Thermoplastic Elastomers Market by Type (SBC, TPU, TPO, TPV, COPE, PEBA), End Use Industry (Automotive, Building & Construction, Footwear, Wire & Cable, Medical, Engineering) and Region (North America, APAC, Europe, RoW) - Global Forecast to 2027

Thermoplastic Elastomers Market

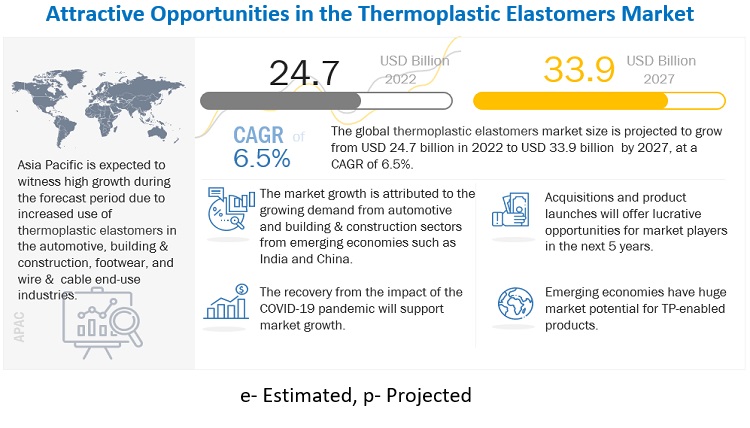

The global thermoplastic elastomers market was valued at USD 24.7 billion in 2022 and is projected to reach USD 33.9 billion by 2027, growing at a cagr 6.5% from 2022 to 2027. Thermoplastic elastomers provide the properties of both plastics and elastomers. The products are widely used to provide the several properties in end use industries such as easy moldability, heat stability, smoothness, wear resistance, and scratch resistance. There are different type of thermoplastic elastomers are available in the market included styrene block copolymer (SBC), thermoplastic polyurethane (TPU), thermoplastic vulcanizates (TPV), thermoplastic polyolefin (TPO), polyester ether elastomer (COPE), and polyether block amide elastomer (PEBA). These are differentiated in the basis of increasing prices and performance.

The demand for thermoplastic elastomers is projected to increase in forecast period due to the recovery of several end use industries such as automotive and construction, from COVID-19 pandemic, and the increasing penetration of electric vehicles (EVs) worldwide. The rising demand from the automotive industry, eco-friendly property of thermoplastic elastomers, and the advance development in the thermoplastic elastomer processing industry are the key factors to boost the demand of thermoplastic elastomers.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 pandemic Impact

COVID-19 pandemic impacted the demand of thermoplastic elastomers market due to the disruption of supply chain, suspension of manufacturing operation, and declining demand from end use industries such as automotive, construction and footwear industries. However, the demand from medical industry increased due to Covid-19 pandemic, which, in turn, support for growth in the demand of thermoplastic elastomer market. Also, with the speed recovery of end-use industries, increasing disposable income, changing lifestyle, and rising awareness regarding the environment has increased the use of thermoplastic elastomers across several industries such as automotive, and footwear in the forecast period.

Thermoplastic Elastomers Market Dynamics

Driver: The recovery of automotive sector and rising penetration of electric vehicles (EVs)

Since 2019, the conventional automobile production has been affected because of declining sales, shift toward car rentals and ride-sharing, changing regulatory scenarios, declining per-capita spending, shift in consumer preferences towards EVs, and economic downturn in several countries. Furthermore, COVID-19 pandemic resulted in the subsequent suspension of production operations, the demand in automotive industry declined in 2020.

According to OICA, in 2021, sales of automotive vehicles increased by 3.1% and 5.0%, respectively as compared to previous year with the recovery from pandemic, and economic downturn, the production.

Asian countries are largely involved in automobile production. Continuous technological developments in the automotive sector are expected to drive the thermoplastic elastomers market in such as China, India, Japan, and South Asia. To boost fuel economy, improve vehicle performance, and reduce CO2 emissions, automotive vehicle manufacturers are channelizing efforts to reduce the vehicle weight by replacing the metal part such as iron and steel components with lightweight high-performance elastomers. Thus, with the growth of automotive industry across the globe, the demand for thermoplastic elastomers is expected to increase during the forecast period.

Thermoplastic elastomers are used to provide several high-performance characteristics in EVs as compared to traditional metals, thermoset rubbers, and other materials. The changing regulatory scenario and government policies to support EVs which, in turn, boost the thermoplastic elastomers market. Owing to the recovery of the automotive industry and rising penetration of EVs across the world, the demand for thermoplastic elastomers is expected to increase in the forecast period.

