Train Battery Market by Type & Technology (Lead Acid-Gel Tubular, VRLA, Conventional; Ni-Cd-Sinter, Fiber, Pocket, & Li-Ion), Advanced Train (Autonomous, Hybrid, Fully Battery-Operated), Rolling Stock Type, Application and Region - Global Forecast to 2030

The global train battery market was valued at USD 518 million in 2022 and is expected to reach USD 758 million by 2030, at a CAGR of 9.7 % during the forecast period 2022-2030. Rapid urbanization and a growing number of passengers are driving the expansion of rail networks around the globe. The emission regulations and high energy consumption remain major challenges for the rail sector. The energy storage systems such as batteries are expected to reduce the demand for energy and thus reduce overall operational costs.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growth in adoption of autonomous and high-speed railways

High-speed and autonomous trains are generally powered by power lines and these railways systems are considered a large energy consumer. Hence, for performance improvement, a large number of energy-saving and storage systems are utilized. For example, regenerative braking techniques are adapted to convert braking energy into electricity and store them onboard energy storage systems. In India, the Delhi metro system was able to eliminate the release of about 90,004 tons of carbon dioxide by adopting regenerative braking systems. In 2017, Hitachi successfully commercialized a battery-powered train, the JR Kyushu Series BEC819, that can run on non-electrified sections of track by using energy stored in batteries that are charged from the alternating current overhead lines. For the hybrid rolling stock that supplies power using a diesel engine and batteries, Hitachi has also developed a facility that enables hybrid locomotives to operate as electric railcars by fitting them with low-capacity emergency batteries that can be used when the main batteries are unavailable. Thus, the adaptation of batteries for high-speed railways and partial and fully autonomous train systems can reduce the operational cost and cost of capital. The saved capital can be used to offset the additional investment and operation costs incurred due to the implementation of the project and to stimulate research and development activities.

Restraint: High capital investment and operating cost of the high-speed rail network

The high infrastructure cost and government budget constraints have hampered the adoption of high-speed train networks in various emerging economies such as Mexico, Indonesia, etc. In October 2021, it was reported that the California bullet train faced at least another billion dollars of proposed cost increases from its contractors. The continued cost increases and the likelihood of similar problems surfacing over the next few years are further deepening the difficult financial condition of the USD 100-billion project. In March 2021, Malaysia paid nearly USD 76.30 million (S$102.8m) to Singapore as a settlement for the cancellation of the Kuala Lumpur-Singapore High-Speed Rail (HSR) project between the two countries. In the UK, completion of the high-speed rail line for the Birmingham branch has recently been pushed back to 2031 and for the Manchester/Leeds branch to 2040, and the projected cost of the project has practically doubled from the initial budget of USD 65 billion to nearly USD 130 billion due to the high cost and environmental impact. Indonesia also suspended a high-speed 150 km long train project line in 2016. Therefore, the high cost of infrastructure is expected to hinder the growth of the high-speed train network in emerging economies, thereby affecting the demand for train batteries.

Opportunity: Expansion of IoT, AI, and DAS technologies

The railway industry has been implementing advanced technologies such as IoT, AI, deep learning, and DAS to improve efficiency and enhance the passenger experience. Improvements in resource planning, passenger experience, and decision making along with the optimization of field equipment such as ACs, heaters, braking systems, and other onboard appliances are expected to increase the adoption rate of train batteries. Rollouts of various rail network intelligent infrastructure programs are expected to drive the adoption of IoT, AI, and deep learning in railways. For instance, according to IoT Times, in 2019, Network Rail launched the Intelligent Infrastructure (II) program to turn data into intelligent information that can effectively deliver improved services for passenger and freight customers. Therefore, the growing implementation of IoT, AI, deep learning, and DAS is expected to reduce travel time and improve the passenger experience. Since these systems are heavily dependent on electricity, train batteries would emerge as a more reliable and stable source for power backup purposes.

Challenge: Technical challenges related to lead-acid and lithium-ion batteries

Rail batteries are required to be longer-lasting and fast-charging. As of now, the rail industry uses lead-acid and Nickel Cadmium (Ni-Cd) batteries extensively. These batteries are difficult to dispose of and contain toxic chemicals. Apart from these drawbacks, they have a high self-discharge rate and a small charge cycle. Though Ni-Cd batteries can deliver 60% more energy than other types, they face a recharging problem called the “memory effect”. Increasing the cell capacity can improve the performance of batteries, but it can compromise the safety of the system. In addition, rail batteries are electrochemical batteries that leverage chemical reactions to produce an electric current. As all chemical reactions are affected by a temperature change, fluctuations affect the performance of rail batteries. Low-temperature conditions reduce the cell performance, thus affecting the specific energy gradient of the battery. Therefore, with the increasing trend toward the use of batteries in traction and auxiliary applications, battery manufacturers are expected to face challenges in terms of battery design, cost-effectiveness, and weight of the batteries. Additionally, manufacturers focused on refining the battery technology to achieve minimal energy loss, improve the onboard charging mechanism, and reduce discharge downtime.

Train Battery Market Supply Chain Analysis

To know about the assumptions considered for the study, download the pdf brochure

VRLA battery is estimated to be the largest market during the forecast period

The VRLA has a lower terminal voltage and lower ampere-hour capacity. It provides nearly constant terminal voltage during discharge. Also, VRLA batteries are more stable at higher temperatures than conventional lead acid batteries. Therefore, the VRLA battery performs better than other batteries at variable load and temperatures and requires lower maintenance than other batteries and is highly reliable. These batteries are used in DMUs and diesel locomotives to start engines and for the auxiliary functions of the trains as they have over twice the cycle life of a conventional flooded product. VRLA batteries do not require frequent refilling of water, which makes them more efficient and reliable in terms of efficiency and maintenance. The VRLA battery is projected to dominate the market in the Asia Pacific owing to its high energy density which makes it ideal for starting engines.

Auxiliary Battery segment is projected to be the largest market during the forecast period

The auxiliary battery systems provide backup to all essential train systems such as emergency lighting and ventilation systems. auxiliary batteries also provide safety to the train in the absence of output failure and train separation incidents. Additionally, the increase in the demand for high-speed trains is leading to the high demand for advanced features such as emergency braking, tilting systems, etc. It also provides traction for hybrid tram systems or hybrid DMUs/ EMUs. In the case of fully battery-operated trains, lithium-ion batteries are expected to drive the battery train market owing to their compact design, lightweight, and superior performance. Therefore, the Asia Pacific and Europe are expected to drive the market for auxiliary function batteries owing to the expansion of the high-speed rail network in these regions.

