Traffic Management Market by Component, System (Urban Traffic Management, Adaptive Traffic Control, Journey Time Management, Predictive Traffic Modeling, Incident Detection & Location, and Dynamic Traffic Management), & Region - Global Forecast to 2027

Traffic Management Market Analysis & Report Summary, Global Size

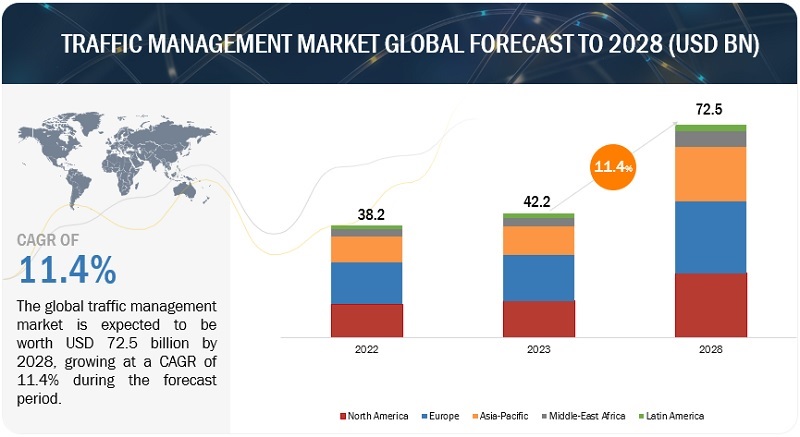

The global Traffic Management Market size is expected to grow steadily over the anticipated frame, recording a CAGR of 12.5% during 2022-2027. The traffic management industry spending value will increase from $38.2 billion in 2022 to reach $68.8 billion by the end of 2027.

Traffic Management Market Growth is driven by the factors such as rising demand for real-time traffic information to drivers and passengers, increasing concerns related to public safety and increasing urban population, growing number of vehicles and insufficient infrastructure, government initiatives for effective traffic management, and development of smart cities.

To know about the assumptions considered for the study, Request for Free Sample Report

Traffic Management Market Growth Dynamics

Driver: Rise in demand for real-time traffic information to drivers and passengers to drive the market

Real-time traffic management systems manage traffic behaviors in real-time by utilizing a network of technologies. These technologies include sensors, GPS, smart cameras, and Bluetooth/Wi-Fi. These technologies help in the reduction of congestion and major traffic issues. Real-time data can be used for alternate route suggestions. Also, real-time data is highly useful for traffic control decision-makers.

Population explosion is directly resulting in increased road density, causing road congestion. Thus, the passengers and drivers need real-time information to know which road is occupied to the fullest. Real-time information will also help to draw a holistic view of the entire network. Thus, the feature of real-time traffic information present in the traffic management system will drive the market in the coming years.

Restraint: Lack of standardized and uniform technologies to streamline with legacy infrastructure

The presence of multiple companies in the traffic management market without the following standardization creates a challenge for users to implement the traffic management system. If an existing system is working, incorporating a new system from a different company is a challenge as both systems do not need to be able to work in coordination. The legacy systems for traffic management may also lack advancements and work on older analog or purely electric systems for traffic control. However, the new advanced systems may not be built keeping the legacy technology in mind. Therefore, it is challenging for the market to cope with legacy infrastructure and align with the latest advanced traffic management systems.

Opportunity: Evolving 5G to transform the traffic management market

For the traffic management market, 5G technology unlocks the efficiency of communications among people, vehicles, and traffic management authorities. And low latency delivers minimal delay between messages, allowing traffic control authorities to surface vital data insights quickly. Real-time communication powered by 5G enables traffic management authorities to improve overall traffic operations while helping in real-time traffic congestion. Traffic management authorities can make use of more data to take well-informed real-time decisions that speed up time to value. When data is synthesized and contextualized, it provides visibility, risk prediction analytics, forecasting and accessible reports for the traffic management ecosystem. Traffic operators can use this information to make better decisions about routes.

Challenge : High expenses associated with equipment installation

Although traffic management systems enhance the traffic operator’s profitability in the long run, they are costly to implement. Huge initial investments are required for setting up a traffic management system that includes installing multiple hardware components. These systems have a high equipment cost, and their accuracy depends on environmental conditions. Also, the operational and maintenance costs regularly add to the overall cost. The installation and maintenance are undertaken by skilled labor who charge for their expertise. Thus, the aggregation of all the costs makes it too high, becoming a major challenge for the global traffic management market.

By system, the DTMS segment is projected to witness the highest growth rate during the forecast period

The traffic management market has been segmented into the urban traffic management system (UTMS), adaptive traffic control system (ATCS), journey time management system (JTMS), predictive traffic modeling system (PTMS), incident detection and location system (IDLS), and dynamic traffic management system (DTMS). Among these, DTMS is projected to account for the highest growth rate during the forecast period. Higher adoption of smart surveillance and traffic analytics solutions will drive the adoption of DTMS in the market.