Restraint: Higher cost of thermoplastic elastomers and increasing raw material prices

The production process of Thermoplastic elastomers is a capital intensive and complex process as compared to other materials such as PVC, rubbers, polyethylene, and polyurethane. In the process of thermoplastic elastomers manufacturing devices are required to set at high temperature in the presence of technical expertise. Since, the requirement of high investments in thermoplastic elastomers process restricted its use in the high-end applications. There are several other products are developed to have properties like TPEs and are relatively cheaper than that of TPE such as compounding grades of polyethylene, polypropylene, acrylonitrile butadiene styrene, and polyurethane. All these factors makes thermoplastic elastomers a competitive product in a few end-use industries such as industrial machinery, building & construction, and electronics. Also, the fluctuations in the price of raw materials affects the prices of thermoplastic elastomers.

The fluctuating prices of oil plays an importation role in the price dynamics of thermoplastic elastomers, as most of its raw materials derived from it. Owing to the OPEC+ strategy and the Russia-Ukraine war, there is a significant increase in the price of crude oil, which resulted in an increase in the prices of raw material across the world. The rapid increase in the prices of raw material will impact the profits margins of TPE products.

Opportunities: Emerging market for biobased thermoplastic elastomers

Biobased thermoplastic elastomers are developed from renewable resources such as fatty acids, and vegetable oils. It provides equivalent as well as better properties than that of traditional thermoplastic elastomer, mainly for industries such as electronics, sporting goods, and footwear. The development of biobased thermoplastic elastomer reduces the use of non-renewable resources and improves the property of biodegradability. Innovations and commercialization of biobased thermoplastic elastomers are creating several new opportunities for thermoplastic elastomer manufacturers. Also, many synthetic thermoplastic elastomer manufacturers such as BASF and Lubrizol, have shifted their focus toward developing sustainable and eco-friendly products. For example, BASF and Lubrizol started manufacturing biobased Thermoplastic elastomers for several industries included footwear, automotive, industrial, electronics, and textile. Various biopolymers in are used to manufacture biobased Thermoplastic elastomer such as corn starch, wheat starch, poly hydroxybutyrate (PHB), polylactide (PLA), castor oil, and palm oil. R&D for manufacturing biobased Thermoplastic elastomers is creating opportunity for manufacturers.

Challenges: Intra thermoplastic elastomer replacement

There are several types of thermoplastic elastomers available in the market which are differentiated on the basis of cost and performance requirement. A specific thermoplastic elastomer type is chosen as based on the profit margin of the applications. The rising trend of simplifying the complex selection process in choosing a specific thermoplastic elastomer type is challenging the demand for the rest of thermoplastic elastomers due to the increasing focus on specific types and enabling them to perform multiple functions.

This situation has led to increase the versatility of a specific type of thermoplastic elastomer and reduce their costs. This situation mainly prevails in the automotive industry where thermoplastic elastomers is replacing costlier and heavier thermoplastic vulcanizates. Thermoplastic polyolefin is expected to replace by PVC and thermoplastic polyurethane films in automotive applications during the forecast period. Hence, replacement in intra- thermoplastic elastomer segment is a challenge for the growth of the overall market.

Ecosystem Diagram

By End Use Industry, Automotive industry accounted for the largest share in 2021

The automotive industry holds the majority of shares in the thermoplastic elastomers market in 2021in terms of value. Thermoplastic elastomer is used in several exterior body parts in automotive industry, such as body seals, exterior filler panels, wipers, automotive gaskets, door & window handles, rocker panels, and vibration damping pads. The thermoplastic elastomers market in the automotive industry is projected to increase due to the increased in the competition between the market players to provide lightweight and growing demand for vehicles, development of transportation infrastructure, supportive government policies, robust auto parts, and rapid economic growth.

By Type, Thermoplastic Polefin accounted for the largest share in 2021

Thermoplastic polyolefin can be manufactured by using several techniques, such as injection molding, profile extrusion, thermoforming, and blow molding. The thermoplastic polyolefin used to provide the quality of weather-resistant and it is non-degradable on exposure to solar radiation. Hence, it is significantly used in making roofs and other outdoor applications, included geomembrane insulation and corrosion protection of oil and gas pipelines.

In terms of volume, Styrene Block Copolymer accounted for the largest share of thermoplastic elastomer market. These Styrene Block Copolymer are high-performance elastomers designed to improve the performance in several applications. The properties of thermoplastics in styrene block copolymer is used to replace ethylene propylene diene monomer (EPDM) and ethylene-propylene (EP) rubber in various end use industries.

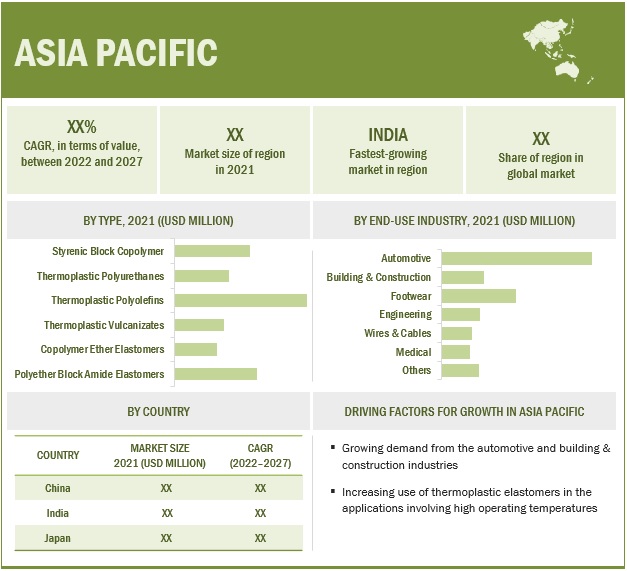

APAC account for the largest share of the thermoplastic elastomers market during the forecast period

