Wireless Testing Market by Offering (Equipment and Services), Technology (Bluetooth, 2G/3G, 4G/5G, Wi-Fi), Application (Consumer electronics, Automotive, IT & telecommunication, Medical devices, Aerospace & defense) & Region - Global Forecast to 2027

[274 Pages Report] Wireless testing market size is valued at USD 13.5 billion in 2022 and is anticipated to be USD 23.7 billion by 2027; growing at a CAGR of 11.9% from 2022 to 2027. Factors such increasing demand for consumer electronics and and development and deployment of 5G network are driving the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Wireless Testing Market

The wireless market witnessed growth in 2021, owing to the adoption of remote working practices due to the lockdowns imposed in various countries worldwide. This, in turn, increased the number of developments in the market in 2021. The global economy is expected to recover swiftly from the COVID-19 crisis, and an increase in technological developments in wireless testing technology is expected in the coming years.

Wireless testing Market Dynamics

How is the deployment and development of 5G network and services related to growth of wireless testing market ?

An increase in the number of connected devices has led to the requirement for high-speed internet connectivity, especially in digitally-advanced workplaces. With 3G becoming obsolete and 4G expanding its prospects rapidly across different applications, efforts are being made worldwide on a large scale for the development of the 5G technology. The 5G network infrastructures are expected to offer connectivity of ≥1 Gbps as speculated by several leading network providers, such as AT&T, Sprint, and T-Mobile, among others. The 5G network infrastructures are intended to cover end-to-end/point-to-point-based ecosystems to develop a fully connected world using a highly heterogeneous network. The 5G network is expected to offer high-speed data transfer, increased device connection density, and real-time services with minimum latency. This, in turn, is expected to contribute to the increasing requirement for network infrastructure testing services.

How is lack of standardization in connectivity protocols holding the market growth of wireless testing market ?

Smart devices form intelligent networks, communicate and share data with each other, which leads to requirement for proper defining of common communication standards for them. The growth of the wireless connectivity market is dependent on the easy exchange of data and information between different connected devices. The current connectivity infrastructures lack of universal communication standards and thus are unable to solve the interoperability issues. Organizations and enterprises are making efforts to develop a universal standard comprising diverse devices, IoT applications, software and platforms. The lack of a uniform communication standard or platform complicates the wireless testing process as providers of these testing services have to cater to the requirements of different customized wireless devices using different protocols.

What opportunities does smart homes bring to the companies in wireless testing market ?

Smart homes equipped with connected wireless devices, such as utility meters, security cameras, utility meters, and thermostats is increasing, globally. Connectivity is expected to emerge as a highly pervasive trend in the coming years to the extent of being an embedded virtual standard in every household device and equipment. Connected home appliances can be controlled remotely by customers as these appliances are connected to the cloud. Thus, the increasing demand for smart homes worldwide is expected to fuel the growth of wireless devices, and consequently present growth opportunities for the wireless testing industry.

How do ever changing technological advancements in wireless market act as a challenge for the players in wireless testing market ?

A major challenge in the field of wireless testing is the requirement for constant upgrading of equipment and services to match the changing technology standards. In the present scenario, 5G technologies being relatively new pose unique challenges for vendors of different wireless services and equipment. Moreover, there is a demand for new features to be integrated with the test solutions and equipment. The key standard for high-speed networks is to ensure good network quality for maximum data throughput, enhanced audio-video quality, and interference measurement.

Services segment to dominate wireless testing market by offering.

The wireless testing market by offering has been divided into equipment and services. Services has been segment into in-house and outsourced. In-house testing facilities enable companies to carry out control inspections internally and quality assurance programs. Wireless testing services can also be outsourced. Specialized public or private sector organizations or firms, such as SGS Group, Bureau Veritas, and Intertek provide these services. Services assure customers that the products tested are safe to use and sustainable as well as fulfill all performance standards.

The wireless testing services can take place in-house or can be outsourced depending on the sector. Industries such as the public sector and mining prefer in-house services rather than opting for outsourced wireless testing services, owing to the criticality of their applications. Outsourced wireless testing services witness increased demand from the consumer goods and environmental sectors.

Wireless network testing segment to hold largest share of wireless testing market during the forecast period

Wireless networks have become heterogeneous and highly complex, due to the integration of multiple technologies, such as 2G/3G/5G, and Wi-Fi. The deployment of advanced technologies, such as 4G/LTE and 5G has highlighted the requirement for adopting wireless testing equipment to efficiently optimize and manage networks, reduce interference and congestion in 4G and future 5G networks, and simplify operational tasks. For instance, the E6568E wireless test manager offered by Keysight is used to test the latest LTE/universal mobile telecommunications service (UMTS) mobile devices. It also uses Microsoft Visual Basic. NET programming to carry out complex tests. Different types of testing such as RF testing and OTA testing are used to test different technologies.