Fully battery-operated trains segment to hold the largest market share during the forecast period

The fully battery operated trains, use batteries in the place of diesel generators to operate on the non-electrified lines. Leading rolling stock manufacturers like Alstom, Hitachi, and Wabtec are investing heavily to increase the battery-operated trains’ range of operation. Currently, the cost of fully battery operated trains is higher than that of hybrid locomotives, which is hindering their adoption in booming markets of Asia Pacific.

Battery-powered trains offer an alternative in areas where electrified rail services are not available. The adoption of battery-operated trains in rail transport is expected to increase at a faster rate in Europe compared to emerging countries owing to stringent emission regulations and an increase in the adoption of lithium-ion battery technology.

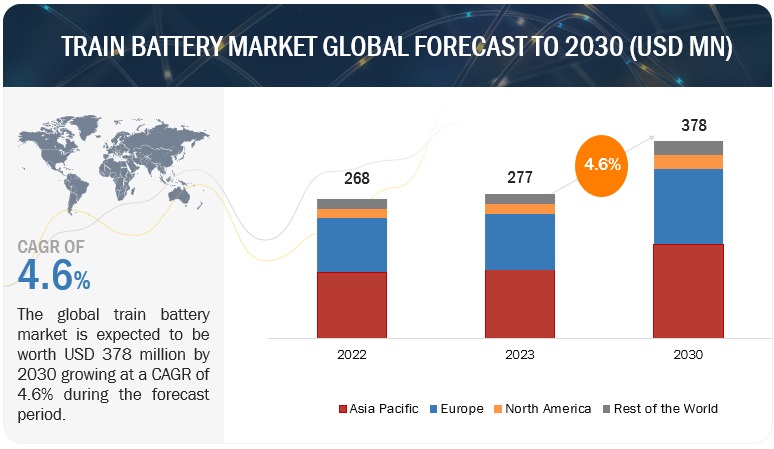

Asia Pacific is projected to be the largest market by 2030

The Asia Pacific is estimated to be the largest and fastest-growing market due to growth in rail expansion in key countries such as China, Japan, India, and South Korea. Additionally, the rail networks of China and India are among the largest in the world. In 2019, China had more than 250,000 km of track length, India had approximately 100,000 km, Japan had 28,000 km, and South Korea had a track length of approximately 4,000 km. Passenger trains are the most commonly used mode of transportation in India, China, and South Korea; whereas, high-speed rails and metro trains are the preferred modes of transportation in Japan. Due to the increased demand for such fully equipped train sets, the requirement for batteries is increasing in the region.

COVID-19 has severely Impacted the rail sector. As per IEA, rail operators lost USD 1.9 billion in revenue in Asia Pacific and USD 2.5 billion in Europe between January and April 2020. Also, social distancing has reduced maximum rail car occupancy and increased sanitation requirements, raising operational costs and reducing profitability. During the lockdown in India, Indian railways, stopped all passenger train services and reduced freight train services to 60% capacity (also due to reduced demand for bulk goods such as iron and coal). Therefore, owing to the stoppage of railway services in most regions, the demand for batteries is expected to witness a downturn.

Key Market Players & Start-ups

The train battery market is led by globally established players such as EnerSys (US), Exide Industries (India), Saft (France), Amara Raja Batteries (India), and GS Yuasa Corporation (Japan). These companies have developed new products; adopted expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing train battery market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 518 billion |

|

Estimated Value by 2030 |

USD 758 billion |

|

Growth Rate |

Poised to grow at a CAGR of 9.7% |

|

Market Segmentation |

By Battery Type, By Battery Technology, By Rolling Stock, By Application, By Advance Train, and Region |

|

Market Driver |

Growth in adoption of autonomous and high-speed railways |

|

Market Opportunity |

Expansion of IoT, AI, and DAS technologies |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

The study categorizes the Train Battery Market based on service type, solution type, transportation type, vehicle type, application type, operating system, and business model at regional and global level.

By Battery Type

- Lead Acid Battery

- Nickel Cadmium Battery

- Lithium Ion Battery

By Technology

- Conventional Lead Acid Battery

- Valve Regulated Lead Acid Battery

- Gel Tubular Lead Acid Battery

- Sinter/PNE Ni-Cd Battery

- Pocket Plate Ni-Cd Battery

- Fiber/PNE Ni-Cd Battery

- Lithium Ion Battery

By Rolling Stock

- Diesel Locomotives

- DMUs

- Electric Locomotives

- EMUs

- Metros

- High-speed Trains

- Light Trains/Trams/Monorails

- Passenger Coaches

By Application

- Starter Battery

- Auxiliary Battery (HVAC, Doors, Infotainment)

By Advance Train

- Autonomous Trains

- Hybrid Locomotives

- Fully Battery Operated Trains

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Frequently Asked Questions (FAQ):

How big is the train battery market?

The global train battery market was valued at USD 518 million in 2022 and is expected to reach USD 758 million by 2030, at a CAGR of 9.7 % during the forecast period 2022-2030

Can you tell us who are the leading global train battery manufacturers and what are strategies they have adopted?

The global train battery market is dominated by players such as EnerSys (US), Exide Industries (India), Saft (France), Amara Raja Batteries (India), and GS Yuasa Corporation (Japan).

These companies invest heavily on product development and improvement. Further, expansion strategies such as collaborations, partnerships, mergers & acquisitions are prominantly used to consolidate their position.

How does the demand for train batteries vary by the region?

The global demand for train batteries has some variation as per the region as well as the rolling stock used in the region. Further, rail expansion and level of electrification contribute to a preference for the battery technology used. For instance, the Asia Pacific region is estimated to be the largest market for passenger coaches and EMUs during the forecast period, coupled with high-speed rail track expansion. Hence, an increase in sales of rolling stock directly impact the demand for train battery in the region. Whereas, the North American region has a high demand for diesel locomotives and DMUs therefore, the demand for batteries changes with different rolling stock.

Which are the key battery technologies at present? How the demand would shift in future?

The Key battery technologies include the conventional lead-acid battery, valve regulated lead-acid battery, Gel Tubular Lead Acid Battery, sinter/PNE Ni-Cd battery, pocket plate Ni-Cd battery, fibre/PNE Ni-Cd battery, and lithium-ion battery.