Asia Pacific accounted for the largest share of overall thermoplastic elastomers market in 2021. The demand for thermoplastic elastomers is mainly driven by the growth of construction sector and automotive industry. Asia Pacific, China dominate holds the largest market share of thermoplastic elastomers market, followed by Japan and South Korea in 2021. Thermoplastic elastomers market in Asia Pacific region is also projected to register high CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The thermoplastic elastomers market comprises of key manufacturers such as Arkema S.A (France), Asahi Kasei Corporation (Japan), BASF SE(Germany), Covestro Ag (Germany) and Huntsman Corporation (US) are the key players operating in the thermoplastic elastomers market. The companies adopted several organic and inorganic strategies such as expansions, acquisitions, joint ventures, and new product developments to enhance their positions in the thermoplastic elastomers market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Billion), and Volume (Kilotons) |

|

Segments |

Type, End Use Industry, and Region |

|

Regions |

Asia-Pacific, North America, Europe, Middle East & Africa and South America |

|

Companies |

The major players are Arkema S.A (France), Asahi Kasei Corporation (Japan), BASF SE(Germany), Covestro Ag (Germany) and Huntsman Corporation (US), and others are covered in the thermoplastic elastomers market. |

This research report categorizes the global thermoplastic elastomers market on the basis of Type, Material, Application, and Region.

Thermoplastic Elastomers market, By Type

- Styrenic Block Copolymers

- Thermoplastic Polyurethanes

- Thermoplastic Polyolefins

- Thermoplastic Vulcanizates

- Copolyester Ether Elastomers

Polyether Block Amide Elastomers Thermoplastic Elastomers market, By End Use Industry

- Automotive

- Building & Construction

- Footwear

- Engineering

- Wire & Cables

- Medical

- Others

Thermoplastic Elastomers market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa (MEA)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In July 2022, Asahi Kasei Corporation launched Plastic North America (APNA) and a new engineered resin series called Soform, as a part Thermylene family portfolio.

- In March 2022, Arkema S.A. is planning to launch new material from photopolymer resins for filament extrusion to new PEBAX at AMUG 2022.

- In January 2022, Arkema S.A. expands its global production capacity of Pebax Elastomer by 25% through an investment at its Serquigny plant in France.

- In January 2022, Covestro AG plans to build a new elastomer plant at the Verbund site in Shanghai.

- In January 2021, Huntsman Corporation acquired Gabriel Performance Products (US), a North American specialty chemical manufacturer company.

Frequently Asked Questions (FAQ):

What are the major drivers driving the demand of thermoplastic elastomers Market?

The major drivers influencing the demand of thermoplastic elastomers market are recovery of automotive industry and the rising penetration of Electric Vechiles (EVs).

What are the major challenges in the Thermoplastic Elastomers Market?

The major challenges in thermoplastic elastomer market is the Intra thermoplastic elastomer replacement.

What are the restraining factors in Thermoplastic Elastomers Market?

The major restraining factor faced by the thermoplastic elastomer market is the higher cost of thermoplastic elastomers and increasing raw material prices.

What is the key opportunity in Thermoplastic Elastomers Market?

Emerging market for biobased thermoplastic elastomers will provide several new opportunities to thermoplastic elastomers market.

What is the impact of COVID-19 pandemic on the Thermoplastic Elastomers Market?

There was a mixed impact on the Thermoplastic Elastomers Market across the globe due to COVID-19. Due to COVID-19, demand for thermoplastic elastomer in the Medical industry has increased whereas in the major end use industries such as automotive, building & construction, and in others the demand for thermoplastic elastomers was declined. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 STUDY SCOPE

FIGURE 1 THERMOPLASTIC ELASTOMERS MARKET SEGMENTATION

1.2.3 REGIONS COVERED

1.2.4 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

1.4 UNITS CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 2 THERMOPLASTIC ELASTOMERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.2.5 List of participating industry experts

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP MARKET SIZE ESTIMATION: ASSESSMENT OF MARKET FROM INDIVIDUAL PRODUCT TYPE

FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.2 ESTIMATING MARKET SIZE FROM SHARES OF KEY APPLICATIONS

FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 THERMOPLASTIC ELASTOMERS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 FORECASTING FACTORS IMPACTING GROWTH

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 1 THERMOPLASTIC ELASTOMERS: MARKET SNAPSHOT

FIGURE 6 TPO ACCOUNTED FOR LARGEST MARKET SHARE

FIGURE 7 AUTOMOTIVE INDUSTRY TO LEAD THERMOPLASTIC ELASTOMERS MARKET

FIGURE 8 ASIA PACIFIC MARKET TO WITNESS SIGNIFICANT GROWTH

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN THERMOPLASTIC ELASTOMERS MARKET

