Warehouse Robotics Market by Type (AMR, AGV, Articulated, Cylindrical and SCARA) Function (Pick & Place, Palletizing & Depalletizing, Transportation, Packaging), Payload, Industry, and Region, 2026

Updated on : May 09, 2023

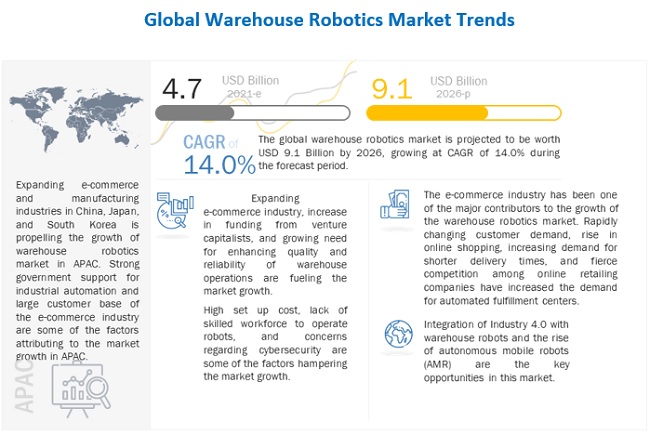

The Warehouse Robotics Market in terms of revenue was estimated to be worth $4.7 billion in 2021 and is poised to reach $9.1 billion by 2026, growing at a CAGR of 14.0% from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

Warehouse robotics is implemented to automate various warehousing functions such as palletizing, de-palletizing,transportation, picking and placing, and packaging. The use of robots in warehouses reduces the need for human intervention thereby reducint human error and increases the efficiency of warehouse operations. They also find applications in various industries, such as e-commerce, automotive, electrical & electronics, food & beverage, and pharmaceutical.

To know about the assumptions considered for the study, Request for Free Sample Report

Warehouse Robotics with Maximizing Efficiency and Reducing Costs

Several factors are driving the warehouse robotics market, including rising demand for automation in the logistics and supply chain industries, the growing need for efficient and cost-effective warehouse operations, and advancements in robotics technology. The rise of e-commerce and the increasing volume of goods shipped globally are also surging this market forward. Adoption of warehouse robotics assists companies in enhancing operational efficiency, lowering labour costs, and increasing order fulfilment accuracy. The growing emphasis in the logistics and supply chain industry on reducing waste and improving sustainability is also fueling the growth of the warehouse robotics industry. The warehouse robotics market is expected to grow significantly over the next few years, thanks to numerous opportunities for growth and innovation.

Warehouse Robotics Market Dynamics

Driver: Increase in funding from venture capitalists

In the past few years, the warehouse robotics ecosystem has witnessed a significant increase in the number of start-ups. Fetch Robotics, Inc. (US), IAM Robotics (US), Magazino GmbH (Germany), GreyOrange Pte Ltd. (US), Locus Robotics (US), Geek+ Inc. (China), and InVia Robotics, Inc. (US) are examples of some of the fastest-growing start-ups. These players are offering cost-effective, flexible, and efficient mobile robots that can be used for automating various warehouse operations, such as storage and retrieval, palletizing and de-palletizing, transportation, and packaging. In this ecosystem, venture capitalists are actively funding start-ups. For instance in May 2022 GreyOrange secured a funding of USd 110 million. As the flow of funds for new and emerging players in the warehouse robotics market is growing the market is also expanding.

Restraint: Lack of skilled workforce to operate robots

Warehouse robotics is a multidisciplinary field, where acquiring and retaining qualified workers is a major issue. There is a scarcity of people specializing in fields such as electrical, embedded, and software. Moreover, there is a shortage of highly qualified workforce with specific educational backgrounds and skills, especially the ones needed to develop high-value-added robots integrated with advanced technologies. The scarcity of a skilled workforce that can operate and manage warehouse robots is a major restraint for the market growth.

Opportunity: Rise of autonomous mobile robots (AMR)

The emergence of AMRs for warehouse and material handling applications has created a lucrative opportunity for companies offering warehouse robotics. The usage of an AMR is safer than manual transportation of materials, such as manned forklifts. These robots are equipped with safety sensors that prevent them from a collision. Their accuracy varies based on functionality and how their work affects safety and efficiency in different environments. The estimation of the location and surroundings could be more or less accurate depending on the sensors and algorithms used in AMRs. Furthermore, technological advancements in AMRs are also creating an opportunity for the integration of AI in warehouse robots.

Challenge: Lack of awareness in developing countries

The awareness regarding warehouse-related technologies currently available is low because of the market fragmentation and a limited number of existing users. Similarly, most of the end users in developing countries such as India, Brazil, Indonesia, Chile, and Colombia are not aware of the benefits of warehouse robots. This lack of awareness can be a challenging factor for the market players because of the limited number of new end users.

Automated Guided Vehicles (AGVs)to hold the second largestmarket during the forecast period

AGVs are estimated to be the second highest market in terms of market share due to the increasing adoption across the retil and logistics industries. Additionally, AGVs offer benefits such as reduced labor costs, higher inventory efficiency and accuracy and enhanced workplace safety allowing the AGVs market to hold a substantial market share after AMRs.

Automotive is expected towitnessthe secondfastest growth during the forecast period

Automotive industry accounts for ~17% of the warehous robotics market in the year 2021. Automotive vertical is highly competitive and the players in the vertical constantly try to offer a differentiated value throught improved warehousing automation. Automotive is one of the largest end user for robots in its manufacturing and warehousing operations.The use of robots has enabled efficient material handling in the warehouses and reduced the time to market the products. Simultaneously, with the use of robots, suppliers are trying to reduce the cost of unproductive labor hours and maximize productivity.