The demand for Nickel-cadmium batteries is projected to grow owing their higher eergy density and longer life cycle. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES

1.2 TRAIN BATTERY MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 SEGMENT-WISE INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: TRAIN BATTERY OE AND AFTERMARKET

1.3.1 TRAIN BATTERY OE MARKET, BY REGION

1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 TRAIN BATTERY MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 LIST OF KEY SECONDARY SOURCES TO ESTIMATE BASE NUMBERS (LOCOMOTIVE & ROLLING STOCK)

2.2.2 LIST OF KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4.1 BOTTOM-UP APPROACH

FIGURE 6 BOTTOM-UP APPROACH – BY BATTERY TYPE, AND TRAIN TYPE

FIGURE 7 BOTTOM-UP APPROACH FOR AFTERMARKET – BY BATTERY TYPE AND ROLLING STOCK

2.4.2 TOP-DOWN APPROACH

FIGURE 8 TOP-DOWN APPROACH: BATTERY TECHNOLOGY

FIGURE 9 MARKET: RESEARCH DESIGN & METHODOLOGY

2.4.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.5 FACTOR ANALYSIS

2.6 MARKET BREAKDOWN

FIGURE 10 DATA TRIANGULATION

2.7 ASSUMPTIONS

2.8 RISK ASSESSMENT AND RANGES

TABLE 2 RISK ASSESSMENT AND RANGES

2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

3.1 PRE- VS POST-COVID-19 SCENARIO

FIGURE 11 PRE VS POST-COVID-19 SCENARIO: TRAIN BATTERY MARKET, 2018–2030 (‘000 USD)

TABLE 3 MARKET: PRE VS. POST-COVID-19 SCENARIO, 2018–2030 (‘000 USD)

3.2 REPORT SUMMARY

FIGURE 12 MARKET OUTLOOK

FIGURE 13 MARKET, BY REGION, 2022 VS. 2030 (‘000 USD)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN TRAIN BATTERY MARKET

FIGURE 14 RISING DEMAND AND DEVELOPMENT OF EMUS, METROS, AND HIGH-SPEED TRAINS AND EXPANSION OF URBAN RAIL NETWORKS EXPECTED TO DRIVE MARKET

4.2 MARKET, BY BATTERY TECHNOLOGY

FIGURE 15 LITHIUM-ION BATTERY SEGMENT PROJECTED TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

4.3 MARKET, BY BATTERY TYPE

FIGURE 16 NICKEL-CADMIUM BATTERY SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2030

4.4 MARKET, BY ROLLING STOCK

FIGURE 17 ELECTRIC LOCOMOTIVE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY APPLICATION

FIGURE 18 AUXILIARY BATTERY SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY ADVANCED TRAIN TYPE

FIGURE 19 FULLY BATTERY-OPERATED TRAIN SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.7 TRAIN BATTERY AFTERMARKET, BY BATTERY TYPE

FIGURE 20 LEAD-ACID SEGMENT TO REGISTER HIGHEST AFTERMARKET DEMAND BY VALUE DURING FORECAST PERIOD

4.8 MARKET, BY REGION

FIGURE 21 ASIA PACIFIC PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: TRAIN BATTERY MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in adoption of autonomous and high-speed railways

TABLE 4 GRADE OF RAIL AUTOMATION

5.2.1.2 Emission regulations to increase demand for energy-efficient transportation systems

5.2.1.3 Expansion of railway networks

TABLE 5 UPCOMING KEY RAIL PROJECTS, BY COUNTRY

5.2.2 RESTRAINTS

5.2.2.1 High capital investment and operating cost of high-speed rail networks

5.2.3 OPPORTUNITIES

5.2.3.1 Expansion of IoT, AI, and DAS technologies

5.2.3.2 Improvements in battery technology

5.2.3.3 Retrofitting of diesel-electric trains

5.2.4 CHALLENGES

5.2.4.1 Technical challenges related to lead-acid and lithium-ion batteries

5.2.4.2 High cost of charging infrastructure and replacement

5.3 MARKET SCENARIO

FIGURE 23 MARKET SCENARIO, 2018–2030 (‘000 USD)

5.3.1 MOST LIKELY/REALISTIC SCENARIO

TABLE 6 REALISTIC SCENARIO - MARKET, BY REGION, 2018–2030 (‘000 USD)

5.3.2 HIGH COVID-19 IMPACT SCENARIO

TABLE 7 HIGH COVID-19 IMPACT SCENARIO - MARKET, BY REGION, 2018–2030 (‘000 USD)

5.3.3 LOW COVID-19 IMPACT SCENARIO

TABLE 8 LOW COVID-19 IMPACT SCENARIO - MARKET, BY REGION, 2018–2030 (‘000 USD)

5.4 REVENUE SHIFT DRIVING MARKET GROWTH

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 9 AVERAGE PRICES OF LEAD-ACID TRAIN BATTERY, 2019-2021

TABLE 10 AVERAGE PRICES OF NICKEL-CADMIUM TRAIN BATTERY, 2019-2021

TABLE 11 AVERAGE PRICES OF LITHIUM-ION TRAIN BATTERY, 2019-2021

5.6 TECHNOLOGICAL ANALYSIS

5.6.1 OVERVIEW

5.6.2 MITRAC PULSE TRACTION BATTERY

5.6.3 MRX NICKEL TECHNOLOGY BATTERY

5.7 MARKET ECOSYSTEM

TABLE 12 MARKET: MARKET ECOSYSTEM

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS: MARKET

5.9 PATENT ANALYSIS

5.10 CASE STUDY

5.10.1 SOUTH-EASTERN PENNSYLVANIA TRANSPORTATION AUTHORITY (SEPTA)

TABLE 13 USE CASE 1: SOUTH-EASTERN PENNSYLVANIA TRANSPORTATION AUTHORITY (SEPTA)

5.10.2 VR GROUP

TABLE 14 USE CASE 2: VR GROUP

TABLE 15 USE CASE 3: CHENGDU METRO

TABLE 16 USE CASE 4: ALSTROM TRANSPORT

5.11 REGULATORY LANDSCAPE

TABLE 17 NORTH AMERICA: LOCOMOTIVE AND ROLLING STOCK REGULATIONS

TABLE 18 EUROPE: LOCOMOTIVE AND ROLLING STOCK REGULATIONS

TABLE 19 ASIA PACIFIC: LOCOMOTIVE AND ROLLING STOCK REGULATIONS

5.12 REGULATORY BODIES/KEY AGENCIES/OTHER ORGANIZATIONS

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY CONFERENCES

TABLE 23 MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

5.14 PORTER’S FIVE FORCES

5.14.1 INTENSITY OF COMPETITIVE RIVALRY

5.14.2 THREAT OF NEW ENTRANTS

5.14.3 THREAT OF SUBSTITUTES

5.14.4 BARGAINING POWER OF SUPPLIERS

5.14.5 BARGAINING POWER OF BUYERS

6 TRAIN BATTERY MARKET, BY BATTERY TYPE (Page No. - 84)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS/LIMITATIONS

6.1.3 INDUSTRY INSIGHTS

FIGURE 25 MARKET, BY BATTERY TYPE, 2022 VS. 2030 (‘000 USD)