FIGURE 9 GROWING DEMAND FROM AUTOMOTIVE INDUSTRY TO DRIVE THERMOPLASTIC ELASTOMERS MARKET

4.2 ASIA PACIFIC THERMOPLASTIC ELASTOMERS MARKET, BY TYPE AND COUNTRY, 2021

FIGURE 10 SBC AND CHINA ACCOUNTED FOR LARGEST SHARES

4.3 THERMOPLASTIC ELASTOMERS MARKET, BY KEY COUNTRY

FIGURE 11 INDIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMOPLASTIC ELASTOMERS MARKET

5.2.1 DRIVERS

5.2.1.1 Recovery of automotive industry and growing penetration of EVs

TABLE 2 GLOBAL AUTOMOTIVE VEHICLE PRODUCTION (MILLION UNIT), BY REGION, 2019–2021

FIGURE 13 GLOBAL ELECTRIC VEHICLES SALES (MILLION UNIT), 2018–2021

5.2.1.2 Stringent emission regulations and standards in developed countries

5.2.1.3 Increasing demand for medical elastomers

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of thermoplastic elastomers and increasing raw material prices

FIGURE 14 CRUDE OIL PRICES, JANUARY 2019–JUNE 2022 (USD/BARREL)

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging market for biobased thermoplastic elastomers

5.2.4 CHALLENGES

5.2.4.1 Intra-thermoplastic elastomer segment replacement

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 15 THERMOPLASTIC ELASTOMERS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 THERMOPLASTIC ELASTOMERS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 16 SUPPLY CHAIN ANALYSIS OF THERMOPLASTIC ELASTOMERS MARKET

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 17 NEXT-GEN MOBILITY, LIGHTWEIGHTING, DIGITALIZATION, AND IMPROVED MEDICAL DEVICES TO CHANGE FUTURE REVENUE MIX OF SUPPLIERS

5.6 REGULATORY LANDSCAPE

FIGURE 18 FORECASTING FACTOR IMPACT ANALYSIS

TABLE 4 KEY CONFERENCES & EVENTS IN 2022–2023

5.7 MACROECONOMIC INDICATORS

5.7.1 GLOBAL GDP OUTLOOK

TABLE 5 WORLD GDP GROWTH PROJECTION (USD BILLION), 2019–2026

5.8 KEY STAKEHOLDERS & BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

5.8.2 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR DIFFERENT THERMOPLASTIC ELASTOMERS

TABLE 7 KEY BUYING CRITERIA FOR DIFFERENT GRADES

5.9 AVERAGE PRICE ANALYSIS

FIGURE 21 WEIGHTED AVERAGE PRICING ANALYSIS (USD/TON) OF THERMOPLASTIC ELASTOMERS, BY REGION, 2021

5.10 TECHNOLOGY ANALYSIS

5.10.1 EXTRUSION

5.10.2 INJECTION MOLDING

5.11 ADJACENT AND RELATED MARKETS

5.11.1 GLOBAL AUTOMOTIVE ELASTOMERS MARKET

FIGURE 22 NATURAL RUBBER (NR) TO LEAD AUTOMOTIVE ELASTOMERS MARKET

TABLE 8 AUTOMOTIVE ELASTOMERS MARKET SIZE, BY TYPE, 2015–2022 (KILOTON)

TABLE 9 AUTOMOTIVE ELASTOMERS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

5.11.2 GLOBAL MEDICAL ELASTOMERS MARKET

FIGURE 23 THERMOSET ELASTOMERS TO ACCOUNT FOR LARGER MARKET SHARE

TABLE 10 MEDICAL ELASTOMERS MARKET SIZE, BY TYPE, 2015–2022 (KILOTON)

TABLE 11 MEDICAL ELASTOMERS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

5.12 ECOSYSTEM/MARKET MAPPING

FIGURE 24 KEY PLAYERS IN THERMOPLASTIC ELASTOMERS MARKET

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

FIGURE 25 NUMBER OF PATENTS PUBLISHED DURING 2010-2021

FIGURE 26 PUBLICATION TRENDS (2010–2021)

5.13.4 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.13.5 JURISDICTION ANALYSIS

FIGURE 28 TOP JURISDICTION, BY DOCUMENT

5.14 TRADE SCENARIO: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 12 INTENSITY OF TRADE, BY KEY COUNTRY

5.15 CASE STUDY

5.15.1 THERMOPLASTIC ELASTOMERS: IDEAL FOR RAIL PADS MADE FOR HEAVY LOADS

6 THERMOPLASTIC ELASTOMERS MARKET, BY TYPE (Page No. - 93)

6.1 INTRODUCTION

FIGURE 29 THERMOPLASTIC POLYOLEFIN TO REMAIN LARGEST MARKET SEGMENT

TABLE 13 COMPARISON OF PROPERTIES OF DIFFERENT TYPES OF THERMOPLASTIC ELASTOMERS

TABLE 14 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 15 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 16 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 17 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

