Water Treatment Chemicals Market by Type (Coagulants & Flocculants, Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Chelating Agents), End-Use (Residential, Commercial, Industrial) and Region - Global Forecast to 2027

Water Treatment Chemicals Market

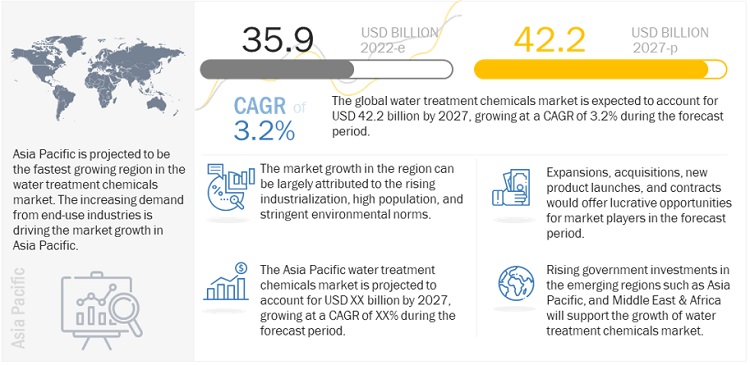

The global water treatment chemicals market was valued at USD 35.9 billion in 2022 and is projected to reach USD 42.2 billion by 2027, growing at a cagr 3.2% from 2022 to 2027. The major factors driving the growth of water treatment chemicals are increasing demand for chemically treated water from various end-use segments and stringent regulations and sustainability mandates concerning the environment.

Global Water Treatment Chemicals Market Trends

Note: e-estimated, p-projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Water Treatment Chemicals Market Dynamics

Driver: Stringent water and wastewater regulations

Regulatory and sustainability mandates pertaining to water and wastewater treatment have increased the demand for the treatment of wastewater. These regulations are especially stringent in developed regions such as North America and Europe. For instance, The Clean Water Act regulation implemented by the US Environmental Protection Agency (EPA) controls water pollution by regulating the sources that discharge pollutants into waters. In Canada, the Wastewater Effluent Regulations established under the Fisheries Act include minimum effluent quality standards that can be achieved through wastewater treatment. Other regions also have regulations which supports the growth of the water treatment sector. Stringent government regulations regarding water and wastewater treatment will boost the water treatment sector, further driving the water treatment chemicals market.

Restrain: Alternative water treatment technologies

Alternative water treatment technologies such as reverse osmosis (RO), ultrafiltration, and UV disinfection restrains the growth water treatment chemicals market. Advance technologies minimize the utilization of water treatment chemicals. Owing to the rising environmental concerns and regulations, end users are looking for sustainable options for water treatment. For instance, Environmental Protection Agency (EPA) regulations encourage the use of UV disinfection over the chlorine-based biocides.

Opportunity: Rising scarcity of freshwater

The scarcity of freshwater is a major concern faced by industries and society in general. Industries require large volumes of water in production processes, generating industrial wastewater. Recycling and reusing water will be essential for companies to manage water as it is a scarce resource. Growing industrialization is expected to require increasing water resources in the coming years. This growth is expected to create new opportunities for the water treatment chemicals market.

Challenge: Need for eco-friendly formulations and vulnerability regarding copying of patents

The major factors inhibiting the water treatment chemicals market growth are the stringent environmental regulations implemented by governments and various agencies such as EPA. End users of water treatment chemicals are looking for environment friendly water treatment chemicals and sustainable options for water treatment. However, manufacturers face problems in costs and profits in green chemistries, which leads to challenges in developing highly effective and economically viable environment-friendly water treatment chemicals.

Once a patented water treatment chemical is made public, it becomes vulnerable to being duplicated. Some manufacturers in Asia offer counterfeit products at lower costs, which pose a major challenge to water treatment chemical manufacturers.

Corrosion inhibitors to be fastest growing segment amongst types in the water treatment chemicals market

Corrosion inhibitors are utilized for preventing or minimizing the corrosion and degradation of metal surfaces in the various equipment including cooling towers and boilers. Increased water recycling and the use of poor-quality water in cooling systems are expected to drive the market for corrosion inhibitors. Furthermore, the increasing demand from the oil & gas industry is expected to support the growth of this segment in the forecast period.

Raw water treatment is project to account for the highest share amongst applications in the water treatment chemicals market

Raw water treatment is used to remove several impurities, including suspended solids, silica, and bacteria, from the water obtained from various sources, such as a lake, river, well, and secondary or tertiary treatment reuse. This segment is the largest in the water treatment chemicals, based on application. Growing scarcity of freshwater will further drive the growth of this segment.

