Wearable AI Market by Product (Smart Watch, Ear Wear, Eye Wear), Operation (On-Device AI, Cloud-Based AI), Component (Processor, Connectivity IC, Sensors), Application (Consumer Electronics, Enterprise, Healthcare), and Geography - Global Forecast to 2023

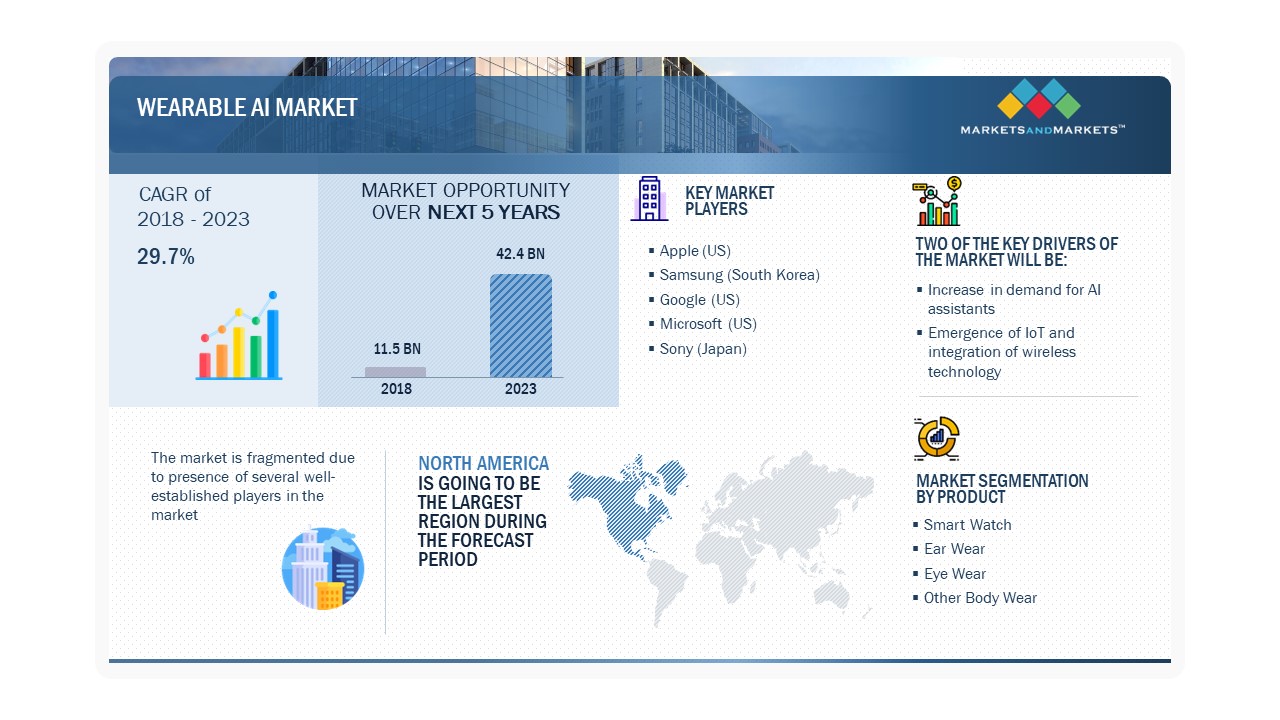

The wearable AI market is projected to grow from USD 11.5 billion in 2018 to USD 42.4 billion by 2023, at a CAGR of 29.7% from 2018 to 2023.

Wearable artificial intelligence (AI) is a combination of wearable devices and AI technology. AI technology brings intelligence to wearable devices that can perform human-like tasks by learning from experiences and predictive analysis.

Wearable AI Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

The use of wearable AI has been mainly prevalent across consumer electronics and healthcare. Consumer wearable electronics include various wearable devices used in multiple applications such as fitness and sports, entertainment and multimedia, and others. Sensors and wearable devices can be integrated into various accessories such as garments, wristwear, shoes, eyeglasses, and other devices, such as headphones, because of their compact size and integration of advanced integration technologies. Various communication technologies such as Bluetooth, ZigBee, and Wi-Fi are being deployed in wearable device applications, such as infotainment. The major products in the infotainment application include smart watches, augmented reality headsets, multimedia players with computing facilities, smart goggles, and other displays. Implementing AI in AR/VR technology offers a fast and immersive gaming experience by effectively rendering optimization of high-end graphics.