6.2 STYRENIC BLOCK COPOLYMER (SBC)

6.2.1 INCREASED USE IN INDUSTRIAL APPLICATIONS

FIGURE 30 STYRENIC BLOCK COPOLYMER MARKET SHARE, BY TYPE, 2021

TABLE 18 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 19 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 20 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3 THERMOPLASTIC POLYURETHANE (TPU)

6.3.1 COMPLIANCE WITH INDUSTRY REQUIREMENTS

TABLE 22 THERMOPLASTIC POLYURETHANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 23 THERMOPLASTIC POLYURETHANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 24 THERMOPLASTIC POLYURETHANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 THERMOPLASTIC POLYURETHANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.4 THERMOPLASTIC POLYOLEFIN (TPO)

6.4.1 CONSOLIDATED MARKET IMPACTING BARGAINING POWER OF BUYERS

FIGURE 31 COMPOSITION OF THERMOPLASTIC POLYOLEFIN, BY PRODUCT TYPE

TABLE 26 THERMOPLASTIC POLYOLEFIN MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 27 THERMOPLASTIC POLYOLEFIN MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 28 THERMOPLASTIC POLYOLEFIN MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 THERMOPLASTIC POLYOLEFIN MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.5 THERMOPLASTIC VULCANIZATE (TPV)

6.5.1 GAINING TRACTION IN AUTOMOTIVE INDUSTRY

TABLE 30 THERMOPLASTIC VULCANIZATE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 31 THERMOPLASTIC VULCANIZATE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 32 THERMOPLASTIC VULCANIZATE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 THERMOPLASTIC VULCANIZATE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.6 POLYETHER BLOCK AMIDE ELASTOMER (PEBA)

6.6.1 HIGH-PERFORMANCE CHARACTERISTICS MAKING IT SUI TABLE FOR SEVERAL INDUSTRIAL APPLICATIONS

TABLE 34 POLYETHER BLOCK AMIDE ELASTOMER MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 35 POLYETHER BLOCK AMIDE ELASTOMER MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 36 POLYETHER BLOCK AMIDE ELASTOMER MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 POLYETHER BLOCK AMIDE ELASTOMER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.7 COPOLYESTER ETHER ELASTOMER (COPE)

6.7.1 INCREASING DEMAND FROM AUTOMOTIVE INDUSTRY

TABLE 38 COPOLYESTER ETHER ELASTOMER MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 39 COPOLYESTER ETHER ELASTOMER MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 40 COPOLYESTER ETHER ELASTOMER MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 COPOLYESTER ETHER ELASTOMER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7 THERMOPLASTIC ELASTOMERS MARKET, BY END-USE INDUSTRY (Page No. - 108)

7.1 INTRODUCTION

FIGURE 32 AUTOMOTIVE INDUSTRY TO HAVE LARGEST SHARE

TABLE 42 THERMOPLASTIC ELASTOMERS: APPLICATIONS IN END-USE INDUSTRIES

TABLE 43 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 44 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 45 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 46 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

7.2 AUTOMOTIVE

7.2.1 GROWTH IN EV PRODUCTION TO DRIVE DEMAND FOR THERMOPLASTIC ELASTOMERS

FIGURE 33 SALE OF EVS, BY REGION/COUNTRY, IN VOLUME (MILLION UNIT), 2018–2021

FIGURE 34 VEHICLE PRODUCTION DATA, UNIT BY COUNTRY, 2019–2021

TABLE 47 THERMOPLASTIC ELASTOMERS MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 48 THERMOPLASTIC ELASTOMERS MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 49 THERMOPLASTIC ELASTOMERS MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 50 THERMOPLASTIC ELASTOMERS MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.3 BUILDING & CONSTRUCTION

7.3.1 EXPECTED RECOVERY AND GOVERNMENT ECONOMIC PACKAGE TO SUPPORT MARKET GROWTH

TABLE 51 THERMOPLASTIC ELASTOMERS MARKET IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 52 THERMOPLASTIC ELASTOMERS MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 53 THERMOPLASTIC ELASTOMERS MARKET IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 THERMOPLASTIC ELASTOMERS MARKET IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.4 FOOTWEAR

7.4.1 ADVANCED PROPERTIES OF THERMOPLASTIC ELASTOMERS TO BOOST MARKET

FIGURE 35 GLOBAL FOOTWEAR PRODUCTION SHARE IN 2021, BY REGION

TABLE 55 THERMOPLASTIC ELASTOMERS MARKET SIZE IN FOOTWEAR INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 56 THERMOPLASTIC ELASTOMERS MARKET SIZE IN FOOTWEAR INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 57 THERMOPLASTIC ELASTOMERS MARKET SIZE IN FOOTWEAR INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 THERMOPLASTIC ELASTOMERS MARKET SIZE IN FOOTWEAR INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.5 WIRES & CABLES