TABLE 24 MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 25 MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 26 MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 27 MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

6.2 LEAD-ACID BATTERY

6.2.1 EASY TRANSPORTATION AND VALUE FOR COST EXPECTED TO INCREASE DEMAND FOR LEAD-ACID BATTERIES IN RAIL SECTOR

TABLE 28 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 29 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 30 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 31 MARKET, BY REGION, 2022–2030 (‘000 USD)

6.3 NICKEL-CADMIUM BATTERY

6.3.1 ADVANTAGES SUCH AS UNINTERRUPTIBLE POWER SUPPLY AND HIGH CURRENT SUPPLY FOR DIESEL STARTING MOTOR LED TO HIGH MARKET PENETRATION

TABLE 32 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 33 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 34 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 35 MARKET, BY REGION, 2022–2030 (‘000 USD)

6.4 LITHIUM-ION BATTERY

6.4.1 LONGER CHARGE CYCLE AND HIGH-POWER DENSITY DRIVING ADOPTION OF LITHIUM-ION BATTERIES IN ROLLING STOCK

TABLE 36 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 37 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 38 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 39 MARKET, BY REGION, 2022–2030 (‘000 USD)

7 TRAIN BATTERY MARKET, BY BATTERY TECHNOLOGY (Page No. - 93)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 26 MARKET, BY BATTERY TECHNOLOGY, 2022 VS 2030 (‘000 USD)

TABLE 40 MARKET, BY BATTERY TECHNOLOGY, 2018–2021 (UNITS)

TABLE 41 MARKET, BY BATTERY TECHNOLOGY, 2022–2030 (UNITS)

7.2 CONVENTIONAL LEAD-ACID BATTERY

7.2.1 GROWING POPULARITY OF VRLA LEAD-ACID BATTERIES TO IMPACT CONVENTIONAL LEAD-ACID BATTERY DEMAND

TABLE 42 CONVENTIONAL LEAD-ACID BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 43 CONVENTIONAL LEAD-ACID BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.3 VALVE REGULATED LEAD-ACID (VRLA) BATTERY

7.3.1 HIGH RELIABILITY AND LOW COST OF OWNERSHIP EXPECTED TO DRIVE DEMAND

TABLE 44 VRLA BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 45 VRLA BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.4 GEL TUBULAR LEAD-ACID BATTERY

7.4.1 HIGH CURRENT APPLICATIONS EXPECTED TO INCREASE DEMAND

TABLE 46 GEL TUBULAR LEAD-ACID BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 47 GEL-TUBULAR LEAD-ACID BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.5 SINTER/PNE NICKEL-CADMIUM BATTERY

7.5.1 GOOD CHARGEABILITY AND LONGER LIFE CYCLE EXPECTED TO DRIVE DEMAND

TABLE 48 SINTER/PNE NI-CD BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 49 SINTER/PNE NI-CD BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.6 POCKET PLATE NICKEL-CADMIUM BATTERY

7.6.1 TECHNICAL CHALLENGES LIKE LOWER ENERGY DENSITY CAPACITY AND SHORT LIFETIME TO IMPACT MARKET SHARE DURING FORECAST PERIOD

TABLE 50 POCKET PLATE NI-CD BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 51 POCKET PLATE NI-CD BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.7 FIBER/PNE NICKEL-CADMIUM BATTERY

7.7.1 REDUCTION IN SHORTCOMINGS OF SECOND-GENERATION NICKEL-CADMIUM BATTERY TECHNOLOGY EXPECTED TO DRIVE DEMAND.

TABLE 52 FIBER/PNE NI-CD BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 53 FIBER/PNE NI-CD BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

7.8 LITHIUM-ION BATTERY

7.8.1 BETTER POWER EFFICIENCY AND HIGH VOLTAGE CAPACITY TO DRIVE DEMAND

TABLE 54 LITHIUM-ION BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 55 LITHIUM-ION BATTERY MARKET, BY REGION, 2022–2030 (UNITS)

8 TRAIN BATTERY MARKET, BY ROLLING STOCK (Page No. - 104)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 27 MARKET, BY ROLLING STOCK, 2022 VS. 2030 (‘000 USD)

TABLE 56 MARKET, BY ROLLING STOCK, 2018–2021 (UNITS)

TABLE 57 MARKET, BY ROLLING STOCK, 2022–2030 (UNITS)

TABLE 58 MARKET, BY ROLLING STOCK, 2018–2021 (‘000 USD)

TABLE 59 MARKET, BY ROLLING STOCK, 2022–2030 (‘000 USD)

8.2 DIESEL LOCOMOTIVE

8.2.1 FREIGHT TRAINS AND RAIL NETWORKS IN DEVELOPING COUNTRIES EXPECTED TO DRIVE DEMAND

TABLE 60 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 61 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 62 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 63 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.3 DIESEL MULTIPLE UNIT (DMU)

8.3.1 EXPANSION OF INTERCITY RAIL NETWORK TO DRIVE DEMAND

TABLE 64 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 65 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 66 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 67 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.4 ELECTRIC LOCOMOTIVE

8.4.1 LOW MAINTENANCE COST AND HIGHER OPERATIONAL EFFICIENCY TO DRIVE DEMAND

TABLE 68 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 69 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 70 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 71 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.5 ELECTRIC MULTIPLE UNIT (EMU)

8.5.1 ADVANCED LIGHTING SOLUTIONS, SAFETY DOORS, AND HVACS EXPECTED TO DRIVE DEMAND FOR EMUS

TABLE 72 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 73 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 74 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 75 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.6 METRO

8.6.1 EXPANSION OF URBAN RAIL NETWORK EXPECTED TO DRIVE DEMAND

TABLE 76 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 77 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 78 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 79 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.7 HIGH-SPEED TRAIN

8.7.1 INFRASTRUCTURE DEVELOPMENT AND NEED FOR CHEAPER AND FASTER TRANSPORTATION MODES EXPECTED TO DRIVE DEMAND

TABLE 80 HIGH-SPEED TRAIN BATTERY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 81 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 82 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 83 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.8 LIGHT RAIL/TRAM/MONORAIL

8.8.1 RAPID URBANIZATION AND AESTHETIC VALUE TO DRIVE DEMAND

TABLE 84 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 85 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 86 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 87 MARKET, BY REGION, 2022–2030 (‘000 USD)

8.9 PASSENGER COACH

8.9.1 RAIL EXPANSION PROJECTS AND INCREASING NUMBER OF PASSENGERS EXPECTED TO DRIVE DEMAND

TABLE 88 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 89 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 90 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 91 MARKET, BY REGION, 2022–2030 (‘000 USD)

