TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKETS COVERED

FIGURE 2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY AND PRICING

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS AND EXCLUSIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

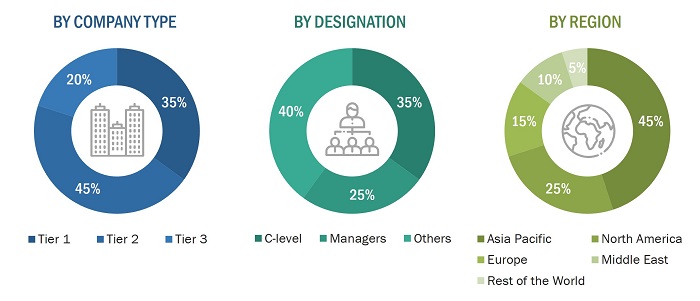

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

FIGURE 6 USV DEVELOPMENT PER REGION, 2019–2022

2.2.2 SUPPLY-SIDE INDICATORS

2.2.2.1 Impact of recession on biannual revenue of suppliers

FIGURE 7 EUROPE: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

FIGURE 8 ASIA PACIFIC: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

FIGURE 9 NORTH AMERICA: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

FIGURE 10 MIDDLE EAST: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

2.3 MARKET SIZE ESTIMATION

2.4 REPORT SCOPE

2.5 RESEARCH APPROACH

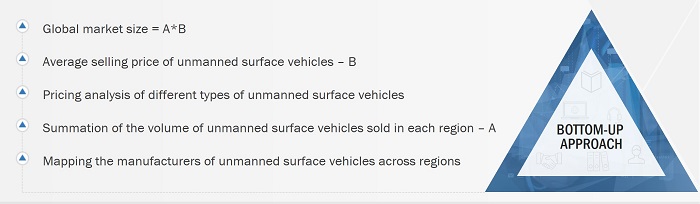

2.5.1 BOTTOM-UP APPROACH

FIGURE 11 BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 12 TOP-DOWN APPROACH

2.6 DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION

2.7 RESEARCH ASSUMPTIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 14 DEFENSE SEGMENT TO LEAD MARKET FROM 2022 TO 2027

FIGURE 15 SMALL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 16 PAYLOAD SEGMENT TO ACQUIRE LARGEST MARKET SHARE BY 2027

FIGURE 17 AUTONOMOUS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 18 SINGLE HULL TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 19 100–500 HOURS SEGMENT TO COMMAND LEADING MARKET POSITION BY 2027

FIGURE 20 MORE THAN 30 KNOTS SURPASSES OTHER CRUISING SPEEDS DURING FORECAST PERIOD

FIGURE 21 ASIA PACIFIC TO BE FASTEST-GROWING REGION FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNMANNED SURFACE VEHICLE MARKET

FIGURE 22 INCREASED INVESTMENTS IN DEVELOPMENT OF UNMANNED SURFACE VEHICLES

4.2 UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION

FIGURE 23 DEFENSE APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 UNMANNED SURFACE VEHICLE MARKET, BY ENDURANCE

FIGURE 24 100–500 HOURS SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4.4 UNMANNED SURFACE VEHICLE MARKET, BY SIZE

FIGURE 25 LARGE SEGMENT ACQUIRES MAXIMUM MARKET SHARE BY 2027

4.5 UNMANNED SURFACE VEHICLE MARKET, BY TYPE

FIGURE 26 AUTONOMOUS SEGMENT GROWS FASTER THAN SEMI-AUTONOMOUS

4.6 UNMANNED SURFACE VEHICLE MARKET, BY SYSTEM

FIGURE 27 PAYLOAD SYSTEM ACQUIRES LEADING MARKET POSITION DURING FORECAST PERIOD

4.7 UNMANNED SURFACE VEHICLE MARKET, BY HULL TYPE

FIGURE 28 SINGLE HULLS DOMINATE OTHER HULLS DURING FORECAST PERIOD

4.8 UNMANNED SURFACE VEHICLE MARKET, BY CRUISING SPEED

FIGURE 29 10–30 KNOTS SEGMENT TO HOLD LARGEST MARKET SHARE

4.9 UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY

FIGURE 30 US TO BE LARGEST COUNTRY-LEVEL MARKET

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 31 UNMANNED SURFACE VEHICLE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for water quality monitoring and ocean data mapping