Asia Pacific is projected to witness the highest CAGR during the forecast period

Factors such as favorable government policies and regulations to drive the expansion of the traffic management market in this area over the next five years. The Asia Pacific is witnessing high growth due to digitalization, rapid economic growth and developments, and rising investments in smart cities. High economic growth in developing countries, such as India, China, and Japan, has increased the number of highway projects for smart transport. This has made traffic management a prominent feature in this region’s growing market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players in the market. The major vendors covered in the traffic management market include Siemens (Germany), Huawei (China), IBM (US), Cisco (US), Kapsch TrafficCom (Austria), SWARCO (Austria), Q-Free (Norway), Thales Group (France), PTV Group (Germany), Teledyne FLIR (US), Cubic (US), TomTom (Netherlands), Alibaba Cloud (China), TransCore (US), Chevron TM (England), Indra (Spain), LG CNS (South Korea), INRIX (England), Notraffic (Israel), Sensys Networks (US), Citilog (France), Bercman Technologies (Estonia), Valerann (Israel), Miovision (Canada), BlueSignal (South Korea), Telegra (Croatia), Oriux (US), Invarion (US), and Rekor (US).

These players have adopted various growth strategies, such as partnerships, business expansions, mergers & acquisitions, agreements, collaborations, and new product launches to expand their presence in the traffic management market. Partnerships and new product launches have been the most adopted strategies by major players from 2019 to 2022, which helped them innovate their offerings and broaden their customer base.

These players have adopted various strategies to grow in the global offering in the market. The study includes an in-depth competitive analysis of these key players in the offering traffic management market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size Value in 2022 |

$38.2 billion |

|

Revenue Forecast Size in 2027 |

$68.8 billion |

|

Growth Rate |

CAGR of 12.5% |

|

Key Market Growth Drivers |

Rise in demand for real-time traffic information to drivers and passengers to drive the market |

|

Key Market Opportunities |

Evolving 5G to transform the traffic management market |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Market Segmentation |

Component (Solutions, Hardware, Services), Systems and Region |

|

Regions covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

Siemens (Germany), Huawei (China), IBM (US), Cisco (US), Kapsch TrafficCom (Austria), SWARCO (Austria), Q-Free (Norway), Thales Group (France), PTV Group (Germany), Teledyne FLIR (US), Cubic (US), TomTom (Netherlands), Alibaba Cloud (China), TransCore (US), Chevron TM (England), Indra (Spain), LG CNS (South Korea), INRIX (England), Notraffic (Israel), Sensys Networks (US), Citilog (France), Bercman Technologies (Estonia), Valerann (Israel), Miovision (Canada), BlueSignal (South Korea), Telegra (Croatia), Oriux (US), Invarion (US), and Rekor (US) |

This research report categorizes the Traffic Management Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

- Smart Signaling

- Route Guidance & Route Optimization

- Traffic Analytics

- Smart Surveillance

-

Hardware

- Display Boards

- Sensors

- Surveillance Cameras

- Other Hardware

-

Services

- Consulting

- Implementation & Integration

- Support & Maintenance

-

Systems

- Urban Traffic Management & Control

- Adaptive Traffic Control System

- Journey Time Measurement System

- Predictive Traffic Modeling System

- Incident Detection & Location System

- Dynamic Traffic Management System

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- Australia & New Zealand

- China

- Japan

- Singapore

- Rest of Asia Pacific

-

Middle East & Africa

- Israel

- Qatar

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2021, Siemens launched Yunex. This has been launched under a new brand name and would operate with a clear business focus and freedom.

- In January 2021, Huawei, with its partners, developed intelligent and connected vehicles for China. The country plans to make traffic smooth and safer for them. A vehicle named X-Bus is linked to a transportation-control network. This would be able to see and decide everything that happens on the test road.

- In October 2019, IBM was chosen by the Stockholm city government to curb the traffic levels in the city. IBM would design, build, and operate the traffic management system to reduce traffic congestion in the city.

- In January 2019, Cisco deployed an edge-processing IoT solution with the City of Las Vegas, in collaboration with Iteris, a global provider of smart mobility infrastructure management solutions. The IoT solution will combine data feeds from the Iteris Vantage Next video detection platform with the Cisco Kinetic software solution to analyze multimodal data from vehicles, bicycles and pedestrians for several high-value use cases to improve traffic flow and reduce congestion.

- In August 2020, Kapsch TrafficCom was the first manufacturer to submit its RIS-9260 roadside unit (RSU) for dual-use certification by the OmniAir Consortium, the global industry association, promoting interoperability and certification for intelligent transportation systems, tolling, and connected vehicles. The Kapsch RIS-9260 is used in connected vehicle (V2X) applications and can operate within either or both the DSRC and C-V2X protocols as dual-mode/dual active. It is already OmniAir-certified for DSRC operation.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Traffic Management Market?

The global Traffic Management Market size is poised to generate revenue from $38.2 billion in 2022 to $68.8 billion by 2027.

What is the estimated growth rate (CAGR) of the global Traffic Management Market for the next five years?

Traffic Management Market is growing at a compound annual growth rate (CAGR) of 12.5% during the forecast period.

What are the major revenue pockets in the Traffic Management Market currently?