Industrial segment to grow at the highest growth rate amongst end users in the overall water treatment chemicals market

Industrial is the largest end user of water treatment chemicals and it is also expected to grow at the fastest CAGR in the forecast period. Water treatment chemicals are widely used in various end-use industries such as oil & gas, pulp & paper, power, chemicals, and food & beverage, among others. Increasing demand for water treatment chemicals from these industries and the rising industrialization are driving the market for industrial segment.

Based on source, synthetic segment is projected to be the largest segment of water treatment chemicals market

Synthetic is estimated to be the largest and the fastest growing segment of water treatment chemicals. The growth of this segment is driven by factors such as cost effectiveness and easy availability of raw materials.

Asia Pacific to be the fastest-growing region in the global water treatment chemicals market

Asia Pacific is projected to grow at the fastest growth rate in the water treatment chemicals market. The region has several emerging economies including China, India, Indonesia, and Vietnam, which supports the growth of the market. Asia Pacific is also witnessing rapid urbanization, rising industrialization, and high population growth which drives the water treatment chemicals market. Furthermore, growing end-use industries and government investments in water & wastewater treatment sector will support the growth of water treatment chemicals market in the region.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Water Treatment Chemicals Market Players

Major players operating in the global water treatment chemicals market include BASF SE (Germany), Kemira Oyj (Finland), Ecolab Inc. (US), Dow Inc. (US), Solenis LLC (US), SNF Floerger (France), Nouryon (Netherlands), Baker Hughes (US), Kurita Water Industries Ltd. (Japan), Veolia (France), and Arxada (Switzerland).

Water Treatment Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 35.9 Billion |

|

Revenue Forecast in 2027 |

USD 42.2 Billion |

|

CAGR |

3.2% |

|

Years considered for the study |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/ Billion), Volume (Kiloton) |

|

Segments |

Type, Application, End-user, Source |

|

Regions |

North America, Europe, Asia Pacific, the Middle East & Africa, and South America |

|

Companies |

Ecolab Inc. (US), Kemira Oyj (Finland), BASF SE (Germany), Solenis LLC (US), Dow Inc. (US), Nouryon (Netherlands), Kurita Water Industries Ltd. (Japan), Veolia (France), SNF Floerger (France), Baker Hughes Company (US), and Arxada (Switzerland) |

This research report categorizes the water treatment chemicals market based on type, end-use industry, and region.

Based on the type:

- Corrosion inhibitors

- Scale inhibitors

- Biocides & disinfectants

- Coagulants & flocculants

- Chelating agents

- Anti-foaming agents

- ph adjusters and stabilizers

- Others

Based on application:

- Boiler water treatment

- Cooling water treatment

- Raw water treatment

- Water Desalination

- Others

Based on the end-user:

- Residential

- Commercial

- Industrial

Based on source:

- Synthetic

- Bio-based

Based on the region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2021, Kemira announced the final completion of the expansion of its production capacity in the UK. The company will increase the annual production of ferric-based water treatment chemicals in its facility in the UK by more than 100.000 tons annually.

- In July 2020, Solenis acquired Poliquímicos, S.A. de C.V. (Poliquímicos) headquartered in Mexico. Poliquímicos is a manufacturer and supplier of specialized chemical solutions for water-intensive industries.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of water treatment chemicals market?

The growth of this market can be attributed to rising demand from the key end-use industries.

Which are the key sectors driving the water treatment chemicals market?

The growth in demand for water treatment chemicals in the region can be largely attributed to factors such as high population, increasing industrial growth, and stringent environmental norms.

Who are the major manufacturers?

A. Major manufactures include Ecolab Inc. (US), BASF SE (Germany), Dow Inc. (US), Kemira Oyj (Finland), Solenis (US), Veolia (France), Nouryon (Netherlands), Baker Hughes (US), SNF Floerger (France), Kurita Water Industries Ltd. (Japan), and Arxada (Switzerland), among others.

What is the biggest restraint for water treatment chemicals?

The alternative water treatment technologies is restraining the growth of the market.

What will be the growth prospects of the water treatment chemicals market?

