Track and Trace Solutions Market by Product (Hardware, Software, Standalone Platforms), Application (Serialization, Aggregation, Reporting), Technology (2D Barcode, RFID) End User (Pharma, Food, Medical Devices, Cosmetics) & Region - Global Forecasts to 2027

Updated on : March 15, 2023

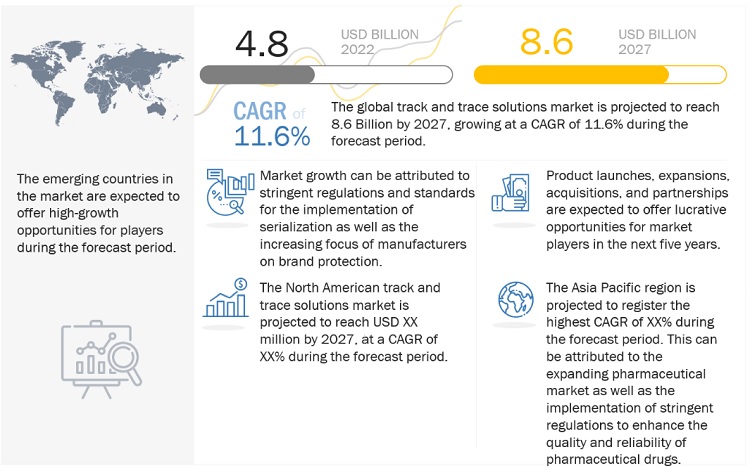

The global track and trace solutions market worth $8.6 billion by 2027, growing at a CAGR of 11.6% in the upcoming years.

The increasing focus of manufacturers on brand protection and the stringent regulations imposed by the government for the implementation of serialization are the major drivers fueling market growth. However, budgetary constraints and huge upfront capital investments are expected to restrain market growth to some extent.

Global Track and Trace Solutions Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

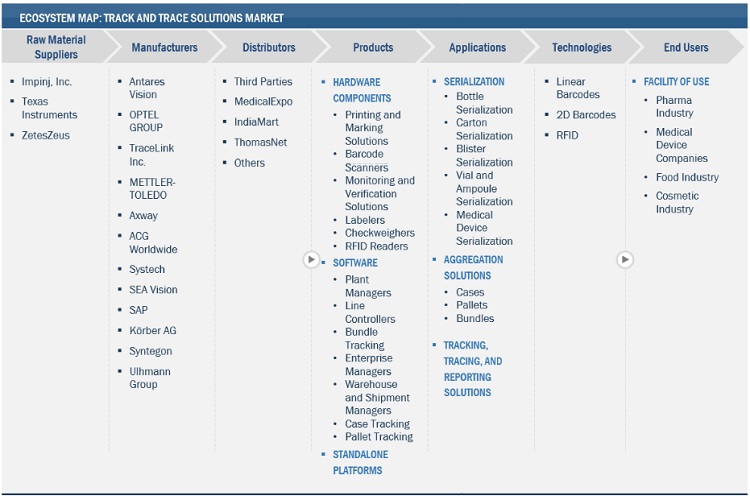

Track and Trace Solutions Market Dynamics:

DRIVERS: Increasing focus of manufacturers on brand protection

Counterfeiting is a growing threat for companies that bring to market medicines, medical devices, cosmetics, and pharmaceutical packaging. Growing international trade and the lack of stringent regulations have increased the use of counterfeit drugs and other products across the globe. Counterfeiting applies to both branded and generic products; that includes products with incorrect/false ingredients, without active ingredients, with an incorrect amount of active ingredients, and with fake packaging. Manufacturers invest large amounts of resources in developing a brand, and counterfeiters use this brand identity to sell counterfeit products. This creates significant damage to the original manufacturer’s revenue and also hampers the brand's image. Hence, in order to prevent counterfeiting, the use of track-and-trace technologies such as barcodes and RFID is imperative. Many manufacturers use a combination of different track-and-trace technologies throughout their supply chain to enhance product traceability and security. A uniquely serialized product allows for item-level traceability across the supply chain, helping brand owners collect more information for deeper insights than lot- or container-level traceability. Thus, the growing focus of manufacturing companies is on brand building, which, in turn, is increasing the usage of serialisation and thereby driving the market for track and trace solutions.

RESTRAINTS: Huge setup costs for technologies

Track-and-trace technologies are capital intensive and necessitate large initial investments. The initial capital expenditure is a barrier to potential entrants. Moreover, heavy investments must be made in transport arrangements to ensure the timely delivery of products. Therefore, new entrants have to bear huge production costs and very low margins, as new facilities need a good amount of time to attain economies of scale. At the same time, these companies need to maintain their prices according to the prevailing market trend to survive in a competitive environment. Getting clearance from government regulators is one of the major problems faced by new entrants. These challenges are expected to restrain the market's growth to some extent.

OPPORTUNITIES: Remote authentication of products

Traditional brand protection technologies such as anti-theft and authentication are meant to protect individual items rather than protecting the entire supply chain. Hence, there is a possibility of false products being introduced at any stage in the supply chain. To combat this, solutions with automatic and non-line-of-sight capabilities are required. The demand for technologies with modular designs that meet enterprise needs has increased in the last few years. For example, track-and-trace technologies based on RFID maintain an electronic pedigree that tracks the transaction information of products within the supply chain. This approach proved to be a standout for protecting the supply chain against infiltration, theft, and fraud and supporting remote authentication in the brand protection supply chain.