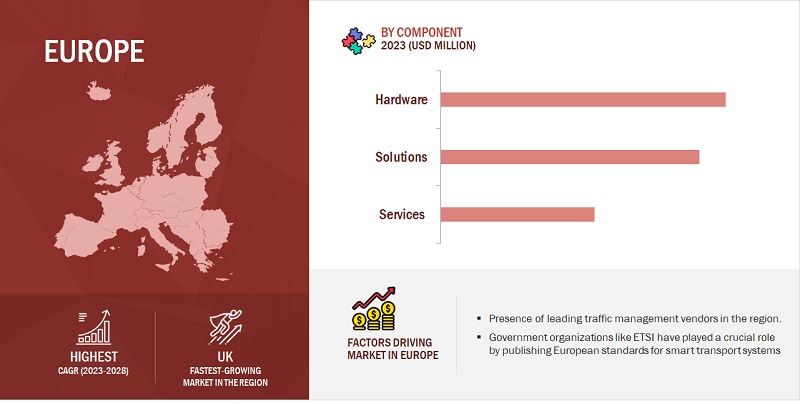

Europe is estimated to be the largest traffic management market

Who are the key vendors in the Traffic Management Market?

Major vendors in the traffic management market include Oracle, Huawei, Cisco, Thales, Kapsch and Siemens

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 TRAFFIC MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakup of primary interviews

2.1.2.3 List of key primary interview participants

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.4 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 2 BOTTOM-UP APPROACH

FIGURE 3 TRAFFIC MANAGEMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH - SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 4 TOP-DOWN APPROACH

2.3.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (DEMAND SIDE): SHARE OF MARKET THROUGH OVERALL IT SPENDING

2.3.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET REVENUE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES IN MARKET

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 TRAFFIC MANAGEMENT MARKET SIZE, 2020-2027

FIGURE 8 LARGEST SEGMENTS IN MARKET, 2022

FIGURE 9 MARKET, REGIONAL SHARES, 2022

FIGURE 10 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING 2022 – 2027

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 BRIEF OVERVIEW OF TRAFFIC MANAGEMENT MARKET

FIGURE 11 RISING TRAFFIC CONGESTION AND RAPID URBANIZATION WORLDWIDE TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY COMPONENT AND COUNTRY

FIGURE 12 SOLUTION SEGMENT AND UNITED STATES TO ACCOUNT FOR LARGE SHARES IN NORTH AMERICAN MARKET IN 2022

4.3 ASIA PACIFIC: MARKET, BY SYSTEM AND COUNTRY

FIGURE 13 JTMS SEGMENT AND CHINA TO ACCOUNT FOR LARGE SHARES IN ASIA PACIFIC MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TRAFFIC MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for real-time traffic information to drivers and passengers

5.2.1.2 Increasing concerns related to public safety

5.2.1.3 Increasing urban population, rising number of vehicles, and inadequate infrastructure

FIGURE 15 URBAN WORLD POPULATION FORECAST

5.2.1.4 Government initiatives for effective traffic management

5.2.1.5 Development of smart cities worldwide

TABLE 3 TOP TEN SMART CITIES WORLDWIDE, 2021

5.2.2 RESTRAINTS

5.2.2.1 Slow growth in infrastructure sector

5.2.2.2 Lack of standardized and uniform technologies to streamline legacy infrastructure

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing concerns about protecting environment with eco-friendly automobile technology

5.2.3.2 Designing and developing smart vehicles compatible with advanced technologies

5.2.3.3 Growth of analytics software

5.2.3.4 Evolving 5G to transform traffic management market

5.2.4 CHALLENGES

5.2.4.1 High expenses associated with equipment installation

5.2.4.2 Security threats and hacking challenges

5.2.4.3 Multiple sensors and touchpoints pose data fusion challenges

5.3 AVERAGE SELLING PRICE TREND

5.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SUBSCRIPTION-BASED SOFTWARE

TABLE 4 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED TRAFFIC MANAGEMENT SOFTWARE

5.4 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 16 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

TABLE 5 TRAFFIC MANAGEMENT ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 BIG DATA AND ANALYTICS

5.6.2 ARTIFICIAL INTELLIGENCE

5.6.3 EDGE COMPUTING

5.6.4 INTERNET OF THINGS

5.6.5 5G

5.7 TRAFFIC DATA FLOW PROCESS

FIGURE 17 TRAFFIC MANAGEMENT MARKET: DATA FLOW PROCESS

5.8 PATENT ANALYSIS

FIGURE 18 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 6 TOP 20 PATENT OWNERS (US)

FIGURE 19 NUMBER OF PATENTS GRANTED YEARLY, 2012–2021

5.9 KEY CONFERENCES AND EVENTS DURING 2022–2023

TABLE 7 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.1 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 MANUAL ON TRAFFIC CONTROL DEVICES FOR STREETS AND HIGHWAYS

5.10.3 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

5.10.3.1 ISO/IEC JTC 1

5.10.3.2 ISO/IEC 27001

5.10.3.3 ISO/IEC 19770

5.10.3.4 ISO/IEC JTC 1/SWG 5

5.10.3.5 ISO/IEC JTC 1/SC 31

5.10.3.6 ISO/IEC JTC 1/SC 27

5.10.3.7 ISO/IEC JTC 1/WG 7 SENSOR

5.10.4 GENERAL DATA PROTECTION REGULATION

5.10.5 FEDERAL MOTOR CARRIER SAFETY ADMINISTRATION

5.10.6 FEDERAL HIGHWAY ADMINISTRATION

5.10.7 INSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERS

5.10.8 CEN/ISO

5.10.9 CEN/CENELEC

5.10.10 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

5.10.11 ITU-T

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 TRAFFIC MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 IMPACT OF PORTER’S FIVE FORCES