Rising population and rapid urbanization in emerging economies and increase in demand for specific formulations are expected to offer significant growth opportunities to manufacturers of water treatment chemicals. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 WATER TREATMENT CHEMICALS MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 WATER TREATMENT CHEMICALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY SIDE)

2.3 DATA TRIANGULATION

FIGURE 7 WATER TREATMENT CHEMICALS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 8 COAGULANTS & FLOCCULANTS SEGMENT TO LEAD MARKET BY 2027

FIGURE 9 RAW WATER TREATMENT TO BE LARGEST SEGMENT

FIGURE 10 INDUSTRIAL SEGMENT TO DOMINATE WATER TREATMENT CHEMICALS MARKET DURING FORECAST PERIOD

FIGURE 11 SYNTHETIC SEGMENT TO LEAD MARKET

FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF WATER TREATMENT CHEMICALS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 EMERGING ECONOMIES TO WITNESS HIGHER DEMAND FOR WATER TREATMENT CHEMICALS

FIGURE 13 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN WATER TREATMENT CHEMICALS MARKET DURING FORECAST PERIOD

4.2 WATER TREATMENT CHEMICALS MARKET, BY TYPE

FIGURE 14 COAGULANTS & FLOCCULANTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION

FIGURE 15 WATER DESALINATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 WATER TREATMENT CHEMICALS MARKET, BY END USER

FIGURE 16 INDUSTRIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.5 WATER TREATMENT CHEMICALS MARKET, BY SOURCE

FIGURE 17 SYNTHETIC SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

4.6 GLOBAL WATER TREATMENT CHEMICALS MARKET, BY COUNTRY

FIGURE 18 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATER TREATMENT CHEMICALS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for chemically treated water in various end-use industries

5.2.1.2 Stringent water and wastewater regulations

5.2.2 RESTRAINTS

5.2.2.1 Alternative water treatment technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Rising population and rapid urbanization in emerging economies

5.2.3.2 Increasing demand for specific formulations

5.2.3.3 Rising scarcity of freshwater

5.2.4 CHALLENGES

5.2.4.1 Need for eco-friendly formulations and vulnerability regarding copying patents

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREATS OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 WATER TREATMENT CHEMICALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 WATER TREATMENT CHEMICAL MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END CONSUMERS

5.5 PRICING ANALYSIS

FIGURE 22 PRICING ANALYSIS: WATER TREATMENT CHEMICALS MARKET, BY REGION

5.6 TARIFF & REGULATIONS

5.6.1 NORTH AMERICA

5.6.1.1 Clean Water Act (CWA)

5.6.1.2 Safe Drinking Water Act (SDWA)

5.6.2 ASIA PACIFIC

5.6.2.1 Environmental Protection Law (EPL)

5.6.2.2 Water Resources Law

5.6.2.3 Water Pollution Prevention and Control Law

5.6.2.4 Water Prevention and Control of Pollution Act

5.6.3 EUROPE

5.6.3.1 Urban Wastewater Treatment Directive

5.6.3.2 Drinking Water Directive

5.6.3.3 Water Framework Directive

5.6.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 TRADE ANALYSIS

5.7.1 IMPORT-EXPORT SCENARIO OF WATER TREATMENT CHEMICALS MARKET

TABLE 6 IMPORT TRADE DATA FOR CHEMICAL PRODUCTS AND PREPARATIONS OF CHEMICALS OR ALLIED INDUSTRIES, INCLUDING THOSE PROVIDING MIXTURES OF NATURAL PRODUCTS

TABLE 7 EXPORT TRADE DATA FOR CHEMICAL PRODUCTS AND PREPARATIONS OF CHEMICALS OR ALLIED INDUSTRIES, INCLUDING THOSE PROVIDING MIXTURES OF NATURAL PRODUCTS

5.8 ECOSYSTEM

TABLE 8 WATER TREATMENT CHEMICALS: ECOSYSTEM

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.10 TECHNOLOGY ANALYSIS

5.10.1 BIOMASS-BASED FLOCCULANTS

5.10.2 BIOSPERSE CHLORINE STABILIZERS FOR BIOFILM CONTROL

5.10.3 EXTENDED-RELEASE (ER) SCALE INHIBITOR TECHNOLOGY

5.11 CASE STUDIES

5.11.1 ECOLAB INC.

5.11.2 BAKER HUGHES COMPANY

5.11.3 SOLENIS

5.12 KEY CONFERENCES & EVENTS IN 2022-23

TABLE 9 WATER TREATMENT CHEMICALS MARKET: LIST OF CONFERENCES & EVENTS

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.2.1 Document type

TABLE 10 GRANTED PATENTS ACCOUNT FOR A 17% SHARE OF TOTAL COUNT DURING LAST TEN YEARS

5.13.2.2 Publication trends over last five years

FIGURE 23 NUMBER OF PATENTS YEAR-WISE DURING LAST TEN YEARS

5.13.3 INSIGHTS

5.13.4 LEGAL STATUS OF PATENTS

5.13.5 JURISDICTION ANALYSIS

FIGURE 24 TOP JURISDICTION-BY DOCUMENT

5.13.6 TOP COMPANIES/APPLICANTS

TABLE 11 LIST OF PATENTS BY ECOLAB INC.