CHALLENGES: Existence of technologies to deter counterfeiters

Some track and trace technologies come with their own limitations. For instance, RFID has limitations in terms of obscuration, orientation, and multiple tracking. Traditional anti-counterfeiting methods that involve tamper-resistant packaging and special hologram labels can be inadequate, as counterfeiters can inexpensively duplicate labels. Barcodes, which account for the largest share of the market, are even easier to copy and account for a major share of the track-and-trace market. Hence, it is imperative to develop and implement next-generation technologies, that can deter counterfeiters and are cost-efficient for companies.

The software solutions segment accounted for the largest share in the track and trace solutions market.

The software segment accounted for the largest share of 60.6% in the market. The major factors driving the growth of this market include rising awareness about counterfeit products, brand protection, and manufacturers' striving to attain brand protection. However, the standalone platforms are expected to witness the highest growth rate of 15.3% during the forecast period. The growth of this segment is mainly due to the increasing regulatory pressure from the government for the implementation of serialization solutions and the rising demand for standalone platforms that reduce the timeframe for implementation and offer end-to-end traceability.

Serialization solutions segment of the track and trace solutions market, is expected to witness the fastest growth in the forecast period.

In 2021, the serialization solutions segment accounted for the largest share of 62.3% in the applications market of track and trace solutions. Moreover, this segment is expected to witness the highest CAGR of 12.08% during the forecast period. The major factor contributing to the growth of this segment is the high regulatory pressure for the implementation of serialization in the packaging and supply chain industries.

D barcode technology account for the largest share in the track and trace solutions market.

The 2D barcodes segmented was accounted for the majority of share in the market. It contributed to 75.8% of the total market. The market growth of this technology segment was driven by the increasing adoption of 2D barcodes for product packaking mainly due to its large data storage capacity. However, the RFID segment is expected to witness highest growth rate of 13.2% during the forecast period. The market growth of RFID technology for track and trace solutions market is fueled by increasing demand of these systems for automating pharmaceutical and medical devices distribution with low labor cost and improved product visibility.

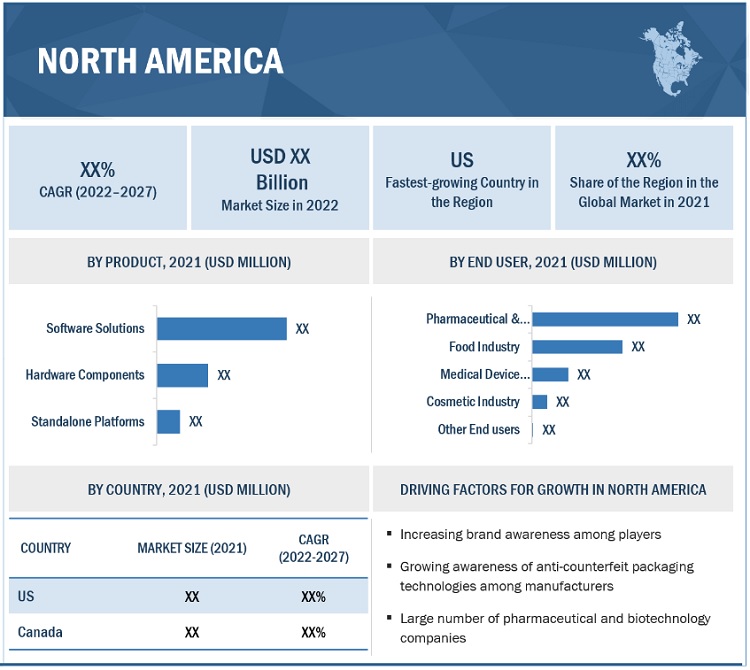

North America accounted for the largest share of the track and trace solutions market in 2021

In 2021, North America had the largest share of 38.7% in the global market. The large share of North America can be attributed to factors like presence of a large pool of pharmaceutical and biotechnology companies, the high regulatory burden for the implementation of serialization and aggregation solutions, and the growing medical device industry.

Moreover, the Asia Pacific region is the fastest-growing market and is projected to grow at the highest CAGR of 13.4% for the track and trace solutions market. Growing regulatory requirements in the healthcare industry, the rising number of pharmaceutical and biotechnology companies, and the significant economic development in the emerging Asia Pacific countries, such as China and India, are the major factors driving the demand for track and trace solutions in the Asia Pacific region.

Geographic Snapshot: Track and Trace Solutions Market

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in this market include OPTEL GROUP (Canada), METTLER-TOLEDO International Inc. (US), Systech International Inc. (US), TraceLink Inc. (US), Antares Vision S.p.a. (Italy), SAP SE (US), Xyntek Inc. (US), SEA Vision Srl (Italy), Syntegon (Germany), Siemens (Germany), Uhlmann Group (Germany), JEKSON VISION (India), Videojet Technologies, Inc. (US), Zebra Technologies Corporation (US), Axway (US), ACG Worldwide (India), Laetus GmbH (Germany), and WIPOTEC-OCS (Germany).