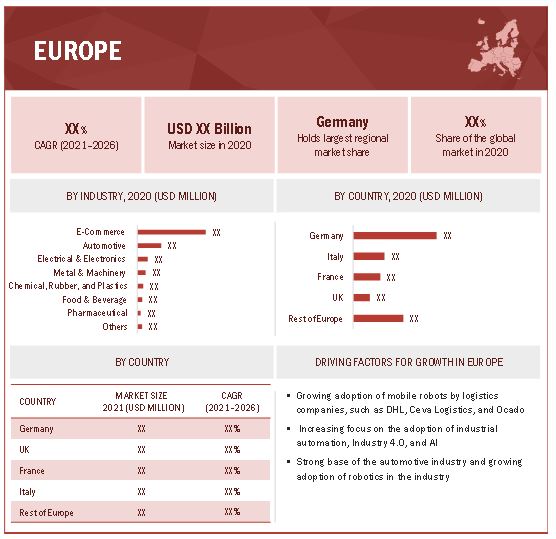

Europw is expected to hold the second largest market for the warehouse robotics marketin 2021

Europe region is the second largest market for the warehouse robotics market globally in 2021.The Europe region benefits from the large automotive and manufacturing industry presence. Countries like UK, Germany and France are witnessing rapid growth in the adoption of warehousing robots. Additionally the government support to improve the infrastructure for warehousing robotics in various industries such as ecommerce, pharmaceutical, and machinery has allowed the warehous robotics market to expand in Europe. While Germany holds the largest market share in Europe, UK is the fastest growing market in the region. The high demand for warehouse robotics in Germany is attributed to the huge automotive industry in the country.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The warehouse robotics companies such as ABB (Switzerland), KUKA (Germany), KION GROUP (Germany), Daifuku (Japan), and FANUC (Japan), GeekplusTechnology(), Greyorange(), Murata Machinery(), Omron Corporation(), and Toyota Industries.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 4.7 Billion |

| Revenue Forecast in 2026 | USD 9.1 Billion |

| Growth Rate | 14.0% |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the warehouse robotics market based on value by type, by function, by payload capacity, by industry, by component, by software at the regional and global levels.

By Type

-

Autonomous Mobile Robot (AMR),

-

AMR Market, By Technology

- Laser/Lidar

- Vision Guidance

- Others

-

AMR Market, By Technology

-

Automated Guided Vehicle (AGV)

-

AGV Market, By Type

- Pallet Trucks And Light Load AGVS

- Forklifts

- Towing AGV

- Unit Load AGV And Other Load AGV

-

AGV Market, By Technology

- Magnetic Tape

- Inductive

- Laser

- Vision-Based System

- Optical Tape

-

AGV Market, By Type

- Articulated Robots

-

Cylindrical And SCARA Robots

- Cylindrical Robots

- SCARA Robots

- Collaborative Robots

-

Others

- Parallel Robots

- Cartesian Robots

By Function

- Picking And Placing

- Palletizing And De-Palletizing

- Transportation

- Sorting And Packaging

By Payload Capacity

- Less Than 20kg

- 20–100 Kg

- 100–200 Kg

- More Than 200 Kg

By Industry

- E-Commerce

- Automotive

- Electrical & Electronics

- Metal & Machinery

- Chemical, Rubber, And Plastics

- Food & Beverage

- Pharmaceutical

-

Others

- Paper & Printing

- Textile & Clothing

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of APAC

-

Rest of the World

- South America

- Middle East & Africa

Recent Developments

- In May 2022, ABB launched the “ABB Robotic Depalletizer” which is a solution for handling complex depalletizing tasks in industries such as healthcare, e-commerce, logistics, and consumer packaged goods.By implementing machine vision technology, this new solution can quickly assess a wide variety of box types, enabling customers to efficiently process assorted loads with very little engineering effort and short set-up time.

- In May 2022, GreyOrange raised USD 110 million. In this funding, GreyOrange opted for growth financing, backed by Mithril Capital Management, with support from BlackRock.

- In January 2022, Fanuc America, launched the M-1000iA robot with capability to handle very heavy products including construction materials, automotive components, and battery packs for electric vehicles.M-1000iA is Fanuc’s largest serial-link robot as of January 2022.

- In July 2021, Omron Automation Americas, a subsidiary of Omron Corporation, has launched a heavy-duty mobile robot with a payload capacity of 1500 Kg. The HD-1500 mobile robot can handle bulky objects allowing manufacturers to expand their options for autonomous material transport.

Frequently Asked Questions (FAQ):

What is the current size of the global warehouse robotics market?

The global warehouse robotics market size is expected to be USD 4.7 Billion in 2021 to USD 9.1 Billion by 2026, at a CAGR of 14.0%.

What are the major driving factors and opportunities in the warehouse robotics market?

The rapidly growinge-commerce industry, large volumes of fundings from venture capitalists, and high demand for enhancing quality and reliability of warehouse operations are driving the warehouse robotics market growth. Evolution of Industry 4.0 with warehouse robots and the growing adoption of of autonomous mobile robots (AMR) are the key opportunities in this market.

Who are the star players in the global warehouse robotics market?

ABB (Switzerland), KION GROUP (Germany), KUKA (Germany), FANUC (Japan) and Daifuku (Japan)are considered as starplayers in the warehouse robotics market. These companies focus on consumer requirements and provide customized products.Furthermore, these players have robust supply chain strategies with their huge network of suppliers and distributors giving them an edge over the other players in the market.

What are the major strategies adopted by the prominent players?

Prominent players in the warehouse robotics market have implemented strategies such as product launches, acquisitions, partnerships, mutual agreements and sales contracts to expand or grow.

Which region is expected to hold the largest market share in warehouse robotics market during the forecast period?

Asia Pacific contributes the largest market share in warehouse robotics market during the forecast period.

What are the benefits of using robots in warehouses?

The benefits of using robots in warehouses include reducing the need for human intervention and thus reducing human error, increasing efficiency of warehouse operations, and finding applications in various industries such as e-commerce, automotive, electrical & electronics, food & beverage, and pharmaceutical.

What are the various functions of warehouse robotics?