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END USERS

5.12.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 10 KEY BUYING CRITERIA FOR END USERS

5.13 CASE STUDY ANALYSIS

5.13.1 CASE STUDY 1: SIEMENS HELPED LONDON CITY WITH TRAFFIC MANAGEMENT SOLUTION TO CREATE ULTRA LOW EMISSION ZONE

5.13.2 CASE STUDY 2: HUAWEI HELPED LAHORE CITY WITH TRAFFIC MANAGEMENT TO IMPROVE TRAFFIC CONDITIONS

5.13.3 CASE STUDY 3: SWARCO AND AITEK HELPED RIYADH WITH TRAFFIC MANAGEMENT

5.13.4 CASE STUDY 4: TRANSCORE DEPLOYED INTELLIGENT TRAFFIC SYSTEM IN NEW YORK CITY

5.13.5 CASE STUDY 5: TOMTOM HELPED HELSINKI STUDY TRAFFIC FLOW

6 TRAFFIC MANAGEMENT MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 23 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 13 COMPONENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 14 COMPONENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2 HARDWARE

FIGURE 24 SURVEILLANCE CAMERAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 15 MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 16 MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 17 HARDWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 DISPLAY BOARDS

FIGURE 25 VEHICLE DETECTION BOARDS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 19 DISPLAY BOARDS: TRAFFIC MANAGEMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 20 DISPLAY BOARDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 21 DISPLAY BOARDS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 DISPLAY BOARDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.1 Multifunctional boards

TABLE 23 MULTIFUNCTIONAL BOARDS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 MULTIFUNCTIONAL BOARDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.2 Vehicle detection boards

TABLE 25 VEHICLE DETECTION BOARDS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 VEHICLE DETECTION BOARDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.3 Communication boards

TABLE 27 COMMUNICATION BOARDS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 COMMUNICATION BOARDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 SENSORS

FIGURE 26 SPEED SENSORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 29 SENSORS: TRAFFIC MANAGEMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 30 SENSORS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 31 SENSORS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.1 Vehicle detection sensors

TABLE 33 VEHICLE DETECTION SENSORS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 VEHICLE DETECTION SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.2 Pedestrian presence sensors

TABLE 35 PEDESTRIAN PRESENCE SENSORS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 PEDESTRIAN PRESENCE SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.3 Speed sensors

TABLE 37 SPEED SENSORS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 SPEED SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.4 Air quality sensors

TABLE 39 AIR QUALITY SENSORS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 AIR QUALITY SENSORS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 SURVEILLANCE CAMERAS

FIGURE 27 IP CAMERAS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 41 SURVEILLANCE CAMERAS: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 42 SURVEILLANCE CAMERAS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 SURVEILLANCE CAMERAS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 SURVEILLANCE CAMERAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3.1 Internet protocol cameras

TABLE 45 INTERNET PROTOCOL CAMERAS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 INTERNET PROTOCOL CAMERAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3.2 Analog cameras

TABLE 47 ANALOG CAMERAS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 ANALOG CAMERAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 OTHER HARDWARE

TABLE 49 OTHER HARDWARE: TRAFFIC MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 OTHER HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTIONS

FIGURE 28 ROUTE GUIDANCE & ROUTE OPTIMIZATION SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 52 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 53 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 SMART SIGNALING

TABLE 55 SMART SIGNALING: MARKET, BY REGION, 2017–2021(USD MILLION)

TABLE 56 SMART SIGNALING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 ROUTE GUIDANCE & ROUTE OPTIMIZATION

TABLE 57 ROUTE GUIDANCE & ROUTE OPTIMIZATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 ROUTE GUIDANCE & ROUTE OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 TRAFFIC ANALYTICS

TABLE 59 TRAFFIC ANALYTICS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 TRAFFIC ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4 SMART SURVEILLANCE

TABLE 61 SMART SURVEILLANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 SMART SURVEILLANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 29 VIDEO ANALYTICS SEGMENT TO ACCOUNT FOR HIGHER CAGR DURING FORECAST PERIOD

TABLE 63 SMART SURVEILLANCE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 64 SMART SURVEILLANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.4.1 Video management software

TABLE 65 VIDEO MANAGEMENT SOFTWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 VIDEO MANAGEMENT SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4.2 Video analytics

TABLE 67 VIDEO ANALYTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 VIDEO ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4.2.1 Video analytics, by application

FIGURE 30 VIDEO ANALYTICS APPLICATIONS

FIGURE 31 AUTOMATIC NUMBER PLATE RECOGNITION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 69 VIDEO ANALYTICS: TRAFFIC MANAGEMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 70 VIDEO ANALYTICS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.4.2.1.1 Automatic Number Plate Recognition (ANPR)

TABLE 71 AUTOMATIC NUMBER PLATE RECOGNITION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 AUTOMATIC NUMBER PLATE RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4.2.1.2 Facial recognition

TABLE 73 FACIAL RECOGNITION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 FACIAL RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4.2.1.3 Pedestrian detection

TABLE 75 PEDESTRIAN DETECTION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 PEDESTRIAN DETECTION: TRAFFIC MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4.2.1.4 Incident detection

TABLE 77 INCIDENT DETECTION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 INCIDENT DETECTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