Track and Trace Solutions Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$ 4.8 billion |

|

Estimated Value by 2027 |

$ 8.6 billion |

|

Growth Rate |

Poised to grow at a CAGR of 11.6% |

|

Largest Share Segments |

|

|

Market Report Segmentation |

Product, By Technology, By application, By end user And Regiona |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

The research report categorizes track and trace solutions market into the following segments and sub-segments:

By Product

- Software Solutions

- Hardware Components

- Standalone Platforms

By Technology

- Linear Barcodes

- 2D Barcodes

- Radiofrequency Identification (RFID)

By Application

- Serialization Solutions

- Aggregation Solutions

- Tracking, Tracing and Reporting Solutions

By End User

- Pharmaceutical and Biopharmaceutical companies

- Medical Device Industry

- Food Industry

- Cosmetic Industry

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Switzerland

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East and Africa

Recent Developments:

- In May-2022, OPTEL Group launched OPTCHAIN, a suite of the modular intelligent supply chain (ISC) that will enable easy capturing and digitization of Critical Tracking Events (CTEs) and Key Data Elements (KDEs) along the entire supply chain of the food and beverage industry.

- In March 2022, Zebra Technologies Corporation (US) launched Reflexis solutions across the Asia Pacific with the vision to have every asset and worker on edge visible, connected and fully optimized.

- In January 2022, OPTEL Group acquired the pharmaceutical track and trace unit of Körber to expand its expertise in pharmaceutical and agrochemical track and trace technologies, thereby expanding its foothold in the European marketplace.

- In April 2021, Syntegon entered into a partnership with Kezzler (Norway). This partnership will offer best-in-class solutions to effectively implement product digitization and traceability strategies with a minimal operational burden.

Frequently Asked Questions (FAQ):

What is the projected market value of the global track and trace solutions market?

The global market of track and trace solutions is projected to reach USD 8.6 billion.

What is the estimated growth rate (CAGR) of the global track and trace solutions market for the next five years?

The global track and trace solutions market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.6% from 2022 to 2027.

What are the major revenue pockets in the track and trace solutions market currently?

In 2021, North America had the largest share of 38.7% in the global market. The large share of North America can be attributed to factors like presence of a large pool of pharmaceutical and biotechnology companies, the high regulatory burden for the implementation of serialization and aggregation solutions, and the growing medical device industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 TRACK AND TRACE SOLUTIONS MARKET SEGMENTATION

FIGURE 2 MARKET, BY GEOGRAPHY

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 8 SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: TOP 10 PLAYERS (HARDWARE SYSTEMS AND STANDALONE PLATFORMS)

FIGURE 10 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 11 TOP-DOWN APPROACH

FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022-2027)

FIGURE 13 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 14 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.6.2 SCOPE-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 15 MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 17 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 18 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 19 MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 MARKET OVERVIEW

FIGURE 20 STRINGENT REGULATIONS AND STANDARDS FOR SERIALIZATION TO DRIVE MARKET

4.2 ASIA PACIFIC: MARKET, BY TECHNOLOGY AND COUNTRY (2021)

FIGURE 21 CHINA TO DOMINATE MARKET SHARE OF ASIA PACIFIC IN 2021

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 22 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 REGIONAL MIX: MARKET (2022−2027)

FIGURE 23 NORTH AMERICA TO DOMINATE TRACK AND TRACE SOLUTIONS MARKET DURING FORECAST PERIOD

4.5 TRACK AND TRACE SOLUTIONS MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 24 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 3 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Stringent regulations and standards for serialization

TABLE 4 SERIALIZATION AND AGGREGATION REGULATIONS, BY COUNTRY/REGION

5.2.1.2 Increasing focus of manufacturers on brand protection

5.2.1.3 Growth in packaging-related product recalls

FIGURE 25 NUMBER OF DRUG RECALLS, 2012–2022

5.2.1.4 High growth in generic and OTC markets

FIGURE 26 GLOBAL SALES OF GENERIC DRUGS, 2006–2020 (USD BILLION)

FIGURE 27 GLOBAL OTC PHARMACEUTICALS MARKET, 2020 (USD BILLION)

FIGURE 28 GLOBAL PHARMACEUTICALS MARKET (USD BILLION)

5.2.1.5 Growth in medical device industry

FIGURE 29 GLOBAL MEDICAL DEVICE MARKET, 2016–2020 (USD BILLION)

5.2.2 RESTRAINTS

5.2.2.1 Huge setup costs for technologies

5.2.2.2 High cost and long implementation timeframe of serialization and aggregation

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in offshore pharmaceutical manufacturing

FIGURE 30 PHARMACEUTICAL IMPORTS AND EXPORTS, BY COUNTRY, 2020 (USD BILLION)

5.2.3.2 Remote authentication of products

5.2.3.3 Significant technological advancements in R&D

5.2.3.4 Growth in food traceability market

5.2.4 CHALLENGES

5.2.4.1 Lack of common standards for serialization and aggregation

5.2.4.2 Existence of technologies to deter counterfeiters

6 INDUSTRY INSIGHTS (Page No. - 82)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 RISING DEMAND FOR INTEGRATED, FULLY AUTOMATED SERIALIZATION AND AGGREGATION SYSTEMS