5.2.1.2 Rise in asymmetric threats and need for maritime security

FIGURE 32 NUMBER OF PIRACY ATTACKS IN SELECTED TERRITORIES, 2020 VS. 2021

5.2.1.3 Increased capital expenditure of companies in offshore oil & gas industry

5.2.2 RESTRAINTS

5.2.2.1 Presence of low-cost substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in USV design

5.2.3.2 Growing use of unmanned surface vehicles in combat operations

5.2.4 CHALLENGES

5.2.4.1 Unclear navigation rules and need for human intervention

5.2.4.2 Development of collision avoidance systems and networking issues

5.3 RECESSION IMPACT ANALYSIS

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR UNMANNED SURFACE VEHICLE MANUFACTURERS

FIGURE 33 REVENUE SHIFT IN UNMANNED SURFACE VEHICLE MARKET

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 2 AVERAGE SELLING PRICE ANALYSIS, 2021

5.6 REGULATORY LANDSCAPE

5.6.1 NORTH AMERICA

TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.6.2 EUROPE

TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.6.3 ASIA PACIFIC

TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.6.4 MIDDLE EAST & AFRICA

TABLE 6 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.6.5 LATIN AMERICA

TABLE 7 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7 MARKET ECOSYSTEM

FIGURE 34 UNMANNED UNDERWATER VEHICLE MARKET ECOSYSTEM MAP

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

TABLE 8 UNMANNED SURFACE VEHICLE MARKET ECOSYSTEM

5.8 TRADE DATA

TABLE 9 COUNTRY-WISE IMPORTS, 2019–2021 (USD THOUSAND)

5.9 USE CASE ANALYSIS

5.9.1 LAUNCH AND RECOVERY

5.9.2 AUTONOMOUS CARGO SHIP

5.9.3 OCEANOGRAPHY

5.10 VALUE CHAIN ANALYSIS

FIGURE 35 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 36 PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 PATENT ANALYSIS

FIGURE 37 MAJOR PATENTS FOR UNMANNED SURFACE VEHICLES

TABLE 11 MAJOR PATENTS FOR UNMANNED SURFACE VEHICLES

5.13 TECHNOLOGY ANALYSIS

5.13.1 KEY TECHNOLOGY

5.13.1.1 Cross-platform operations

FIGURE 38 CROSS-PLATFORM OPERATIONS

5.13.1.2 Marine-AI software

5.13.1.3 Anti-collision technologies

5.13.2 SUPPORTING TECHNOLOGY

5.13.2.1 HD cameras

5.13.2.2 Object recognition

5.13.2.3 Mapping

5.13.2.4 Localization

5.13.2.5 Predictive maintenance

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ENDURANCE

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ENDURANCE (%)

5.14.2 BUYING CRITERIA

FIGURE 40 KEY BUYING CRITERIA FOR UNMANNED SURFACE VEHICLES, BY APPLICATION

TABLE 13 KEY BUYING CRITERIA FOR UNMANNED SURFACE VEHICLES, BY APPLICATION

5.15 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 14 CONFERENCES AND EVENTS

6 INDUSTRY TRENDS (Page No. - 90)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 41 SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY TRENDS

6.3.1 MODULAR SYSTEM

6.3.2 MARITIME SWARMING TECHNOLOGY

6.3.3 AUTONOMOUS REFUELING

6.3.4 COLLABORATIVE UNMANNED SYSTEM

6.3.5 SPECIAL MONITORING OF APPLIED RESPONSE TECHNOLOGY

6.3.6 CARACAS TECHNOLOGY

6.3.7 LAUNCH AND RECOVERY SYSTEM

6.4 IMPACT OF MEGA TRENDS

6.4.1 UNMANNED SURFACE VEHICLES AS WEAPONS OF WAR

6.4.2 DATA DISSEMINATION

6.4.3 ARTIFICIAL INTELLIGENCE

6.4.4 MARITIME AUTONOMY SURFACE TEST BED

6.4.5 3D PRINTING

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS

7 UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION (Page No. - 99)

7.1 INTRODUCTION

FIGURE 42 UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 16 UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 17 UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 43 UNMANNED SURFACE VEHICLE VOLUME, BY APPLICATION, 2018–2027 (UNITS)