9 TRAIN BATTERY MARKET, BY APPLICATION (Page No. - 124)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 28 MARKET, BY APPLICATION, 2022 VS. 2030 (‘000 USD)

TABLE 92 MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 93 MARKET, BY APPLICATION, 2022–2030 (UNITS)

TABLE 94 MARKET, BY APPLICATION, 2018–2021 (‘000 USD)

TABLE 95 MARKET, BY APPLICATION, 2022–2030 (‘000 USD)

9.2 STARTER BATTERY

9.2.1 GROWTH OF DIESEL & HYBRID LOCOMOTIVES MARKET IN EMERGING ECONOMIES TO DRIVE DEMAND

TABLE 96 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 97 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 98 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 99 MARKET, BY REGION, 2022–2030 (‘000 USD)

9.3 AUXILIARY BATTERY (HVAC, DOORS, INFOTAINMENT)

9.3.1 METRO & HIGH-SPEED TRAINS TO DRIVE DEMAND FOR AUXILIARY FUNCTION BATTERIES

TABLE 100 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 101 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 102 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 103 MARKET, BY REGION, 2022–2030 (‘000 USD)

10 TRAIN BATTERY MARKET, BY ADVANCED TRAIN TYPE (Page No. - 131)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 29 MARKET, BY ADVANCED TRAIN TYPE, 2025 VS. 2030 (‘000 USD)

TABLE 104 MARKET, BY ADVANCED TRAIN TYPE, 2025–2030 (UNITS)

TABLE 105 MARKET, BY ADVANCED TRAIN TYPE, 2025–2030 (‘000 USD)

10.2 AUTONOMOUS TRAIN

10.2.1 CONTINUOUS DEVELOPMENTS, LOW COST OF OPERATION, AND LOW ENERGY CONSUMPTION DRIVING DEMAND FOR AUTONOMOUS TRAINS

TABLE 106 AUTONOMOUS TRAIN BATTERY MARKET, BY REGION, 2025–2030 (UNITS)

TABLE 107 AUTONOMOUS TRAIN BATTERY MARKET, BY REGION, 2025–2030 (‘000 USD)

10.3 HYBRID LOCOMOTIVE

10.3.1 REDUCTION IN ENERGY CONSUMPTION AND REDUCED LIFECYCLE COST DRIVE DEMAND FOR HYBRID LOCOMOTIVES

TABLE 108 HYBRID LOCOMOTIVE BATTERY MARKET, BY REGION, 2025–2030 (UNITS)

TABLE 109 HYBRID LOCOMOTIVE BATTERY MARKET, BY REGION, 2025–2030 (‘000 USD)

10.4 FULLY BATTERY-OPERATED TRAIN

10.4.1 EXPANSION OF RAIL NETWORK AND HIGHER COST OF ELECTRIFICATION DRIVING DEMAND FOR FULLY BATTERY-OPERATED LOCOMOTIVES

TABLE 110 FULLY BATTERY-OPERATED TRAIN BATTERY MARKET, BY REGION, 2025–2030 (UNITS)

TABLE 111 FULLY BATTERY-OPERATED TRAIN BATTERY MARKET, BY REGION, 2025–2030 (‘000 USD)

11 TRAIN BATTERY AFTERMARKET, BY ROLLING STOCK (Page No. - 139)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 30 TRAIN BATTERY AFTERMARKET, BY ROLLING STOCK, 2022 VS. 2030 (‘000 USD)

TABLE 112 MARKET, BY ROLLING STOCK, 2018–2021 (UNITS)

TABLE 113 MARKET, BY ROLLING STOCK, 2022–2030 (UNITS)

TABLE 114 MARKET, BY ROLLING STOCK, 2018–2021 (‘000 USD)

TABLE 115 MARKET, BY ROLLING STOCK, 2022–2030 (‘000 USD)

11.2 LOCOMOTIVES

11.2.1 IMPROVED LIFE CYCLE OF LOCOMOTIVES TO DRIVE DEMAND FOR TRAIN BATTERIES

TABLE 116 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 117 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 118 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 119 MARKET, BY REGION, 2022–2030 (‘000 USD)

11.3 MULTIPLE UNITS (MU)

11.3.1 ADVANCED FEATURES IN URBAN TRANSIT SYSTEMS INCREASE ADOPTION OF TRAIN BATTERIES IN MULTIPLE UNITS

TABLE 120 MULTIPLE UNITS: BATTERY AFTERMARKET, BY REGION, 2018–2021 (UNITS)

TABLE 121 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 122 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 123 MARKET, BY REGION, 2022–2030 (‘000 USD)

11.4 PASSENGER COACHES

11.4.1 REFURBISHMENT PROJECTS TO EXTEND THE OPERATIONAL LIFE OF PASSENGER COACHES BOOST DEMAND

TABLE 124 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 125 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 126 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 127 MARKET, BY REGION, 2022–2030 (‘000 USD)

12 TRAIN BATTERY AFTERMARKET, BY BATTERY TYPE (Page No. - 148)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 31 TRAIN BATTERY AFTERMARKET, BY BATTERY TYPE, 2022 VS. 2030 (‘000 USD)

TABLE 128 MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 129 MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 130 MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 131 MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

12.2 LEAD-ACID BATTERY

12.2.1 FREQUENT REPLACEMENT RATE AND LOW CYCLE LIFE DRIVE DEMAND

TABLE 132 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 133 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 134 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 135 MARKET, BY REGION, 2022–2030 (‘000 USD)

12.3 NICKEL-CADMIUM BATTERY

12.3.1 LONGER LIFE AND EASY MAINTENANCE BOOST MARKET SHARE

TABLE 136 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 137 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 138 MARKET, BY REGION, 2018–2020 (‘000 USD)

TABLE 139 MARKET, BY REGION, 2022–2030 (‘000 USD)

12.4 LITHIUM-ION BATTERY

12.4.1 HIGHER ADOPTION OF LITHIUM-ION BATTERIES TO DRIVE REPLACEMENT MARKET IN FUTURE

TABLE 140 LITHIUM-ION BATTERY AFTERMARKET, BY REGION, 2018–2021 (UNITS)

TABLE 141 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 142 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 143 MARKET, BY REGION, 2022–2030 (‘000 USD)

13 TRAIN BATTERY AFTERMARKET, BY APPLICATION (Page No. - 157)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS/LIMITATIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 32 TRAIN BATTERY AFTERMARKET, BY APPLICATION, 2022 VS. 2030 (‘000 USD)

TABLE 144 MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 145 MARKET, BY APPLICATION, 2022–2030 (UNITS)

TABLE 146 MARKET, BY APPLICATION, 2018–2021 (‘000 USD)

TABLE 147 MARKET, BY APPLICATION, 2022–2030 (‘000 USD)

