Wi-Fi 6 Market by Offering (Hardware, Solution, and Services), Location Type (Indoor and Outdoor), Organization Size, Vertical (Education, Healthcare, Government, Manufacturing) and Region (2022 - 2027)

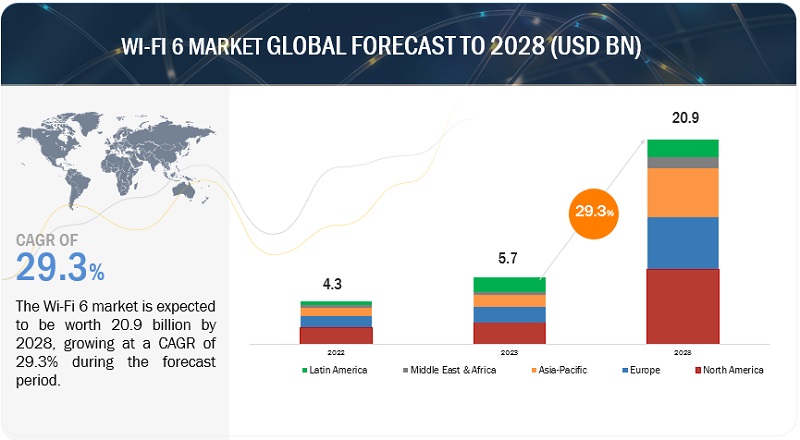

[218 Pages Report] The global Wi-Fi 6 market size is projected to grow at a CAGR of 17.9% during the forecast period to reach USD 26.2 billion by 2027 from an estimated USD 11.5 billion in 2022. The Wi-Fi 6 market is gaining traction due to increasing number of internet users.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

- During COVID–19, internet access has been provided through free APs to consumers that cannot afford to purchase the broadband service.

- Due to the COVID–19 outbreak, there is a dramatic increase in telecommuting and data traffic from households and businesses, resulting in the adoption of Wi–Fi 6 solution.

- The worldwide lockdowns and stay–at–home orders prompted by COVID–19 increased wireless broadband.

- Enhancing digital technology and the global proliferation of Wi–Fi 6 access is important for both established and developing economies.

- Due to the COVID–19 outbreak, the number of Wi–Fi 6 connected devices across homes are increasing day–by–day.

- Lockdown has given rise to digital learning platforms and message boards for remote education, thereby boosting the market growth.

Market Dynamics

Driver: Increasing number of internet users

Because of the number of internet users has been rising in the recent years and is projected to continue to rise in the next few years, the demand for Wi–Fi 6 and its services is expected to rise at the same time. Due to increased smartphone penetration and improved connectivity, the number of internet users worldwide is quickly expanding. Increased internet connectivity around the world has opened new business prospects for telecom service providers. However, along with these advantages in terms of latency and bandwidth, they also need to match their competitors’ uptime. Telecom companies are investing extensively in upgraded Wi–Fi solutions to take advantage of these new opportunities, which might provide the requisite connectivity bandwidth, security, and network dependability. The industry is expected to rise as telecom companies increase their investments in wireless network infrastructure.

Restraint: Contention loss and co–channel interference

Contention loss and co–channel interference are the key issues associated with Wi–Fi networks. Contention loss refers to poor network performance due to various clients converging on a single AP, whereas co–channel interference is caused when two or more APs use the same Radio Frequency (RF) channel, thereby affecting the network performance. It is a threat in some of the mature markets, such as North America, Europe, and some APAC countries. Regions already have well–established Wi–Fi networks and implementing a new network may cause network mapping between the channels, thereby hindering the performance of the network. The distribution of users along the APs would not be even, which would pose a problem in making decisions about the implementation of new APs.