TABLE 18 UNMANNED SURFACE VEHICLE VOLUME, BY APPLICATION, 2018–2027 (UNITS)

7.2 DEFENSE

FIGURE 44 UNMANNED SURFACE VEHICLE MARKET, BY DEFENSE APPLICATION, 2022–2027 (USD MILLION)

TABLE 19 UNMANNED SURFACE VEHICLE MARKET, BY DEFENSE APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 UNMANNED SURFACE VEHICLE MARKET, BY DEFENSE APPLICATION, 2022–2027 (USD MILLION)

FIGURE 45 UNMANNED SURFACE VEHICLE VOLUME, BY DEFENSE APPLICATION, 2018–2027 (UNITS)

TABLE 21 UNMANNED SURFACE VEHICLE VOLUME, BY DEFENSE APPLICATION, 2018–2027 (UNITS)

7.2.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

7.2.1.1 High demand for USVs due to ISR capabilities

7.2.2 MINE COUNTERMEASURE

7.2.2.1 Need for minesweeping and mine identification

7.2.3 HYDROGRAPHIC SURVEY

7.2.3.1 Capability of performing coastal surveillance and port patrol operations

7.2.4 ANTI-SUBMARINE WARFARE

7.2.4.1 Used for anti-submarine warfare

7.2.5 ELECTRONIC WARFARE

7.2.5.1 Development of USVs for use in electronic warfare

7.2.6 COMMUNICATION

7.2.6.1 Strategic & tactical superiority of unmanned systems and communication technology

7.2.7 NAVAL WARFARE

7.2.7.1 Need to mitigate risks

7.2.8 FIREFIGHTING

7.2.8.1 Deployment in firefighting and rescue operations

7.3 COMMERCIAL

FIGURE 46 UNMANNED SURFACE VEHICLE MARKET, BY COMMERCIAL APPLICATION, 2022–2027 (USD MILLION)

TABLE 22 UNMANNED SURFACE VEHICLE MARKET, BY COMMERCIAL APPLICATION, 2018–2021 (USD MILLION)

TABLE 23 UNMANNED SURFACE VEHICLE MARKET, BY COMMERCIAL APPLICATION, 2022–2027 (USD MILLION)

FIGURE 47 UNMANNED SURFACE VEHICLE VOLUME, BY COMMERCIAL APPLICATION, 2018–2027 (UNITS)

TABLE 24 UNMANNED SURFACE VEHICLE VOLUME, BY COMMERCIAL APPLICATION, 2018–2027 (UNITS)

7.3.1 WEATHER MONITORING

7.3.1.1 Used for collection of ocean data

7.3.2 SEARCH AND RESCUE

7.3.2.1 Better reliability for offshore rescue operations

7.3.3 ENVIRONMENT MONITORING

7.3.3.1 Demand for real-time data for weather forecast analysis and monitoring

7.3.4 INFRASTRUCTURE INSPECTION

7.3.4.1 Low maintenance and repair costs

7.3.5 HYDROGRAPHIC SURVEY

7.3.5.1 Used for surveying shallow depths of water bodies and shores

7.3.6 SECURITY

7.3.6.1 Increased threats over ports

7.3.7 FIREFIGHTING

7.3.7.1 Growing demand for shallow-water firefighting

8 UNMANNED SURFACE VEHICLE MARKET, BY SYSTEM (Page No. - 111)

8.1 INTRODUCTION

FIGURE 48 UNMANNED SURFACE VEHICLE MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 25 UNMANNED SURFACE VEHICLE MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 26 UNMANNED SURFACE VEHICLE MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

8.2 PROPULSION

FIGURE 49 ELECTRIC PROPULSION SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 27 PROPULSION: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 PROPULSION: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1 DIESEL/GASOLINE ENGINES

8.2.1.1 High energy and payload capacity

8.2.2 RENEWABLE

8.2.2.1 Reduced operating and maintenance costs

8.2.3 HYBRID

8.2.3.1 Improved endurance and payload weight carrying capacity

8.2.4 ELECTRIC

8.2.4.1 High demand for lithium-ion battery-based electric propulsion systems

8.3 COMMUNICATION

FIGURE 50 SATELLITE COMMUNICATION SEGMENT TO LEAD MARKET BY 2027

TABLE 29 COMMUNICATION: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 COMMUNICATION: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3.1 RADIO