Wearables play a crucial role in remote patient monitoring. This application of wearable AI is critical when the patient is at a remote location or may not be able to directly provide information to the physician, such as in case of children, the elderly, or those battling mental health issues. Wearables working in conjunction with Amyx+’s neuroscience platform inform wearers about their anxiety and stress levels, mental focus, and general productivity. Also, hearing aid has started adopting AI functionalities that further drives the healthcare application for wearable AI. Moreover, the introduction of AI-enabled AR/VR drives the growth of surgical developments. This is expected to fuel the growth of the wearable AI market in coming years.

Wearable AI Market Dynamics:

Driver: Increase in demand for AI assistants

Intelligent virtual assistant handles high-volume data, support effective communications, and carries intelligent tasks such as visual perception, speech recognition, and decision-making, which otherwise require human intelligence and intervention. Furthermore, virtual assistants can provide an emotional association explicitly intended for a customer’s decision process. Also, virtual assistants can build meaningful online involvements as an alternative to human support, which drives customer engagement and satisfaction. Also, virtual assistants are now being adopted in the wellness and sports industry. AI-powered wearables gather a significant amount of data to learn from the behavioral patterns of sportspersons and users based on individual physiological parameters

Restraint: Rapidly evolving consumer electronics sector with a shorter life cycle

The consumer electronics sector is a rapidly evolving marketplace. However, due to the development of new technologies, products with old technologies lose their significance because market players face high price erosion. Keeping up with growing technological advancements is challenging for companies because the technology changes when engineers come up with a prototype. New technologies are being developed at a rapid pace and are integrated into various products for additional functions. Consumers prefer technologically advanced products with more features. Thus, companies need to embrace new technologies and reduce design and production cycles to keep up with the pace of the wearable technology market.

Opportunity: Wearable as a service

Wearable as a service is one of the key opportunities in wearable AI and the overall wearable market. Wearable as a service is gaining traction in the wearable AI market owing to developments in wearable computing. With wearable electronic devices all set to join the mainstream of personal computing, companies are adopting business models that operate on wearable as a service. This will not only engage and encourage consumers to use wearables but also add a new revenue stream for businesses.

Challenge: Designing technologically advanced product along with fashionable elements

Tech companies are developing innovative products and selling customers more technologically advanced features; at the same time, they overlook the style quotient and status motivation. Although consumers demand more features, they always prefer body-worn devices with stylistic elements. Most technology vendors are not accustomed to fashion designs and thus may not be able to match up with customers’ perceived image of body-worn devices. Therefore, technology brands and manufacturers must be able to balance fashion along with technological innovations.

Wearable AI Market Segment Insights

Based on product, smart watches, to hold the highest market share from 2018 to 2023

Based on product, the wearable AI market has been segmented into smartwatches, earwear, eyewear, and other body wear such as smart clothing and footwear.

Smartwatches offer many features, such as fitness tracking, text messaging, answering calls, accessing social media, and music. Companies such as Apple (US), Huawei (Japan), and Samsung (South Korea) are offering smart watches for fitness and sports applications. There has been a wide adoption for smart watches owing to the ease in access to AI functionalities offered by them. Therefore, this segment will register the highest market share over the forecast timeframe.

Based on components, the display accounts for the largest size of the wearable AI market during the forecast period

Based on components, the wearable AI market has been classified into processors, displays, memory, sensors, connectivity IC, user interface (UI), power management, and others. The display is projected to hold the largest size of the wearable AI market from 2018 to 2023.

The large market for displays is attributed to the dominance of smartwatches over the entire wearable market, which, in turn, is fundamentally characterized by high-quality displays. Rising awareness among consumers about the benefits of OLED technology featuring better viewing angle, excellent contrast, and refresh rates have resulted in the increased use of OLED displays. This is contributing significantly to the growth of the wearable display market. Moreover, the increasing adoption of AR/VR-based head-mounted displays in various verticals is driving the growth of the market for displays. Therefore, this segment will register high market share over the forecast timeframe.

Based on operation, the cloud-based AI segment to account for larger size of the wearable AI market during forecast period

Based on operation, the wearable AI market is segmented cloud-based AI and on-device AI. Cloud-based AI is projected to hold the larger size of the wearable AI market from 2018 to 2023.

The larger market of cloud-based AI in wearables is due to the simplicity of operations. Although time response for cloud-based AI applications is not as quick as on-device AI, the market for cloud-based AI is still preferred due to its cost-effectiveness. Also, the introduction of high-end processors and software developments in cloud-based AI makes it reliable and easy for wearable devices to operate.