Opportunity: Increasing deployment of public Wi–Fi

Wi–Fi is becoming more widely available in public spaces such as supermarkets, stadiums, airports, and hotels. The increased demand for Wi–Fi devices and guest Wi–Fi solutions is due to this factor. People now have access to speedier broadband services that provide continuous internet access everywhere and at any time. Organizations can use Wi–Fi analytics to extract critical information and data points that aid management in making marketing–related decisions. For instance, with the help of location analytics, the hotel management can tell how frequently guests use their in–house gym, hotel bar, restaurant, and lobby. With such analytics, organizations can provide more customized and tailored solutions to customers. Additionally, in case of guest Wi–Fi, service providers are able to maintain a log of return customers who visit the store and log into the store Wi–Fi. With this information, the management would be able to provide loyalty points to regularly visiting customers.

Challenge: Data security and privacy concerns

Data security is a big concern for numerous organizations. Because if the massive increase in data quantities, businesses are looking for stronger security and privacy protection to protect their networks and keep them safe from online dangers, including corporate monitoring, data breaches, and data espionage. Various security and privacy challenges have arisen as the number of systems has grown, and every endpoint, gateway, sensor, and smartphone has become a possible target for hackers. Since the WLAN network provides access to various smart devices, security is a major factor that needs to be considered while deploying Wi–Fi networks. Wi–Fi solutions and associated services, in the scenario, offer secure, reliable, and high–speed internet access. Any disruption to enterprise processes can have a significant effect on the entire business. As a result, several enterprises are reluctant to adopt Wi–Fi solutions and services. Hence, proper security and privacy are needed for Wi–Fi solutions and associated services to be successfully deployed. Factors mentioned above are some of the major challenges that may affect the growth of the market.

By Location type, the outdoor segment to have a higher growth during the forecast period

The outdoor Wi-Fi 6 solution is simply Wi-Fi access is provided outside of a building.Outdoor Wi-Fi 6 is usually uses as an extension of the internal WLAN network of an organization to five users a continuous WI-Fi 6 services.The outdoor Wi-Fi 6 include outdoor area of a school ,college,university,hospital,holtes.Outdoor WiFi 6 operates in the 2.4 or 5 GHz frequency and can achiveve theoretical thrughputs of up to 1.7 Gbps true throughputs depend on client devices and the quality of Wireless access points.Outdoor access points are often deployed with sectoredantennas focusing on the wireless coverage onto a specific areas.

APAC to grow at the highest CAGR during the forecast period

Asia Pacific is rapidly establishing itself as the world’s most powerful area, home to a number of smart cities. Increased security spending to keep up with the ever-changing threat landscape is causing great concern among governments in this region. Asia Pacific comprises China, India, Australia, Hong Kong, and Japan, which are examples of developing economies in the region. . Various businesses and commercial clients in this region have begun to use dependable W–Fi 6 hardware, solutions and services, contributing to the region’s overall growth in the Wi–Fi 6 industry. The popularity of smart gadgets and the internet is increasing in Asia Pacific, necessitating the need for reliable and secure internet connectivity. Wi–Fi 6 solutions and services are increasingly being used by businesses to provide internet connectivity to their employees and visitors. The technological advancements in APAC along with the increasing trend toward adopting Wi–Fi 6 offering are expected to provide added benefits to the APAC Wi–Fi 6 market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players Wi-Fi 6 market. The major vendors covered in the Wi-Fi 6 market include Cisco Systems (US), Intel Corporation (US), Huawei Technologies (China), NETGEAR (US), Juniper Networks (US), Broadcom (US), Qualcomm Inc. (US), Extreme Networks (US), Ubiquiti Networks (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), Cambium Networks (US), D-Link Corporation (China), Alcatel-Lucent (US), TP-Link (China), MediaTek (China), Telstra (Australia), Murata (Japan), Sterlite Technologies Limited (India), Celeno (Israel), H3C (China), Senscomm Semiconductor (China), XUNISON (Ireland), Redway Networks (UK), VSORA (France), NEWRACOM (US), WILUS Group (South Korea), Federated Wireless (US). These players have adopted various growth strategies, such as partnerships, business expansions, mergers and acquisitions, agreements, and collaborations, new product launches to expand their presence in the Wi-Fi 6 market. Partnerships and new product launches have been the most adopted strategies by major players from 2019 to 2022, which helped them innovate their offerings and broaden their customer base.