TABLE 12 LIST OF PATENTS BY BASF SE

TABLE 13 LIST OF PATENTS BY DOW

TABLE 14 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

5.14 KEY FACTORS AFFECTING BUYING DECISIONS

5.14.1 QUALITY

5.14.2 SERVICE

FIGURE 25 SUPPLIER SELECTION CRITERIA

6 WATER TREATMENT CHEMICALS MARKET, BY TYPE (Page No. - 90)

6.1 INTRODUCTION

FIGURE 26 CORROSION INHIBITORS TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

TABLE 15 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 16 WATER TREATMENT CHEMICAL MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 17 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 18 WATER TREATMENT CHEMICAL MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

6.2 COAGULANTS & FLOCCULANTS

6.2.1 USED FOR SOLID REMOVAL, SLUDGE THICKENING, AND SOLID DEWATERING

6.2.2 ORGANIC COAGULANTS

6.2.2.1 Polyamine and PolyDADMAC

6.2.2.2 PolyDADMAC

6.2.3 INORGANIC COAGULANTS

6.2.3.1 Aluminum sulfate

6.2.3.2 Polyaluminum chloride (PAC)

6.2.3.3 Ferric chloride

6.2.3.4 Others

6.2.4 FLOCCULANTS

6.2.4.1 Anionic flocculants

6.2.4.2 Cationic flocculants

6.2.4.3 Non-ionic flocculants

6.2.4.4 Amphoteric flocculants

6.3 CORROSION INHIBITORS

6.3.1 UTILIZED TO PREVENT CORROSION AND DEGRADATION OF METAL SURFACES

6.3.2 ANODIC INHIBITORS

6.3.3 CATHODIC INHIBITORS

6.4 SCALE INHIBITORS

6.4.1 REDUCE SCALING ON EQUIPMENT SURFACE

6.4.2 PHOSPHONATES

6.4.3 CARBOXYLATES/ACRYLIC

6.4.4 OTHERS

6.5 BIOCIDES & DISINFECTANTS

6.5.1 USED TO REMOVE CONTAMINANTS FROM WATER

6.5.2 OXIDIZING

6.5.3 NON-OXIDIZING

6.5.4 DISINFECTANTS

6.6 CHELATING AGENTS

6.6.1 REMOVE HEAVY METAL IONS FROM WATER

6.7 ANTI-FOAMING AGENTS

6.7.1 REDUCE/HINDER FOAM FORMATION

6.8 PH ADJUSTERS & STABILIZERS

6.8.1 USED TO MAINTAIN PH OF WATER

6.9 OTHERS

7 WATER TREATMENT CHEMICALS MARKET, BY SOURCE (Page No. - 100)

7.1 INTRODUCTION

FIGURE 27 SYNTHETIC SOURCE SEGMENT TO DRIVE WATER TREATMENT CHEMICALS MARKET

TABLE 19 WATER TREATMENT CHEMICALS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 20 WATER TREATMENT CHEMICAL MARKET SIZE, BY SOURCE, 2018–2021 (KILOTON)

TABLE 21 WATER TREATMENT CHEMICALS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 22 WATER TREATMENT CHEMICAL MARKET SIZE, BY SOURCE, 2022–2027 (KILOTON)

7.2 BIO-BASED

7.2.1 WIDELY USED TO STOP GROWTH OF MICROORGANISMS

7.3 SYNTHETIC

7.3.1 HIGH NUMBER OF ADDED CHARACTERISTICS COMPARED TO NATURAL CHEMICALS

8 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 28 RAW WATER TREATMENT TO DRIVE WATER TREATMENT CHEMICALS MARKET

TABLE 23 WATER TREATMENT CHEMICALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 WATER TREATMENT CHEMICAL MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 25 WATER TREATMENT CHEMICALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 26 WATER TREATMENT CHEMICAL MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.2 BOILER WATER TREATMENT

8.2.1 WATER TREATMENT CHEMICALS IMPROVE OPERATION AND MAINTENANCE OF BOILER SYSTEMS

8.3 COOLING WATER TREATMENT

8.3.1 LARGEST APPLICATION OF WATER TREATMENT CHEMICALS

8.4 RAW WATER TREATMENT

8.4.1 REMOVES A NUMBER OF IMPURITIES FROM WATER OBTAINED FROM VARIOUS SOURCES

8.5 WATER DESALINATION

8.5.1 WATER DESALINATION GAINING SIGNIFICANCE DUE TO RISING FRESHWATER SCARCITY

8.6 OTHERS

9 WATER TREATMENT CHEMICALS MARKET, BY END USER (Page No. - 108)

9.1 INTRODUCTION

FIGURE 29 INDUSTRIAL SEGMENT TO BE LARGEST END USER DURING FORECAST PERIOD

TABLE 27 WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 28 WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 29 WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 30 WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 31 WATER TREATMENT CHEMICALS MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 32 WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 33 WATER TREATMENT CHEMICALS MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 34 WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