Based on application, enterprise & industrial segments to grow at the highest rate

By application, the wearable AI market has been segmented into Consumer Electronics, Healthcare, Enterprise & Industrial, and Others, which includes retail, security & defense, and more. The market for enterprise & industrial applications is expected to grow at the highest CAGR during the forecast period.

This growth is mainly attributed to the increasing demand for wearable AR/VR in enterprise processes to increase efficiency. With the help of smart glasses, workers can improve their day-to-day tasks as they could see a list in their field of vision that provides information such as part numbers and stored locations. Also, touch and voice control functions enable efficient, hands-free motion, thereby increasing their mobility. Therefore, wearable AI device adoption is expected to grow at the highest rate in enterprise and industrial applications, considering the ease of operation.

Wearable AI Market Regional Insights:

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period

The growth of the wearable AI market in Asia Pacific can be attributed to the fact that Asia Pacific consists of developing economies such as China and India—which have a huge appetite for consumer product adoption and the potential for different applications of wearable AI.

It is also observed that the geographic regions with higher incomes tend to purchase wearable AI devices. Therefore, rising per capita income in Asian countries will drive the adoption of wearable AI devices. Moreover, the increasing adoption of new technologies in enterprise and industrial applications will drive the wearable AI market in this region.

Wearable AI Market by Region

To know about the assumptions considered for the study, download the pdf brochure

In the Asia Pacific region, countries such as China, South Korea, and India are estimated to witness significant growth in the wearable AI market during the forecast period owing to the growing fitness awareness and consumer electronics interests. Applications such as consumer electronics, industrial, healthcare, and textile contribute significantly to this region's wearable AI market. Asia Pacific has become a global focal point for significant investments and business expansion opportunities. The major consumer electronics companies operating in Asia Pacific include Samsung (South Korea), Sony (Japan), and LG Electronics (South Korea). As a result, the wearable AI market in the Asia Pacific is expected to grow at the highest CAGR in the coming years.

The North America region held the major share of the Wearable AI market in 2017

North America holds the largest share of the wearable AI market and is expected to retain its dominant position throughout the forecast period.

A major driving factor for the growth of the wearable AI market in North America is the increasing R&D at both academic and the industry levels, which, in turn, is broadening the application areas of wearable AI in different industries such as consumer electronics, enterprise & industrial applications, and healthcare. The largest market in North America is also attributed to technological innovations and advancements leading to the introduction of new products. Other factors promoting the market's growth are the ease of use of wearables and an increase in the prevalence of chronic diseases and lifestyle diseases, such as diabetes.

Key Market Players in Wearable AI Industry

Some of the Major players in the wearable AI market are Apple (US), Samsung (South Korea), Google (US), Microsoft (US) and Sony (Japan). These players have adopted various growth strategies such as Product launches and developments, partnerships, agreements, and collaborations to further expand their presence in the wearable AI market.

Apple (US) has been in the top position because of its market share in consumer electronics and high financial power. The company’s strong market position is characterized by its strong brand equity coupled with technical expertise and broad offerings in the wearable AI market. Well-established market with a large customer base and community imparts a significant competitive edge. The company manufactures its wearable devices and supports them with its own OS, AI solutions, and services. The company is self-sufficient in all possible ways. With leading innovations in devices, controls, sensors, data analytics, and advanced solutions, the company focuses on opportunities in the wearable AI industry. Also, the company is financially stable with a sound liquidity position. This enables the company to make substantial strategic investments in emerging technologies such as artificial intelligence and machine learning.

Samsung (South Korea) ranked second in the market. The company is one of the leading providers of wearable technologies. Along with better sensing technologies in wearable, the company has been consistently focused on developing AI technologies and bring innovative wearable devices to the market. Presently, Samsung is aggressively expanding its R&D facilities and investments specifically dedicated to AI with a launch of new research centers in the UK, Canada, and Russia to accelerate the development of AI technologies.

Wearable AI Market Trends Highlights:

Recent Developments in Wearable AI Industry

- In September 2022, Apple (US) introduced Apple Smart Watch Series 8. Apple Watch Series, 8 features temperature sensing for insights into women's health, Car Crash Detection, and sleep stages to understand sleep patterns.