Consumer Electronics application in wireless testing market to register highest CAGR during the forecast period

The rise in demand for wearables and smart electronic gadgets, are expected to fuel the market growth for wireless testing in consumer electronic application. Wireless testing plays a vital role in the consumer electronics industry, wherein the focus is on making devices compact and smart, where product requires to be tested with respect to its safety, functioning and performance prior to its commercialization. These products undergo component tests, integration tests, and end-of-line production tests. Consumer devices, such as smartphones and tablets mainly use technologies, such as GSM, universal mobile telecommunication system (UMTS), and LTE. The providers of testing services conduct tests of different wireless technologies, such as Bluetooth, cellular, near-field communication (NFC), and Wi-Fi, which are incorporated in consumer electronics.

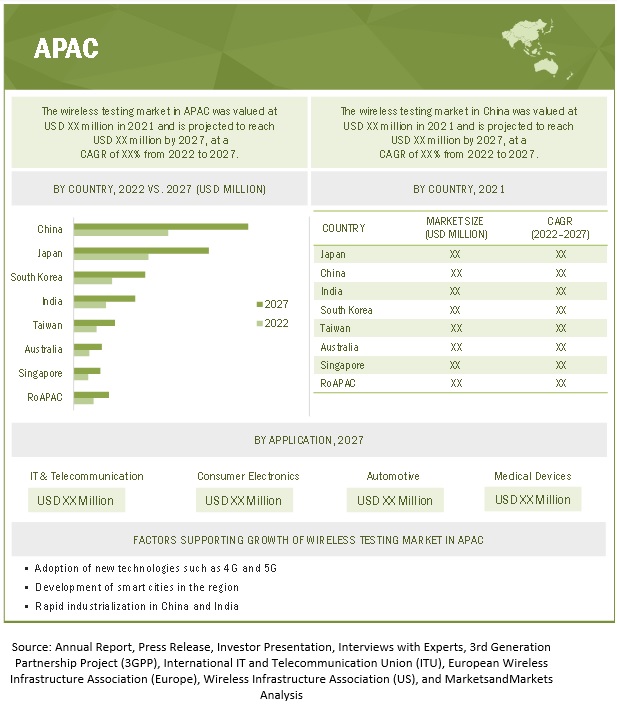

Deployment of 5G network in APAC, to dive the market growth for wireless testing in APAC region

APAC is witnessing dynamic changes in terms of the adoption of new technologies across various industries. 5G networks are expected to play an integral role in advanced technologies, such as IoT and M2M. 5G network is considered critical for smart cities and industrial automation, as it provides simultaneous connectivity to multiple devices and has low latency, resulting in the improved overall performance of systems. Companies, such as Huawei and China Mobile are making efforts to develop 5G technologies. These factors are responsible to drive the market growth for wireless testing in APAC region.

To know about the assumptions considered for the study, download the pdf brochure

The wireless testing companies is dominated by a few globally established players such as SGS Group (Switzerland), Bureau Veritas (France), Intertek (UK) and Dekra SE (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Offering By Connectivity Technology, By Application, By Geography |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies covered |

The key players operating in the wireless testing market are Anritsu (Japan), SGS Group (Switzerland), Bureau Veritas (France), Intertek (UK), DEKRA SE (Germany), Keysight (US), Rohde & Schwarz (Germany), and Viavi Solutions (US). |

The study categorizes the wireless testing market based on offering,connectivity technology, application, and geography.

By Offering:

- Equipment

- Services

By Connectivty Technology:

- Wireless network testing

- Wireless device testing

By Application:

- Consumer Electronics

- Automotive

- IT & Telecommunication

- Energy & power

- Medical devices

- Aerospace & Defense

- Industrial

- Others

By Region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In April 2022, Viavi Solutions launched ALT-9000 a universal radio altimeter (RADALT) flight line test set. The RADALT measures an aircraft’s altitude above the terrain, by transmitting a radio frequency (RF) signal down to the ground and receiving a reflection..

- In April 2022, Rohde & Schwarz launched the FSW signal and spectrum analyzer. Its new front end continues the path of innovation with unrivaled error vector magnitude EVM measurement accuracy for wideband modulated signals in the mm Wave range. This makes testing any high-end communication component or systems, including 5G NR FR2 or IEEE 802.11ay / ad chipsets, amplifiers, user equipment, and base stations.

- In March 2022, Viavi Solutions launched FiberComplete PRO a fiber test solution with a suite of capabilities, which replaces six test instruments. With one push of a button, it sequences all the required tests for single or multiple fibers.

Frequently Asked Questions (FAQ):

What is the current size of the global wireless testing market?

The artificial intelligence in manufacturing market is projected to grow from USD 13.5 Billion in 2022 and growing at a CAGR of 11.9% from 2022 to 2027 it is expected to reach USD 23.7 Billion by 2027.

Why wireless testing is used consumer electronics ?

Portable devices such as wearable wireless devices pose a high risk, such as electromotive field (EMF) , due to direct exposure and contact with the human body. The risk directly depends on output power, antenna gain, and operating frequency.

What is the impact of covid-19 on the wireless testing market for automotive industry?

Across the globe vehicle production has suffered because of the production suspensions and supply chain shortages in leading countries across the world by the spread of the COVID-19. Owing to the COVID-19 global vehicle production fell by 20–25% in 2020. This, in turn, has hampered the growth of the wireless testing market for automotive application worldwide. However, the estimates suggest global automobile production has increased from 2022 onward, but the demand side is expected to fully recover by 2027.