9.2 RESIDENTIAL

9.2.1 RESIDENTIAL WATER TREATMENT SYSTEMS TO WITNESS GROWTH DUE TO INCREASING NEED FOR TREATED WATER

9.3 COMMERCIAL

9.3.1 COVID-19 PANDEMIC BOOSTED USE OF TREATED WATER IN HEALTHCARE INDUSTRY

9.3.2 OFFICE SPACES

9.3.3 HOTELS & RESTAURANTS

9.3.4 HOSPITALS

9.3.5 SWIMMING POOLS

9.3.6 OTHERS

9.4 INDUSTRIAL

9.4.1 INCREASING DEMAND FOR WATER TREATMENT DUE TO RAPID INDUSTRIALIZATION IN EMERGING COUNTRIES

9.4.2 MUNICIPAL

9.4.3 POWER

9.4.4 OIL & GAS

9.4.5 MINING & MINERAL PROCESSING

9.4.6 CHEMICALS & FERTILIZERS

9.4.7 FOOD & BEVERAGE

9.4.8 PULP & PAPER

9.4.9 OTHERS

10 WATER TREATMENT CHEMICALS MARKET, BY REGION (Page No. - 118)

10.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 35 WATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 WATER TREATMENT CHEMICAL MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 37 WATER TREATMENT CHEMICAL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 WATER TREATMENT CHEMICAL MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

10.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 41 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 43 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 45 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 47 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 49 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.2.1 US

10.2.1.1 US to lead water treatment chemicals market in North American region

TABLE 51 US: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 52 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 53 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 54 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 55 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 56 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 57 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 58 US: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.2.2 CANADA

10.2.2.1 Increasing governmental support for wastewater treatment to boost market growth

TABLE 59 CANADA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 60 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 61 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 62 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 63 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 64 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 65 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 66 CANADA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.2.3 MEXICO

10.2.3.1 Industrial sector to drive market

TABLE 67 MEXICO: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 68 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 69 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 70 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 71 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 72 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 73 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 74 MEXICO: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3 EUROPE

FIGURE 32 EUROPE: WATER TREATMENT CHEMICALS MARKET SNAPSHOT

TABLE 75 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 79 EUROPE: MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 81 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 83 EUROPE: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 85 EUROPE: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.1 GERMANY

10.3.1.1 Growing end-use industries and positive economic outlook to support market growth

TABLE 87 GERMANY: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 88 GERMANY: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 89 GERMANY: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 91 GERMANY: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 92 GERMANY: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 93 GERMANY: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.2 ITALY

10.3.2.1 Utilization of advanced treatment procedures and chemicals a market driver

TABLE 95 ITALY: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 96 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 97 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 98 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 99 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 100 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 101 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 102 ITALY: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.3 FRANCE

10.3.3.1 Growth in end-use industries drives market

TABLE 103 FRANCE: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 104 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 105 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 107 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 108 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 109 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 110 FRANCE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.4 SPAIN

10.3.4.1 Government focus on water and wastewater treatment to drive market

TABLE 111 SPAIN: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 112 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 113 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 114 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 115 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 116 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 117 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 118 SPAIN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.5 UK

10.3.5.1 Growing end-use industries and government initiatives to support market growth

TABLE 119 UK: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 120 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 121 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 122 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 123 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 124 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 125 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 126 UK: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.6 RUSSIA

10.3.6.1 Strong energy sector driving market

TABLE 127 RUSSIA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 128 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 129 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 130 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 131 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 132 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 133 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 134 RUSSIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.3.7 REST OF EUROPE

TABLE 135 REST OF EUROPE: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 137 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 138 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 139 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 140 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 141 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 142 REST OF EUROPE: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET SNAPSHOT

TABLE 143 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 145 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 147 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 149 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 151 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 153 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.1 CHINA

10.4.1.1 China to lead water treatment chemicals market in Asia Pacific

TABLE 155 CHINA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 156 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 157 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 158 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 159 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 160 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 161 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 162 CHINA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.2 INDIA

10.4.2.1 Rising population, growing economy, and increasing adoption of wastewater technologies to drive market

TABLE 163 INDIA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 164 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 165 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 166 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 167 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 168 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 169 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 170 INDIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.3 JAPAN

10.4.3.1 Technological advancements in water treatment techniques to drive market

TABLE 171 JAPAN: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 172 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 173 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 174 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 175 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 176 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 177 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 178 JAPAN: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.4 SOUTH KOREA