7.5.1 INCREASING APPLICATIONS IN WIRES & CABLES DUE TO HEAT RESISTANCE

TABLE 59 THERMOPLASTIC ELASTOMERS MARKET SIZE IN WIRE & CABLE INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 60 THERMOPLASTIC ELASTOMERS MARKET SIZE IN WIRE & CABLE INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 61 THERMOPLASTIC ELASTOMERS MARKET SIZE IN WIRE & CABLE INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 THERMOPLASTIC ELASTOMERS MARKET SIZE IN WIRE & CABLE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.6 MEDICAL

7.6.1 THERMOPLASTIC ELASTOMERS ARE COMPATIBLE WITH MEDICAL DEVICES

TABLE 63 THERMOPLASTIC ELASTOMERS MARKET SIZE IN MEDICAL INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 64 THERMOPLASTIC ELASTOMERS MARKET SIZE IN MEDICAL INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 65 THERMOPLASTIC ELASTOMERS MARKET SIZE IN MEDICAL INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 66 THERMOPLASTIC ELASTOMERS MARKET SIZE IN MEDICAL INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.7 ENGINEERING

7.7.1 GROWTH OF MANUFACTURING SECTOR ACROSS ASIA PACIFIC

TABLE 67 THERMOPLASTIC ELASTOMERS MARKET SIZE IN ENGINEERING INDUSTRY, BY REGION, 2018–2020 (KILOTON)

TABLE 68 THERMOPLASTIC ELASTOMERS MARKET SIZE IN ENGINEERING INDUSTRY, BY REGION, 2021–2027 (KILOTON)

TABLE 69 THERMOPLASTIC ELASTOMERS MARKET SIZE IN ENGINEERING INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 THERMOPLASTIC ELASTOMERS MARKET SIZE IN ENGINEERING INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

7.8 OTHERS

TABLE 71 THERMOPLASTIC ELASTOMERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2020 (KILOTON)

TABLE 72 THERMOPLASTIC ELASTOMERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2021–2027 (KILOTON)

TABLE 73 THERMOPLASTIC ELASTOMERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 THERMOPLASTIC ELASTOMERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

8 THERMOPLASTIC ELASTOMERS MARKET, BY REGION (Page No. - 127)

8.1 INTRODUCTION

FIGURE 36 RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 75 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 76 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 77 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 78 THERMOPLASTIC ELASTOMERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 80 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 81 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 84 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 85 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 88 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 89 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Growth of automotive and construction industries to drive market

FIGURE 38 US: AUTOMOTIVE PRODUCTION AND SALES, 2019–2021 (‘000 UNIT)

TABLE 91 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 92 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 93 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 94 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 95 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 96 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 97 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 98 US: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increasing investment in automotive industry

TABLE 99 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 100 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 101 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 102 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 103 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 104 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 105 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 106 CANADA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Growth in automotive industry to drive market

TABLE 107 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 108 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 109 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 110 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 111 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 112 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 113 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 114 MEXICO: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SNAPSHOT

TABLE 115 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 116 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 117 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 118 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 120 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 121 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 124 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 125 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Healthy growth of automotive industry to drive market

FIGURE 40 AUTOMOTIVE PRODUCTION IN CHINA, 2019–2021 (MILLION UNIT)

TABLE 127 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 128 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 129 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 130 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 131 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 132 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 133 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 134 CHINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.2 JAPAN

8.3.2.1 Emission standards to govern growth of market

FIGURE 41 JAPAN: AUTOMOTIVE PRODUCTION DATA, 2019–2021 (MILLION UNIT)

TABLE 135 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 136 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 137 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 138 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 139 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 140 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 141 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 142 JAPAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.3 SOUTH KOREA

8.3.3.1 Automobile manufacturing to propel market

TABLE 143 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 144 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 145 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 146 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 147 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 148 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 149 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 150 SOUTH KOREA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.4 INDIA

8.3.4.1 FDI initiatives to drive market

FIGURE 42 AUTOMOTIVE PRODUCTION IN INDIA, 2019–2021 (MILLION UNIT)

TABLE 151 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 152 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 153 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 154 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 155 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 156 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 157 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 158 INDIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.5 INDONESIA

8.3.5.1 Investment in automotive industry to drive market

TABLE 159 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 160 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 161 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 162 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 163 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 164 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 165 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 166 INDONESIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.6 TAIWAN

8.3.6.1 Growth in automotive industry to drive market

TABLE 167 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 168 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 169 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 170 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 171 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 172 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 173 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 174 TAIWAN: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.3.7 REST OF ASIA PACIFIC

TABLE 175 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 176 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 177 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 180 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 181 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4 EUROPE

TABLE 183 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 184 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 185 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 186 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 187 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 188 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 189 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 190 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 191 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 192 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 193 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 194 EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Government support to boost electric vehicle market

FIGURE 43 GERMANY: AUTOMOTIVE PRODUCTION & SALES, 2019–2021 (MILLION UNITS)

TABLE 195 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 196 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 197 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 198 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 199 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 200 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027(KILOTON)