FIGURE 32 IMPLEMENTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 79 TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 80 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 81 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 82 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.1 CONSULTING

TABLE 83 CONSULTING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 84 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2 IMPLEMENTATION

TABLE 85 IMPLEMENTATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 86 IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3 SUPPORT & MAINTENANCE

TABLE 87 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 88 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 TRAFFIC MANAGEMENT MARKET, BY SYSTEM (Page No. - 121)

7.1 INTRODUCTION

7.1.1 SYSTEM: MARKET DRIVERS

FIGURE 33 INCIDENT DETECTION & LOCATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 89 MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 90 MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

7.2 URBAN TRAFFIC MANAGEMENT & CONTROL

FIGURE 34 URBAN TRAFFIC MANAGEMENT & CONTROL SYSTEM

TABLE 91 URBAN TRAFFIC MANAGEMENT & CONTROL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 92 URBAN TRAFFIC MANAGEMENT & CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ADAPTIVE TRAFFIC CONTROL SYSTEM

FIGURE 35 ADAPTIVE TRAFFIC CONTROL SYSTEM

TABLE 93 ADAPTIVE TRAFFIC CONTROL SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 94 ADAPTIVE TRAFFIC CONTROL SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 JOURNEY TIME MANAGEMENT SYSTEM

FIGURE 36 STRUCTURE OF JOURNEY TIME MEASUREMENT SYSTEM

TABLE 95 JOURNEY TIME MEASUREMENT SYSTEM: TRAFFIC MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 96 JOURNEY TIME MEASUREMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 PREDICTIVE TRAFFIC MODELING SYSTEM

TABLE 97 PREDICTIVE TRAFFIC MODELING SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 98 PREDICTIVE TRAFFIC MODELING SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 INCIDENT DETECTION & LOCATION SYSTEM

TABLE 99 INCIDENT DETECTION & LOCATION SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 100 INCIDENT DETECTION & LOCATION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 DYNAMIC TRAFFIC MANAGEMENT SYSTEM

TABLE 101 DYNAMIC TRAFFIC MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 102 DYNAMIC TRAFFIC MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 TRAFFIC MANAGEMENT MARKET, BY REGION (Page No. - 133)

8.1 INTRODUCTION

FIGURE 37 EUROPE TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 103 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 104 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA: MARKET DRIVERS

8.2.2 NORTH AMERICA: TRAFFIC MANAGEMENT REGULATIONS

8.2.3 PESTLE ANALYSIS: NORTH AMERICA

TABLE 105 TRAFFIC SCORECARD 2021: NORTH AMERICA

TABLE 106 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.2.4 US

8.2.4.1 Major initiatives by government to drive market

8.2.5 CANADA

8.2.5.1 Development of smart cities to drive market

8.3 EUROPE

8.3.1 EUROPE: MARKET DRIVERS

8.3.2 EUROPE: TRAFFIC MANAGEMENT REGULATIONS

8.3.3 PESTLE ANALYSIS: EUROPE

TABLE 128 TRAFFIC SCORECARD, 2021: EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT

TABLE 129 EUROPE: TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 138 EUROPE: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 141 EUROPE: TRAFFIC MANAGEMENT MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 143 EUROPE: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 144 EUROPE: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.3.4 UK

8.3.4.1 Government initiatives supported by collaborations and partnerships to drive market

8.3.5 GERMANY

8.3.5.1 Government initiatives supported by private collaborations and partnerships to drive market

8.3.6 FRANCE

8.3.6.1 Advancements in robotics and IoT to drive market

8.3.7 REST OF EUROPE

8.4 ASIA PACIFIC

8.4.1 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET DRIVERS

8.4.2 ASIA PACIFIC: TRAFFIC MANAGEMENT REGULATIONS

8.4.3 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 151 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.4.4 AUSTRALIA AND NEW ZEALAND

8.4.4.1 Increasing adoption of latest technologies to drive market

8.4.5 CHINA

8.4.5.1 Need to overcome traffic congestion to drive market

TABLE 173 CHINA: TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 174 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 175 CHINA: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 176 CHINA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 177 CHINA: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 178 CHINA: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 179 CHINA: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 180 CHINA: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 181 CHINA: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 182 CHINA: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 183 CHINA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 184 CHINA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 185 CHINA: MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 186 CHINA: TRAFFIC MANAGEMENT MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 187 CHINA: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 188 CHINA: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 189 CHINA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 190 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 191 CHINA: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 192 CHINA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

8.4.6 JAPAN

8.4.6.1 Digital transformation across country to drive market

8.4.7 SINGAPORE

8.4.7.1 Increasing investments in Singapore for network extensions to drive market

8.4.8 REST OF ASIA PACIFIC

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET DRIVERS

8.5.2 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT REGULATIONS

8.5.3 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 193 TRAFFIC SCORECARD, 2021: MIDDLE EAST & AFRICA