10.4.4.1 Food & beverage industry, skilled workforce, and laws & regulations to drive market

TABLE 179 SOUTH KOREA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 180 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 181 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 182 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 183 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 184 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 185 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 186 SOUTH KOREA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.5 INDONESIA

10.4.5.1 Growing water treatment infrastructure to drive market in country

TABLE 187 INDONESIA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 188 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 189 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 190 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 191 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 192 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 193 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 194 INDONESIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.4.6 REST OF ASIA PACIFIC

TABLE 195 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 196 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 197 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 199 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 201 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 202 REST OF ASIA PACIFIC: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

FIGURE 34 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS SNAPSHOT

TABLE 203 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 205 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 207 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 209 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 211 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 213 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5.1 SAUDI ARABIA

10.5.1.1 Saudi Arabia to be leading market in region

TABLE 215 SAUDI ARABIA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 216 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 217 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 218 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 219 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 220 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 221 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 222 SAUDI ARABIA: WATER TREATMENT CHEMICAL MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5.2 SOUTH AFRICA

10.5.2.1 Favorable government initiatives supporting market growth

TABLE 223 SOUTH AFRICA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 224 SOUTH AFRICA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 225 SOUTH AFRICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 227 SOUTH AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 229 SOUTH AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 230 SOUTH AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5.3 UAE

10.5.3.1 Oil & gas sector and municipal water treatment to drive market

TABLE 231 UAE: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 232 UAE: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 233 UAE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 234 UAE: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 235 UAE: WATER TREATMENT CHEMICALS MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 236 UAE: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 237 UAE: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 238 UAE: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5.4 EGYPT

10.5.4.1 Water treatment and oil & gas sectors supporting market growth

TABLE 239 EGYPT: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 240 EGYPT: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 241 EGYPT: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 242 EGYPT: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 243 EGYPT: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 244 EGYPT: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 245 EGYPT: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 246 EGYPT: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 247 REST OF MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 249 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 250 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 251 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 252 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 253 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 254 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.6 SOUTH AMERICA

TABLE 255 SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 256 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 257 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 259 SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 260 SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 261 SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 262 SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 263 SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 264 SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 265 SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Brazil to lead water treatment chemicals market in South America

TABLE 267 BRAZIL: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 268 BRAZIL: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 269 BRAZIL: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 270 BRAZIL: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 271 BRAZIL: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 272 BRAZIL: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 273 BRAZIL: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 274 BRAZIL: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.6.2 ARGENTINA

10.6.2.1 Recovering economy to support market growth

TABLE 275 ARGENTINA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 276 ARGENTINA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 277 ARGENTINA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 278 ARGENTINA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 279 ARGENTINA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 280 ARGENTINA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 281 ARGENTINA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 282 ARGENTINA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.6.3 VENEZUELA

10.6.3.1 Power and oil & gas sectors to increase demand for water treatment chemicals

TABLE 283 VENEZUELA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 284 VENEZUELA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 285 VENEZUELA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 286 VENEZUELA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 287 VENEZUELA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 288 VENEZUELA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 289 VENEZUELA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 290 VENEZUELA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

10.6.4 REST OF SOUTH AMERICA

TABLE 291 REST OF SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 292 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2021 (KILOTON)

TABLE 293 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 294 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (KILOTON)

TABLE 295 REST OF SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (USD MILLION)

TABLE 296 REST OF SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2018–2021 (KILOTON)

TABLE 297 REST OF SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (USD MILLION)

TABLE 298 REST OF SOUTH AMERICA: MARKET SIZE, BY INDUSTRIAL END USER, 2022–2027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 230)

11.1 INTRODUCTION

11.1.1 WATER TREATMENT CHEMICALS MARKET, KEY DEVELOPMENTS

TABLE 299 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS

11.2.1 ECOLAB INC.

11.2.2 KEMIRA OYJ

11.2.3 BASF SE

11.2.4 SOLENIS

11.2.5 DOW INC.

11.3 MARKET SHARE ANALYSIS

FIGURE 35 WATER TREATMENT CHEMICALS MARKET SHARE, BY COMPANY

11.4 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 36 WATER TREATMENT CHEMICALS MARKET, REVENUE ANALYSIS

11.5 MARKET EVALUATION MATRIX

TABLE 300 MARKET EVALUATION MATRIX

11.6 COMPETITIVE EVALUATION QUADRANT (TIER 1)

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

FIGURE 37 WATER TREATMENT CHEMICALS MARKET (GLOBAL) COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES

11.7 COMPANY TYPE FOOTPRINT

11.8 COMPANY INDUSTRY FOOTPRINT

11.9 COMPANY REGION FOOTPRINT

11.10 STRENGTH OF STRATEGY EXCELLENCE

FIGURE 38 STRENGTH OF STRATEGY EXCELLENCE

11.11 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 STRENGTH OF PRODUCT PORTFOLIO