8.3.1.1 Use of radios to receive commands from ground stations

8.3.2 WI-FI

8.3.2.1 Increased use of Wi-Fi-based communication for small-range operations

8.3.3 SATELLITE

8.3.3.1 Uninterrupted connectivity in harsh maritime conditions

8.3.4 UHF/VHF

8.3.4.1 Used in beyond-line-of-sight or beyond-the-horizon operations

8.3.5 OTHERS

8.4 PAYLOAD

FIGURE 51 CAMERAS SURPASS OTHER PAYLOAD SYSTEMS DURING FORECAST PERIOD

TABLE 31 PAYLOAD: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 32 PAYLOAD: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.4.1 CAMERAS

8.4.1.1 Precise visual and thermal data collection capabilities

8.4.2 SENSORS

8.4.2.1 Need for examining undersea cables

8.4.3 SONAR

8.4.3.1 Motion sensing and collision prevention capabilities

8.4.4 X-MARINE BAND RADARS

8.4.4.1 Need for understanding sea dynamics

8.4.5 VISUAL SYSTEMS

8.4.5.1 Widescale adoption in navy operations

8.4.6 LIDAR

8.4.6.1 Used in remote sensing applications

8.4.7 ECHO SOUNDERS

8.4.7.1 Used for bathymetry and other hydrographic surveys

8.4.8 OTHERS

8.5 CHASSIS MATERIAL

FIGURE 52 THERMOPLASTIC SEGMENT TO COMMAND LEADING MARKET POSITION BY 2027

TABLE 33 CHASSIS MATERIAL: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 34 CHASSIS MATERIAL: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.5.1 ALUMINUM

8.5.1.1 Malleable and non-corrosive properties

8.5.2 CARBON FIBER

8.5.2.1 High stiffness and low weight

8.5.3 THERMOPLASTIC

8.5.3.1 Better resistance to chemical attack

8.5.4 FIBERGLASS

8.5.4.1 Inexpensive and more flexible than others

8.6 COMPONENT

FIGURE 53 NAVIGATION, GUIDANCE, AND CONTROL SYSTEMS TO ACQUIRE LARGEST SHARE FROM 2022 TO 2027

TABLE 35 COMPONENT: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 36 COMPONENT: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.6.1 MOTORS

8.6.1.1 Major component of USVs

8.6.2 NAVIGATION, GUIDANCE, AND CONTROL SYSTEMS

8.6.2.1 NGC to be fastest-growing component

8.6.3 HARDWARE

8.6.3.1 Increased adoption of autonomous components

8.6.4 SOFTWARE

9 UNMANNED SURFACE VEHICLE MARKET, BY ENDURANCE (Page No. - 123)

9.1 INTRODUCTION

FIGURE 54 UNMANNED SURFACE VEHICLE MARKET, BY ENDURANCE, 2022–2027 (USD MILLION)

TABLE 37 UNMANNED SURFACE VEHICLE MARKET, BY ENDURANCE, 2018–2021 (USD MILLION)

TABLE 38 UNMANNED SURFACE VEHICLE MARKET, BY ENDURANCE, 2022–2027 (USD MILLION)

9.2 <100 HOURS

9.2.1 LARGE-SCALE ADOPTION IN COMMERCIAL AND DEFENSE APPLICATIONS

9.3 100–500 HOURS

9.3.1 USED FOR OCEANOGRAPHY AND RIVER MAPPING APPLICATIONS

9.4 500–1,000 HOURS

9.4.1 DEPLOYMENT IN OILFIELD SERVICES

9.5 >1,000 HOURS

9.5.1 USED IN MILITARY APPLICATIONS SUCH AS IISR, MCM, ASW, AND AMD MISSIONS

10 UNMANNED SURFACE VEHICLE MARKET, BY HULL TYPE (Page No. - 126)

10.1 INTRODUCTION

FIGURE 55 UNMANNED SURFACE VEHICLE MARKET, BY HULL TYPE, 2022–2030

TABLE 39 UNMANNED SURFACE VEHICLE MARKET, BY HULL TYPE, 2018–2021 (USD MILLION)

TABLE 40 UNMANNED SURFACE VEHICLE MARKET, BY HULL TYPE, 2022–2027 (USD MILLION)