What are the technological trends going in the wireless testing market?

The 5G technology introduces an entirely new challenge in the form of over-the-air (OTA) testing. Radio transmission at FR2 frequencies experiences increased path loss and other forms of channel degradation. However, with shorter wavelengths of FR2, you can use multiple antennas to focus the signal, producing antenna gain and increasing the effective signal power in the desired direction. This beam steering technique compensates for the higher path loss at the expense of a more complex antenna system. The shorter FR2 wavelengths mean these antenna arrays can be very small and may be integrated into components or devices

Which are the major companies in the wireless testing market?

Intertek (UK), SGS Group (Switzerland), Bureau Veritas (France), Anritsu (Japan), Rohde & Schwarz (Germany) are some of the players dominating the global artificial intelligence in manufacturing market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC ANALYSIS

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 WIRELESS TESTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share using bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE FROM EQUIPMENT/SERVICES MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL EQUIPMENT/SERVICES OF THE MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 10 MARKET SIZE FROM 2018 TO 2027

FIGURE 11 THE WIRELESS NETWORK TESTING TECHNOLOGIES SEGMENT PROJECTED TO LEAD THE MARKET FROM 2022 TO 2027

FIGURE 12 THE OUTSOURCED SERVICES SEGMENT OF THE WIRELESS TESTING SERVICES MARKET PROJECTED TO GROW AT A HIGHER RATE THAN THE IN-HOUSE SERVICES SEGMENT BETWEEN 2022 AND 2027

FIGURE 13 IT & TELECOMMUNICATION APPLICATION SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 14 APAC ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2021

3.1 COVID-19 IMPACT ANALYSIS: WIRELESS TESTING MARKET

FIGURE 15 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR THE MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 WIRELESS TESTING MARKET, 2022–2027 (USD MILLION)

FIGURE 16 INCREASING DEMAND FOR WIRELESS TESTING OF CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE MARKET GROWTH GLOBALLY

4.2 MARKET, BY OFFERING

FIGURE 17 THE SERVICES SEGMENT OF THE MARKET PROJECTED TO GROW AT A HIGHER CAGR THAN THE EQUIPMENT SEGMENT FROM 2022 TO 2027

4.3 MARKET, BY APPLICATION AND REGION

FIGURE 18 APAC AND THE IT & TELECOMMUNICATION SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARES OF THE MARKET IN 2027

4.4 MARKET, BY REGION

FIGURE 19 APAC ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN 2027

4.5 MARKET, BY APPLICATION

FIGURE 20 THE IT & TELECOMMUNICATION SEGMENT OF THE MARKET PROJECTED TO BE THE LARGEST MARKET SEGMENT IN 2027

4.6 MARKET, BY CONNECTIVITY TECHNOLOGY

FIGURE 21 THE WIRELESS NETWORK TESTING TECHNOLOGIES SEGMENT OF CONNECTIVITY TECHNOLOGY PROJECTED TO GROW AT A HIGHER CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 INCREASING FOCUS ON THE DEVELOPMENT OF THE 5G NETWORK AND GROWING ADOPTION OF SMART DEVICES ARE DRIVING MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Rising advancements in wireless technology

5.2.1.2 Increasing focus on the development of the 5G network

5.2.1.3 Growing global adoption of smartphones and smart gadgets

5.2.1.4 Increasing adoption of cloud computing and IoT devices

5.2.2 RESTRAINTS

5.2.2.1 High costs associated with the establishment of electromagnetic compatibility (EMC) testing facilities

5.2.2.2 Lack of standardization in connectivity protocols

5.2.2.3 High cost and lack of skilled workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for smart homes worldwide

5.2.3.2 Growing demand for smart cities and self-driving cars

5.2.4 CHALLENGES

5.2.4.1 Long lead time required for the overseas qualification tests

5.2.4.2 Keeping pace with technological advancements

5.3 VALUE CHAIN ANALYSIS

5.4 WIRELESS TESTING ECOSYSTEM

FIGURE 23 WIRELESS TESTING MARKET: ECOSYSTEM ANALYSIS

5.5 REVENUE SHIFT IN MARKET

5.6 PRICING ANALYSIS

FIGURE 24 ASP OF WIRELESS NETWORK TESTING EQUIPMENT,2021 (USD)

TABLE 1 ASP RANGE OF WIRELESS NETWORK TESTING EQUIPMENT, 2021 (USD)

FIGURE 25 ASP OF WIRELESS DEVICE TESTING EQUIPMENT, 2021 (USD)

TABLE 2 ASP RANGE OF WIRELESS DEVICE TESTING EQUIPMENTS, 2021 (USD)

5.7 TECHNOLOGY ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 BARGAINING POWER OF SUPPLIERS

5.8.2 BARGAINING POWER OF BUYERS

5.8.3 THREAT OF NEW ENTRANTS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 IMPACT OF EACH FORCE ON MARKET

5.9 KEY STAKEHOLDER AND BUYING PROCESS AND/OR BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 5 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.10 WIRELESS TESTING MARKET: CASE STUDIES