- In May 2022, Samsung Electronics (South Korea) and Google (US) teamed up to build a unified Wear OS platform that seamlessly connects Android devices. The platform includes Google Play, which gives users access to some of the most popular apps and services from Google, including Google Maps, Google Pay, and YouTube Music. This enables Galaxy Watch4 users to download Google Assistant2 on their devices, gaining access to fast, more natural voice interactions, quick answers to questions and on-the-go help.

- In May 2022, Sony (Japan) launched Wena 3, a smartwatch that can be used as a regular watch; however, it accepts mobile payments via Barclaycard in the UK. bPay, a wearable technology company backed by Barclaycard, offers jackets, fobs, and stickers that can be used to perform contactless payments.

- In September 2022, Google Cloud (US) and Fitbit Health Solutions (US) launched the Device Connect for Fitbit solution, which aims to give healthcare organizations a more holistic view of patients outside clinical settings using data from wearable devices.

- In August 2021, LifeScan, a world leader in blood glucose monitoring, and Fitbit, announced a collaboration to offer diabetic people a complete view by providing insights into daily activity, nutrition, and sleep. LifeScan’s OneTouch Reveal app uses a cloud-based digital ecosystem to deliver a powerful combination of data, technology, and insights for improved diabetes management, with the ability to link people to healthcare providers. Through this collaboration, people will receive a Fitbit Inspire 2 and access to Fitbit Premium, which provides guided programs, hundreds of workouts, mindfulness content, a wellness report, and more personalized insights in the Fitbit health metrics dashboard.

Key Benefits of the Report/Reason to Buy:

Target Audience: Wearable technology companies, Artificial Intelligence companies, companies involved in the ecosystem of wearable technology and AI market, Key service providers, Software solution providers

Frequently Asked Questions (FAQs):

What is the current size of the wearable AI market?

The wearable AI market is projected to grow from USD 11.5 billion in 2018 to USD 42.4 billion by 2023, at a CAGR of 29.7% from 2018 to 2023.

Who are the winners in the wearable AI market?

Apple (US), Samsung (South Korea), Google (US), Microsoft (US) and Sony (Japan).

What are some of the technological advancements in the market?

Internet of Things (IoT) and wireless technology: The emergence of IoT led to the development of miniaturized sensors, actuators, and low-power wireless communication technologies. The recent advancements in intelligent sensing and actuating devices and appropriate communication technologies such as Bluetooth Low Energy (BLE), Wi-Fi, ANT, and others make integrating AI technology in wearables a lot easier.

Global positioning system (GPS) and digital compass are used to determine an object or individual's co-ordinates (position and orientation). These technologies in wearable devices are a major breakthrough in patient monitoring and child surveillance. Similarly, wearable devices can be embedded in precious, antique, and costly objects and inventories for tracking.

What are the factors driving the growth of the market?

An increase in demand for AI assistants, augmentation of operations in the healthcare industry, and growth prospects of wearable component technology are some factors driving the market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Wearable AI Market Opportunities

4.2 Market for On-Device AI, By Application

4.3 Market in APAC, By Application & Country

4.4 Country-Wise Snapshot of Market

4.5 Market in APAC, By Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for AI Assistants

5.2.1.2 Augmentation of Operations in Healthcare Industry

5.2.1.3 Emergence of IoT and Integration of Wireless Technology

5.2.1.4 Growth Prospects of Wearable Component Technology

5.2.1.5 Increase in Consumer Preference and Demand for Advanced Wearable Devices

5.2.2 Restraints

5.2.2.1 Rapidly Evolving Consumer Electronics Sector With Shorter Life Cycle

5.2.3 Opportunities

5.2.3.1 Wearable as A Service

5.2.3.2 Wearables for Pets and Animals

5.2.4 Challenges

5.2.4.1 Charging, Power, and Battery Life Optimization

5.2.4.2 Designing Technologically Advanced Product Along With Fashionable Elements

5.2.4.3 Data Privacy Compliances and Regulations

5.3 Value Chain Analysis

6 Wearable AI Market, By Product (Page No. - 45)

6.1 Introduction

6.2 Smart Watch

6.2.1 Being Most Popular Wearable Product, Smart Watch to Have A Highest Rate of Adoption for AI Integration

6.3 Ear Wear

6.3.1 Adoption of AI in Hearable to Grow Owing to Best Suitability for Voice Assistance and Bring AI Features to Users in Most Convenient Way