10.2 SINGLE

10.2.1 CONVENIENT MOUNTING AND LOADING CAPABILITIES

10.3 TWIN

10.3.1 DEPLOYMENT IN MILITARY APPLICATIONS

10.4 TRIPLE

10.4.1 EXCELLENT SYSTEM STABILITY AND MINIMIZED RISK OF CAPSIZING IN ROUGH WATER

10.5 RIGID INFLATABLE

10.5.1 HIGH ENDURANCE AND PAYLOAD CAPACITY

11 UNMANNED SURFACE VEHICLE MARKET, BY CRUISING SPEED (Page No. - 129)

11.1 INTRODUCTION

FIGURE 56 UNMANNED SURFACE VEHICLE MARKET, BY CRUISING SPEED, 2022–2027 (USD MILLION)

TABLE 41 UNMANNED SURFACE VEHICLE MARKET, BY CRUISING SPEED, 2018–2021 (USD MILLION)

TABLE 42 UNMANNED SURFACE VEHICLE MARKET, BY CRUISING SPEED, 2022–2027 (USD MILLION)

11.2 LESS THAN 10 KNOTS

11.2.1 USED FOR HYDROGRAPHIC SURVEYS

11.3 10–30 KNOTS

11.3.1 INCREASED DEMAND FOR LAUNCH AND RECOVERY OPERATIONS

11.4 MORE THAN 30 KNOTS

11.4.1 DEPLOYMENT IN DEFENSE APPLICATIONS

12 UNMANNED SURFACE VEHICLE MARKET, BY TYPE (Page No. - 132)

12.1 INTRODUCTION

FIGURE 57 UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 44 UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2 SEMI-AUTONOMOUS

12.2.1 ENHANCED OPERATIONAL EFFICIENCY

12.3 AUTONOMOUS

12.3.1 ABILITY TO HANDLE CRITICAL MISSIONS IN MARINE WARFARE

13 UNMANNED SURFACE VEHICLE MARKET, BY SIZE (Page No. - 135)

13.1 INTRODUCTION

FIGURE 58 UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 45 UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 46 UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

FIGURE 59 UNMANNED SURFACE VEHICLE VOLUME, BY SIZE, 2018–2027 (UNITS)

TABLE 47 UNMANNED SURFACE VEHICLE VOLUME, BY SIZE, 2018–2027 (UNITS)

13.2 SMALL (<3 METERS)

13.2.1 HIGH DEMAND FROM COMMERCIAL SECTOR

13.3 MEDIUM (3–7 METERS)

13.3.1 USED FOR PRE-WAR AND POST-WAR MAINTENANCE AND SUPPORT

13.4 LARGE 7–14 METERS

13.4.1 USED FOR MINE COUNTERMEASURE MISSIONS, ANTI-SUBMARINE WARFARE, AND MARITIME SHIELDS

13.5 EXTRA LARGE >14 METERS

13.5.1 DEPLOYMENT IN MISSIONS REQUIRING LARGE PAYLOADS AND HIGH AUTONOMY

14 UNMANNED SURFACE VEHICLE MARKET, BY REGION (Page No. - 140)

14.1 INTRODUCTION

FIGURE 60 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 48 UNMANNED SURFACE VEHICLE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 UNMANNED SURFACE VEHICLE MARKET, BY REGION, 2022–2027 (USD MILLION)

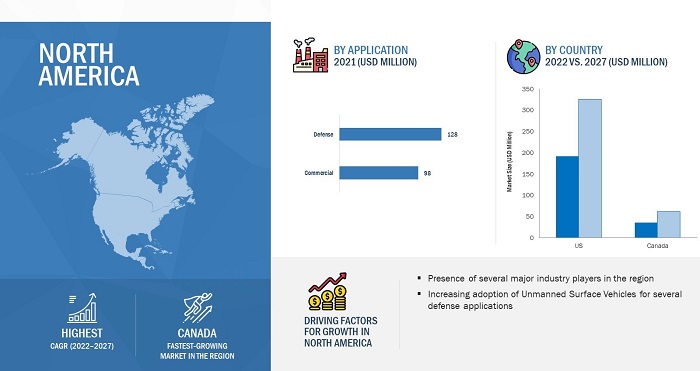

14.2 NORTH AMERICA

14.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 61 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