13.2 STARTER BATTERY

13.2.1 REPLACEMENT BATTERY DEMAND IN EMU, DMU, AND PASSENGER COACHES TO DRIVE DEMAND FOR STARTER BATTERIES

TABLE 148 STARTER BATTERY AFTERMARKET, BY REGION, 2018–2021 (UNITS)

TABLE 149 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 150 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 151 MARKET, BY REGION, 2022–2030 (‘000 USD)

13.3 AUXILIARY BATTERY (HVAC, DOORS, INFOTAINMENT)

13.3.1 GROWING POWER REQUIREMENT OF ONBOARD ELECTRIC SYSTEMS TO RAISE MARKET DEMAND

TABLE 152 AUXILIARY FUNCTION BATTERY AFTERMARKET, BY REGION, 2018–2021 (UNITS)

TABLE 153 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 154 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 155 MARKET, BY REGION, 2022–2030 (‘000 USD)

14 US TRAIN BATTERY AFTERMARKET, BY ROLLING STOCK (Page No. - 164)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 33 US TRAIN BATTERY AFTERMARKET, BY ROLLING STOCK, 2022 VS. 2030 (‘000 USD)

TABLE 156 US: MARKET, BY ROLLING STOCK, 2018–2021 (UNITS)

TABLE 157 US: MARKET, BY ROLLING STOCK, 2022–2030 (UNITS)

TABLE 158 US: MARKET, BY ROLLING STOCK, 2018–2021 (‘000 USD)

TABLE 159 US: MARKET, BY ROLLING STOCK, 2022–2030 (‘000 USD)

14.2 LOCOMOTIVES

14.2.1 HIGHER CAPITAL SPENDING FOR INCREASING LIFECYCLE OF LOCOMOTIVES TO DRIVE DEMAND FOR REPLACEMENT BATTERIES

14.3 MULTIPLE UNITS

14.3.1 EXPANSION OF URBAN AND INTERCITY RAIL NETWORKS TO DRIVE REPLACEMENT TRAIN BATTERY MARKET FOR MULTIPLE UNITS

14.4 PASSENGER COACHES

14.4.1 RETROFITTING OF PASSENGER COACHES TO PROVIDE MORE COMFORT AND BETTER SAFETY TO DRIVE DEMAND

15 TRAIN BATTERY AFTERMARKET, BY REGION (Page No. - 170)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 34 INDUSTRY INSIGHTS

FIGURE 35 TRAIN BATTERY AFTERMARKET, BY REGION, 2022 VS 2030 (‘000 USD)

TABLE 160 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 161 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 162 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 163 MARKET, BY REGION, 2022–2030 (‘000 USD)

15.2 ASIA PACIFIC

15.3 EUROPE

15.4 NORTH AMERICA

16 TRAIN BATTERY MARKET, BY REGION (Page No. - 175)

16.1 INTRODUCTION

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 36 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY REGION, 2022 VS 2030 (‘000)

TABLE 164 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 165 MARKET, BY REGION, 2022–2030 (UNITS)

TABLE 166 MARKET, BY REGION, 2018–2021 (‘000 USD)

TABLE 167 MARKET, BY REGION, 2022–2030 (‘000 USD)

16.2 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 169 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (UNITS)

TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (‘000 USD)

TABLE 171 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (‘000 USD)

16.2.1 CHINA

16.2.1.1 Rail expansion projects expected to drive market

TABLE 172 CHINA: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 173 CHINA: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 174 CHINA: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 175 CHINA: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.2.2 INDIA

16.2.2.1 Electrification of rail routes to drive demand for train batteries

TABLE 176 INDIA: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 177 INDIA: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 178 INDIA: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 179 INDIA: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.2.3 JAPAN

16.2.3.1 High-speed EMUs projected to drive demand

TABLE 180 JAPAN: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 181 JAPAN: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 182 JAPAN: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 183 JAPAN: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.2.4 SOUTH KOREA

16.2.4.1 Strong urban rail network and development of high-speed rail service to drive demand

TABLE 184 SOUTH KOREA: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 185 SOUTH KOREA: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 186 SOUTH KOREA: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 187 SOUTH KOREA: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3 EUROPE

FIGURE 39 EUROPE: MARKET, BY COUNTRY, 2022 VS 2030 (‘000 USD)

TABLE 188 EUROPE: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 189 EUROPE: MARKET, BY COUNTRY, 2022–2030 (UNITS)

TABLE 190 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 USD)

TABLE 191 EUROPE: MARKET, BY COUNTRY, 2022–2030 (‘000 USD)

16.3.1 FRANCE

16.3.1.1 Stringent emission norms for locomotives expected to boost demand for train batteries

TABLE 192 FRANCE: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 193 FRANCE: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 194 FRANCE: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 195 FRANCE: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.2 GERMANY

16.3.2.1 Replacement of diesel locomotives with battery operated trains to drive demand

TABLE 196 GERMANY: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 197 GERMANY: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 198 GERMANY: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 199 GERMANY: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.3 ITALY

16.3.3.1 Increase in demand for batteries for EMUs and light rails to drive market

TABLE 200 ITALY: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 201 ITALY: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 202 ITALY: MARKET, BY BATTERY TYPE, 2018– 2021 (‘000 USD)

TABLE 203 ITALY: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.4 SPAIN

16.3.4.1 High-speed trains to drive future demand

TABLE 204 SPAIN: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 205 SPAIN: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 206 SPAIN: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 207 SPAIN: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.5 UK

16.3.5.1 Urban rail developments to drive future demand

TABLE 208 UK: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 209 UK: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 210 UK: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 211 UK: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.6 SWITZERLAND

16.3.6.1 Passenger trains to drive demand for batteries

TABLE 212 SWITZERLAND: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 213 SWITZERLAND: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 214 SWITZERLAND: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 215 SWITZERLAND: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.7 POLAND

16.3.7.1 Intercity trains to drive demand for train batteries

TABLE 216 POLAND: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 217 POLAND: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 218 POLAND: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 219 POLAND: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.3.8 SWEDEN

16.3.8.1 Rising demand for regional trains to drive market

TABLE 220 SWEDEN: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 221 SWEDEN: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 222 SWEDEN: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 223 SWEDEN: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.4 NORTH AMERICA

FIGURE 40 NORTH AMERICA MARKET SNAPSHOT

TABLE 224 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 225 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (UNITS)

TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 USD)

TABLE 227 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (‘000 USD)

16.4.1 US

16.4.1.1 High diesel prices to drive market

TABLE 228 US: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 229 US: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 230 US: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 231 US: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.4.2 CANADA