The various functions of warehouse robotics include palletizing, de-palletizing, transportation, picking and placing, and packaging.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

FIGURE 1 WAREHOUSE ROBOTICS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 WAREHOUSE ROBOTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 WAREHOUSE ROBOTICS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 4 TOP TOWN APPROACH: MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 SUPPLY SIDE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 SUPPLY SIDE

2.2.1.2 Market projections (Factor analysis)

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for capturing market share by bottom-up analysis (demand side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 AMR SEGMENT TO REGISTER HIGHEST CAGR IN WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

FIGURE 8 WAREHOUSE ROBOTICS MARKET FOR TRANSPORTATION FUNCTION TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 E-COMMERCE INDUSTRY TO REGISTER HIGHEST CAGR IN WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

FIGURE 10 APAC WAREHOUSE ROBOTICS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 2 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF WAREHOUSE ROBOTICS MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

TABLE 3 WAREHOUSE ROBOTICS MARKET—COVID 19 IMPACT ANALYSIS

FIGURE 12 WAREHOUSE ROBOTICS MARKET: IMPACT ANALYSIS OF COVID-19

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN WAREHOUSE ROBOTICS MARKET

FIGURE 13 INCREASING INVESTMENTS IN WAREHOUSE AUTOMATION TO CREATE GROWTH OPPORTUNITIES FOR WAREHOUSE ROBOTICS MARKET

4.2 WAREHOUSE ROBOTICS MARKET, BY FUNCTION

FIGURE 14 TRANSPORTATION SEGMENT TO REGISTER HIGHEST CAGR IN WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

4.3 WAREHOUSE ROBOTICS MARKET IN APAC, BY INDUSTRY AND COUNTRY

FIGURE 15 E-COMMERCE INDUSTRY AND CHINA HELD LARGEST SHARES OF WAREHOUSE ROBOTICS MARKET IN 2020

4.4 COUNTRY-WISE GROWTH RATE OF WAREHOUSE ROBOTICS MARKET

FIGURE 16 CHINA WAREHOUSE ROBOTICS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 IMPACT OF DRIVERS AND OPPORTUNITIES ON WAREHOUSE ROBOTICS MARKET

FIGURE 18 IMPACT OF RESTRAINTS AND CHALLENGES ON WAREHOUSE ROBOTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Expanding e-commerce industry

5.2.1.2 Increase in funding from venture capitalists

FIGURE 19 INVESTMENTS BY SEVERAL COMPANIES IN WAREHOUSE ROBOTICS, 2019

5.2.1.3 Growing need for enhancing quality and reliability of warehouse operations

5.2.1.4 Growing adoption of warehouse robotics by small- and medium-sized enterprises (SMEs)

5.2.2 RESTRAINTS

5.2.2.1 High set up cost

5.2.2.2 Lack of skilled workforce to operate robots

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of Industry 4.0 with warehouse robots

5.2.3.2 Rise of autonomous mobile robots (AMR)

5.2.4 CHALLENGES

5.2.4.1 Concerns regarding cybersecurity

5.2.4.2 Lack of awareness in developing countries

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS OF WAREHOUSE ROBOTICS ECOSYSTEM: COMPONENT MANUFACTURERS, SOFTWARE PROVIDERS, AND MANUFACTURERS COLLECTIVELY CONTRIBUTE MAXIMUM VALUE

5.4 ECOSYSTEM/MARKET MAP

FIGURE 21 WAREHOUSE ROBOTICS MARKET ECOSYSTEM

FIGURE 22 WAREHOUSE ROBOTICS MARKET PLAYER ECOSYSTEM

5.4.1 R&D INSTITUTES

5.4.2 ROBOT MANUFACTURERS

5.4.3 SYSTEM INTEGRATORS

5.4.4 END USERS

5.5 WAREHOUSE ROBOTICS MARKET: SUPPLY CHAIN

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES IMPACT ON WAREHOUSE ROBOTICS MARKET

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: BLOCKCHAIN AS A SERVICE MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS (YC-YCC SHIFT)

FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS (YC-YCC SHIFT) FOR WAREHOUSE ROBOTICS MARKET

5.8 CASE STUDIES

5.8.1 WALMART FOCUSES ON ROBOT-STAFFED WAREHOUSES TO HANDLE ONLINE ORDERS

5.8.2 COCA-COLA DEPLOYED ROBOTS AT ITS FACILITIES ACROSS EMEA

5.8.3 FEDEX USES ROBOTIC ARMS IN ITS SUPERHUB

5.8.4 IKEA CHOSE SWISSLOG TO IMPLEMENT PALLET WAREHOUSE SOLUTIONS

5.8.5 UPS INSTALLED AUTONOMOUS MOBILE ROBOTS, SUPPLY CHAIN TECH TO BOOST WAREHOUSE PRODUCTIVITY

5.8.6 NIKE INTEGRATED ROBOTS FROM GEEK+ INTO ITS JAPAN WAREHOUSE

5.8.7 MITSUBISHI LOGISNEXT HAS SCALED UP REMOTE OPERATIONS OF UNMANNED FORKLIFTS

5.9 TARIFFS, STANDARDS, AND REGULATIONS

5.9.1 TARIFFS

5.9.2 STANDARDS AND REGULATIONS

5.9.2.1 Europe

5.9.2.2 North America

5.9.2.3 APAC

5.9.2.4 Global

5.10 TECHNOLOGY ANALYSIS

5.10.1 KEY TECHNOLOGIES

5.10.1.1 Intelligent warehousing robots

5.10.1.2 Mobile rack goods-to-person (GTP) AMR robots

5.10.2 ADJACENT TECHNOLOGIES

5.10.2.1 Drones

5.10.2.2 AI and machine learning

5.11 TECHNOLOGY TRENDS

5.11.1 ADOPTION OF BLOCKCHAIN IN WAREHOUSE ROBOTICS

5.11.2 ADOPTION OF PORTABLE DEVICES, SMARTPHONES, AND TABLETS IN WAREHOUSE ROBOTICS

5.11.3 PICK-TO-VOICE SYSTEMS AND WAREHOUSE ROBOTICS

5.11.4 CLOUD-BASED WAREHOUSE MANAGEMENT SYSTEM (WMS) SOFTWARE

5.12 PATENT ANALYSIS

FIGURE 25 NUMBER OF PATENTS GRANTED FOR WAREHOUSE ROBOTICS IN A YEAR OVER LAST 10 YEARS

5.12.1 LIST OF MAJOR PATENTS

TABLE 5 LIST OF MAJOR PATENTS GRANTED FOR WAREHOUSE ROBOTICS, 2017–2021

5.13 AVERAGE SELLING PRICE (ASP) ANALYSIS

FIGURE 26 AVERAGE SELLING PRICE (ASP) ANALYSIS OF WAREHOUSE ROBOTICS

5.14 TRADE DATA

5.14.1 IMPORT DATA

FIGURE 27 IMPORT DATA FOR HS CODE 847950, BY COUNTRY, 2016–2020

TABLE 6 IMPORT DATA FOR HS CODE 847950, BY COUNTRY, 2016–2020 (USD BILLION)