14.2.2 IMPACT OF RECESSION ON NORTH AMERICA

FIGURE 62 NAVAL BUDGET TREND, BY COUNTRY (2019–2022)

TABLE 58 NORTH AMERICA: RECESSION IMPACT ANALYSIS

14.2.3 US

14.2.3.1 High adoption of USVs for anti-submarine warfare, mine countermeasure, and other defense applications

TABLE 59 US: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 US: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 US: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 62 US: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 63 US: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 64 US: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.2.4 CANADA

14.2.4.1 Strategic decisions for developing indigenous marine industry

TABLE 65 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 68 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 69 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 70 CANADA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3 ASIA PACIFIC

14.3.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 63 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET SNAPSHOT

TABLE 71 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 72 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 76 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 78 ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.2 IMPACT OF RECESSION ON ASIA PACIFIC

FIGURE 64 NAVAL BUDGET TREND, BY COUNTRY (2019–2022)

TABLE 79 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

14.3.3 CHINA

14.3.3.1 Increased adoption of unmanned systems

TABLE 80 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 83 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 84 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 CHINA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.4 INDIA

14.3.4.1 Lucrative growth opportunities for USVs in Indian Navy

TABLE 86 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 89 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 90 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 INDIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.5 JAPAN

14.3.5.1 High demand for USVs in border security & surveillance applications

TABLE 92 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 95 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 96 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 JAPAN: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.6 SOUTH KOREA

14.3.6.1 Government support for developing USVs

TABLE 98 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 101 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 102 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 SOUTH KOREA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.7 AUSTRALIA

14.3.7.1 Continuous developments in autonomous systems

TABLE 104 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 107 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 108 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 AUSTRALIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.3.8 REST OF ASIA PACIFIC

TABLE 110 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 115 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4 EUROPE

14.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 65 EUROPE: UNMANNED SURFACE VEHICLE MARKET SNAPSHOT

TABLE 116 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 121 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 123 EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.2 IMPACT OF RECESSION ON EUROPE

FIGURE 66 NAVAL BUDGET TREND, BY COUNTRY (2019–2022)

TABLE 124 EUROPE: RECESSION IMPACT ANALYSIS

14.4.3 UK

14.4.3.1 Use of USVs in oil & gas industry surveys

TABLE 125 UK: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 UK: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 UK: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 128 UK: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 129 UK: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 UK: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.4 GERMANY

14.4.4.1 Development of new technologies for conserving resources

TABLE 131 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 134 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 135 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 GERMANY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.5 FRANCE

14.4.5.1 Need for mine countermeasure USVs

TABLE 137 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 140 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 141 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 142 FRANCE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.6 ITALY

14.4.6.1 Demand for USVs for exploring archeological sites in North Tyrrhenian Sea

TABLE 143 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 146 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 147 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 ITALY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.7 NORWAY

14.4.7.1 Use of USVs in coastal surveillance and combatting illegal drug trade

TABLE 149 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 151 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 152 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 153 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 154 NORWAY: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.4.8 REST OF EUROPE

TABLE 155 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 158 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 159 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 160 REST OF EUROPE: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.5 MIDDLE EAST

14.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 67 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET SNAPSHOT

TABLE 161 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 162 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 164 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 166 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 167 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 168 MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

14.5.2 IMPACT OF RECESSION ON MIDDLE EAST

FIGURE 68 NAVAL BUDGET TREND, BY COUNTRY (2019–2022)

TABLE 169 MIDDLE EAST: RECESSION IMPACT ANALYSIS

14.5.3 SAUDI ARABIA

14.5.3.1 Need for cyber-defense

TABLE 170 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 171 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 173 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 174 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 175 SAUDI ARABIA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.5.4 ISRAEL

14.5.4.1 Military modernization programs

TABLE 176 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 177 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 179 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 180 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 181 ISRAEL: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.5.5 REST OF MIDDLE EAST

TABLE 182 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 183 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 185 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 186 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.6 REST OF THE WORLD

14.6.1 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 69 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET SNAPSHOT

TABLE 188 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 189 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 191 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 192 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 193 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 195 REST OF THE WORLD: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