5.10.1 EXCIS PLANNING, INSTALLATION, AND MANAGEMENT FOR END-TO-END WIRELESS INFRASTRUCTURE

5.10.2 5G NETWORK ROLL OUT IN ITALY

5.11 TRADE ANALYSIS

5.11.1 EXPORT SCENARIO OF ELECTRICAL APPARATUS FOR LINE TELEPHONY OR LINE TELEGRAPHY

TABLE 6 ELECTRICAL APPARATUS FOR LINE TELEPHONY OR LINE TELEGRAPHY MACHINES EXPORT, BY KEY COUNTRY, 2017–2020 (USD THOUSAND)

5.11.2 IMPORT SCENARIO OF ELECTRICAL APPARATUS FOR LINE TELEPHONY OR LINE TELEGRAPHY

TABLE 7 ELECTRICAL APPARATUS FOR LINE TELEPHONY OR LINE TELEGRAPHY IMPORT, BY KEY COUNTRY, 2017–2020 (USD THOUSAND)

5.12 PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED PER YEAR OVER THE LAST 10 YEARS

TABLE 8 TOP 10 PATENT OWNERS

FIGURE 29 TOP 10 COMPANIES WITH THE HIGHEST NO. OF PATENT APPLICATIONS

TABLE 9 IMPORTANT PATENT REGISTRATIONS, 2017–2022

5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 10 WIRELESS TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022–2023)

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 REGULATORY STANDARDS

5.15.1 GENERAL DATA PROTECTION REGULATION (GDPR)

5.15.2 STANDARDS IN ITS/C-ITS

TABLE 15 SECURITY AND PRIVACY STANDARDS DEVELOPED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

6 WIRELESS TESTING MARKET, BY OFFERING (Page No. - 89)

6.1 INTRODUCTION

TABLE 16 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 EQUIPMENT

TABLE 18 MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

6.2.1 WIRELESS DEVICE TESTING

6.2.1.1 Rising deployment of integrated instruments to drive the demand for wireless device testing globally

TABLE 20 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 21 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 22 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 23 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2022–2027 (THOUSAND UNITS)

6.2.1.2 Oscilloscopes

6.2.1.2.1 Usage of digital oscilloscopes to fuel the segment growth

6.2.1.3 Signal generators

6.2.1.3.1 The use of signal generators across various industries in testing applications to drive the growth of the segment

6.2.1.4 Spectrum analyzers

6.2.1.4.1 Ability of spectrum analyzers to connect to wireless devices and analyze electromagnetic signals to fuel segment growth

6.2.1.5 Network analyzers

6.2.1.5.1 IoT device testing application of VNA to drive growth for network analyzers

6.2.1.6 Others

6.2.2 WIRELESS NETWORK TESTING

TABLE 24 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 25 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 26 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 27 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT TYPE, 2022–2027 (THOUSAND UNITS)

6.2.2.1 Network testers

6.2.2.1.1 Wi-Fi and LAN testers to drive market growth for Network testers.

6.2.2.2 Network scanners

6.2.2.2.1 Increased use of network scanners by network administrators to verify IP address documentation to drive market growth

6.2.2.3 OTA testers

6.2.2.3.1 Usage of OTA testers to test IoT devices to drive market growth

6.2.2.4 Others

6.3 SERVICES

TABLE 28 MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

6.3.1 IN-HOUSE

6.3.1.1 Expertise of big players to fuel the market for in-house wireless testing services

6.3.2 OUTSOURCED

6.3.2.1 Small- and medium-sized players to dominate the market of outsourced wireless testing services

7 WIRELESS TESTING MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 99)

7.1 INTRODUCTION

TABLE 30 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 32 WIRELESS TESTING SERVICE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 34 WIRELESS TESTING EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 WIRELESS TESTING EQUIPMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 36 WIRELESS DEVICE TESTING MARKET, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 37 WIRELESS DEVICE TESTING MARKET, BY TECHNOLOGY TYPE, 2022–2027 (USD MILLION)

TABLE 38 WIRELESS NETWORK TESTING MARKET, BY CONNECTIVITY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 39 WIRELESS NETWORK TESTING MARKET, BY CONNECTIVITY TECHNOLOGY TYPE, 2022–2027 (USD MILLION)

7.2 BLUETOOTH

7.2.1 RELIABILITY OF THE BLUETOOTH CONNECTIVITY IN MULTIPLE APPLICATIONS RESPONSIBLE FOR THE GROWTH OF THE TECHNOLOGY SEGMENT

7.3 WI-FI

7.3.1 DIGITAL TRANSFORMATION INITIATIVES IN BUSINESSES TO DRIVE THE GROWTH OF THE WI-FI SEGMENT

7.4 BLUETOOTH SMART/BLE/WLAN

7.4.1 USAGE OF BLUETOOTH SMART IN IOT-ENABLED DEVICES TO FUEL MARKET GROWTH

7.5 GLOBAL POSITIONING SYSTEM (GPS)/ GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS) MODULE

7.5.1 USE OF GPS IN MILITARY, CIVIL, AND COMMERCIAL APPLICATIONS TO DRIVE MARKET GROWTH OF THE GPS CONNECTIVITY TECHNOLOGY SEGMENT