5.14.2 EXPORT DATA

FIGURE 28 EXPORT DATA FOR HS CODE 847950, BY COUNTRY, 2016–2020

TABLE 7 EXPORT DATA FOR HS CODE 847950, BY COUNTRY, 2016–2020 (USD BILLION)

6 WAREHOUSE ROBOTICS MARKET, BY TYPE (Page No. - 99)

6.1 INTRODUCTION

FIGURE 29 WAREHOUSE ROBOTICS MARKET FOR AMR TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 WAREHOUSE ROBOTICS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 9 WAREHOUSE ROBOTICS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 10 WAREHOUSE ROBOTICS MARKET SIZE IN TERMS OF VOLUME, BY TYPE, 2020–2026 (THOUSAND UNITS)

6.2 AUTONOMOUS MOBILE ROBOT (AMR)

TABLE 11 WAREHOUSE ROBOTICS MARKET FOR AMR, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 12 WAREHOUSE ROBOTICS MARKET FOR AMR, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 30 E-COMMERCE SEGMENT TO DOMINATE WAREHOUSE ROBOTICS MARKET FOR AMR DURING FORECAST PERIOD

TABLE 13 WAREHOUSE ROBOTICS MARKET FOR AMR, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 14 WAREHOUSE ROBOTICS MARKET FOR AMR, BY INDUSTRY, 2021–2026 (USD MILLION)

6.2.1 AMR MARKET, BY TECHNOLOGY

6.2.1.1 Laser/LiDAR

6.2.1.1.1 Laser/LiDAR allows for better navigation and increases efficiency of robots

6.2.1.2 Vision guidance

6.2.1.2.1 Vision guidance system allows modern robots to navigate efficiently in warehouses

6.2.1.3 Others

6.3 AUTOMATED GUIDED VEHICLE (AGV)

TABLE 15 WAREHOUSE ROBOTICS MARKET FOR AGV, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 WAREHOUSE ROBOTICS MARKET FOR AGV, BY TYPE, 2021–2026 (USD MILLION)

TABLE 17 WAREHOUSE ROBOTICS MARKET FOR AGV, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 18 WAREHOUSE ROBOTICS MARKET FOR AGV, BY INDUSTRY, 2021–2026 (USD MILLION)

6.3.1 AGV MARKET, BY TYPE

6.3.1.1 Pallet trucks and light load AGVs

6.3.1.1.1 Pallet trucks and light load AGVs can lower logistics and non-value-added tasks

6.3.1.2 Forklifts

6.3.1.2.1 Forklifts ensure safe transportation process

6.3.1.3 Towing AGV

6.3.1.3.1 Towing AGV allows for transporting heavy loads over long distances

6.3.1.4 Unit load AGV and other load AGV

6.3.1.4.1 Unit load AGVs and heavy load AGVs allow for efficient transport of materials in production processes and assembly lines

6.3.2 AGV MARKET, BY TECHNOLOGY

FIGURE 31 LASER-BASED NAVIGATION TECHNOLOGY TO LEAD WAREHOUSE ROBOTICS MARKET FOR AGV DURING FORECAST PERIOD

TABLE 19 WAREHOUSE ROBOTICS MARKET FOR AGV, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 20 WAREHOUSE ROBOTICS MARKET FOR AGV, BY TECHNOLOGY, 2021–2026 (USD MILLION)

6.3.2.1 Magnetic tape

6.3.2.1.1 Magnetic tapes allow for safe and precise warehouse operation

6.3.2.2 Inductive

6.3.2.2.1 Inductive AGVs and AMRs reduce costs related to maintenance and replacement of batteries

6.3.2.3 Laser

6.3.2.3.1 Laser-based navigation system offers better navigation to forklift trucks in warehouses

6.3.2.4 Vision-based system

6.3.2.4.1 Vision-based system allows AGVs to determine accurate positions and navigate accordingly

6.3.2.5 Optical tape

6.3.2.5.1 Sensitive cameras are used to detect optical tape paths for AGV navigation

6.4 ARTICULATED ROBOTS

6.4.1 ARTICULATED ROBOTS OFFER HIGH PAYLOAD CAPACITY FOR SEVERAL WAREHOUSE APPLICATIONS

FIGURE 32 E-COMMERCE SEGMENT TO LEAD WAREHOUSE ROBOTICS MARKET FOR ARTICULATED ROBOTS DURING FORECAST PERIOD

TABLE 21 WAREHOUSE ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 22 WAREHOUSE ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY INDUSTRY, 2021–2026 (USD MILLION)

6.5 CYLINDRICAL AND SCARA ROBOTS

6.5.1 CYLINDRICAL ROBOTS

6.5.1.1 Cylindrical robots allow for easy storage and retrieval of packages placed at higher levels

6.5.2 SCARA ROBOTS

6.5.2.1 SCARA robots offer high price-to-performance ratio for high-speed operations

TABLE 23 WAREHOUSE ROBOTICS MARKET FOR CYLINDRICAL AND SCARA ROBOTS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 WAREHOUSE ROBOTICS MARKET FOR CYLINDRICAL AND SCARA ROBOTS, BY INDUSTRY, 2021–2026 (USD MILLION)

6.6 COLLABORATIVE ROBOTS

6.6.1 COLLABORATIVE ROBOTS MINIMIZE TIME AND LABOR COST OF PICKERS

TABLE 25 WAREHOUSE ROBOTICS MARKET FOR COLLABORATIVE ROBOTS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 26 WAREHOUSE ROBOTICS MARKET FOR COLLABORATIVE ROBOTS, BY INDUSTRY, 2021–2026 (USD MILLION)