6.2.2 INCREASING CONSOLIDATION

6.2.3 USE OF BLOCKCHAIN IN TRACK AND TRACE SOLUTIONS

6.3 TECHNOLOGY ANALYSIS

6.3.1 GROWING DEMAND FOR L4 AND L5 TRACK AND TRACE SOLUTIONS IN PHARMACEUTICAL INDUSTRY FOR COMPLIANCE MANAGEMENT

FIGURE 31 TRACK AND TRACE SOLUTIONS OFFERED BY VENDORS, BY LEVEL

6.4 GLOBAL PHARMACEUTICAL AND FOOD TRACK AND TRACE SOLUTIONS MARKET: PENETRATION AND OPPORTUNITY

TABLE 5 NUMBER OF SERIALIZATION AND AGGREGATION SOLUTION INSTALLATIONS, BY COMPANY

6.5 REGULATORY ANALYSIS

FIGURE 32 MARKET: REGULATORY TIMELINES, BY COUNTRY

6.5.1 NORTH AMERICA

TABLE 6 NORTH AMERICA: SERIALIZATION AND E-PEDIGREE REGULATIONS FOR PHARMACEUTICAL INDUSTRY

TABLE 7 US: UDI REGULATIONS FOR MEDICAL DEVICES

6.5.2 EUROPE

TABLE 8 EUROPE: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

TABLE 9 EUROPE: REGULATIONS FOR UDI SYSTEM COMPLIANCE

6.5.3 ASIA PACIFIC

TABLE 10 ASIA PACIFIC: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

6.5.4 LATIN AMERICA AND MIDDLE EAST & AFRICA

TABLE 11 LATIN AMERICA AND MIDDLE EAST & AFRICA: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

6.6 VALUE CHAIN ANALYSIS

FIGURE 33 VALUE CHAIN ANALYSIS

6.7 END USER DEMAND ANALYSIS

6.7.1 DEMAND ANALYSIS FOR TRACK AND TRACE SOLUTIONS

6.7.2 UNMET NEEDS

6.7.3 CHALLENGES ASSOCIATED WITH MANUAL TRACK AND TRACE OF PRODUCTS: END USER PERSPECTIVE

6.8 ECOSYSTEM ANALYSIS

TABLE 12 TRACK AND TRACE SOLUTIONS MARKET: ECOSYSTEM MAPPING

FIGURE 34 ECOSYSTEM ANALYSIS

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 PORTER’S FIVE FORCES ANALYSIS

6.9.1 INTENSITY OF COMPETITIVE RIVALRY

6.9.2 BARGAINING POWER OF BUYERS

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 THREAT FROM SUBSTITUTES

6.9.5 THREAT FROM NEW ENTRANTS

6.10 PATENT ANALYSIS

FIGURE 35 TOP PATENT OWNERS AND APPLICANTS (JANUARY 2011–DECEMBER 2021)

FIGURE 36 PATENT ANALYSIS: MARKET (JANUARY 2017–DECEMBER 2021)

6.11 PRICING ANALYSIS

6.12 KEY CONFERENCES AND EVENTS (2022−2023)

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS ON BUYING PROCESS

FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

6.13.2 BUYING CRITERIA

FIGURE 38 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 15 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6.14 ADJACENT MARKET ANALYSIS

FIGURE 39 ANTI-COUNTERFEIT PACKAGING MARKET: MARKET OVERVIEW

FIGURE 40 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET: MARKET OVERVIEW

6.15 CASE STUDY

7 MARKET, BY PRODUCT (Page No. - 105)

7.1 INTRODUCTION

TABLE 16 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 SOFTWARE SOLUTIONS

TABLE 17 TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 18 TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 PLANT MANAGERS

7.2.1.1 Growing awareness of secure packaging and strict regulations to drive market

TABLE 19 PLANT MANAGERS OFFERED BY KEY MARKET PLAYERS

TABLE 20 PLANT MANAGERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 ENTERPRISE & NETWORK MANAGERS

7.2.2.1 Reporting mandates of product information to propel market

TABLE 21 ENTERPRISE & NETWORK MANAGERS OFFERED BY KEY MARKET PLAYERS

TABLE 22 ENTERPRISE & NETWORK MANAGERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 LINE CONTROLLERS

7.2.3.1 Increasing need to improve supply chain efficiency to boost market

TABLE 23 LINE CONTROLLERS OFFERED BY KEY MARKET PLAYERS

TABLE 24 LINE CONTROLLERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.4 BUNDLE TRACKING SOLUTIONS

7.2.4.1 Accuracy in serialization and identification to drive market

TABLE 25 BUNDLE TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 26 BUNDLE TRACKING SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.5 CASE TRACKING SOLUTIONS

7.2.5.1 Accurate serialization of cases to ensure traceability throughout supply chain to propel market

TABLE 27 CASE TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 28 CASE TRACKING SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.6 WAREHOUSE AND SHIPMENT MANAGERS