7.6 2G/3G

7.6.1 SHIFTING OF CUSTOMER BASE TO 4G AND 5G TECHNOLOGIES TO DECLINE THE MARKET FOR 2G/3G CONNECTIVITY TECHNOLOGY

7.7 4G/LTE

7.7.1 DEMAND FOR HIGH-SPEED CONNECTIVITY SERVICES TO FUEL THE MARKET GROWTH OF 4G

7.8 5G

7.8.1 CAPACITY OF 5G TO DELIVER ENHANCED BROADBAND EXPERIENCE AND PROVIDE THE PLATFORM FOR CLOUD AND AI-BASED SERVICES TO DRIVE MARKET GROWTH FOR THE 5G TECHNOLOGY

7.9 OTHERS

8 WIRELESS TESTING MARKET, BY APPLICATION (Page No. - 108)

8.1 INTRODUCTION

TABLE 40 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 30 IT & TELECOMMUNICATION ESTIMATED TO BE THE LARGEST APPLICATION SEGMENT OF THE WIRELESS TESTING EQUIPMENT MARKET IN 2027

TABLE 42 WIRELESS TESTING EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 WIRELESS TESTING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 44 WIRELESS TESTING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 WIRELESS TESTING SERVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 CONSUMER ELECTRONICS

8.2.1 RISE IN DEMAND FOR WEARABLE DEVICES TO FUEL THE MARKET GROWTH FOR WIRELESS TESTING IN CUSTOMER ELECTRONICS APPLICATION

TABLE 46 MARKET IN CONSUMER ELECTRONICS, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 47 MARKET IN CONSUMER ELECTRONICS, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 48 MARKET IN CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET IN CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 52 EUROPE MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 53 EUROPE MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 APAC WIRELESS TESTING MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 APAC MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 ROW MARKET IN CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 ROW MARKET IN CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

8.2.2 TABLETS

8.2.3 LAPTOPS

8.2.4 SMARTPHONES

8.2.5 WEARABLES

8.2.6 OTHERS

8.3 AUTOMOTIVE

8.3.1 RISE IN DEMAND FOR AUTONOMOUS AND CONNECTED VEHICLES TO DRIVE MARKET GROWTH FOR WIRELESS TESTING IN THE AUTOMOTIVE SECTOR

TABLE 58 MARKET IN AUTOMOTIVE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 59 MARKET IN AUTOMOTIVE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 60 MARKET IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA WIRELESS TESTING MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 EUROPE MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 EUROPE MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 APAC MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 APAC MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 ROW MARKET IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 ROW MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

8.3.2 VEHICLE ELECTRONICS

8.3.3 INFOTAINMENT SYSTEMS

8.3.4 BATTERY SYSTEMS

8.4 IT & TELECOMMUNICATION

8.4.1 INCREASE IN THE NUMBER OF MOBILE USERS LEADS TO A RISE IN DEMAND FOR WIRELESS TESTING OF ANTENNAS AND TOWERS

TABLE 70 MARKET IN IT & TELECOMMUNICATION, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 71 MARKET IN IT & TELECOMMUNICATION, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 72 MARKET IN IT & TELECOMMUNICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 MARKET IN IT & TELECOMMUNICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA WIRELESS TESTING MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 EUROPE MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 EUROPE MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 APAC MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 APAC MARKET IN IT & TELECOMMUNICATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 ROW MARKET IN IT & TELECOMMUNICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 ROW MARKET IN IT & TELECOMMUNICATION, BY REGION, 2022–2027 (USD MILLION)

8.4.2 ROUTERS, HOTSPOTS, ACCESS POINTS, GATEWAYS, AND MIFI

8.4.3 ANTENNAS AND TOWERS

8.5 ENERGY & POWER

8.5.1 TRANSMISSION OF POWER WITHOUT CABLES WITH THE ADOPTION OF WIRELESS TECHNOLOGY IN THE POWER GENERATION TO DRIVE THE MARKET GROWTH.

TABLE 82 MARKET IN ENERGY & POWER, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 83 MARKET IN ENERGY & POWER, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 84 MARKET IN ENERGY & POWER, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN ENERGY & POWER, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA WIRELESS TESTING MARKET IN ENERGY & POWER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 NORTH AMERICA MARKET IN ENERGY & POWER, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 EUROPE MARKET IN ENERGY & POWER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 EUROPE MARKET IN ENERGY & POWER, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 APAC MARKET IN ENERGY & POWER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 APAC MARKET IN ENERGY & POWER, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 ROW MARKET IN ENERGY & POWER, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN ENERGY & POWER, BY REGION, 2022–2027 (USD MILLION)