6.4 Eye Wear

6.4.1 Demand for AI in Eye Wear is Growing Owing to Its Wide Usage in Enterprise & Industrial Applications

6.5 Other Body Wear

7 Wearable AI Market, By Component (Page No. - 54)

7.1 Introduction

7.2 Display

7.2.1 Market for Displays to Lead During Forecast Period Owing to Dominance of Smart Watches

7.3 Processor

7.3.1 Growing Market for Processors Attributed to Increasing Demand for High-End Features to Facilitate Ease in AI Integration

7.4 Power Management

7.4.1 Challenges for Power Management in Adherence With Increasing Trend of Miniaturization to Drive the Growth of Power Management Market

7.5 Connectivity IC

7.5.1 Cellular

7.5.1.1 to Achieve A Data Connectivity Over A Long Distance Cellular is One of the Most Preferred Connectivity Technology

7.5.2 NFC

7.5.2.1 NFC is Preferred to Achieve A Quick Connection for A Closed Proximity Operation

7.5.3 Bluetooth

7.5.3.1 Bluetooth is Mostly Preferred for Convenient Connectivity With Other Portable Devices

7.5.4 Wi-Fi+Bluetooth

7.5.4.1 Achieving High Performance and Cost-Effective Communication Wi-Fi + Bluetooth is Most Preferred Technology

7.5.5 Wi-Fi

7.5.5.1 The Requirement for Operations Over Cloud to Drive the Increasing Demand for Wi-Fi Technology

7.5.6 ANT+

7.5.6.1 The Market for ANT+ is Attributed to the Operations Over Low-Power Sensor Networks

7.5.7 GPS

7.5.7.1 The Increasing Demand for GPS Technology is Owing to the Applications Areas Such as Patient Monitoring, Child Surveillance, and Others

7.6 Memory/Storage

7.6.1 Increasing Multimedia Features in Wearable Devices Such as Smart Watches Driving the Need for Additional Internal Memory

7.7 Sensors

7.7.1 Increasing Need for Monitoring More Number of Physiological Parameters That Would Facilitate Better AI Integration to Drive the Growth of Sensor Market

7.8 UI

7.8.1 UI Market Growth Attributed to Ongoing Improvements for Better User Experience

7.9 Others

8 Wearable AI Market, By Operation (Page No. - 66)

8.1 Introduction

8.2 On-Device AI

8.2.1 Increasing Need for Higher Performance and Better Reliability to Drive the Demand for On-Device AI Wearables

8.3 Cloud-Based AI

8.3.1 Cloud-Based AI to Hold Largest Market Owing to Simplicity in Operation and Cost-Effectiveness

9 Wearable AI Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Consumer Electronics

9.2.1 Growth of Market in Consumer Electronics Attributed to Rising Consumer Awareness for Fitness and Health

9.3 Healthcare

9.3.1 Increasing Adoption of Technology in Healthcare for Process Improvement to Drive Adoption of Wearable AI in Healthcare

9.4 Enterprise and Industrial

9.4.1 Increasing Worker Performance and Process Efficiency to Drive the Demand for Wearable AI in Enterprise and Industrial Applications

9.5 Others

10 Geographic Analysis (Page No. - 78)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US to Hold Largest Market of Wearable AI in North America During Forecast Period

10.2.2 Canada

10.2.2.1 Market in Canada to Grow With Rising Adoption of Wearables in Healthcare and Enterprises

10.2.3 Mexico

10.2.3.1 Increasing Use of Consumer Electronics to Drive Market in Mexico

10.3 Europe

10.3.1 Germany

10.3.1.1 Increasing Consumer Adoption of Wearable Devices to Define the Growth of Wearable AI in the Country

10.3.2 France

10.3.2.1 Growth of Market in France Driven By Increasing Demand for Portable Electronic Products, Especially From the Country’s Healthcare and Consumer Sectors

10.3.3 UK

10.3.3.1 Market in the UK to Grow With Wearable Adoption in Healthcare and Consumer Electronics

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 China to Hold Largest Market Share of Wearable AI in APAC During Forecast Period

10.4.2 Japan

10.4.2.1 Technologically Advanced Manufacturing Industry to Drive the Growth of Wearable AI in Japan

10.4.3 South Korea

10.4.3.1 Presence of Leading Manufacturers in Wearable Space Drive Market Growth in Consumer Electronics in the Country

10.4.4 India

10.4.4.1 Wearable AI Market in India is Primarily Driven By Increasing Application Areas in Consumer and Healthcare Sectors

10.4.5 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.1.1 Growing Economies Such as Brazil and Other are Driving the Growth of Market in South America