These players have adopted various strategies to grow in the global offering Wi-Fi 6 market. The study includes an in-depth competitive analysis of these key players in the offering Wi-Fi 6 market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 11.5 Billion |

|

Market size value in 2027 |

USD 26.2 Billion |

|

Growth rate |

CAGR of 17.9% |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Offering, Location Type, Organization Size, Industry Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Cisco Systems (US), Intel Corporation (US), Huawei Technologies (China), NETGEAR (US), Juniper Networks (US), Broadcom (US), Qualcomm Inc. (US), Extreme Networks (US), Ubiquiti Networks (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), Cambium Networks (US), D-Link Corporation (China), Alcatel-Lucent (US), TP-Link (China), MediaTek (China), Telstra (Australia), Murata (Japan), Sterlite Technologies Limited (India), Celeno (Israel), H3C (China), Senscomm Semiconductor (China), XUNISON (Ireland), Redway Networks (UK), VSORA (France), NEWRACOM (US), WILUS Group (South Korea), Federated Wireless (US). |

This research report categorizes the Wi-Fi 6 market to forecast revenues and analyze trends in each of the following subsegments:

By Offering:

-

Hardware

- Wireless Access Points

- Mesh Routers

- Home Gateways

- Wireless Repeaters

- Solution

-

Services

- Professional Services

- Managed Services

By Location Type:

- Outdoor

- Indoor

By Organization Size:

- Large enterprises

- SMEs

By Industry Vertical:

- Education

- Retail and eCommerce

- Healthcare

- Government

- Hospitality

- Transportation and Logistics

- Manufacturing

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- Malaysia

- Rest of Asia Pacific

-

Middle East and Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022, NETGEAR launches nighthawk ax1800 (EAX20) and nighthawk ax6000 (EAX80) Wi–Fi 6 mesh extenders. The new Wi–Fi extenders are designed to widen bandwidth using Orthogonal Frequency Division Multiple Access (OFDMA) technology. In terms of differences between the two, the NETGEAR nighthawk ax1800 mesh extender comes as a new four–stream mesh extender and is capable of delivering up to 1.8Gbps speeds.

- In December 2021, Huawei launch AirEngine 6760–X1 & 6760–X1E APs is ultra–high performance indoor settled Wi–Fi 6 (802.11ax) APs with ten spatial streams by default and two built–in IoT slots. With an RTU license, the AP can provide up to 12 spatial streams and work in the triple–radio mode.

- In November 2021,Juniper Networks announced two new 6 GHz access points that leverage Mist AI. This aims to maximize Wi–Fi performance and capacity while simplifying IT operations. Wi–Fi 6E is a new wireless standard that expands network capacity by making a larger amount of RF spectrum available in the 6 GHz range to add to the existing 2.4 GHz and 5 GHz bands.

- In October 2021, Qualcomm launches Networking Pro 1610 Platform is, a fully integrated Wi–Fi 6E platform ideally suited for enterprise–class applications such as large corporate campuses and venues. It is an industry–leading, 16–stream offering featuring Qualcomm Tri–Band Wi–Fi 6.

- In March 2021, Intel launches Wi–Fi 6 (Gig+) adapter supports the new IEEE 802.11ax standard – Wi–Fi 6 technology and is Wi–Fi CERTIFIED 6. The product supports 2x2 Wi–Fi 6 technology, including new features such as UL and DL OFDMA and 1024QAM, delivering data rates of up to 2.4Gbps and increased network capacity as well as Bluetooth 5.1 support.

Frequently Asked Questions (FAQ):

How is the Wi-Fi 6 market expected to grow in the next five years?

According to MarketsandMarkets, the Wi-Fi 6 market size is expected to grow USD 11.5 billion in 2022 to USD 26.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.9% during the forecast period.