8.5.2 POWER GENERATION

8.5.3 POWER DISTRIBUTION

8.5.4 OTHERS

8.6 MEDICAL DEVICES

8.6.1 EASE OF MOBILITY TO PATIENTS DUE TO WIRELESS TECHNOLOGY TO DRIVE MARKET GROWTH FOR MEDICAL DEVICES APPLICATION

TABLE 94 MARKET IN MEDICAL DEVICES, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN MEDICAL DEVICES, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN MEDICAL DEVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN MEDICAL DEVICES, BY REGION, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA WIRELESS TESTING MARKET IN MEDICAL DEVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 NORTH AMERICA MARKET IN MEDICAL DEVICES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 EUROPE MARKET IN MEDICAL DEVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 EUROPE MARKET IN MEDICAL DEVICES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 APAC MARKET IN MEDICAL DEVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 APAC MARKET IN MEDICAL DEVICES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 ROW MARKET IN MEDICAL DEVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 ROW MARKET IN MEDICAL DEVICES, BY REGION, 2022–2027 (USD MILLION)

8.6.2 MEDICAL EQUIPMENT

8.6.3 LABORATORY DEVICES

8.7 AEROSPACE & DEFENSE

8.7.1 RISE IN USE OF WIRELESS TESTING TO CHECK DIFFERENT EQUIPMENT AND SYSTEMS USED IN AEROSPACE & DEFENSE SECTOR

TABLE 106 WIRELESS TESTING MARKET IN AEROSPACE & DEFENSE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 107 LESS TESTING MARKET IN AEROSPACE & DEFENSE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 108 MARKET IN AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 MARKET IN AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 NORTH AMERICA MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 EUROPE MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 EUROPE MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 APAC MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 APAC MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 ROW MARKET IN AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 ROW MARKET IN AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

8.8 INDUSTRIAL

8.8.1 ADOPTION OF WIRELESS SENSOR NETWORKS IN THE INDUSTRIAL SECTOR LEADS TO INCREASED DEMAND FOR WIRELESS TESTING

TABLE 118 MARKET IN INDUSTRIAL, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 119 MARKET IN INDUSTRIAL, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 120 MARKET IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 MARKET IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA WIRELESS TESTING MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 123 NORTH AMERICA MARKET IN INDUSTRIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 EUROPE MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 125 EUROPE MARKET IN INDUSTRIAL, BY COUNTRY 2022–2027 (USD MILLION)

TABLE 126 APAC MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 127 APAC MARKET IN INDUSTRIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 128 ROW MARKET IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 129 ROW MARKET IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHERS

TABLE 130 MARKET IN OTHER APPLICATIONS, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 131 MARKET IN OTHER APPLICATIONS, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 132 MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 133 MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 134 NORTH AMERICA WIRELESS TESTING MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 NORTH AMERICA MARKET IN OTHER APPLICATIONS, BY COUNTRY,2022–2027 (USD MILLION)

TABLE 136 EUROPE MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 137 EUROPE MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 138 APAC MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 139 APAC MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 140 ROW MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 141 MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

9 WIRELESS TESTING MARKET, BY GEOGRAPHY (Page No. - 152)

9.1 INTRODUCTION

FIGURE 31 ARKET, BY GEOGRAPHY

TABLE 142 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 143 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 144 WIRELESS TESTING EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 145 WIRELESS TESTING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 146 MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 147 MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 148 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 149 WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 150 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 151 WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA WIRELESS TESTING MARKET SNAPSHOT

TABLE 152 NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 153 NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 154 NORTH AMERICA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 NORTH AMERICA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 NORTH AMERICA MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 157 NORTH AMERICA MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 158 NORTH AMERICA WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 159 NORTH AMERICA WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 160 NORTH AMERICA WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 161 NORTH AMERICA WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increased demand for automotive electronics leading to the growth of the market in the US

TABLE 162 US MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 163 US MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increased adoption of wireless services and products in Canada

TABLE 164 CANADA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 165 CANADA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Mexico holds a small share in the market in North America

TABLE 166 MEXICO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 167 MEXICO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 33 EUROPE WIRELESS TESTING MARKET SNAPSHOT

TABLE 168 EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 169 EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 170 EUROPE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 171 EUROPE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 EUROPE MARKET, BY EQUIPMENT 2018–2021 (USD MILLION)

TABLE 173 EUROPE MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 174 EUROPE MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 175 EUROPE WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 176 EUROPE WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 177 EUROPE WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Development of smart cities leading to the growth of the market in the UK

TABLE 178 UK MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 179 UK MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Smart utility and smart city projects to increase the adoption of wireless technologies in Germany

TABLE 180 GERMANY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 181 GERMANY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.3 SPAIN

9.3.3.1 Spain has adopted the EU directives to develop certification and testing standards

TABLE 182 SPAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 183 SPAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.4 FRANCE

9.3.4.1 Presence of renowned car manufacturers in France fueling the adoption of wireless technologies in the country

TABLE 184 FRANCE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 185 FRANCE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Development of a new wireless network for IoT has led to the requirement for wireless testing in Italy

TABLE 186 ITALY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 187 ITALY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.6 SWITZERLAND

9.3.6.1 A number of companies provide testing, inspecting, and certifying services in Switzerland

TABLE 188 SWITZERLAND MARKET, BY APPLICATION, 2018–2021(USD MILLION)