7.2.6.1 Management of order receipts from ERP and shipment operations to direct growth

TABLE 29 WAREHOUSE & SHIPMENT MANAGERS OFFERED BY KEY MARKET PLAYERS

TABLE 30 WAREHOUSE & SHIPMENT MANAGERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.7 PALLET TRACKING SOLUTIONS

7.2.7.1 Pallet tracking solutions to identify and verify pallets throughout supply chain

TABLE 31 PALLET TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 32 PALLET TRACKING SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 HARDWARE COMPONENTS

TABLE 33 TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 PRINTING AND MARKING SOLUTIONS

7.3.1.1 Printing and marking solutions to dominate market during forecast period

TABLE 35 PRINTING & MARKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 36 PRINTING AND MARKING SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 BARCODE SCANNERS

7.3.2.1 Rising need for anti-counterfeiting technologies and patient safety to drive market

TABLE 37 BARCODE SCANNERS OFFERED BY KEY MARKET PLAYERS

TABLE 38 BARCODE SCANNERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.3 MONITORING AND VERIFICATION SOLUTIONS

7.3.3.1 Optical character recognition and optical character verification camera systems to verify serial numbers and code sets

TABLE 39 MONITORING & VERIFICATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 40 MONITORING & VERIFICATION SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.4 LABELERS

7.3.4.1 Pharmaceutical industry to focus on implementing anti-counterfeiting measures and making labels tamper-evident

TABLE 41 LABELERS OFFERED BY KEY MARKET PLAYERS

TABLE 42 LABELERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.5 CHECKWEIGHERS

7.3.5.1 Automatic tracking of products from point-of-code verification to reject mechanism to propel market

TABLE 43 CHECKWEIGHERS OFFERED BY KEY MARKET PLAYERS

TABLE 44 CHECKWEIGHERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.6 RFID READERS

7.3.6.1 RFID readers to offer reduced data entry errors with easier tracking of pharmaceutical drugs and medical devices

TABLE 45 RFID READERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 STANDALONE PLATFORMS

7.4.1 INCREASING ADOPTION OF FULLY INTEGRATED PLATFORMS WITH AUTOMATED FORMAT ADJUSTMENT TO BOOST MARKET

TABLE 46 STANDALONE PLATFORMS OFFERED BY KEY MARKET PLAYERS

TABLE 47 STANDALONE PLATFORMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 MARKET, BY APPLICATION (Page No. - 131)

8.1 INTRODUCTION

TABLE 48 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 SERIALIZATION SOLUTIONS

TABLE 49 SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 SERIALIZATION SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.1 CARTON SERIALIZATION

8.2.1.1 Mandates for serialization solutions to secure supply chain to drive market

TABLE 51 CARTON SERIALIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2 BOTTLE SERIALIZATION

8.2.2.1 Implementation of serialization solutions in India and US to boost market

TABLE 52 BOTTLE SERIALIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.3 MEDICAL DEVICE SERIALIZATION

8.2.3.1 Increasing product recalls to drive market

TABLE 53 MEDICAL DEVICE SERIALIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.4 BLISTER SERIALIZATION

8.2.4.1 Advantages of blister packaging to fuel market

TABLE 54 BLISTER SERIALIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.5 VIAL AND AMPOULE SERIALIZATION

8.2.5.1 Increasing demand for serialization at primary packaging level to boost market

TABLE 55 VIAL AND AMPOULE SERIALIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 AGGREGATION SOLUTIONS

TABLE 56 REGULATORY STANDARDS FOR AGGREGATION SOLUTIONS AT VARIOUS PACKAGING LEVELS

TABLE 57 AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 AGGREGATION SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.1 CASE AGGREGATION

8.3.1.1 Rising track and trace capabilities throughout supply chain to drive segment

TABLE 59 CASE AGGREGATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.2 PALLET AGGREGATION

8.3.2.1 Rising demand for brand protection to fuel market

TABLE 60 PALLET AGGREGATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.3 BUNDLE AGGREGATION

8.3.3.1 Rising awareness about secure packaging and regulatory mandates to contribute to growth

TABLE 61 BUNDLE AGGREGATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 TRACKING, TRACING, AND REPORTING SOLUTIONS

8.4.1 REGULATORY VIGILANCE TO DRIVE DEMAND

TABLE 62 TRACKING, TRACING & REPORTING SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9 MARKET, BY TECHNOLOGY (Page No. - 145)

9.1 INTRODUCTION

TABLE 63 MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

9.2 2D BARCODES

9.2.1 ADVANTAGES ASSOCIATED WITH 2D BARCODES TO DRIVE SEGMENT

TABLE 64 2D BARCODES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 RADIOFREQUENCY IDENTIFICATION

9.3.1 INCREASING ADOPTION IN MEDICAL DEVICES AND COSMETIC PRODUCTS DISTRIBUTION TO DRIVE MARKET

TABLE 65 RFID MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 LINEAR BARCODES

9.4.1 HIGH ADOPTION IN ASIA PACIFIC COUNTRIES TO PROPEL MARKET

TABLE 66 LINEAR BARCODES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10 MARKET, BY END USER (Page No. - 151)