6.7 OTHERS

6.7.1 PARALLEL ROBOTS

6.7.2 CARTESIAN ROBOTS

TABLE 27 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY INDUSTRY, 2021–2026 (USD MILLION)

6.8 IMPACT OF COVID-19 ON TYPES OF ROBOTS

7 WAREHOUSE ROBOTICS MARKET, BY FUNCTION (Page No. - 116)

7.1 INTRODUCTION

FIGURE 33 TRANSPORTATION SEGMENT TO DOMINATE WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

TABLE 29 WAREHOUSE ROBOTICS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 30 WAREHOUSE ROBOTICS MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

7.2 PICKING AND PLACING

7.2.1 EXPANDING E-COMMERCE INDUSTRY TO FUEL GROWTH OF PICKING AND PLACING SEGMENT

TABLE 31 WAREHOUSE ROBOTICS MARKET FOR PICKING AND PLACING FUNCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 WAREHOUSE ROBOTICS MARKET FOR PICKING AND PLACING FUNCTION, BY REGION, 2021–2026 (USD MILLION)

7.3 PALLETIZING AND DE-PALLETIZING

7.3.1 EASE IN HANDLING OF HIGH-VOLUME MATERIALS THROUGH PALLETIZING AND DE-PALLETIZING FUNCTION TO DRIVE MARKET GROWTH

TABLE 33 WAREHOUSE ROBOTICS MARKET FOR PALLETIZING AND DE-PALLETIZING FUNCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 WAREHOUSE ROBOTICS MARKET FOR PALLETIZING AND DE-PALLETIZING FUNCTION, BY REGION, 2021–2026 (USD MILLION)

7.4 TRANSPORTATION

7.4.1 MINIMIZATION OF RISKS ASSOCIATED WITH MANUAL LABOR THROUGH AUTOMATED TRANSPORTATION TO FUEL GROWTH OF TRANSPORTATION SEGMENT

FIGURE 34 APAC WAREHOUSE ROBOTICS MARKET FOR TRANSPORTATION FUNCTION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 WAREHOUSE ROBOTICS MARKET FOR TRANSPORTATION FUNCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 WAREHOUSE ROBOTICS MARKET FOR TRANSPORTATION FUNCTION, BY REGION, 2021–2026 (USD MILLION)

7.5 SORTING AND PACKAGING

7.5.1 INCREASING DEMAND FOR UNIFORM PACKAGING TO ACCELERATE ADOPTION OF AUTOMATED PACKAGING

TABLE 37 WAREHOUSE ROBOTICS MARKET FOR SORTING AND PACKAGING FUNCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 WAREHOUSE ROBOTICS MARKET FOR SORTING AND PACKAGING FUNCTION, BY REGION, 2021–2026 (USD MILLION)

8 WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (Page No. - 123)

8.1 INTRODUCTION

FIGURE 35 WAREHOUSE ROBOTICS MARKET FOR 100–200 KG PAYLOAD CAPACITY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY, 2017–2020 (USD MILLION)

TABLE 40 WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY, 2021–2026 (USD MILLION)

8.2 LESS THAN 20KG

8.2.1 ROBOTS WITH LESS THAN 20 KG PAYLOAD CAPACITY ARE USED FOR MATERIAL HANDLING AND PICKING AND PLACING TASKS

FIGURE 36 APAC WAREHOUSE ROBOTICS MARKET FOR LESS THAN 20 KG PAYLOAD CAPACITY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 41 WAREHOUSE ROBOTICS MARKET FOR LESS THAN 20 KG PAYLOAD CAPACITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 WAREHOUSE ROBOTICS MARKET FOR LESS THAN 20 KG PAYLOAD CAPACITY, BY REGION, 2021–2026 (USD MILLION)

8.3 20–100 KG

8.3.1 ROBOTS WITH 20–100 KG PAYLOAD CAPACITY ARE VERSATILE AND HELP IN SPACE OPTIMIZATION

TABLE 43 WAREHOUSE ROBOTICS MARKET FOR 20–100 KG PAYLOAD CAPACITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 WAREHOUSE ROBOTICS MARKET FOR 20–100 KG PAYLOAD CAPACITY, BY REGION, 2021–2026 (USD MILLION)

8.4 100–200 KG

8.4.1 ROBOTS WITH 100–200 KG PAYLOAD CAPACITY ARE PREFERRED FOR CARRYING OR MANIPULATING HEAVY LOADS IN WAREHOUSES

TABLE 45 WAREHOUSE ROBOTICS MARKET FOR 100–200 KG PAYLOAD CAPACITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 WAREHOUSE ROBOTICS MARKET FOR 100–200 KG PAYLOAD CAPACITY, BY REGION, 2021–2026 (USD MILLION)

8.5 MORE THAN 200 KG

8.5.1 ROBOTS WITH MORE THAN 200 KG PAYLOAD CAPACITY ARE USED IN HEAVY LOAD LIFTING APPLICATIONS IN AUTOMOTIVE AND METAL & MACHINERY INDUSTRIES

TABLE 47 WAREHOUSE ROBOTICS MARKET FOR MORE THAN 200 KG PAYLOAD CAPACITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 WAREHOUSE ROBOTICS MARKET FOR MORE THAN 200 KG PAYLOAD CAPACITY, BY REGION, 2021–2026 (USD MILLION)

9 WAREHOUSE ROBOTICS MARKET, BY INDUSTRY (Page No. - 130)

9.1 INTRODUCTION

FIGURE 37 E-COMMERCE SEGMENT TO LEAD WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

TABLE 49 WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 50 WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.2 E-COMMERCE

9.2.1 INCREASING TREND OF ONLINE SHOPPING TO BOOST GROWTH OF WAREHOUSE ROBOTICS MARKET

TABLE 51 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 52 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 53 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 54 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

FIGURE 38 APAC TO LEAD WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE INDUSTRY BY 2026