11.12 COMPETITIVE EVALUATION QUADRANT (SMES)

11.12.1 STARTING BLOCKS

11.12.2 RESPONSIVE COMPANIES

11.12.3 PROGRESSIVE COMPANIES

11.12.4 DYNAMIC COMPANIES

FIGURE 40 WATER TREATMENT CHEMICALS MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR SMES

11.13 COMPETITIVE BENCHMARKING

TABLE 301 WATER TREATMENT MARKET: DETAILED LIST OF SMES

TABLE 302 WATER TREATMENT CHEMICALS MARKET: COMPETITIVE BENCHMARKING OF SMES

11.14 COMPETITIVE SITUATIONS & TRENDS

11.14.1 PRODUCT LAUNCHES

TABLE 303 WATER TREATMENT CHEMICAL MARKET: PRODUCT LAUNCHES, 2019-2022

11.14.2 DEALS

TABLE 304 WATER TREATMENT CHEMICALS MARKET: DEALS, 2019-2022

11.14.3 OTHERS

TABLE 305 WATER TREATMENT CHEMICAL MARKET: OTHERS, 2019-2022

12 COMPANY PROFILES (Page No. - 247)

(Business overview, Products/Solutions/Services Offered, Recent Developments, MNM view)*

12.1 ECOLAB INC.

TABLE 306 ECOLAB INC.: COMPANY OVERVIEW

FIGURE 41 ECOLAB INC.: COMPANY SNAPSHOT

TABLE 307 ECOLAB INC.: PRODUCT OFFERINGS

TABLE 308 ECOLAB INC.: PRODUCT LAUNCHES

TABLE 309 ECOLAB INC.: DEALS

TABLE 310 ECOLAB INC.: OTHER DEVELOPMENTS

12.2 KEMIRA OYJ

TABLE 311 KEMIRA OYJ: COMPANY OVERVIEW

FIGURE 42 KEMIRA OYJ: COMPANY SNAPSHOT

TABLE 312 KEMIRA OYJ: PRODUCT OFFERINGS

TABLE 313 KEMIRA OYJ: DEALS

TABLE 314 KEMIRA OYJ: OTHER DEVELOPMENTS

12.3 BASF SE

TABLE 315 BASF SE: COMPANY OVERVIEW

FIGURE 43 BASF SE: COMPANY SNAPSHOT

TABLE 316 BASF SE: PRODUCT OFFERINGS

TABLE 317 BASF SE: DEALS

TABLE 318 BASF SE: OTHER DEVELOPMENTS

12.4 SOLENIS

TABLE 319 SOLENIS: COMPANY OVERVIEW

TABLE 320 SOLENIS: PRODUCT OFFERINGS

12.5 DOW INC.

TABLE 322 DOW INC.: COMPANY OVERVIEW

FIGURE 44 DOW INC.: COMPANY SNAPSHOT

TABLE 323 DOW INC.: PRODUCT OFFERINGS

TABLE 324 DOW INC.: PRODUCT LAUNCHES

12.6 NOURYON

TABLE 326 NOURYON: COMPANY OVERVIEW

TABLE 327 NOURYON: PRODUCT OFFERINGS

TABLE 328 NOURYON: PRODUCT LAUNCHES

TABLE 329 NOURYON: DEALS

TABLE 330 NOURYON: OTHER DEVELOPMENTS

12.7 KURITA WATER INDUSTRIES LTD.

TABLE 331 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

FIGURE 45 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 332 KURITA WATER INDUSTRIES LTD.: PRODUCT OFFERINGS

TABLE 333 KURITA WATER INDUSTRIES LTD.: DEALS

TABLE 334 KURITA WATER INDUSTRIES: OTHER DEVELOPMENTS

12.8 VEOLIA

TABLE 335 VEOLIA: COMPANY OVERVIEW

FIGURE 46 VEOLIA: COMPANY SNAPSHOT

TABLE 336 VEOLIA: PRODUCT OFFERINGS

TABLE 337 VEOLIA: DEALS

TABLE 338 VEOLIA: OTHER DEVELOPMENTS

12.9 SNF FLOERGER

TABLE 339 SNF FLOERGER: COMPANY OVERVIEW

TABLE 340 SNF FLOERGER: PRODUCT OFFERINGS

TABLE 341 SNF FLOERGER: DEALS

TABLE 342 SNF FLOERGER: OTHER DEVELOPMENTS

12.10 BAKER HUGHES COMPANY

TABLE 343 BAKER HUGHES COMPANY: COMPANY OVERVIEW

FIGURE 47 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

TABLE 344 BAKER HUGHES COMPANY: PRODUCT OFFERINGS

TABLE 345 BAKER HUGHES COMPANY: DEALS

12.11 ARXADA

TABLE 346 ARXADA: COMPANY OVERVIEW

TABLE 347 ARXADA: PRODUCT OFFERINGS

TABLE 348 ARXADA: DEALS

12.12 OTHER PLAYERS

12.12.1 ARIES CHEMICAL, INC.

12.12.2 BUCKMAN LABORATORIES, INC.

12.12.3 DORF KETAL

12.12.4 FERALCO AB

12.12.5 GEO SPECIALTY CHEMICALS INC.

12.12.6 HYDRITE CHEMICAL CO.

12.12.7 INNOSPEC INC.

12.12.8 ION EXCHANGE (INDIA) LTD.

12.12.9 ITALMATCH CHEMICALS S.P.A.

12.12.10 IXOM

12.12.11 MCC CHEMICALS, INC.

12.12.12 ROEMEX LIMITED

12.12.13 SOMICON ME FZC

12.12.14 THERMAX LIMITED

12.12.15 UNIPHOS CHEMICALS

*Details on Business overview, Products/Solutions/Services Offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 292)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

Purification Chemicals Market Overview

Purification chemicals are used in various industries such as water treatment, pharmaceuticals, food and beverage, and others to remove impurities and contaminants from different substances. The market for purification chemicals is driven by the increasing demand for purified water, strict regulations for water treatment and purification, and growing demand for purified products in the pharmaceutical and food industries.