10.1 INTRODUCTION

TABLE 67 MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.2.1 REGULATORY MANDATES FOR SERIALIZATION IN PHARMACEUTICAL SUPPLY CHAINS TO DRIVE MARKET

TABLE 68 TRACK AND TRACE SOLUTIONS MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

10.3 FOOD INDUSTRY

10.3.1 GROWING HEALTH CONCERNS TO SUPPORT INCREASED ADOPTION OF TRACK AND TRACE SOLUTIONS

TABLE 69 TRACK AND TRACE SOLUTIONS MARKET FOR FOOD INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

10.4 MEDICAL DEVICE COMPANIES

10.4.1 MANDATES FOR SERIALIZATION AND UDI COMPLIANCE TO BOOST SEGMENT

TABLE 70 TRACK AND TRACE SOLUTIONS MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

10.5 COSMETIC INDUSTRY

10.5.1 IMPLEMENTATION OF MEASURES AGAINST COUNTERFEITING TO DRIVE MARKET

TABLE 71 TRACK AND TRACE SOLUTIONS MARKET FOR COSMETIC INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

10.6 OTHER END USERS

TABLE 72 MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

11 MARKET, BY REGION (Page No. - 160)

11.1 INTRODUCTION

TABLE 73 MARKET, BY REGION, 2020–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.1 US

11.2.1.1 US to dominate North American track and trace solutions market

TABLE 83 US: KEY MACROINDICATORS

TABLE 84 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 85 US: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 US: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 US: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 88 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 US: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 US: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing government focus on serialization in pharmaceutical industry to drive market

TABLE 92 CANADA: KEY MACROINDICATORS

TABLE 93 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 94 CANADA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 CANADA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 CANADA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 97 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 CANADA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 CANADA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3 EUROPE

TABLE 101 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 103 EUROPE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany to dominate European track and trace solutions market

TABLE 110 GERMANY: KEY MACROINDICATORS

TABLE 111 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 112 GERMANY: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 GERMANY: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 GERMANY: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 GERMANY: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Presence of leading pharmaceutical companies to support market

TABLE 119 FRANCE: KEY MACROINDICATORS

TABLE 120 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 FRANCE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 FRANCE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 FRANCE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 125 FRANCE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 FRANCE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.3 ITALY

11.3.3.1 Growing counterfeit drugs to drive adoption of track and trace solutions

TABLE 128 ITALY: KEY MACROINDICATORS

TABLE 129 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 130 ITALY: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 ITALY: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 ITALY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 133 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 134 ITALY: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 ITALY: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.4 SWITZERLAND

11.3.4.1 Implementation of serialization solutions to support market

TABLE 137 SWITZERLAND: KEY MACROINDICATORS

TABLE 138 SWITZERLAND: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 139 SWITZERLAND: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 SWITZERLAND: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 141 SWITZERLAND: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 142 SWITZERLAND: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 143 SWITZERLAND: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 SWITZERLAND: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 SWITZERLAND: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Growth in pharmaceuticals sector to support market

TABLE 146 UK: KEY MACROINDICATORS

TABLE 147 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 148 UK: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 UK: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 UK: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 151 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 UK: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 UK: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.6 SPAIN

11.3.6.1 Growing generic drugs and medical devices sectors to propel market

TABLE 155 SPAIN: KEY MACROINDICATORS

TABLE 156 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 157 SPAIN: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 SPAIN: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 SPAIN: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 160 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 SPAIN: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 SPAIN: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 164 REST OF EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 165 REST OF EUROPE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 REST OF EUROPE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 168 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 169 REST OF EUROPE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 REST OF EUROPE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 172 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 ASIA PACIFIC: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 ASIA PACIFIC: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China to dominate Asia Pacific market during forecast period

TABLE 181 CHINA: KEY MACROINDICATORS

TABLE 182 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 183 CHINA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 CHINA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 CHINA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 186 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 CHINA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 CHINA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Rising use of serialization with track and trace solutions in pharmaceutical supply chain to drive market

TABLE 190 JAPAN: KEY MACROINDICATORS

TABLE 191 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 192 JAPAN: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 JAPAN: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 JAPAN: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 195 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 196 JAPAN: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 197 JAPAN: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Low manufacturing cost and skilled workforce to attract outsourcing and investments

TABLE 199 INDIA: KEY MACROINDICATORS

TABLE 200 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 201 INDIA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 INDIA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 203 INDIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 204 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 205 INDIA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 206 INDIA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Increased spending on geriatric health and coverage for major chronic diseases to support market

TABLE 208 SOUTH KOREA: KEY MACROINDICATORS

TABLE 209 SOUTH KOREA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 210 SOUTH KOREA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 SOUTH KOREA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 213 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 214 SOUTH KOREA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 SOUTH KOREA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 SOUTH KOREA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Favorable R&D tax benefits to drive market

TABLE 217 AUSTRALIA: KEY MACROINDICATORS

TABLE 218 AUSTRALIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 219 AUSTRALIA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 AUSTRALIA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 221 AUSTRALIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 222 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 223 AUSTRALIA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 AUSTRALIA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 225 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 226 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 230 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 231 REST OF ASIA PACIFIC: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 REST OF ASIA PACIFIC: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 233 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5 LATIN AMERICA