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.5.4 ISRAEL

8.5.4.1 Major investments for better transport infrastructure to drive market

8.5.5 QATAR

8.5.5.1 Increasing traffic management projects to drive market

8.5.6 UAE

8.5.6.1 Advancements in technology to drive market

8.5.7 SOUTH AFRICA

8.5.7.1 Adoption of IoT and cloud technologies to drive market

8.5.8 REST OF MIDDLE EAST & AFRICA

8.6 LATIN AMERICA

8.6.1 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET DRIVERS

8.6.2 LATIN AMERICA: TRAFFIC MANAGEMENT REGULATIONS

8.6.3 PESTLE ANALYSIS: LATIN AMERICA

TABLE 216 TRAFFIC SCORECARD, 2021: LATIN AMERICA

TABLE 217 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY DISPLAY BOARD TYPE, 2017–2021 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET, BY DISPLAY BOARD TYPE, 2022–2027 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY SURVEILLANCE CAMERA, 2017–2021 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY SURVEILLANCE CAMERA, 2022–2027 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY SENSOR, 2017–2021 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY SENSOR, 2022–2027 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 228 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET, BY SMART SURVEILLANCE, 2017–2021 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY SMART SURVEILLANCE, 2022–2027 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY VIDEO ANALYTICS, 2017–2021 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY VIDEO ANALYTICS, 2022–2027 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 234 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET, BY SYSTEM, 2017–2021 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.6.4 BRAZIL

8.6.4.1 Digital transformation to drive market

8.6.5 MEXICO

8.6.5.1 Increasing demand for improved infrastructures to drive market

8.6.6 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 198)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES

TABLE 239 OVERVIEW OF STRATEGIES ADOPTED BY KEY TRAFFIC MANAGEMENT MARKET VENDORS

9.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 40 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

9.4 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 41 MARKET: REVENUE ANALYSIS

9.5 COMPANY MARKET RANKING ANALYSIS

FIGURE 42 RANKING OF KEY PLAYERS IN MARKET, 2022

9.6 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 240 TRAFFIC MANAGEMENT MARKET: DEGREE OF COMPETITION

9.7 MARKET EVALUATION FRAMEWORK

FIGURE 43 MARKET EVALUATION FRAMEWORK, 2019–2022

9.8 KEY MARKET DEVELOPMENTS

9.8.1 PRODUCT LAUNCHES

TABLE 241 PRODUCT LAUNCHES, 2019–2021

9.8.2 DEALS

TABLE 242 DEALS, 2019–2022

9.9 COMPANY EVALUATION MATRIX OVERVIEW

9.9.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 243 PRODUCT FOOTPRINT WEIGHTAGE

9.9.1.1 Stars

9.9.1.2 Emerging leaders

9.9.1.3 Pervasive players

9.9.1.4 Participants

FIGURE 44 TRAFFIC MANAGEMENT MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2022

9.10 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 244 COMPANY PRODUCT FOOTPRINT

TABLE 245 COMPANY APPLICATION FOOTPRINT

TABLE 246 COMPANY INFRASTRUCTURE FOOTPRINT

TABLE 247 COMPANY REGION FOOTPRINT

9.11 COMPETITIVE BENCHMARKING

TABLE 248 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 249 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

9.12 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

9.12.1 PROGRESSIVE COMPANIES

9.12.2 RESPONSIVE COMPANIES

9.12.3 DYNAMIC COMPANIES

9.12.4 STARTING BLOCKS

FIGURE 45 TRAFFIC MANAGEMENT MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2022

10 COMPANY PROFILES (Page No. - 219)

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

10.1 MAJOR PLAYERS

10.1.1 SIEMENS

TABLE 250 SIEMENS: BUSINESS OVERVIEW

FIGURE 46 SIEMENS: COMPANY SNAPSHOT

TABLE 251 SIEMENS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 252 SIEMENS: MARKET: PRODUCT LAUNCHES

TABLE 253 SIEMENS: MARKET: DEALS

10.1.2 HUAWEI

TABLE 254 HUAWEI: BUSINESS OVERVIEW

FIGURE 47 HUAWEI: COMPANY SNAPSHOT

TABLE 255 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 HUAWEI: TRAFFIC MANAGEMENT MARKET: PRODUCT LAUNCHES

TABLE 257 HUAWEI: MARKET: DEALS

10.1.3 IBM

TABLE 258 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 259 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 260 IBM: MARKET: OTHERS

10.1.4 CISCO

TABLE 261 CISCO: BUSINESS OVERVIEW

FIGURE 49 CISCO: COMPANY SNAPSHOT

TABLE 262 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 CISCO: MARKET: PRODUCT LAUNCHES

TABLE 264 CISCO: MARKET: DEALS

10.1.5 KAPSCH TRAFFICCOM

TABLE 265 KAPSCH TRAFFICCOM: BUSINESS OVERVIEW

FIGURE 50 KAPSCH TRAFFICCOM: COMPANY SNAPSHOT

TABLE 266 KAPSCH TRAFFICCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267 KAPSCH TRAFFICCOM: TRAFFIC MANAGEMENT MARKET: PRODUCT LAUNCHES