Purification chemicals are a sub-segment of water treatment chemicals that are used in various water treatment applications. Water treatment chemicals are used to purify water for various applications, such as drinking water, industrial water, and wastewater. Purification chemicals are specifically used for removing impurities, organic and inorganic compounds, and other contaminants from water.

The purification chemicals market is expected to grow at a steady pace, which will positively impact the water treatment chemicals market. The demand for purified water is increasing due to the rising population and industrialization, which is expected to drive the growth of the water treatment chemicals market. The increasing use of advanced purification chemicals for water treatment is expected to further drive the demand for water treatment chemicals.

Futuristic Growth Use-cases of Purification Chemicals Market

Some futuristic growth use-cases of purification chemicals include the use of advanced purification chemicals for water treatment, the development of new and innovative purification chemicals for different applications, and the increasing demand for purified products in various industries.

Top players in Purification Chemicals Market

Some of the top players in the purification chemicals market include BASF SE, Dow Chemical Company, Ecolab Inc., Kemira Oyj, and Solenis LLC, among others.

Industries Impacted Due To Purification Chemicals Market

Other industries that are expected to be impacted by the purification chemicals market in the future include the pharmaceuticals, food and beverage, and oil and gas industries, among others. The increasing demand for purified products in these industries is expected to drive the growth of the purification chemicals market.

Speak to our Analyst today to know more about Purification Chemicals Market!

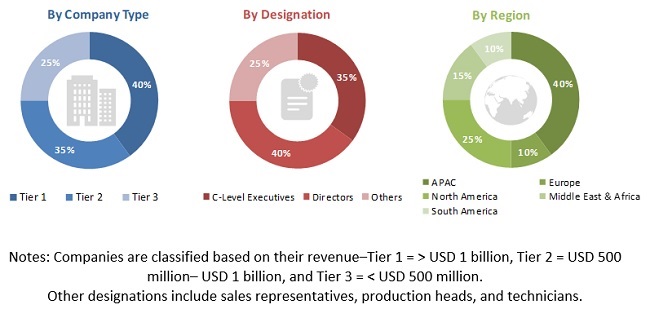

The study involved four major activities in estimating the current size of the water treatment chemicals market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, World Bank, International Energy Agency (IEA), Environmental Protection Agency (EPA), International Monetary Fund (IMF), BusinessWeek, Factiva, ICIS, OneSource, and other government & private websites, associations related to the water treatment chemicals industry to identify and collect information useful for the technical, market-oriented, and commercial study of the water treatment chemicals market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The water treatment chemicals market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as residential, commercial, and industrial. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the water treatment chemicals market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the water treatment chemicals market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the water treatment chemicals market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the water treatment chemicals market

- To analyze and forecast the size of the market based on type, application, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the water treatment chemicals market

- To strategically identify and profile the key market players and analyze their core competencies

- Notes: 1. Micro markets are defined as sub segments of the water treatment chemicals market included in the report.

- 2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the water treatment chemicals market report:

Regional Analysis

- A further breakdown of the water treatment chemicals market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water Treatment Chemicals Market