10.5.2 Middle East & Africa

10.5.2.1 Industrial Development to Drive the Demand of Wearable AI in the Middle East

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Ranking Analysis

11.2.1 Apple (US)

11.2.2 Samsung (South Korea)

11.2.3 Google (US)

11.2.4 Microsoft (US)

11.2.5 Sony (Japan)

11.3 Competitive Scenario

11.3.1 Product Developments and Launches

11.3.2 Partnerships, Agreements, and Collaborations

11.3.3 Acquisitions

11.3.4 Investments and Expansions

12 Company Profiles (Page No. - 114)

12.1 Key Companies

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1.1 Apple

12.1.2 Samsung

12.1.3 Google

12.1.4 Microsoft

12.1.5 Sony

12.1.6 Garmin

12.1.7 Fitbit

12.1.8 Huawei

12.1.9 Amazon

12.1.10 IBM

12.1.11 Oracle

12.2 Key Start-UPS

12.2.1 Bragi

12.2.2 Motive

12.2.3 Shft

12.2.4 Lifebeam

12.2.5 Focusmotion

12.2.6 Moov

12.2.7 Atlas

12.2.8 Biobeats

12.2.9 Physiq

12.2.10 Touchkin

*Details on Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 147)

13.1 Insights From Industry Experts

13.2 Questionnaire

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Report

13.6 Author Details

List of Tables (70 Tables)

Table 1 Wearable AI Market, By Product, 2016–2023 (USD Million)

Table 2 Market, By Product, 2016–2023 (Thousand Units)

Table 3 Market for AI Smart Watches, By Component, 2016–2023, (USD Million)

Table 4 Market for Ear Wear, By Component, 2016–2023, (USD Million)

Table 5 Market for Eye Wear, By Component, 2016–2023, (USD Million)

Table 6 Market for Other Body Wear, By Component, 2016–2023 (USD Thousand)

Table 7 Market, By Component, 2016–2023 (USD Billion)

Table 8 Market for Displays, By Product, 2016–2023 (USD Million)

Table 9 Market for Processors, By Product, 2016–2023 (USD Million)

Table 10 Market for Power Management, By Product, 2016–2023 (USD Million)

Table 11 Market for Connectivity Ic, By Product, 2016–2023 (USD Million)

Table 12 Market for Connectivity Ic, By Type, 2016–2023 (USD Thousand)

Table 13 Market for Memory/Storage, By Product, 2016–2023 (USD Million)

Table 14 Market for Sensors, By Product, 2016–2023 (USD Million)

Table 15 Market for UI, By Product, 2016–2023 (USD Million)

Table 16 Market, By Operation, 2016–2023 (USD Million)

Table 17 Market for On-Device AI, By Application, 2016–2023 (USD Million)

Table 18 Market for Cloud-Based AI, By Application, 2016–2023 (USD Million)

Table 19 Market, By Application, 2016–2023 (USD Billion)

Table 20 Market for Consumer Electronics Applications, By Operation, 2016–2023 (USD Million)

Table 21 Market for Consumer Electronics Applications, By Region, 2016–2023 (USD Billion)

Table 22 Market for Healthcare Applications, By Operation, 2016–2023 (USD Million)

Table 23 Market for Healthcare Applications, By Region, 2016–2023 (USD Billion)

Table 24 Market for Enterprise & Industrial Applications, By Operation, 2016–2023 (USD Million)

Table 25 Market for Enterprise & Industrial Applications, By Region, 2016–2023 (USD Million)

Table 26 Wearable AI Market for Other Applications, By Operation, 2016–2023 (USD Million)

Table 27 Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 28 Market, By Region, 2016–2023 (USD Billion)

Table 29 Market in North America, By Country, 2016–2023 (USD Billion)

Table 30 Market in North America, By Application, 2016–2023 (USD Billion)

Table 31 Market in North America for Consumer Electronics Applications, By Country, 2016–2023 (USD Billion)

Table 32 Market in North America for Healthcare Applications, By Country, 2016–2023 (USD Billion)

Table 33 Market in North America for Enterprise & Industrial Applications, By Country, 2016–2023 (USD Million)

Table 34 Market in North America for Other Applications, By Country, 2016–2023 (USD Million)

Table 35 Market in Us, By Application, 2016–2023 (USD Million)

Table 36 Market in Canada, By Application, 2016–2023 (USD Million)

Table 37 Market in Mexico, By Application, 2016–2023 (USD Million)

Table 38 Market in Europe, By Country, 2016–2023 (USD Billion)