TABLE 268 KAPSCH TRAFFICCOM: MARKET: DEALS

10.1.6 SWARCO

TABLE 269 SWARCO: BUSINESS OVERVIEW

TABLE 270 SWARCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 SWARCO: MARKET: PRODUCT LAUNCHES

TABLE 272 SWARCO: MARKET: DEALS

10.1.7 Q FREE

TABLE 273 Q-FREE: BUSINESS OVERVIEW

FIGURE 51 Q-FREE: COMPANY SNAPSHOT

TABLE 274 Q-FREE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 Q-FREE: MARKET: PRODUCT LAUNCHES

TABLE 276 Q-FREE: MARKET: DEALS

10.1.8 THALES GROUP

TABLE 277 THALES GROUP: BUSINESS OVERVIEW

FIGURE 52 THALES GROUP: COMPANY SNAPSHOT

TABLE 278 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 279 THALES GROUP: TRAFFIC MANAGEMENT MARKET: DEALS

10.1.9 PTV GROUP

TABLE 280 PTV GROUP: BUSINESS OVERVIEW

TABLE 281 PTV GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 282 PTV GROUP: MARKET: PRODUCT LAUNCHES

TABLE 283 PTV GROUP: MARKET: DEALS

10.1.10 TELEDYNE FLIR

TABLE 284 TELEDYNE FLIR: BUSINESS OVERVIEW

FIGURE 53 TELEDYNE FLIR: COMPANY SNAPSHOT

TABLE 285 TELEDYNE FLIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286 TELEDYNE FLIR: MARKET: PRODUCT LAUNCHES

TABLE 287 TELEDYNE FLIR: MARKET: DEALS

10.1.11 CUBIC

TABLE 288 CUBIC: BUSINESS OVERVIEW

FIGURE 54 CUBIC: COMPANY SNAPSHOT

TABLE 289 CUBIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 290 CUBIC: TRAFFIC MANAGEMENT MARKET: PRODUCT LAUNCHES

TABLE 291 CUBIC: MARKET: DEALS

10.1.12 TOMTOM

TABLE 292 TOMTOM: BUSINESS OVERVIEW

FIGURE 55 TOMTOM: COMPANY SNAPSHOT

TABLE 293 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 294 TOMTOM: MARKET: PRODUCT LAUNCHES

TABLE 295 TOMTOM: MARKET: DEALS

10.1.13 ALIBABA CLOUD

TABLE 296 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 56 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 297 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 298 ALIBABA CLOUD: MARKET: DEALS

10.1.14 TRANSCORE

TABLE 299 TRANSCORE: BUSINESS OVERVIEW

TABLE 300 TRANSCORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 301 TRANSCORE: TRAFFIC MANAGEMENT MARKET: PRODUCT LAUNCHES

TABLE 302 TRANSCORE: MARKET: DEALS

10.1.15 CHEVRON TM

TABLE 303 CHEVRON TM: BUSINESS OVERVIEW

TABLE 304 CHEVRON TM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 305 CHEVRON TM: MARKET: PRODUCT LAUNCHES

11.1.2.8 Smart utilities, by component

10.1.16 INDRA

TABLE 307 INDRA: BUSINESS OVERVIEW

TABLE 308 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 309 INDRA: MARKET: DEALS

10.1.17 LG CNS

TABLE 310 LG CNS: BUSINESS OVERVIEW

TABLE 311 LG CNS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

10.2 STARTUP/SME PLAYERS

10.2.1 INRIX

10.2.2 NOTRAFFIC

10.2.3 SENSYS NETWORKS

10.2.4 CITILOG

10.2.5 BERCMAN TECHNOLOGIES

10.2.6 VALERANN

10.2.7 MIOVISION

10.2.8 BLUESIGNAL

10.2.9 TELEGRA

10.2.10 ORIUX

10.2.11 INVARION

10.2.12 REKOR

11 APPENDIX (Page No. - 282)

11.1 ADJACENT MARKETS

11.1.1 LIMITATIONS

11.1.2 SMART CITIES MARKET

11.1.2.1 Market definition

11.1.2.2 Market overview

11.1.2.3 Smart cities market, by focus area

TABLE 312 SMART CITIES MARKET, BY FOCUS AREA, 2016–2020 (USD BILLION)

TABLE 313 SMART CITIES MARKET, BY FOCUS AREA, 2021–2026 (USD BILLION)

11.1.2.4 Smart transportation market, by component

TABLE 314 SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2020 (USD BILLION)

TABLE 315 SMART TRANSPORTATION MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

TABLE 316 SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 317 SMART TRANSPORTATION MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 318 SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 319 SMART TRANSPORTATION MARKET, BY SERVICE, 2021–2026 (USD BILLION)

11.1.2.5 Smart transportation market, by type

TABLE 320 SMART TRANSPORTATION MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 321 SMART TRANSPORTATION MARKET, BY TYPE, 2021–2026 (USD BILLION)

11.1.2.6 Smart buildings market, by solution

TABLE 322 SMART BUILDINGS MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 323 SMART BUILDINGS MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

11.1.2.7 Smart buildings, by service

TABLE 324 SMART BUILDINGS MARKET, BY SERVICE, 2016–2020 (USD BILLION)

11.1.2.8 Smart utilities, by component

TABLE 326 SMART UTILITIES MARKET, BY COMPONENT, 2016–2020 (USD BILLION)

TABLE 327 SMART UTILITIES MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

TABLE 328 SMART UTILITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 329 SMART UTILITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 330 SMART UTILITIES MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 331 SMART UTILITIES MARKET, BY SERVICE, 2021–2026 (USD BILLION)

11.1.2.9 Smart utilities, by type

TABLE 332 SMART UTILITIES MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 333 SMART UTILITIES MARKET, BY TYPE, 2021–2026 (USD BILLION)