TABLE 55 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 WAREHOUSE ROBOTICS MARKET FOR E-COMMERCE, BY REGION, 2021–2026 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 INCREASING DEMAND FOR AUTOMOBILE SPARE PARTS TO DRIVE MARKET GROWTH

FIGURE 39 AMR MARKET FOR AUTOMOTIVE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 57 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 58 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 59 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 60 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 61 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 WAREHOUSE ROBOTICS MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

9.4 ELECTRICAL & ELECTRONICS

9.4.1 GROWING NEED FOR ENHANCING EFFICIENCY OF ELECTRONICS TO DRIVE GROWTH OF WAREHOUSE ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY

TABLE 63 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 64 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 65 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 66 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

FIGURE 40 APAC WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 67 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 WAREHOUSE ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.5 METAL & MACHINERY

9.5.1 INCREASING CONSTRUCTION, MINING, AND MANUFACTURING ACTIVITIES TO ACCELERATE ADOPTION OF WAREHOUSE ROBOTS IN METAL & MACHINERY INDUSTRY

TABLE 69 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 70 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 71 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 72 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 73 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 WAREHOUSE ROBOTICS MARKET FOR METAL & MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.6 CHEMICAL, RUBBER, AND PLASTICS

9.6.1 STEADY GROWTH OF RUBBER INDUSTRY TO INCREASE NEED FOR AUTOMATED WAREHOUSING

TABLE 75 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 77 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 78 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 79 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 WAREHOUSE ROBOTICS MARKET FOR CHEMICAL, RUBBER, AND PLASTICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.7 FOOD & BEVERAGE

9.7.1 GROWING USE OF ROBOTICS IN COLD STORAGE WAREHOUSES TO DRIVE MARKET GROWTH

TABLE 81 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 84 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

FIGURE 41 APAC TO LEAD WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY DURING FORECAST PERIOD

TABLE 85 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 WAREHOUSE ROBOTICS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.8 PHARMACEUTICAL

9.8.1 RISING TREND OF FULLY AUTOMATED PHARMACEUTICAL WAREHOUSES TO BOOST MARKET GROWTH

TABLE 87 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 89 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 91 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 92 WAREHOUSE ROBOTICS MARKET FOR PHARMACEUTICAL INDUSTRY, BY FUNCTION, 2021–2026 (USD MILLION)

9.9 OTHERS

TABLE 93 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 94 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 96 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 97 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 WAREHOUSE ROBOTICS MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

9.9.1 PAPER & PRINTING

9.9.2 TEXTILE & CLOTHING

9.10 IMPACT OF COVID-19 ON VARIOUS INDUSTRIES

10 WAREHOUSE ROBOTICS, BY COMPONENT (Page No. - 155)

10.1 INTRODUCTION

10.2 SAFETY SYSTEMS

10.3 COMMUNICATION SYSTEM

10.4 JOB CONTROL SYSTEM

10.5 TRAFFIC MANAGEMENT SYSTEM

10.6 BATTERY CHARGING SYSTEM

10.7 SENSORS

10.8 CONTROLLERS

10.9 DRIVES

10.10 ROBOTIC ARMS

11 WAREHOUSE ROBOTICS, BY SOFTWARE (Page No. - 157)

11.1 INTRODUCTION

11.2 WAREHOUSE MANAGEMENT SYSTEM (WMS)

11.2.1 BENEFITS OF WMS

11.3 WAREHOUSE CONTROL SYSTEM (WCS)

11.3.1 BENEFITS OF WCS

11.4 WAREHOUSE EXECUTION SYSTEM (WES)

FIGURE 42 WES INTEGRATES KEY FUNCTIONALITIES OF BOTH WMS AND WCS

11.4.1 BENEFITS OF WES

12 GEOGRAPHIC ANALYSIS OF WAREHOUSE ROBOTICS MARKET (Page No. - 159)

12.1 INTRODUCTION

FIGURE 43 APAC TO LEAD WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

TABLE 99 WAREHOUSE ROBOTICS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 WAREHOUSE ROBOTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 44 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA: SNAPSHOT

TABLE 101 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 103 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY PAYLOAD CAPACITY, 2017–2020 (USD MILLION)

TABLE 104 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY PAYLOAD CAPACITY, 2021–2026 (USD MILLION)

TABLE 105 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 106 WAREHOUSE ROBOTICS MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 High labor cost and attrition rates to drive growth of warehouse robotics market in US

12.2.2 CANADA

12.2.2.1 Warehouse robotics to open new avenues for various businesses in Canada

12.2.3 MEXICO

12.2.3.1 Increasing investments in improvement of warehouse infrastructure to boost market growth

12.3 EUROPE

FIGURE 45 WAREHOUSE ROBOTICS MARKET IN EUROPE: SNAPSHOT

TABLE 107 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 108 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 109 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY PAYLOAD CAPACITY, 2017–2020 (USD MILLION)

TABLE 110 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY PAYLOAD CAPACITY, 2021–2026 (USD MILLION)

TABLE 111 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 112 WAREHOUSE ROBOTICS MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Germany is expected to witness fastest growth in European market

12.3.2 UK

12.3.2.1 High support from government and warehouse robotics associations in UK to accelerate adoption of warehouse robotics

12.3.3 FRANCE

12.3.3.1 Foreign direct investments have accelerated demand for warehouse robotics in France

12.3.4 ITALY

12.3.4.1 Growing e-commerce industry and adoption of automation to fuel growth of warehouse robotics market in Italy

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

FIGURE 46 WAREHOUSE ROBOTICS MARKET IN APAC: SNAPSHOT

TABLE 113 WAREHOUSE ROBOTICS MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 WAREHOUSE ROBOTICS MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 WAREHOUSE ROBOTICS MARKET IN APAC, BY PAYLOAD CAPACITY, 2017–2020 (USD MILLION)

TABLE 116 WAREHOUSE ROBOTICS MARKET IN APAC, BY PAYLOAD CAPACITY, 2021–2026 (USD MILLION)

TABLE 117 WAREHOUSE ROBOTICS MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 118 WAREHOUSE ROBOTICS MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Rising labor cost and government initiatives are supporting the growth of warehouse robotics market