Table 39 Market in Europe, By Application, 2016–2023 (USD Billion)

Table 40 Market in Europe for Consumer Electronics Applications, By Country, 2016–2023 (USD Billion)

Table 41 Market in Europe for Healthcare Applications, By Country, 2016–2023 (USD Billion)

Table 42 Market in Europe for Enterprise & Industrial Applications, By Country, 2016–2023 (USD Million)

Table 43 Market in Europe for Other Applications, By Country, 2016–2023 (USD Million)

Table 44 Market in Germany, By Application, 2016–2023 (USD Million)

Table 45 Market in France, By Application, 2016–2023 (USD Million)

Table 46 Market in Uk, By Application, 2016–2023 (USD Million)

Table 47 Market in Rest of Europe, By Application, 2016–2023 (USD Million)

Table 48 Wearable AI Market in APAC, By Country, 2016–2023 (USD Million)

Table 49 Market in APAC, By Application, 2016–2023 (USD Million)

Table 50 Market in APAC for Consumer Electronics Applications, By Country, 2016–2023 (USD Million)

Table 51 Market in APAC for Healthcare Applications, By Country, 2016–2023 (USD Million)

Table 52 Market in APAC for Enterprise & Industrial Applications, By Country, 2016–2023 (USD Million)

Table 53 Market in APAC for Other Applications, By Country, 2016–2023 (USD Million)

Table 54 Market in China, By Application, 2016–2023 (USD Million)

Table 55 Market in Japan, By Application, 2016–2023 (USD Million)

Table 56 Market in South Korea, By Application, 2016–2023 (USD Million)

Table 57 Market in India, By Application, 2016–2023 (USD Million)

Table 58 Market in Rest of APAC, By Application, 2016–2023 (USD Million)

Table 59 Wearable AI Market in RoW, By Region, 2016–2023 (USD Million)

Table 60 Market in RoW, By Application, 2016–2023 (USD Million)

Table 61 Market in RoW for Consumer Electronics Applications, By Region, 2016–2023 (USD Million)

Table 62 Market in RoW for Healthcare Applications, By Region, 2016–2023 (USD Million)

Table 63 Market in RoW for Enterprise & Industrial Applications, By Region, 2016–2023 (USD Million)

Table 64 Market in RoW for Other Applications, By Region, 2016–2023 (USD Million)

Table 65 Market in South America, By Application, 2016–2023 (USD Million)

Table 66 Market in Middle East & Africa, By Application, 2016–2023 (USD Million)

Table 67 Product Developments and Launches, 2018

Table 68 Partnership, Agreement, and Collaborations, 2018

Table 69 Acquisitions, 2016–2018

Table 70 Investments and Expansions, 2016–2018

List of Figures (49 Figures)

Figure 1 Wearable AI Market Segmentation

Figure 2 Research Flow

Figure 3 Market: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Smart Watch to Hold Largest Size of Market During Forecast Period

Figure 8 Market for Sensors to Grow at Highest CAGR During Forecast Period

Figure 9 Market for On-Device AI to Grow at Higher CAGR During Forecast Period

Figure 10 Market for Enterprise and Industrial Applications to Grow at Highest CAGR During Forecast Period

Figure 11 North America Accounted for Largest Share in Market in 2017

Figure 12 Market to Provide Attractive Growth Opportunities During Forecast Period

Figure 13 On-Device AI Market for Enterprise & Industrial Application to Grow at Highest CAGR During Forecast Period

Figure 14 Consumer Electronics Held Largest Share of Market in APAC in 2017

Figure 15 Market in India to Grow at Highest CAGR During Forecast Period

Figure 16 Market in India to Grow at Highest CAGR During Forecast Period

Figure 17 Augmentation of Operations in Healthcare Industry Driving Growth of Market

Figure 18 Digital Assistant Device Market, 2015–2017

Figure 19 Value Chain: Wearable AI Market, 2017

Figure 20 Market for Other Body Wear to Grow at Highest CAGR During Forecast Period

Figure 21 Eye Wear Component Market for Processor to Hold Largest Share By 2023

Figure 22 Wearable AI Market for Sensors to Grow at Highest CAGR During Forecast Period

Figure 23 Processor Market for Eye Wear to Grow at Highest CAGR During Forecast Period

Figure 24 Connectivity IC Market for Wi-Fi+ Bluetooth to Grow at Highest CAGR During Forecast Period

Figure 25 Market for On-Device Wearable AI Devices to Grow at Higher CAGR During Forecast Period