TABLE 189 SWITZERLAND MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.7 REST OF EUROPE (ROE)

9.3.7.1 Massive MIMO antenna systems to contribute to the rapid development of 5G infrastructure in Rest of Europe

TABLE 190 REST OF EUROPE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 191 REST OF EUROPE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC (APAC)

FIGURE 34 APAC WIRELESS TESTING MARKET SNAPSHOT

TABLE 192 APAC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 193 APAC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 194 APAC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 195 APAC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 APAC MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 197 APAC MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 198 APAC WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 199 APAC WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 200 APAC WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 201 APAC WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Significant deployment of advanced wireless infrastructures leading to the growth of the market in Japan

TABLE 202 JAPAN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 203 JAPAN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Deployment of 5G services in China to fuel market growth for wireless testing

TABLE 204 CHINA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 205 CHINA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Launch of 4G and 5G networks to fuel the growth of the market in India

TABLE 206 INDIA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 207 INDIA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 R&D activities and field trials for 5G technology expected to contribute to the growth of the wireless testing market in South Korea

TABLE 208 SOUTH KOREA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 209 SOUTH KOREA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.5 TAIWAN

9.4.5.1 E&E and wireless testing platform of Taiwan used to test wireless technologies

TABLE 210 TAIWAN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 211 TAIWAN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.6 AUSTRALIA

9.4.6.1 Australia has a mature regulatory framework for ICT products

TABLE 212 AUSTRALIA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 213 AUSTRALIA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.7 SINGAPORE

9.4.7.1 Frequency band fees waiver for 5G trials expected to contribute to the adoption of the 5G network in Singapore

TABLE 214 SINGAPORE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 215 SINGAPORE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.8 REST OF APAC (ROAPAC)

9.4.8.1 Rapid developments related to 5G network implementation expected to fuel the growth of the market in Rest of APAC

TABLE 216 REST OF APAC WIRELESS TESTING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 217 REST OF APAC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

FIGURE 35 ROW MARKET SNAPSHOT

TABLE 218 ROW MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 219 ROW MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 220 ROW MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 221 ROW MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 222 ROW MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 223 ROW MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 224 ROW WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 225 ROW WIRELESS NETWORK TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 226 ROW WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 227 ROW WIRELESS DEVICE TESTING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Increased demand for improved data transfer speed expected to fuel the growth of the wireless testing market in South America

TABLE 228 SOUTH AMERICA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 229 SOUTH AMERICA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.2 MIDDLE EAST

9.5.2.1 Deployment of 5G technology expected to lead to the growth of the market in the Middle East

TABLE 230 MIDDLE EAST MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 231 MIDDLE EAST MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.3 AFRICA

9.5.3.1 Increase in mobile data traffic expected to lead to an increased requirement for wireless testing of mobile networks in Africa

TABLE 232 AFRICA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 233 AFRICA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 203)

10.1 INTRODUCTION

10.2 REVENUE ANALYSIS: TOP - COMPANIES

FIGURE 36 DOMINANCE OF TOP 3 PLAYERS IN WIRELESS TESTING SERVICE PROVIDERS MARKET IN LAST 5 YEARS

10.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 234 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE MARKET

10.4 MARKET SHARE ANALYSIS, 2021

TABLE 235 WIRELESS TESTING SERVICE MARKET: DEGREE OF COMPETITION

FIGURE 37 MARKET SHARE, BY COMPANY (2021)

TABLE 236 WIRELESS TESTING EQUIPMENT MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE, BY COMPANY (2021)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 39 WIRELESS TESTING MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

10.6 WIRELESS TESTING MARKET: COMPANY FOOTPRINT

10.6.1 APPLICATION AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 237 APPLICATION AND REGIONAL FOOTPRINT OF COMPANIES

TABLE 238 APPLICATION FOOTPRINT OF COMPANIES

TABLE 239 REGIONAL FOOTPRINT OF COMPANIES

10.7 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2021

10.7.1 PROGRESSIVE COMPANY

10.7.2 RESPONSIVE COMPANY

10.7.3 DYNAMIC COMPANY

10.7.4 STARTING BLOCK

FIGURE 40 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

10.8 COMPETITIVE SITUATIONS & TRENDS

TABLE 240 WIRELESS TESTING MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 241 MARKET: DEALS

TABLE 242 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 243 AI IN MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11 COMPANY PROFILE (Page No. - 218)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 SGS GROUP

TABLE 244 SGS GROUP: BUSINESS OVERVIEW

FIGURE 41 SGS GROUP: COMPANY SNAPSHOT

11.1.2 BUREAU VERITAS

TABLE 245 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 42 BUREAU VERITAS: COMPANY SNAPSHOT