14.6.2 IMPACT OF RECESSION ON REST OF THE WORLD

FIGURE 70 NAVAL BUDGET TREND, BY COUNTRY (2019–2022)

TABLE 196 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

14.6.3 LATIN AMERICA

14.6.3.1 Heavy investment in offshore oil & gas drilling activities

TABLE 197 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.6.4 AFRICA

14.6.4.1 Growth of commercial application segment

TABLE 203 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 204 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 205 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 206 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 207 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 208 AFRICA: UNMANNED SURFACE VEHICLE MARKET, BY TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 207)

15.1 INTRODUCTION

TABLE 209 KEY DEVELOPMENTS BY LEADING PLAYERS IN UNMANNED SURFACE VEHICLE MARKET, 2018–2021

15.2 REVENUE ANALYSIS, 2021

FIGURE 71 REVENUE ANALYSIS OF LEADING MARKET PLAYERS, 2021

15.3 MARKET SHARE ANALYSIS, 2021

FIGURE 72 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

TABLE 210 DEGREE OF COMPETITION

15.4 RANK ANALYSIS, 2021

FIGURE 73 REVENUE SHARE OF TOP FIVE MARKET PLAYERS, 2021

15.5 COMPANY EVALUATION QUADRANT

15.5.1 COMPETITIVE LEADERSHIP MAPPING (KEY PLAYERS)

15.5.1.1 Stars

15.5.1.2 Emerging leaders

15.5.1.3 Pervasive players

15.5.1.4 Participants

FIGURE 74 COMPETITIVE LEADERSHIP MAPPING (KEY PLAYERS)

15.5.2 COMPETITIVE LEADERSHIP MAPPING (SMES)

15.5.2.1 Progressive companies

15.5.2.2 Responsive companies

15.5.2.3 Starting blocks

15.5.2.4 Dynamic companies

FIGURE 75 COMPETITIVE LEADERSHIP MAPPING (SMES)

15.6 COMPANY FOOTPRINT ANALYSIS

TABLE 211 COMPANY FOOTPRINT

TABLE 212 COMPANY PRODUCT FOOTPRINT

TABLE 213 COMPANY REGIONAL FOOTPRINT

15.7 COMPETITIVE SCENARIO AND TRENDS

15.7.1 DEALS

TABLE 214 DEALS, 2018–2021

15.7.2 PRODUCT LAUNCHES

TABLE 215 PRODUCT LAUNCHES, 2018–2021

15.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 216 KEY STARTUPS/SMES

TABLE 217 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

16 COMPANY PROFILES (Page No. - 223)

16.1 INTRODUCTION

16.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

16.2.1 L3HARRIS TECHNOLOGIES

TABLE 218 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 76 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 219 L3HARRIS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 L3HARRIS TECHNOLOGIES: PRODUCT DEVELOPMENT

TABLE 221 L3HARRIS TECHNOLOGIES: DEALS

16.2.2 FUGRO

TABLE 222 FUGRO: BUSINESS OVERVIEW

FIGURE 77 FUGRO: COMPANY SNAPSHOT

TABLE 223 FUGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 FUGRO: DEALS

16.2.3 TEXTRON INC.

TABLE 225 TEXTRON INC.: BUSINESS OVERVIEWS

FIGURE 78 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 226 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 227 TEXTRON INC.: DEALS

16.2.4 ECA GROUP

TABLE 228 ECA GROUP: BUSINESS OVERVIEW

FIGURE 79 ECA GROUP: COMPANY SNAPSHOT

TABLE 229 ECA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 230 ECA GROUP: DEALS

16.2.5 THALES GROUP

TABLE 231 THALES GROUP: BUSINESS OVERVIEW

FIGURE 80 THALES GROUP: COMPANY SNAPSHOT

TABLE 232 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.6 TELEDYNE TECHNOLOGIES

TABLE 233 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 81 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 234 TELEDYNE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 TELEDYNE TECHNOLOGIES: PRODUCT DEVELOPMENT

TABLE 236 TELEDYNE TECHNOLOGIES: DEALS

16.2.7 ELBIT SYSTEMS

TABLE 237 ELBIT SYSTEMS: BUSINESS OVERVIEW

FIGURE 82 ELBIT SYSTEMS: COMPANY SNAPSHOT

TABLE 238 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 239 ELBIT SYSTEM: PRODUCT DEVELOPMENT