Figure 26 Market for Enterprise & Industrial Applications to Grow at Highest CAGR During Forecast Period

Figure 27 Market in APAC for Healthcare Applications to Grow at Highest CAGR During Forecast Period

Figure 28 Geographic Snapshot: APAC Countries Emerging as Potential Markets for Wearable AI (2018–2023)

Figure 29 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 30 North America: Snapshot of Market

Figure 31 Market in US for Enterprise & Industrial Applications to Grow at Highest CAGR During Forecast Period

Figure 32 Europe: Snapshot of Wearable AI Market

Figure 33 Market in Europe for Enterprise & Industrial Applications to Grow at Highest CAGR During Forecast Period

Figure 34 APAC: Snapshot of Wearable AI Market

Figure 35 Market in South Korea for Enterprise & Industrial Applications to Grow at Highest CAGR During Forecast Period

Figure 36 Market in Middle East & Africa for to Grow at Higher CAGR During Forecast Period

Figure 37 Companies Adopted Product Developments and Launches as Key Growth Strategies Over the Last 5 Years (2013–2018)

Figure 38 Ranking Analysis of Top 5 Players in Wearable AI Market

Figure 39 Apple: Company Snapshot

Figure 40 Samsung: Company Snapshot

Figure 41 Google: Company Snapshot

Figure 42 Microsoft: Company Snapshot

Figure 43 Sony: Company Snapshot

Figure 44 Garmin: Company Snapshot

Figure 45 Fitbit: Company Snapshot

Figure 46 Huawei: Company Snapshot

Figure 47 Amazon: Company Snapshot

Figure 48 IBM: Company Snapshot

Figure 49 Oracle: Company Snapshot

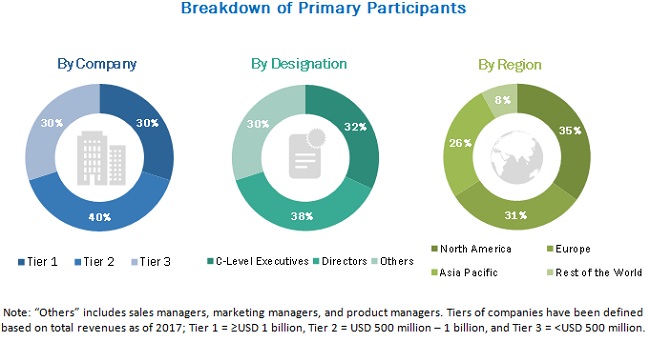

The study involved 4 major activities for estimating the current market size for wearable AI products. An exhaustive secondary research was done to collect information on the market, as well as its peer and parent markets. The next step was validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include Wearable Tech World, Association for the Advancement of Artificial Intelligence, European Association For Artificial Intelligence, Consumer Technology Association, Semiconductor Equipment and Materials International (SEMI) (US), Journals, press releases, and financials of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the wearable AI market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the wearable AI market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends identified from both demand and supply sides, in consumer electronics, enterprise & industrial, and healthcare. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major objectives of the study.

- To describe and forecast the wearable AI market, in terms of value, by product, operation, component, and application

- To describe and forecast the wearable AI market, in terms of volume, by product

- To describe and forecast the market, in terms of value, by region—North Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D) in the wearable AI market

Scope of the Report

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) in million/ billion |

|

Segments covered |

Product, component, operation, application, and region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Apple (US), Samsung (South Korea), Google (US), Microsoft (US), Sony (Japan), Garmin (US), Fitbit (US), Huawei (China), Amazon (US), IBM (US), and Oracle (US) Bragi (Germany), Motive (Canada), SHFT (Denmark), LifeBEAM) (US), FocusMotion (US), Moov (US), Atlas (US), BioBeats (UK), PhysIQ (US), and Touchkin (UK) |

This research report categorizes the wearable AI market based on product, component, operation, application, and region.

By Product

- Smart Watch

- Ear Wear

- Eye Wear

- Other Body Wear (fitness trackers, smart clothing, accessories, footwear)

By Component

- Display

- Processor

- Power Management

- Connectivity IC

- Memory/Storage

- Sensors

- UI

By Operation

- On-Device AI

- Cloud-Based AI

By Application:

- Consumer Electronics

- Enterprise & Industrial

- Healthcare

- Others (retail, agriculture, construction, military & defense)

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per a client’s specific requirements. The available customization options are as follows:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Wearable AI Market