Which region has the largest market share in the Wi-Fi 6 market?

North America is estimated to hold the largest market share in Wi-Fi 6 market in 2022. North America is one of the technologically advanced markets in the world. It drives the large-scale implementation Wi-Fi 6 market.

What are the major factors driving Wi-Fi 6 market?

The major drivers Wi-Fi 6 market are Increasing number of internet users to improve compliance with governments.

Who are the major vendors in Wi-Fi 6 market?

Major vendors in Wi-Fi 6 market include Cisco, Intel, Huawei, Braodcom, and Qualcomm. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 INTRODUCTION TO COVID–19

1.2 COVID–19 HEALTH ASSESSMENT

FIGURE 1 COVID–19: GLOBAL PROPAGATION

FIGURE 2 COVID–19 PROPAGATION: SELECT COUNTRIES

1.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONAL SCOPE

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 WI-FI 6 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 8 WI-FI 6 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 – BOTTOM–UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES IN THE MARKET

2.3.1 TOP–DOWN APPROACH

2.3.2 BOTTOM–UP APPROACH

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

TABLE 3 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 4 WI-FI 6 MARKET SIZE AND GROWTH RATE, 2017–2021 (USD MILLION, Y–O–Y %)

TABLE 5 MARKET SIZE AND GROWTH RATE, 2022–2027(USD MILLION, Y–O–Y %)

FIGURE 9 MARKET, 2020–2027 (USD MILLION)

FIGURE 10 FASTEST–GROWING SEGMENTS IN THE MARKET DURING 2022–2027

FIGURE 11 WI-FI 6: REGIONAL MARKET SCENARIO

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 BRIEF OVERVIEW OF THE WI-FI 6 MARKET

FIGURE 12 INCREASING NUMBER OF INTERNET USERS DRIVES THE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 MARKET SHARE, BY OFFERING

FIGURE 13 SOLUTION SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2022

4.3 MARKET SHARE, BY LOCATION TYPE

FIGURE 14 INDOOR TO HOLD A LARGER MARKET SHARE IN 2022

4.4 MARKET SHARE, BY ORGANIZATION SIZE

FIGURE 15 LARGE ENTERPRISES TO HOLD A LARGER MARKET SHARE IN 2022

4.5 MARKET SHARE, BY INDUSTRY VERTICAL

FIGURE 16 EDUCATION TO HOLD THE LARGEST MARKET SHARE IN 2022

4.6 MARKET SHARE, BY REGION

FIGURE 17 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2022

4.7 MARKET: WI-FI 6 MARKET INVESTMENT SCENARIO (2022–2027)

FIGURE 18 ASIA PACIFIC TO EMERGE AS THE BEST MARKET TO INVEST DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WI-FI 6 MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing number of internet users

5.2.1.2 Rise in the adoption of IoT devices

5.2.1.3 Growing need for faster and secure network

5.2.2 RESTRAINTS

5.2.2.1 Contention loss and co-channel interference

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing deployment of public Wi-Fi

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.3 COVID–19 MARKET OUTLOOK FOR THE WI-FI 6 MARKET

TABLE 6 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID–19 ERA

TABLE 7 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID–19 ERA

5.3.1 CUMULATIVE GROWTH ANALYSIS

TABLE 8 MARKET: CUMULATIVE GROWTH ANALYSIS

5.4 REGULATORY IMPACT

5.5 INDUSTRY TRENDS

5.5.1 USE CASES

5.5.1.1 Use case 1: Cisco Meraki helps BBVA implement driving operational excellence with Wi-Fi 6

5.5.1.2 Use case 2: Huawei provides Carrier Midea India with AirEngine Wi-Fi 6 solution to enhance its production line

5.5.1.3 Use case 2: Southstar Drug deployed Huawei Wi-Fi 6 solution for a smooth wireless network experience

5.5.1.4 Use case 2: St. Jakob Park used Aruba Wi-Fi 6 for high user concurrency and secure connection

5.6 VALUE CHAIN ANALYSIS

FIGURE 20 WI-FI 6 MARKET: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM

TABLE 9 MARKET: ECOSYSTEM

5.8 PATENT ANALYSIS

FIGURE 21 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 10 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 22 NUMBER OF PATENTS GRANTED IN A YEAR, 2012–2021