TABLE 240 ELBIT SYSTEMS: DEALS

16.2.8 KONGSBERG MARITIME

TABLE 241 KONGSBERG MARITIME: BUSINESS OVERVIEW

FIGURE 83 KONGSBERG MARITIME: COMPANY SNAPSHOT

TABLE 242 KONGSBERG MARITIME: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 243 KONGSBERG MARITIME: DEALS

16.2.9 QINETIQ

TABLE 244 QINETIQ: BUSINESS OVERVIEW

FIGURE 84 QINETIQ: COMPANY SNAPSHOT

TABLE 245 QINETIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.10 SAAB AB

TABLE 246 SAAB AB: BUSINESS OVERVIEW

FIGURE 85 SAAB AB: COMPANY SNAPSHOT

TABLE 247 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 248 SAAB AB: PRODUCT DEVELOPMENT

16.2.11 ATLAS ELEKTRONIK GMBH

TABLE 249 ATLAS ELEKTRONIK GMBH: BUSINESS OVERVIEW

FIGURE 86 THYSSENKRUPP AG: COMPANY SNAPSHOT

TABLE 250 ATLAS ELEKTRONIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.12 SEAROBOTICS

TABLE 251 SEAROBOTICS: BUSINESS OVERVIEW

TABLE 252 SEAROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 253 SEAROBOTICS: PRODUCT DEVELOPMENT

TABLE 254 SEAROBOTICS: DEALS

16.2.13 RAFAEL ADVANCED DEFENSE SYSTEMS

TABLE 255 RAFAEL ADVANCED DEFENSE SYSTEMS: BUSINESS OVERVIEW

TABLE 256 RAFAEL ADVANCED DEFENSE SYSTEMS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

16.2.14 5G INTERNATIONAL

TABLE 257 5G INTERNATIONAL: BUSINESS OVERVIEW

TABLE 258 5G INTERNATIONAL: PRODUCT/SOLUTIONS/SERVICES OFFERED

16.2.15 LIQUID ROBOTICS

TABLE 259 LIQUID ROBOTICS: BUSINESS OVERVIEW

TABLE 260 LIQUID ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 261 LIQUID ROBOTICS: DEALS

16.2.16 MARITIME TACTICAL SYSTEMS (MARTAC)

TABLE 262 MARTAC: BUSINESS OVERVIEW

TABLE 263 MARTAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.17 CLEARPATH ROBOTICS

TABLE 264 CLEARPATH ROBOTICS: BUSINESS OVERVIEW

TABLE 265 CLEARPATH ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.18 OCEAN AERO

TABLE 266 OCEAN AERO: BUSINESS OVERVIEW

TABLE 267 OCEAN AERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 OCEAN AERO: DEALS

16.2.19 DEEP OCEAN ENGINEERING

TABLE 269 DEEP OCEAN ENGINEERING: BUSINESS OVERVIEW

TABLE 270 DEEP OCEAN ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.20 MARINE ADVANCED RESEARCH

TABLE 271 MARINE ADVANCED RESEARCH: BUSINESS OVERVIEW

TABLE 272 MARINE ADVANCED RESEARCH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

16.2.21 SAILDRONE

TABLE 273 SAILDRONE: BUSINESS OVERVIEW

TABLE 274 SAILDRONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 SAILDRONE: DEALS

16.2.22 SEAFLOOR SYSTEMS

TABLE 276 SEAFLOOR SYSTEMS: BUSINESS OVERVIEW

TABLE 277 SEAFLOOR SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.2.23 OCIUS TECHNOLOGIES

TABLE 278 OCIUS TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 279 OCIUS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 280 OCIUS TECHNOLOGIES: DEALS

16.3 OTHER PLAYERS

16.3.1 ZHUHAI YUNZHOU INTELLIGENCE TECHNOLOGY

TABLE 281 ZHUHAI YUNZHOU INTELLIGENCE TECHNOLOGY: COMPANY OVERVIEW

16.3.2 MARINE ROBOTICS

TABLE 282 MARINE ROBOTICS: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 276)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unmanned Surface Vehicles Market

We are developing small USV and associated systems and we are searching for the global business volume figures for a study.

I'd like know only the data of the global market for monitoring water of the ocean. Thanks for your time.