11.1.3 INTERTEK

TABLE 246 INTERTEK: BUSINESS OVERVIEW

FIGURE 43 INTERTEK: COMPANY SNAPSHOT

11.1.4 DEKRA SE

TABLE 247 DEKRA SE: BUSINESS OVERVIEW

11.1.5 ANRITSU

TABLE 248 ANRITSU: BUSINESS OVERVIEW

FIGURE 44 ANRITSU: COMPANY SNAPSHOT

11.1.6 KEYSIGHT

TABLE 249 KEYSIGHT: BUSINESS OVERVIEW

FIGURE 45 KEYSIGHT: COMPANY SNAPSHOT

11.1.7 ROHDE & SCHWARZ

TABLE 250 ROHDE & SCHWARZ: BUSINESS OVERVIEW

11.1.8 VIAVI SOLUTIONS

TABLE 251 VIAVI SOLUTIONS: BUSINESS OVERVIEW

FIGURE 46 VIAVI SOLUTIONS: COMPANY SNAPSHOT

11.1.9 TÜV NORD GROUP

TABLE 252 TÜV NORD GROUP: BUSINESS OVERVIEW

FIGURE 47 TÜV NORD GROUP: COMPANY SNAPSHOT

11.1.10 EXFO

TABLE 253 EXFO: BUSINESS OVERVIEW

FIGURE 48 EXFO: COMPANY SNAPSHOT

11.2 OTHER KEY PLAYERS

11.2.1 TÜV RHEINLAND

11.2.2 TÜV SÜD

11.2.3 SPIRENT COMMUNICATIONS

11.2.4 EUROFINS SCIENTIFIC

11.2.5 APPLUS+GROUP

11.3 STARTUP ECOSYSTEM

11.3.1 CELONA

11.3.2 VERKOTAN

11.3.3 BLUFLUX

11.3.4 TESTILABS

11.3.5 ELEMENTS MATERIALS TECHNOLOGY

11.3.6 EVTL INDIA

11.3.7 QUADSAT

11.3.8 IOTAS- GLOBAL WIRELESS TESTING

11.3.9 ELECTROMAGNETIC TEST INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 267)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the wireless testing market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations (such as International IT and Telecommunication Union (ITU), European Wireless Infrastructure Association (Europe), Wireless Infrastructure Association (US),); white papers, wireless testing related marketing journals, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases.

Secondary research has been conducted to obtain key information about the supply chain of the wireless testing industry, monetary chain of the market, the total pool of key players, and market segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both market- and technology oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

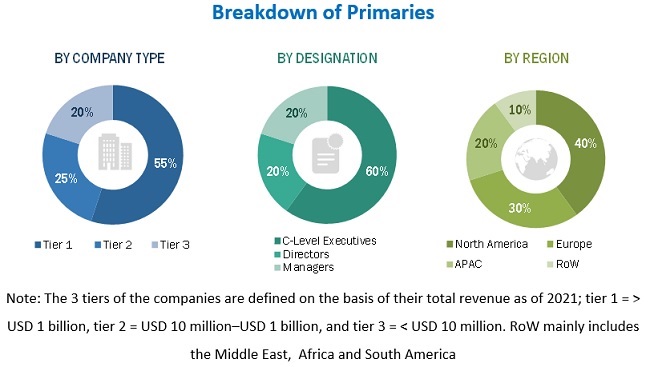

Extensive primary research has been conducted after acquiring an understanding of wireless testing market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand-(manufacturing industries such as consumer electronics and automotive indusrty) and supply-side (wireless testing equipment and service providers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (the South America, Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

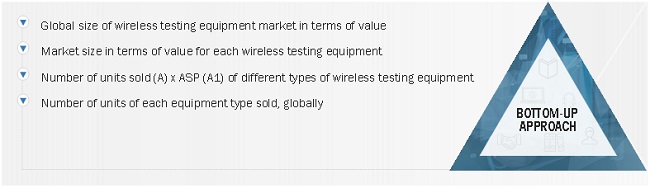

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the wireless testing market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various process industries that are using or are expected implement wireless testing related to equipment and services.

- Conducting multiple on-field discussions with key opinion leaders of major companies involved in the development of wireless testing for various applications in different regions

- Understanding the demand for wireless testing equipment in different regions

- Calculating the volume of wireless testing equipment shipped globally

- Obtaining the overall size of the wireless testing equipment market by multiplying the total shipment with the average selling price (ASP) of each wireless testing equipment

- Estimating and understanding the demand generated by industries in the overall wireless testing market; this helps in understanding the demand generated by the industries and related companies for both pre- and post-COVID-19 scenarios

- Tracking the ongoing and upcoming implementation of AI in manufacturing projects by process industries and forecasting the market based on these developments and anticipated changes in the demand in the post-COVID-19 scenario

- Analyzing the wirlees testing companies as per their countries and then combining this information to get the market estimate by regions

- Verifying the estimate at every level through discussions with key opinion leaders, such as CXOs, directors, and operation managers, and then finally with the domain experts based within MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the wireless testing market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To describe, analyze, and forecast the wireless testing market, in terms of value, based on offering, connectivity technology, application, and region

- To estimate and forecast the size of the offering segment, in terms of volume, based on equipment

- To describe and forecast the market size, in terms of value for various segments, with regard to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the wireless testing market, globally

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the wireless testing market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with the detailed competitive landscape for market leaders

- To provide a detailed competitive landscape for the market leaders

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research and development (R&D) in the wireless testing market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Testing Market