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

FIGURE 23 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

TABLE 11 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD)

5.10 TECHNOLOGY ANALYSIS

5.10.1 5G NETWORK

5.10.2 WIMAX

5.10.3 INTERNET OF THINGS

5.10.4 MULTEFIRE

5.10.5 LTE

5.11 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 24 REVENUE SHIFT FOR THE WI-FI 6 MARKET

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 MARKET: PORTER’S FIVE FORCES MODEL

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 COMPETITIVE RIVALRY

5.13 KEY CONFERENCES AND EVENTS IN 2022

TABLE 13 WI-FI 6 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR TOP THREE END–USE INDUSTRIES

TABLE 14 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR TOP THREE END–USE INDUSTRIES (%)

5.14.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE USE–END INDUSTRIES

TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END–USE INDUSTRIES

6 WI-FI 6 MARKET, BY OFFERING (Page No. - 67)

6.1 INTRODUCTION

FIGURE 28 SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.1 OFFERINGS: MARKET DRIVERS

6.1.2 OFFERINGS: COVID–19 IMPACT

TABLE 16 MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 17 MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 18 OFFERING: WI-FI 6 MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 19 OFFERING: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 20 HARDWARE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 HARDWARE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.1 WIRELESS ACCESS POINTS

TABLE 22 WIRELESS ACCESS POINTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 WIRELESS ACCESS POINTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.2 MESH ROUTERS

TABLE 24 MESH ROUTERS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 MESH ROUTERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.3 HOME GATEWAYS

TABLE 26 HOME GATEWAYS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 HOME GATEWAYS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.2.4 WIRELESS REPEATERS

TABLE 28 WIRELESS REPEATERS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 WIRELESS REPEATERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTION

TABLE 30 SOLUTION: WI-FI 6 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 SOLUTION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

TABLE 32 SERVICES: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 33 SERVICES: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 34 SERVICES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4.1 PROFESSIONAL SERVICES

6.4.2 MANAGED SERVICES

7 WI-FI 6 MARKET, BY LOCATION TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 29 OUTDOOR SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 LOCATION TYPES: MARKET DRIVERS

7.1.2 LOCATION TYPES: COVID–19 IMPACT

TABLE 36 MARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 37 MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

7.2 INDOOR

TABLE 38 INDOOR: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 INDOOR: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 OUTDOOR

TABLE 40 OUTDOOR: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 OUTDOOR: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 WI-FI 6 MARKET, BY ORGANIZATION SIZE (Page No. - 83)

8.1 INTRODUCTION

FIGURE 30 LARGE ENTERPRISES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID–19 IMPACT

TABLE 42 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 43 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 44 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM–SIZED ENTERPRISES

TABLE 46 SMALL AND MEDIUM–SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 SMALL AND MEDIUM–SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 WI-FI 6 MARKET, BY INDUSTRY VERTICAL (Page No. - 88)

9.1 INTRODUCTION

FIGURE 31 GOVERNMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

9.1.1 INDUSTRY VERTICALS: WI-FI MARKET DRIVERS

9.1.2 INDUSTRY VERTICALS: COVID–19 IMPACT

TABLE 48 MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 49 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 EDUCATION

TABLE 50 EDUCATION: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 EDUCATION: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 HEALTHCARE

TABLE 52 HEALTHCARE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 RETAIL AND ECOMMERCE

TABLE 54 RETAIL AND ECOMMERCE: WI-FI 6 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 GOVERNMENT

TABLE 56 GOVERNMENT: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 GOVERNMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 HOSPITALITY