TABLE 234 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 236 LATIN AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 LATIN AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 240 LATIN AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 241 LATIN AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Large pharmaceutical industry and increased investments in healthcare to boost market

TABLE 243 BRAZIL: KEY MACROINDICATORS

TABLE 244 BRAZIL: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 245 BRAZIL: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 246 BRAZIL: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 247 BRAZIL: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 248 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 249 BRAZIL: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 250 BRAZIL: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 251 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.2 MEXICO

11.5.2.1 Increasing government support for biotechnology and pharmaceutical industries to drive market

TABLE 252 MEXICO: KEY MACROINDICATORS

TABLE 253 MEXICO: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 254 MEXICO: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 255 MEXICO: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 256 MEXICO: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 257 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 258 MEXICO: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 MEXICO: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 260 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.3 REST OF LATIN AMERICA

TABLE 261 REST OF LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 262 REST OF LATIN AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 263 REST OF LATIN AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 264 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 265 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 266 REST OF LATIN AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 267 REST OF LATIN AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 268 REST OF LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 HIGH GROWTH IN PHARMACEUTICAL INDUSTRY AND POLITICAL INSTABILITY TO IMPACT MARKET

TABLE 269 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 270 MIDDLE EAST & AFRICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 271 MIDDLE EAST & AFRICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 272 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 273 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 274 MIDDLE EAST & AFRICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 276 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 252)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 43 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN 2018 AND 2021

12.3 R&D EXPENDITURE OF KEY PLAYERS

FIGURE 44 R&D EXPENDITURE OF KEY PLAYERS (2019 VS 2021)

12.4 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 45 REVENUE ANALYSIS OF KEY MARKET PLAYERS (2021)

12.5 MARKET SHARE ANALYSIS

12.5.1 TRACK AND TRACE HARDWARE COMPONENTS & STANDALONE PLATFORMS MARKET

TABLE 277 TRACK AND TRACE HARDWARE COMPONENTS & STANDALONE PLATFORMS MARKET: DEGREE OF COMPETITION

FIGURE 46 TRACK AND TRACE HARDWARE COMPONENTS & STANDALONE PLATFORMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

12.5.2 TRACK AND TRACE SOFTWARE SOLUTIONS MARKET LEADERSHIP ANALYSIS

FIGURE 47 TRACELINK DOMINATED TRACK AND TRACE SOFTWARE MARKET (2021)

12.6 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

FIGURE 48 GEOGRAPHIC REVENUE MIX

12.7 PRODUCT PORTFOLIO MATRIX

12.7.1 OVERALL COMPANY FOOTPRINT

TABLE 278 OVERALL COMPANY FOOTPRINT

TABLE 279 COMPANY FOOTPRINT: BY PRODUCT

TABLE 280 COMPANY FOOTPRINT: BY APPLICATION

TABLE 281 COMPANY FOOTPRINT: BY END USER

12.8 COMPANY EVALUATION QUADRANT

12.8.1 STARS

12.8.2 EMERGING LEADERS

12.8.3 PERVASIVE PLAYERS

12.8.4 PARTICIPANTS

FIGURE 49 MARKET: COMPANY EVALUATION MATRIX, 2021

12.9 COMPETITIVE LEADERSHIP MAPPING – START-UPS/SMES

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

FIGURE 50 COMPANY LEADERSHIP MAPPING, START-UPS/SMES (2021)

12.1 COMPETITIVE SITUATION AND TRENDS

12.10.1 PRODUCT LAUNCHES

TABLE 282 PRODUCT LAUNCHES, JANUARY 2019–JULY 2022

12.10.2 DEALS

TABLE 283 DEALS, JANUARY 2019–JULY 2022

12.10.3 OTHER DEVELOPMENTS

TABLE 284 OTHER DEVELOPMENTS, JANUARY 2019–JULY 2022

13 COMPANY PROFILES (Page No. - 270)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 ANTARES VISION S.P.A.

TABLE 285 ANTARES VISION S.P.A.: COMPANY OVERVIEW

FIGURE 51 ANTARES VISION S.P.A.: COMPANY SNAPSHOT (2021)

13.2 AXWAY

TABLE 286 AXWAY: COMPANY OVERVIEW

FIGURE 52 AXWAY: COMPANY SNAPSHOT (2021)

13.3 OPTEL GROUP

TABLE 287 OPTEL GROUP: COMPANY OVERVIEW

13.4 TRACELINK INC.

TABLE 288 TRACELINK INC.: COMPANY OVERVIEW

13.5 SYNTEGON (FORMERLY ROBERT BOSCH GMBH)

TABLE 289 SYNTEGON: COMPANY OVERVIEW

13.6 ACG

TABLE 290 ACG: COMPANY OVERVIEW

13.7 SEA VISION S.R.L

TABLE 291 SEA VISION S.R.L.: COMPANY OVERVIEW

13.8 SYSTECH INTERNATIONAL (A PART OF MARKEM-IMAJE)

TABLE 292 SYSTECH INTERNATIONAL: COMPANY OVERVIEW

13.9 UHLMANN GROUP

TABLE 293 UHLMANN GROUP: COMPANY OVERVIEW

13.10 SIEMENS

TABLE 294 SIEMENS: COMPANY OVERVIEW

FIGURE 53 SIEMENS: COMPANY SNAPSHOT (2021)

