 TÜV NORD GROUP

TABLE 335 TÜV NORD GROUP: BUSINESS OVERVIEW

FIGURE 69 TÜV NORD GROUP: COMPANY SNAPSHOT

TABLE 336 TÜV NORD GROUP: PRODUCTS/SERVICES OFFERED

TABLE 337 TÜV NORD GROUP: PRODUCT/SERVICE LAUNCHES

TABLE 338 TÜV NORD GROUP: DEALS

11.1.12 LLOYD’S REGISTER GROUP SERVICES LIMITED

TABLE 339 LLOYD’S REGISTER GROUP SERVICES LIMITED: BUSINESS OVERVIEW

TABLE 340 LLOYD’S REGISTER GROUP SERVICES LIMITED: PRODUCTS/SERVICES OFFERED

TABLE 341 LLOYD’S REGISTER GROUP SERVICES LIMITED: PRODUCT/SERVICE LAUNCHES

TABLE 342 LLOYD’S REGISTER GROUP SERVICES LIMITED: DEALS

TABLE 343 LLOYD’S REGISTER GROUP SERVICES LIMITED: OTHER DEVELOPMENTS

11.1.13 MISTRAS

TABLE 344 MISTRAS: BUSINESS OVERVIEW

FIGURE 70 MISTRAS: COMPANY SNAPSHOT

TABLE 345 MISTRAS: PRODUCTS/SERVICES OFFERED

TABLE 346 MISTRAS: PRODUCT/SERVICES LAUNCHES

TABLE 347 MISTRAS: DEALS

11.1.14 ELEMENT MATERIALS TECHNOLOGY

TABLE 348 ELEMENT MATERIALS TECHNOLOGY: BUSINESS OVERVIEW

TABLE 349 ELEMENT MATERIALS TECHNOLOGY: PRODUCTS/SERVICES OFFERED

TABLE 350 ELEMENT MATERIALS TECHNOLOGY: PRODUCT/SERVICE LAUNCHES

TABLE 351 ELEMENT MATERIALS TECHNOLOGY: DEALS

TABLE 352 ELEMENT MATERIALS TECHNOLOGY: OTHER DEVELOPMENTS

11.1.15 UL LLC

TABLE 353 UL SOLUTIONS: BUSINESS OVERVIEW

TABLE 354 UL SOLUTIONS: PRODUCTS/SERVICES OFFERED

TABLE 355 UL SOLUTIONS: PRODUCT/SERVICE LAUNCHES

TABLE 356 UL SOLUTIONS: DEALS

TABLE 357 UL SOLUTIONS: OTHER DEVELOPMENTS

*Details on Business overview, Products/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 APAVE INTERNATIONAL

11.2.2 IRCLASS

11.2.3 NORMEC QS

11.2.4 THOMAS BELL-WRIGHT INTERNATIONAL CONSULTANTS

11.2.5 TIC-SERA LTD.

11.2.6 HOHENSTEIN

11.2.7 ASTM

11.2.8 VDE TESTING AND CERTIFICATION INSTITUTE

11.2.9 KEYSTONE COMPLIANCE

11.2.10 WASHINGTON LABORATORIES, LTD.

11.2.11 FORCE TECHNOLOGY

11.2.12 KIWA INSPECTA

11.2.13 RINA S.P.A.

11.2.14 TECHNICKÁ INŠPEKCIA

11.2.15 TÜRK LOYDU

11.2.16 SAFETY ASSESSMENT FEDERATION (SAFED)

11.2.17 PRIME GROUP

11.2.18 HV TECHNOLOGIES, INC.

11.2.19 CORE LABORATORIES

11.2.20 NATIONAL COMMODITIES MANAGEMENT SERVICES LIMITED (NCML)

11.2.21 AMSPEC, LLC

11.2.22 ASUREQUALITY

11.2.23 MEDISTRI SA

11.2.24 AVOMEEN ANALYTICAL SERVICES

11.2.25 INOTIV, INC.

11.2.26 GATEWAY ANALYTICAL

11.2.27 GULF INSPECTION INTERNATIONAL CO.

11.2.28 NIPPON KAIJI KENTEI KYOKAI (NKKK)

11.2.29 HUMBER INSPECTION INTERNATIONAL INDIA PRIVATE LIMITED

11.2.30 NQAQSR

11.2.31 BALTIC CONTROL

11.2.32 BRITISH STANDARDS INSTITUTION (BSI)

11.2.33 OPUS GROUP AB

11.2.34 TEAM, INC.

11.2.35 FAVARETO SA

11.2.36 LENOR GROUP

11.2.37 COTECNA INSPECTION SA

12 APPENDIX (Page No. - 509)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 QUESTIONNAIRE FOR TESTING, INSPECTION, AND CERTIFICATION MARKET

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Testing, Inspection and Certification (TIC) Market

Interested in New/emerging areas of testing in line with new/emerging technologies