TABLE 58 HOSPITALITY: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 HOSPITALITY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.7 TRANSPORTATION AND LOGISTICS

TABLE 60 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.8 MANUFACTURING

TABLE 62 MANUFACTURING: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 MANUFACTURING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER INDUSTRY VERTICALS

TABLE 64 OTHER INDUSTRY VERTICALS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 OTHER INDUSTRY VERTICALS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 WI-FI 6 MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD (2022-2027)

FIGURE 33 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD (2022-2027)

TABLE 66 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID–19 IMPACT

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: WI-FI 6 MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: WI-FI 6 MARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 UNITED STATES

10.2.4 CANADA

10.3 EUROPE

10.3.1 EUROPE: WI-FI 6 MARKET DRIVERS

10.3.2 EUROPE: COVID–19 IMPACT

TABLE 82 EUROPE: MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MWI-FI 6 ARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UNITED KINGDOM

10.3.4 GERMANY

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: WI-FI 6 MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID–19 IMPACT

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: WI-FI 6 MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.4 SOUTH KOREA

10.4.5 MALAYSIA

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: WI-FI 6 MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID–19 IMPACT

TABLE 110 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA: MARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA: MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA: WI-FI 6 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

10.5.4 UNITED ARAB EMIRATES

10.5.5 AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: WI-FI 6 MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID–19 IMPACT

TABLE 124 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 130 LATIN AMERICA: WI-FI 6 MARKET SIZE, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 131 LATIN AMERICA: MARKET SIZE, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 133 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.4 MEXICO

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 138 OVERVIEW OF STRATEGIES ADOPTED BY KEY WI-FI 6 VENDORS

11.3 REVENUE ANALYSIS

11.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 36 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2017–2021

11.3.2 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 37 WI-FI 6 MARKET: REVENUE ANALYSIS

11.4 RANKING OF KEY PLAYERS

FIGURE 38 RANKING OF KEY MARKET PLAYERS

11.5 MARKET SHARE ANALYSIS

TABLE 139 MARKET: DEGREE OF COMPETITION

11.6 MARKET EVALUATION FRAMEWORK

FIGURE 39 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN THE MARKET BETWEEN 2019 AND 2022

11.7 COMPANY EVALUATION QUADRANT

11.7.1 STAR

11.7.2 EMERGING LEADER

11.7.3 PERVASIVE

11.7.4 PARTICIPANT

FIGURE 40 WI-FI 6 MARKET: COMPANY EVALUATION MATRIX, 2022

TABLE 140 COMPANY FOOTPRINT ANALYSIS: MARKET

TABLE 141 COMPANY COMPONENT FOOTPRINT: MARKET

TABLE 142 COMPANY REGION FOOTPRINT: MARKET

TABLE 143 MARKET MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 144 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 STARTUP/SME EVALUATION QUADRANT

11.8.1 PROGRESSIVE COMPANIES

FIGURE 41 MARKET, STARTUP/SME EVALUATION MATRIX

11.9 COMPETITIVE SCENARIO AND TRENDS

11.9.1 NEW PRODUCT LAUNCHES

TABLE 145 NEW SERVICE/PRODUCT LAUNCHES, 2019–2022

11.9.2 DEALS

TABLE 146 DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 152)

12.1 MAJOR COMPANIES

(Business Overview, Products & Solutions, Recent Developments, Response to COVID-19, MnM View)*