13.11 SAP SE

TABLE 295 SAP SE: COMPANY OVERVIEW

FIGURE 54 SAP SE: COMPANY SNAPSHOT

13.12 ZEBRA TECHNOLOGIES CORPORATION

TABLE 296 ZEBRA TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

FIGURE 55 ZEBRA TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT (2021)

13.13 METTLER-TOLEDO INTERNATIONAL INC.

TABLE 297 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 56 METTLER-TOLEDO: COMPANY SNAPSHOT (2021)

13.14 IBM

TABLE 298 IBM: COMPANY OVERVIEW

FIGURE 57 IBM: COMPANY SNAPSHOT (2021)

13.15 WIPOTEC-OCS GMBH

TABLE 299 WIPOTEC-OCS GMBH: COMPANY OVERVIEW

13.16 XYNTEK INC.

TABLE 300 XYNTEK INC.: COMPANY OVERVIEW

13.17 JEKSON VISION

TABLE 301 JEKSON VISION.: COMPANY OVERVIEW

13.18 VIDEOJET TECHNOLOGIES INC.

TABLE 302 VIDEOJET TECHNOLOGIES INC.: COMPANY OVERVIEW

13.19 KEVISION SYSTEMS

TABLE 303 KEVISION SYSTEMS.: COMPANY OVERVIEW

13.20 LAETUS GMBH

TABLE 304 LAETUS GMBH: COMPANY OVERVIEW

13.21 VISIOTT TECHNOLOGIE GMBH

13.22 TRACKTRACERX INC.

13.23 RN MARK INC.

13.24 ARVATO - BERTELSMANN SE & CO. KGAA

13.25 KEZZLER AS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 331)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This study involved four major approaches in estimating the current track and trace solutions market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the animal parasiticides market. It was also used to obtain important information about key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of track and trace solutions manufacturing companies, key opinion leaders, and suppliers and distributors. Primary sources from the demand side include veterinary hospitals and clinics, research institutes, academic institutions, and contract manufacturing organizations.

Market Size Estimation

The total size of the track and trace solutions market was arrived at after data triangulation from three different approaches, as mentioned below.

APPROACH 1: Supply Side Analysis (Revenue Share Analysis)

- Revenues of individual companies were gathered from public sources and databases.

- Shares of the track and trace solutions businesses of leading players were gathered from secondary sources to the extent available. In certain cases, shares of the track and trace solutions businesses were ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, as well as geographic reach and strength.

- Individual shares or revenue estimates were validated through expert interviews.

APPROACH 2: Parent Market Approach

- The overall share of the market was obtained from the parent pharma packaging and food packaging market.

- The track and trace solutions market was then extrapolated to the global level using the share of the same in the total pharma packaging and food packaging market.

APPROACH 3: Company Presentations and Primary Interviews

- The track and trace solutions market size was obtained from the annual presentations and investor presentations of leading players.

- Shares of different product types in the overall track and trace solutions market were obtained from secondary data and validated by primary participants to arrive at the total market size.

- Primary participants validated the numbers. As part of the primary research process, individual respondents’ insights on the market size and market growth were taken during the interview (regional and global, as applicable).

- All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall animal parasiticides market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

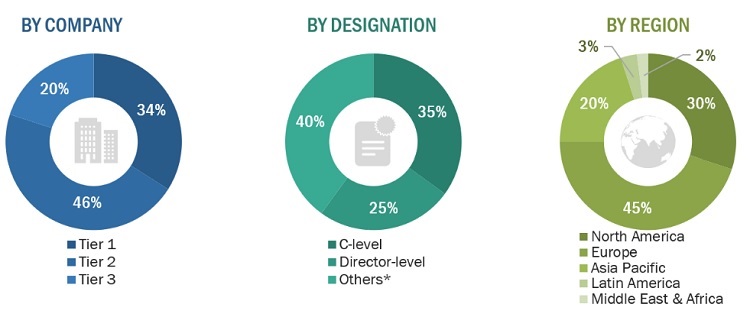

Breakdown of Primary Interviews

A breakdown of the primary respondents for track and trace solutions market (supply side) market is provided below:

*Others include sales managers, marketing managers, and product managers

Note: Tiers are defined based on a company’s total revenue, as of 2019: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the in vitro diagnostics business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, and forecast the global track and trace solutions market by product, application, technology, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall track and trace solutions market

- To assess the track and trace solutions market with regard to Porter’s Five Forces, regulatory landscape, value chain, ecosystem map, patent protection and key stakeholder’s buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the track and trace solutions market with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the track and trace solutions market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the track and trace solutions market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into New Zealand, Hong Kong, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Nordic countries, and other countries

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Track and Trace Solutions Market

How the key players are supposed to dominate the global Track and Trace Solutions Market?

Which of the segments is expected to hold most of the share of the global Track and Trace Solutions Market?

Which factors are responsible for restraining the global growth of Track and Trace Solutions Market?