16.4.2.1 Commuter trains like metros and passenger rails projected to drive demand for train batteries

TABLE 232 CANADA: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 233 CANADA: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 234 CANADA: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 235 CANADA: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.4.3 MEXICO

16.4.3.1 Catenary free rail track expected to drive market

TABLE 236 MEXICO: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 237 MEXICO: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 238 MEXICO: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 239 MEXICO: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.5 REST OF THE WORLD (ROW)

FIGURE 41 ROW: MARKET, BY COUNTRY, 2022 VS 2030 (‘000 USD)

TABLE 240 ROW: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 241 ROW: MARKET, BY COUNTRY, 2022–2030 (UNITS)

TABLE 242 ROW: MARKET, BY COUNTRY, 2018–2021 (‘000 USD)

TABLE 243 ROW: MARKET, BY COUNTRY, 2022–2030 (‘000 USD)

16.5.1 RUSSIA

16.5.1.1 Demand for wide temperature range rail batteries to drive market

TABLE 244 RUSSIA: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 245 RUSSIA: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 246 RUSSIA: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 247 RUSSIA: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

16.5.2 BRAZIL

16.5.2.1 Demand for auxiliary function batteries to drive market

TABLE 248 BRAZIL: MARKET, BY BATTERY TYPE, 2018–2021 (UNITS)

TABLE 249 BRAZIL: MARKET, BY BATTERY TYPE, 2022–2030 (UNITS)

TABLE 250 BRAZIL: MARKET, BY BATTERY TYPE, 2018–2021 (‘000 USD)

TABLE 251 BRAZIL: MARKET, BY BATTERY TYPE, 2022–2030 (‘000 USD)

17 RECOMMENDATIONS FROM MARKETSANDMARKETS (Page No. - 217)

17.1 ASIA PACIFIC: POTENTIAL MARKET FOR TRAIN BATTERY MANUFACTURERS TO FOCUS ON

17.2 COST-EFFECTIVE BATTERY TECHNOLOGIES WITH HIGH ENERGY DENSITY THE NEED OF THE FUTURE

17.3 CONCLUSION

18 COMPETITIVE LANDSCAPE (Page No. - 219)

18.1 OVERVIEW

18.2 TRAIN BATTERY MARKET SHARE ANALYSIS, 2021

FIGURE 42 MARKET SHARE, 2021

TABLE 252 MARKET SHARE ANALYSIS FOR MARKET, 2022

18.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 43 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

18.4 COMPETITIVE EVALUATION QUADRANT

18.4.1 TERMINOLOGY

18.4.2 STAR

18.4.3 EMERGING LEADERS

18.4.4 PERVASIVE

18.4.5 PARTICIPANTS

TABLE 253 TRAIN BATTERY MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 254 MARKET: COMPANY APPLICATION FOOTPRINT, 2021

TABLE 255 MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 44 TRAIN BATTERY MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

18.5 COMPETITIVE EVALUATION QUADRANT – TRAIN BATTERY MANUFACTURERS

18.5.1 STAR

18.5.2 EMERGING LEADERS

18.5.3 PERVASIVE

18.5.4 PARTICIPANTS

18.6 COMPETITIVE SCENARIO

18.6.1 PRODUCT LAUNCHES

TABLE 256 PRODUCT LAUNCHES, 2018–2021

18.6.2 DEALS

TABLE 257 DEALS, 2018–2022

18.6.3 EXPANSIONS, 2019–2021

TABLE 258 EXPANSIONS, 2019–2021

18.7 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

TABLE 259 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2018–2021

19 COMPANY PROFILES (Page No. - 234)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

19.1 KEY PLAYERS

19.1.1 ENERSYS

TABLE 260 ENERSYS: BUSINESS OVERVIEW

FIGURE 45 ENERSYS: COMPANY SNAPSHOT

TABLE 261 ENERSYS– DEALS

TABLE 262 ENERSYS: PRODUCT LAUNCHES

19.1.2 SAFT

TABLE 263 SAFT: BUSINESS OVERVIEW

TABLE 264 SAFT– DEALS

TABLE 265 SAFT: EXPANSION

19.1.3 GS YUASA INTERNATIONAL LTD.

TABLE 266 GS YUASA INTERNATIONAL LTD.: BUSINESS OVERVIEW

FIGURE 46 GS YUASA INTERNATIONAL LTD.: COMPANY SNAPSHOT

TABLE 267 GS YUASA INTERNATIONAL LTD.: EXPANSION

TABLE 268 GS YUASA INTERNATIONAL LTD.: PRODUCT LAUNCHES

19.1.4 EXIDE INDUSTRIES LTD.

TABLE 269 EXIDE INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 47 EXIDE INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 270 EXIDE INDUSTRIES LTD.: DEALS