TABLE 201 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 202 GERMANY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027(USD MILLION)

8.4.2 UK

8.4.2.1 Growing electric vehicle penetration to meet vehicle emission targets

TABLE 203 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 204 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 205 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 206 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 207 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 208 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 209 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 210 UK: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Growing consumption of thermoplastic elastomers in EVs to drive demand

TABLE 211 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 212 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 213 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 214 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 215 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 216 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 217 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 218 FRANCE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.4 RUSSIA

8.4.4.1 Rising demand for lightweight components in automotive sector

TABLE 219 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 220 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 221 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 222 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 223 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 224 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 225 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 226 RUSSIA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.5 ITALY

8.4.5.1 Significant economic recovery and growing automotive industry

TABLE 227 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 228 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 229 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 230 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 231 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 232 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 233 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 234 ITALY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.6 TURKEY

8.4.6.1 Growing footwear production capacity

TABLE 235 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 236 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027(KILOTON)

TABLE 237 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 238 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 239 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 240 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 241 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 242 TURKEY: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 243 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 244 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 245 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 246 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 247 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 248 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 249 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 250 REST OF EUROPE: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 251 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 252 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 253 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 254 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 255 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 256 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 257 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 258 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 259 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 260 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 261 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 262 MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.5.1 GCC COUNTRIES

8.5.1.1 Investment in building & construction industry to propel demand

TABLE 263 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 264 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 265 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 266 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 267 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 268 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 269 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 270 GCC COUNTRIES: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.5.2 SOUTH AFRICA

8.5.2.1 Steady recovery of several end-use industries to support market growth

TABLE 271 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 272 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 273 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 274 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 275 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 276 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 277 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 278 SOUTH AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 279 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 280 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 281 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 282 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 283 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 284 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 285 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 286 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 287 AUTOMOTIVE VEHICLE PRODUCTION IN SOUTH AMERICA (UNIT), 2019–2021

TABLE 288 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 289 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 290 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 291 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 292 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 293 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 294 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 295 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 296 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 297 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 298 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 299 SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Economic downturn and declining automobile production to significantly impact demand

TABLE 300 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 301 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 302 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 303 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 304 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 305 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 306 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 307 BRAZIL: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Automotive industry to drive demand

TABLE 308 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 309 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 310 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 311 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 312 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 313 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 314 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 315 ARGENTINA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 316 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 317 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 318 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 319 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 320 REST OF THE SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (KILOTON)

TABLE 321 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

TABLE 322 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 323 REST OF SOUTH AMERICA: THERMOPLASTIC ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 229)

9.1 INTRODUCTION

FIGURE 44 ACQUISITION WAS KEY STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 45 MARKET SHARE OF KEY PLAYERS, 2021

9.3 KEY PLAYERS’ STRATEGIES

TABLE 324 STRATEGIC POSITIONING OF KEY PLAYERS

9.4 COMPANY EVALUATION QUADRANT

9.4.1 STAR PLAYERS

9.4.2 PERVASIVE PLAYERS

9.4.3 PARTICIPANTS

9.4.4 EMERGING LEADERS

9.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES(SMES) EVALUATION MATRIX

9.6 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST THREE YEARS (2019–2021)

9.7 COMPETITIVE BENCHMARKING

TABLE 325 THERMOPLASTIC ELASTOMERS: DETAILED LIST OF KEY STARTUP/SMES

TABLE 326 THERMOPLASTIC ELASTOMERS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.8 COMPETITIVE SITUATIONS AND TRENDS

9.8.1 PRODUCT LAUNCHES

TABLE 327 THERMOPLASTIC ELASTOMERS: PRODUCT LAUNCHES (2018–2022)

9.8.2 DEALS

TABLE 328 THERMOPLASTIC ELASTOMERS MARKET: DEALS (2018–2022)

9.8.3 OTHER DEVELOPMENTS

TABLE 329 THERMOPLASTIC ELASTOMERS MARKET: EXPANSIONS (2018–2022)

10 COMPANY PROFILES (Page No. - 242)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1 KEY PLAYERS

10.1.1 ARKEMA S.A.

TABLE 330 ARKEMA S.A.: COMPANY OVERVIEW

FIGURE 49 ARKEMA S.A.: COMPANY SNAPSHOT

TABLE 331 ARKEMA S.A.: PRODUCT LAUNCHES

TABLE 332 ARKEMA S.A.: DEALS

TABLE 333 ARKEMA S.A.: OTHERS

10.1.2 ASAHI KASEI CORPORATION

TABLE 334 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

FIGURE 50 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

TABLE 335 ASAHI KASEI CORPORATION: PRODUCT LAUNCHES

TABLE 336 ASAHI KASEI CORPORATION: DEALS

10.1.3 BASF SE

TABLE 337 BASF SE: COMPANY OVERVIEW

FIGURE 51 BASF SE: COMPANY SNAPSHOT

TABLE 338 BASF SE: DEALS

TABLE 339 BASF SE: OTHERS

10.1.4 THE DOW CHEMICAL COMPANY

TABLE 340 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 52 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