12.1.1 CISCO

TABLE 147 CISCO: BUSINESS OVERVIEW

FIGURE 42 CISCO: COMPANY SNAPSHOT

TABLE 148 CISCO: PRODUCTS/SOLUTIONS OFFERED

TABLE 149 CISCO: SOLUTION LAUNCHES

TABLE 150 CISCO: DEALS

12.1.2 INTEL

TABLE 151 INTEL: BUSINESS OVERVIEW

FIGURE 43 INTEL: COMPANY SNAPSHOT

TABLE 152 INTEL: PRODUCTS OFFERED/SOLUTIONS OFFERED

TABLE 153 INTEL: PRODUCT LAUNCHES

12.1.3 HUAWEI

TABLE 154 HUAWEI: BUSINESS OVERVIEW

FIGURE 44 HUAWEI: COMPANY SNAPSHOT

TABLE 155 HUAWEI: PRODUCTS OFFERED/SOLUTIONS OFFERED

TABLE 156 HUAWEI: PRODUCT LAUNCHES

TABLE 157 HUAWEI: DEALS

12.1.4 BROADCOM

TABLE 158 BROADCOM: BUSINESS OVERVIEW

FIGURE 45 BROADCOM: COMPANY SNAPSHOT

TABLE 159 BROADCOM: SOLUTION OFFERED

TABLE 160 BROADCOM: PRODUCT LAUNCHES

TABLE 161 BROADCOM: DEALS

12.1.5 QUALCOMM

TABLE 162 QUALCOMM: BUSINESS OVERVIEW

FIGURE 46 QUALCOMM: COMPANY SNAPSHOT

TABLE 163 QUALCOMM: SOLUTIONS OFFERED

TABLE 164 QUALCOMM: PRODUCT LAUNCHES

12.1.6 NETGEAR

TABLE 165 NETGEAR: BUSINESS OVERVIEW

FIGURE 47 NETGEAR: COMPANY SNAPSHOT

TABLE 166 NETGEAR: PRODUCTS/SOLUTIONS OFFERED

TABLE 167 NETGEAR: PRODUCT LAUNCHES

12.1.7 JUNIPER NETWORKS

TABLE 168 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 48 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 169 JUNIPER NETWORKS: SOLUTIONS OFFERED

TABLE 170 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 171 JUNIPER NETWORKS: DEALS

12.1.8 EXTREME NETWORKS

TABLE 172 EXTREME NETWORKS: BUSINESS OVERVIEW

FIGURE 49 EXTREME NETWORKS: COMPANY SNAPSHOT

TABLE 173 EXTREME NETWORKS: SOLUTIONS OFFERED

TABLE 174 EXTREME NETWORKS: PRODUCT LAUNCHES

TABLE 175 EXTREME NETWORKS: DEALS

12.1.9 UBIQUITI NETWORKS

TABLE 176 UBIQUITI NETWORKS: BUSINESS OVERVIEW

FIGURE 50 UBIQUITI NETWORKS: COMPANY SNAPSHOT

TABLE 177 UBIQUITI NETWORKS: SOLUTIONS OFFERED

TABLE 178 UBIQUITI NETWORKS: PRODUCT LAUNCHES

12.1.10 FORTINET

TABLE 179 FORTINET: BUSINESS OVERVIEW

FIGURE 51 FORTINET: COMPANY SNAPSHOT

TABLE 180 FORTINET: SOLUTIONS OFFERED

TABLE 181 FORTINET: PRODUCT LAUNCHES

12.1.11 ARUBA NETWORKS

TABLE 182 ARUBA NETWORKS: BUSINESS OVERVIEW

TABLE 183 ARUBA NETWORKS: SOLUTIONS OFFERED

TABLE 184 ARUBA NETWORKS: PRODUCT LAUNCHES

12.1.12 NXP SEMICONDUCTORS

TABLE 185 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 52 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 186 NXP SEMICONDUCTORS: SOLUTION OFFERED

TABLE 187 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

*Details on Business Overview, Products & Solutions, Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

12.1.13 AT&T

12.1.14 CAMBIUM NETWORKS

12.1.15 D–LINK

12.1.16 ALCATEL–LUCENT

12.1.17 TP-LINK

12.1.18 MEDIATEK

12.1.19 TELSTRA

12.1.20 MURATA

12.1.21 STERLITE TECHNOLOGIES

12.1.22 CELENO

12.1.23 H3C

12.1.24 SENSCOMM SEMICONDUCTORS

12.1.25 XUNISON

12.1.26 REDWAY NETWORKS

12.1.27 VSORA

12.1.28 NEWRACOM

12.1.29 WILUS GROUP

12.1.30 FEDERATED WIRELESS

13 ADJACENT MARKETS (Page No. - 205)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 188 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 WI-FI MARKET