11.1.2.10 Smart citizen services, by type

TABLE 334 SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 335 SMART CITIZEN SERVICES MARKET, BY TYPE, 2021–2026 (USD BILLION)

11.1.2.11 Smart cities market, by region

TABLE 336 NORTH AMERICA: SMART CITIES MARKET, BY FOCUS AREA, 2016–2020 (USD MILLION)

TABLE 337 NORTH AMERICA: SMART CITIES MARKET, BY FOCUS AREA, 2021–2026 (USD MILLION)

TABLE 338 EUROPE: SMART CITIES MARKET, BY FOCUS AREA, 2016–2020 (USD MILLION)

TABLE 339 EUROPE: SMART CITIES MARKET, BY FOCUS AREA, 2021–2026 (USD MILLION)

11.1.3 PARKING MANAGEMENT MARKET

11.1.3.1 Market overview

11.1.3.2 Parking management market, by offering

TABLE 340 PARKING MANAGEMENT MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 341 PARKING MANAGEMENT MARKET, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 342 OFFERING: PARKING MANAGEMENT MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 343 OFFERING: PARKING MANAGEMENT MARKET, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 344 OFFERING: PARKING MANAGEMENT MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 345 OFFERING: PARKING MANAGEMENT MARKET, BY SERVICE, 2019–2025 (USD MILLION)

11.1.3.3 Parking management market, by parking site

TABLE 346 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 347 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2019–2025 (USD MILLION)

11.1.3.4 Parking management market, by deployment type

TABLE 348 PARKING MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 349 PARKING MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

11.1.3.5 Parking management market, by region

TABLE 350 PARKING MANAGEMENT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 351 PARKING MANAGEMENT MARKET, BY REGION, 2019–2025 (USD MILLION)

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

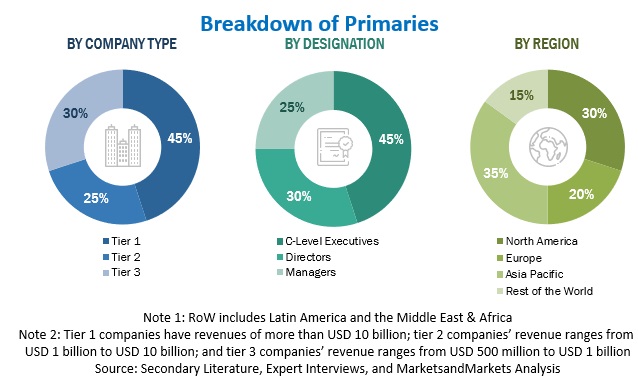

This research study involved the extensive use of secondary sources, directories, and databases such as Dun and Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, and commercial study of the traffic management market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information. The following illustrative figure shows the market research methodology applied in making this report on the traffic management market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations, such as the International Road Federation (IRF), International Traffic Safety Data and Analysis Group (IRTAD), The World Road Association (PIARC), American Traffic Safety Services Association (ATSSA), and Traffic Management Association of Australia (TMAA) were also referred to. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from traffic management solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use traffic management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of traffic management solutions, which is expected to affect the overall traffic management market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the traffic management market. The first approach involves the estimation of the market size by summing up revenues generated by companies through the sale of solutions and services.

Approach for capturing the market share using the bottom-up analysis (demand side)

- Analyzing the size of the global traffic management market by identifying segment and subsegment revenue related to the market

- Estimating the size of various market hardware and solutions

- Estimating the revenue contribution of traffic management system providers in the ecosystem

Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual market segments through percentage splits obtained from secondary and primary research.

For the calculation of specific market segments, the most appropriate immediate parent market size was used to implement the top-down approach.

The market share of each company was obtained to verify the revenue share used in the bottom-up approach. Through data triangulation and validation of data with the help of primary research, the overall parent market size and each market segment size were determined.

Approach for capturing the market share using the top-down analysis (supply side):

- The initial focus was on top-line investments and spending in the ecosystems. Further, the segment level splits and major developments in the market were considered.

- Information related to the market revenue generated by key players was obtained.

- Multiple discussions were conducted with key opinion leaders from major companies developing traffic management hardware, solutions, related products, and supply-related services.

Report Objectives

- To determine and forecast the global traffic management market by component (hardware, solutions, and services), system, and region, from 2022 to 2027, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Latin America, Asia Pacific (APAC), and the Middle East and Africa (MEA)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the traffic management market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research & development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Traffic Management Market

Interested in LiDAR (Lighting Detection And Ranging) in the traffic

Understanding the market segments of Traffic Management Market

Intersted in Traffic management market

Interseted in Traffic management market

Interested in sensor technology in traffic management market

Interested in traffic management market in south africa

Understanding the market size and growth in traffic management system and itelligent transport systems.

Interseted in Traffic management market

Interested in Trafiic control market

Interested in Traffic management market in south africa

Understanding the market segments of Traffic Management Market

Interested in Traffic Management Market

Understanding the close-loop traffic light control system market

Understanding the market segments of Traffic Management Market

Market prediction and future scope of traffic management system

Segments and players in the solution segments

Interested in Traffic management market in south africa

Interested in Traffic management market in south africa

Interested in data on toll management solutions

Interseted in Traffic management market

Interested in Traffic Survey Market

Interested in market size and forecast of traffic management market