10.1.5 COVESTRO AG

TABLE 341 COVESTRO AG: COMPANY OVERVIEW

FIGURE 53 COVESTRO AG: COMPANY SNAPSHOT

TABLE 342 COVESTRO AG: PRODUCT LAUNCHES

TABLE 343 COVESTRO AG: DEALS

TABLE 344 COVESTRO AG: OTHERS

10.1.6 HUNTSMAN CORPORATION

TABLE 345 HUNTSMAN CORPORATION: COMPANY OVERVIEW

FIGURE 54 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 346 HUNTSMAN CORPORATION: DEALS

TABLE 347 HUNTSMAN CORPORATION: OTHERS

10.1.7 EXXONMOBIL CORPORATION

TABLE 348 EXXONMOBIL CORPORATION: COMPANY OVERVIEW

FIGURE 55 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

TABLE 349 EXXONMOBIL CORPORATION: PRODUCT LAUNCHES

10.1.8 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

TABLE 350 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 56 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 351 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: PRODUCT LAUNCHES

TABLE 352 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: DEALS

TABLE 353 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: OTHERS

10.1.9 LUBRIZOL CORPORATION

TABLE 354 LUBRIZOL CORPORATION: COMPANY OVERVIEW

TABLE 355 LUBRIZOL CORPORATION: PRODUCT LAUNCHES

10.2 OTHER PLAYERS

10.2.1 DUPONT DE NEMOURS, INC.

TABLE 356 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

10.2.2 SIBUR

TABLE 357 SIBUR: COMPANY OVERVIEW

10.2.3 DYNASOL ELASTOMERS

TABLE 358 DYNASOL ELASTOMERS: COMPANY OVERVIEW

10.2.4 CELANESE CORPORATION

TABLE 359 CELANESE CORPORATION: COMPANY OVERVIEW

10.2.5 ZEON CORPORATION

TABLE 360 ZEON CORPORATION: COMPANY OVERVIEW

10.2.6 LYONDELLBASELL INDUSTRIES N.V.

TABLE 361 LYONDELLBASELL INDUSTRIES N.V.: COMPANY OVERVIEW

10.2.7 ELASTRON

TABLE 362 ELASTRON: COMPANY OVERVIEW

10.2.8 ALPHAGARY LIMITED

TABLE 363 ALPHAGARY LIMITED: COMPANY OVERVIEW

10.2.9 WASHINGTON PENN

TABLE 364 WASHINGTON PENN: COMPANY OVERVIEW

10.2.10 HEXPOL AB

TABLE 365 HEXPOL AB: COMPANY OVERVIEW

10.2.11 NOBLE POLYMERS

TABLE 366 NOBLE POLYMERS: COMPANY OVERVIEW

10.2.12 TEKNOR APEX COMPANY

TABLE 367 TEKNOR APEX COMPANY: COMPANY OVERVIEW

10.2.13 GAF

TABLE 368 GAF: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 280)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the thermoplastic elastomers market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

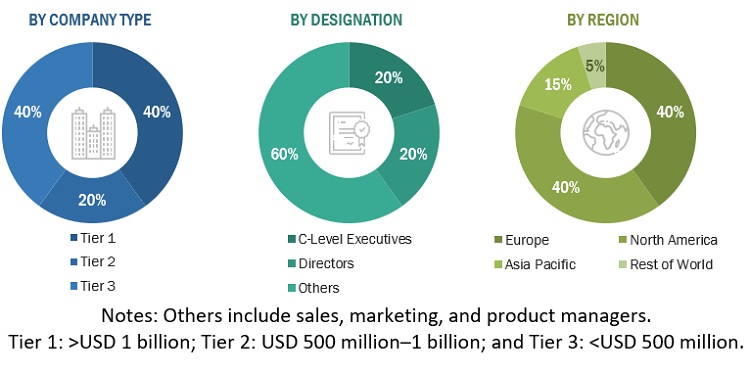

Primary Research

The thermoplastic elastomers market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the thermoplastic elastomers market. Primary sources from the supply side include associations and institutions involved in the thermoplastic elastomers industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global thermoplastic elastomers market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global thermoplastic elastomers market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on material, type, and application

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC thermoplastic elastomers market

- Further breakdown of Rest of Europe thermoplastic elastomers market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Elastomers Market

Interested in Thermoplastic Elastomers market

% replacement of syenthetic elastomers by thermoplastic elastomers in mechanical rubber goods application in the next 5-10 years.

Requires a copy of Research Methodology and sources

Interested in market of thermoplastic elastomers

Inforamtion on Thermoplastic Elastomers, especially for TPVs

Specific interest on TPE market in food indusrty

Report needed for Thermoplastic Elastomers Marke

Just an extract of TPE for medical market

Thermoplastic Elastomers market report

Interested in updated version of report

General information on TPO,TPV market

Information on Thermoplastic Elastomer market

Interested in TPES market report

TPES market by type, by Application, trend and players profile