TABLE 189 WI-FI MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 190 WI-FI MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 191 WI-FI MARKET SIZE, BY DENSITY, 2015–2019 (USD MILLION)

TABLE 192 WI-FI MARKET SIZE, BY DENSITY, 2020–2026 (USD MILLION)

TABLE 193 WI-FI MARKET SIZE, BY LOCATION TYPE, 2015–2019 (USD MILLION)

TABLE 194 WI-FI MARKET SIZE, BY LOCATION TYPE, 2020–2026 (USD MILLION)

TABLE 195 WI-FI MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 196 WI-FI MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 197 WI-FI MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 198 WI-FI MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

13.4 WI-FI AS A SERVICE MARKET

TABLE 199 WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 200 WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 201 WI-FI AS A SERVICE MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 202 WI-FI AS A SERVICE MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 203 WI-FI AS A SERVICE MARKET SIZE, BY LOCATION TYPE, 2017–2020 (USD MILLION)

TABLE 204 WI-FI AS A SERVICE MARKET SIZE, BY LOCATION TYPE, 2021–2026 (USD MILLION)

TABLE 205 WI-FI AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 206 WI-FI AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 207 WI-FI AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 208 WI-FI AS A SERVICE MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 212)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

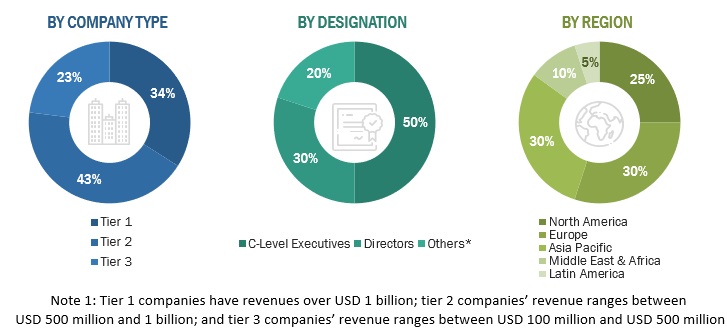

The study involved four major activities in estimating the current size of the Wi-Fi 6 market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Wi-Fi 6 market.

Secondary Research

The market for the companies offering Wi-Fi 6 solutions and services for various verticals is arrived at based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, the press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from different key companies and organizations operating in the Wi-Fi 6 market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the Wi-Fi 6 market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the sale of solutions and services.

In the top-down approach, an exhaustive list of all the vendors that offer solutions and services in the Wi-Fi 6 market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their products/services by application, offering, and region. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption of Wi-Fi 6 solutions and services for different applications in key countries with respect to their region that contributes to the majority of the market share was identified. Furthermore, for cross-validation, the adoption of Wi-Fi 6 solutions and services in different applications along with different use cases with respect to their region has been identified and extrapolated. In addition, weightage has been given to the use cases identified in different regions for the calculation. Based on these numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Wi-Fi 6 market’s regional penetration. Based on secondary research, the regional spending on IoT, Artificial Intelligence (AI), big data, and Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of the major Wi-Fi 6 providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and validation of data through primaries, the exact values of the overall Wi-Fi 6 market size and its segments’ market size were determined and confirmed using this study

Data Triangulation

Report Objectives

- To determine and forecast the global Wi-Fi 6 market by , by Offering (Hardware, Solution, and Services), Location Type (Indoor and Outdoor), Organization Size, Industry Vertical, and Region from 2022 to 2027, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle east and Africa (MEA), and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Wi-Fi 6 market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Wi-Fi 6 market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wi-Fi 6 Market