12.4.2 JAPAN

12.4.2.1 Increasing government-led investments in warehouse robotics technologies to drive market growth

12.4.3 SOUTH KOREA

12.4.3.1 Increasing e-commerce activities to contribute to growth of warehouse robotics market in South Korea

12.4.4 REST OF APAC

12.5 REST OF THE WORLD

TABLE 119 WAREHOUSE ROBOTICS MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 120 WAREHOUSE ROBOTICS MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 121 WAREHOUSE ROBOTICS MARKET IN ROW, BY PAYLOAD CAPACITY, 2017–2020 (USD MILLION)

TABLE 122 WAREHOUSE ROBOTICS MARKET IN ROW, BY PAYLOAD CAPACITY, 2021–2026 (USD MILLION)

TABLE 123 WAREHOUSE ROBOTICS MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 124 WAREHOUSE ROBOTICS MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 Expanding retail industry in South America to drive growth of warehouse robotics market

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 Increasing investments and low tax environment to fuel market growth

12.6 IMPACT OF COVID-19 ON WAREHOUSE ROBOTICS MARKET IN DIFFERENT REGIONS

13 COMPETITIVE LANDSCAPE (Page No. - 180)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 125 OVERVIEW OF STRATEGIES DEPLOYED BY KEY WAREHOUSE ROBOTICS MANUFACTURERS

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 MARKET SHARE ANALYSIS: WAREHOUSE ROBOTICS MARKET, 2020

FIGURE 47 MARKET SHARE ANALYSIS: WAREHOUSE ROBOTICS MARKET, 2020

TABLE 126 DEGREE OF COMPETITION, 2020

13.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 48 5-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN WAREHOUSE ROBOTICS MARKET

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 49 WAREHOUSE ROBOTICS MARKET: COMPANY EVALUATION QUADRANT, 2020

13.5.5 COMPETITIVE BENCHMARKING

FIGURE 50 OVERALL COMPANY FOOTPRINT, 2020

TABLE 127 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS OFFERINGS

TABLE 128 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS INDUSTRIES

TABLE 129 FOOTPRINT OF DIFFERENT COMPANIES IN DIFFERENT REGIONS

13.6 START-UP/SME EVALUATION MATRIX

TABLE 130 LIST OF START-UP COMPANIES IN WAREHOUSE ROBOTICS MARKET

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 STARTING BLOCK

FIGURE 51 WAREHOUSE ROBOTICS MARKET: START-UP/SME EVALUATION MATRIX, 2020

13.7 COMPETITIVE SCENARIO AND TRENDS

13.7.1 PRODUCT LAUNCHES

TABLE 131 PRODUCT LAUNCHES, 2020–2021

13.7.2 DEALS

TABLE 132 PARTNERSHIPS AND COLLABORATIONS, 2018–2021

14 COMPANY PROFILE (Page No. - 198)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 DAIFUKU

TABLE 133 DAIFUKU: BUSINESS OVERVIEW

FIGURE 52 DAIFUKU: COMPANY SNAPSHOT

TABLE 134 DAIFUKU: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 135 DAIFUKU: DEALS

TABLE 136 DAIFUKU: OTHERS

TABLE 137 DAIFUKU: COVID-19-RELATED DEVELOPMENTS

14.1.2 KION GROUP

TABLE 138 KION GROUP AG: BUSINESS OVERVIEW

FIGURE 53 KION GROUP AG: COMPANY SNAPSHOT

TABLE 139 KION GROUP AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 140 KION GROUP AG: DEALS

TABLE 141 KION GROUP AG: OTHERS

TABLE 142 KION GROUP AG: COVID-19-RELATED DEVELOPMENTS

14.1.3 KUKA

TABLE 143 KUKA AG: BUSINESS OVERVIEW

FIGURE 54 KUKA: COMPANY SNAPSHOT

TABLE 144 KUKA: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 145 KUKA : PRODUCT LAUNCHES

TABLE 146 KUKA : DEALS

TABLE 147 KUKA : OTHERS

TABLE 148 KUKA : COVID-19-RELATED DEVELOPMENTS

14.1.4 ABB

TABLE 149 ABB: BUSINESS OVERVIEW

FIGURE 55 ABB: COMPANY SNAPSHOT

TABLE 150 ABB: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 151 ABB: PRODUCT LAUNCHES

TABLE 152 ABB: DEALS

TABLE 153 ABB: COVID-19-RELATED DEVELOPMENTS

14.1.5 FANUC

TABLE 154 FANUC CORP.: BUSINESS OVERVIEW

FIGURE 56 FANUC CORP.: COMPANY SNAPSHOT

TABLE 155 FANUC CORP.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 156 FANUC CORP.: PRODUCT LAUNCHES

TABLE 157 FANUC CORP.: DEALS

TABLE 158 FANUC CORP.: OTHERS

TABLE 159 FANUC CORP.: COVID-19-RELATED DEVELOPMENTS

14.1.6 GEEKPLUS TECHNOLOGY

TABLE 160 GEEKPLUS TECHNOLOGY: BUSINESS OVERVIEW

TABLE 161 GEEKPLUS TECHNOLOGY: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 162 GEEKPLUS TECHNOLOGY: PRODUCT LAUNCHES

TABLE 163 GEEKPLUS TECHNOLOGY: DEALS

TABLE 164 GEEKPLUS TECHNOLOGY: OTHERS

TABLE 165 GEEKPLUS TECHNOLOGY: COVID-19-RELATED DEVELOPMENTS

14.1.7 GREYORANGE

TABLE 166 GREYORANGE: BUSINESS OVERVIEW

TABLE 167 GREYORANGE: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 168 GREYORANGE: DEALS