19.1.5 AMARA RAJA BATTERIES LTD.

TABLE 271 AMARA RAJA BATTERIES LTD.: BUSINESS OVERVIEW

FIGURE 48 AMARA RAJA BATTERIES LTD.: COMPANY SNAPSHOT

TABLE 272 AMARA RAJA BATTERIES: DEALS

19.1.6 HOPPECKE CARL ZOELLNER & SOHN GMBH

TABLE 273 HOPPECKE CARL ZOELLNER & SOHN GMBH: BUSINESS OVERVIEW

TABLE 274 HOPPECKE CARL ZOELLNER & SOHN GMBH: DEALS

TABLE 275 HOPPECKE CARL ZOELLNER & SOHN GMBH: EXPANSION

19.1.7 SEC BATTERY

TABLE 276 SEC BATTERY: BUSINESS OVERVIEW

19.1.8 FIRST NATIONAL BATTERY

TABLE 277 FIRST NATIONAL BATTERY: BUSINESS OVERVIEW

19.1.9 POWER & INDUSTRIAL BATTERY SYSTEMS GMBH

TABLE 278 POWER & INDUSTRIAL BATTERY SYSTEMS GMBH: BUSINESS OVERVIEW

19.2 TRAIN BATTERY MARKET – ADDITIONAL PLAYERS

19.2.1 HITACHI RAIL LIMITED

TABLE 279 HITACHI RAIL LIMITED: COMPANY OVERVIEW

19.2.2 EAST PENN MANUFACTURING COMPANY

TABLE 280 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

19.2.3 AEG POWER SOLUTIONS

TABLE 281 AEG POWER SOLUTIONS: COMPANY OVERVIEW

19.2.4 FURUKAWA ELECTRIC CO., LTD,

TABLE 282 FURUKAWA ELECTRIC CO., LTD: COMPANY OVERVIEW

19.2.5 HUNAN FENGRI POWER & ELECTRIC CO., LTD.

TABLE 283 HUNAN FENGRI POWER & ELECTRIC CO. LTD.: COMPANY OVERVIEW

19.2.6 SHUANGDENG GROUP CO., LTD.

TABLE 284 SHUANGDENG GROUP CO., LTD.: COMPANY OVERVIEW

19.2.7 COSLIGHT INDIA

TABLE 285 COSLIGHT INDIA: COMPANY OVERVIEW

19.2.8 SHIELD BATTERIES

TABLE 286 SHIELD BATTERIES: COMPANY OVERVIEW

19.2.9 AKASOL AG

TABLE 287 AKASOL AG: COMPANY OVERVIEW

19.2.10 DMS TECHNOLOGIES

TABLE 288 DMS TECHNOLOGIES: COMPANY OVERVIEW

19.2.11 NATIONAL RAILWAY SUPPLY

TABLE 289 NATIONAL RAILWAY SUPPLY: COMPANY OVERVIEW

19.2.12 LECLANCHÉ SA

TABLE 290 LECLANCHÉ SA: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

20 APPENDIX (Page No. - 271)

20.1 CURRENCY & PRICING

20.2 KEY INSIGHTS OF INDUSTRY EXPERTS

20.3 DISCUSSION GUIDE

20.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

20.5 AVAILABLE CUSTOMIZATIONS

20.5.1 TRAIN BATTERY MARKET, BY APPLICATION AND ROLLING STOCK

20.5.1.1 Engine Starters

20.5.1.2 Auxiliary Functions

20.5.2 TRAIN BATTERY MARKET, BY ROLLING STOCK AND BY BATTERY TYPE

20.5.2.1 Lead-acid

20.5.2.2 Nickel-Cadmium

20.5.2.3 Lithium-ion

20.6 RELATED REPORTS

20.7 AUTHOR DETAILS

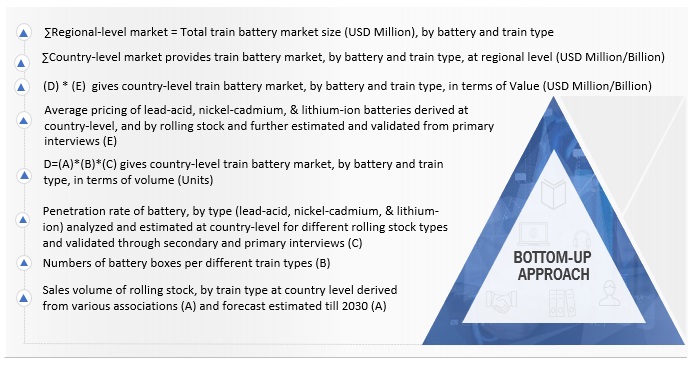

The study involved four major activities in estimating the current size of the train battery market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and industry associations. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

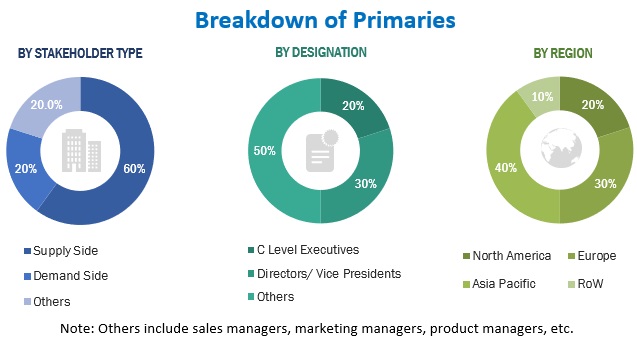

Extensive primary research has been conducted after acquiring an understanding of the train battery market through secondary research. Several primary interviews have been conducted with market experts from both, demand- (locomotive & rolling stock manufacturers) and supply-side (battery manufacturers) across major regions, namely, North America, Europe, Asia Pacific, and RoW. Approximately 60%, 20% and 10% of primary interviews were conducted from the supply-side, demand-side and others respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the primary research, we have strived to cover various departments within organizations, such as sales, operations, and administration, to enable a holistic approach in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings through the primaries conducted by us. This, along with the opinions of in-house subject matter experts, led us to the findings which have been delineated in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The study uses the bottom-up approach to estimate the market size and forecast the same for segments such as train type and battery type for each country considered under the scope of the study. The study covers the impact of the COVID-19 pandemic on the demand for various train types. The country-level forecast of train types is based on various secondary sources to understand the recovery period of the market and validate the same from industry experts. Once the base numbers were calculated, each train type was studied for the penetration of battery types in the same for all countries under the scope of the study. Then the Average Selling Price (ASP) was multiplied with each battery type for all train types to arrive at the country-wise value of the train and battery types. These numbers when collated represent the regional and global market size and forecast (volume as well as value) for train and battery types.

The top-down approach was used to estimate and validate the market size of the segment – battery technology. The market for battery type was arrived at using the bottom down approach to estimate the battery technology market. For instance, the market for the three types of lead-acid batteries (conventional lead-acid, VRLA, gel tubular) was arrived at using the base number of lead-acid batteries. This is done by referring to multiple secondary sources and validating the penetration of battery technologies (in each battery type) from various industry experts.

Train Battery Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides

Report Objectives

- To define, describe and forecast the market size of the train battery market, in terms of volume (units) and value (‘000 USD)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges)

-

To segment the market and forecast the market size, by value and volume, based on:

- Battery type - lead acid battery, nickel-cadmium battery, and lithium-ion battery

- Battery technology - conventional lead-acid battery, valve regulated lead-acid battery, Gel Tubular Lead Acid Battery, sinter/PNE Ni-Cd battery, pocket plate Ni-Cd battery, fiber/PNE Ni-Cd battery, lithium ion battery

- Rolling stock - diesel locomotives, DMUs, electric locomotives, EMUs, metros, high-speed trains, light trains/trams/monorails, passenger coaches

- Application - starter battery, auxiliary function battery (HVAC, doors, infotainment)

- Advance train - autonomous trains, hybrid locomotives, fully battery-operated trains

- Region – Asia Pacific, Europe, North America, and Rest of the World

- To analyze the market ranking of key manufacturers operating in the market

- To understand the competition in the market and position the players as stars, leaders, pervasive, and emerging companies according to their product portfolios, strengths, and business strategies

- To provide an analysis of the recent developments, alliances, joint ventures, and mergers & acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Train Battery Market, By Application, By Rolling Stock

- Engine Starter

- Auxiliary Function

Note: The segment would be further segmented by region.

Train Battery Market, By Rolling Stock, By Battery Type

- Lead Acid

- Nickel-Cadmium

- Lithium-Ion

Note: The segment would be further segmented by region

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Train Battery Market

We are interested in train battery market report, would like to understand how can we also gain a better understanding of "advanced train" application with the free customization you are offering