TABLE 169 GREYORANGE: COVID-19-RELATED DEVELOPMENTS

14.1.8 MURATA MACHINERY (MURATEC)

TABLE 170 MURATA MACHINERY: BUSINESS OVERVIEW

TABLE 171 MURATA MACHINERY: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 172 MURATA MACHINERY: PRODUCT LAUNCHES

TABLE 173 MURATA MACHINERY: DEALS

TABLE 174 MURATA MACHINERY: OTHERS

TABLE 175 MURATA MACHINERY: COVID-19-RELATED DEVELOPMENTS

14.1.9 OMRON CORPORATION

TABLE 176 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 57 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 177 OMRON CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 178 OMRON CORPORATION: PRODUCT LAUNCHES

TABLE 179 OMRON CORPORATION: DEALS

TABLE 180 OMRON CORPORATION: COVID-19-RELATED DEVELOPMENTS

14.1.10 TOYOTA INDUSTRIES

TABLE 181 TOYOTA INDUSTRIES: BUSINESS OVERVIEW

TABLE 182 TOYOTA INDUSTRIES: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 183 TOYOTA INDUSTRIES: PRODUCT LAUNCHES

TABLE 184 TOYOTA INDUSTRIES: DEALS

TABLE 185 TOYOTA INDUSTRIES: COVID-19-RELATED DEVELOPMENTS

14.2 OTHER PLAYERS

14.2.1 SHOPIFY

TABLE 186 SHOPIFY: COMPANY OVERVIEW

14.2.2 HIKROBOT

TABLE 187 HIKROBOT: COMPANY OVERVIEW

14.2.3 IAM ROBOTICS

TABLE 188 IAM ROBOTICS: COMPANY OVERVIEW

14.2.4 INVIA ROBOTICS

TABLE 189 INVIA ROBOTICS : COMPANY OVERVIEW

14.2.5 JBT

TABLE 190 JBT: COMPANY OVERVIEW

14.2.6 KNAPP

TABLE 191 KNAPP: COMPANY OVERVIEW

14.2.7 LOCUS ROBOTICS

TABLE 192 LOCUS ROBOTICS: COMPANY OVERVIEW

14.2.8 MAGAZINO

TABLE 193 MAGAZINO: COMPANY OVERVIEW

14.2.9 SCALLOG

TABLE 194 SCALLOG: COMPANY OVERVIEW

14.2.10 SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY

TABLE 195 SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY

14.2.11 SSI SCHAEFER

TABLE 196 SSI SCHAEFER: COMPANY OVERVIEW

14.2.12 TERADYNE

TABLE 197 TERADYNE: COMPANY OVERVIEW

14.2.13 VECNA ROBOTICS

TABLE 198 VECNA ROBOTICS: COMPANY OVERVIEW

14.2.14 YASKAWA ELECTRIC CORPORATION

TABLE 199 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

14.2.15 ZEBRA TECHNOLOGIES

TABLE 200 ZEBRA TECHNOLOGIES : COMPANY OVERVIEW

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 262)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

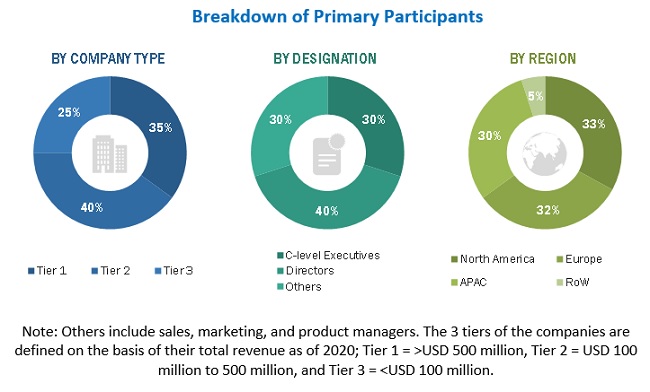

The study involved four major activities in estimating the current size of the global warehouse robotics market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (OneSource, Factiva, and Bloomberg). The secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, articles, white papers, industry news, business, and professional associations. The secondary data have been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the Warehouse Robotics market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews have been conducted with the demand side and 70% with the supply side. These primary data have been collected mainly through telephonic interviews, which consist of 80% of the overall primary interviews; also, questionnaires and emails were used to collect the data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the Warehouse Robotics market. These methods have also been used extensively to estimate the size of various market subsegments.

The research methodology used to estimate the market size by top-down approach includes the following:

- Focusing initially on top-line investments and expenditures being made in the ecosystems of the warehouse robotics market

- Calculating the market size considering the revenues generated by players through the sale of different types of warehouse robots such as AGV, AMR, and articulated robots

- Further segmentation on the basis of R&D and key developments in key market areas

- Further segmentation on the basis of mapping usage of warehouse robotics for different functions and industries

- Building and developing the information related to the revenues generated by players through different offerings

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of warehouse robotics

- Estimating the geographic split using secondary sources based on various factors such as number of players in a specific country and region, role of major players in the market for the development of innovative products, adoption and penetration rates in particular country for various industries, government support, investments, and others.

- Estimating the geographic split using secondary sources based on various factors such as the number of players in a specific country and region, the role of major players in the market for the development of innovative products, adoption and penetration rates in a particular country for various end-user applications, government support, investments, and others

The research methodology used to estimate the market size by bottom-up approach includes the following:

- Identifying the entities in the warehouse robotics market influencing the entire market, along with the related players including different types of warehouse robots and software providers

- Analyzing major manufacturers of warehouse robots, studying their portfolios, and understanding different types of robots such as AGV, AMR, collaborative robot, articulated robots, and cylindrical and SCARA robots

- Analyzing trends pertaining to the use of different types of robots for different types of functions, industries, and payload capacities

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, government support, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types of robots, software, functions, industries, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing revenues of the companies generated from each type of robot and then combining the same to get the market estimate

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources for information, such as annual reports, press releases, white papers, and databases

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the warehouse robotics market, in terms of value, based on type, function, payload capacity, industry, and geography

- To define, describe, and forecast the warehouse robotics market, in terms of volume, based on type

- To forecast the market size, in terms of value, for various segments, with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of

the warehouse robotics market (drivers, restraints, opportunities, and industry-specific challenges) - To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for the market players by identifying high-growth segments of the warehouse robotics market

- To benchmark players operating in the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

- To track and analyze competitive developments such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches in the warehouse robotics market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Warehouse Robotics Market