X-ray Inspection System Market by Technique (Film-Based Imaging, Digital Imaging (Computed Tomography, Computed Radiography, Direct Radiography)), Dimension (2D, 3D), Vertical (Manufacturing, Oil & Gas, Aerospace), and Geography - Global Forecast to 2023

[142 Pages Report] The X-ray inspection system market is expected to be valued at USD 860.5 Million by 2023 from USD 545.0 Million in 2016, at a CAGR of 6.51% between 2017 and 2023. The base year considered for the study is 2016, and the forecast period provided is between 2017 and 2023.

Objectives of Study:

- To define, describe, and forecast the global X-ray inspection system market, in terms of value, on the basis of technique, dimension, vertical, and geography

- To forecast the market size, in terms of value, for the concerned segments with regard to four main regions, namely, Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically analyze the micromarkets with regard to the individual growth trends, prospects, and contribution to the market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and the details of the competitive landscape for the market leaders

- To provide a detailed overview of the X-ray inspection system value chain

- To benchmark players within the market using proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

- To analyze competitive developments such as partnerships, acquisitions, expansions, agreements, collaborations, contracts, and product launches, along with research and development (R&D) in the market

- To strategically profile key players of the X-ray inspection system market and comprehensively analyze their market shares and core competencies

Research Methodology:

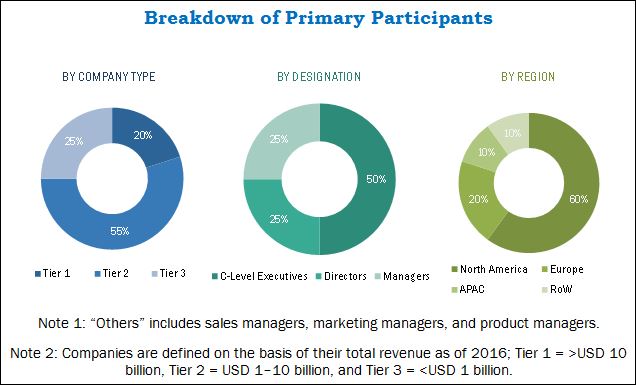

This research involves the use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the extensive technical, market-oriented, and commercial study of the X-ray inspection systems. Primary sources mainly comprise several industry experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, standards, and certification organizations related to various parts of the value chain of the industry. In-depth interviews with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key players, and industry consultants have been conducted to obtain and verify critical qualitative and quantitative information as well as assess prospects. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

In 2016, the X-ray inspection system market was dominated by North Star Imaging, Inc. (US), Nikon Metrology NV (Belgium), Nordson DAGE (UK), YXLON International GmbH (Germany), VJ Group, Inc. (US), 3DX-RAY Ltd. (UK), VisiConsult X-ray Systems & Solutions GmbH (Germany), Smiths Detection, Inc. (UK), Mettler-Toledo International Inc. (Switzerland), and General Electric Co. (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

20172023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

North Star Imaging, Inc. (US), Nikon Metrology NV (Belgium), Nordson DAGE (UK), YXLON International GmbH (Germany), VJ Group, Inc. (US), 3DX-RAY Ltd. (UK), VisiConsult X-ray Systems & Solutions GmbH (Germany), Smiths Detection, Inc. (UK), Mettler-Toledo International Inc. (Switzerland), and General Electric Co. (US). |

Key Target Audience:

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Technology and solution providers

- Software service providers

- Rental service providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Trainers and consultants

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

Scope of Report:

The research report segments the market into the following submarkets:

- X-ray Inspection System Market, by Technique

- FilmBased Imaging

- Digital Imaging

- Computed Tomography (CT)

- Computed Radiography (CR)

- Direct Radiography (DR)

- Market, by Dimension

- 2D

- 3D

- Market, by Vertical

- Manufacturing

- Oil and Gas

- Aerospace

- Government Infrastructure

- Automotive

- Power Generation

- Food and Pharmaceuticals

- Others (Research and development, marine, and plastics and polymers.)

- Market, by Geography

- Americas

- US

- Canada

- Mexico

- Brazil

- Rest of Americas

- Europe

- UK

- France

- Germany

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

- Rest of the World (RoW)

- Middle East

- Africa

- Americas

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

X-Ray Inspection System Market Analysis

- Further breakdown of the other vertical segment into subcategories

- Further breakdown of the regions into various countries

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Get more insight on other verticals of Semiconductor and Electronics Market Research Reports & Consulting

The X-ray inspection system market is expected to be valued at USD 860.5 Million by 2023, at a CAGR of 6.51% between 2017 and 2023. Growing consumer awareness raising the bar of safety and quality standards acts as a driver for the growth of the market. Moreover, stringent government regulations due to security concerns, and demand from both developed and developing economies also drive the growth of this market.

This report segments the market on the basis of technique, dimension, vertical, and geography. Digital imaging held a larger share of the market based on technique in 2016. The increased use of systems based on digital imaging technique for detection of damages such as cracks, reduction in time of image processing, and 3D visualization ability contribute to a high growth of the market for this segment.

3D X-ray inspection system market is expected to grow at a higher CAGR during the forecast period. The growth of this market can be attributed to the use of 3D X-ray inspection systems in a wide range of industries, from semiconductors to automotive manufacturing, and their vital role in quality control. These systems also allow manufacturers to diagnose issues such as metal bridging, foreign materials, and construction defects in 3D planes.

The oil and gas vertical held the largest share of the X-ray inspection system market in 2016. X-ray inspection systems are widely used in both the downstream as well as upstream segments of the oil and gas wells. X-ray inspection systems are highly efficient in delivering solutions for the pressure vessels, pipes, boilers, and valves inspections, which, in turn, is driving the growth of this market.

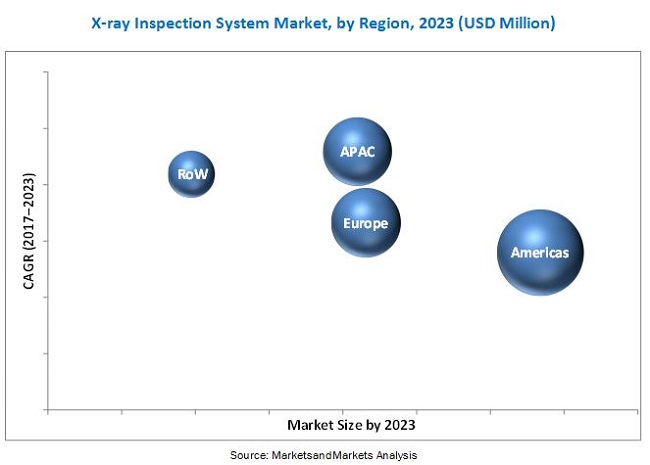

The X-ray inspection system market in Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the continuous demand for cost-effective and fast-processing X-ray inspection systems from the oil and gas, and power generation verticals.

The risk of radiation exposure and high system cost act as a restraint for the overall X-ray inspection system market. Though the X-ray inspection systems provide an assured return on investment for the durability of complex machinery, the deployment cost of these systems is currently beyond limits for some of the industry minors. The end users see it as a burden on the company investments and thus prefer third-party inspection services.

The key players in the X-ray inspection system market include North Star Imaging, Inc. (US), Nikon Metrology NV (Belgium), Nordson DAGE (UK), YXLON International GmbH (Germany), VJ Group, Inc. (US), 3DX-RAY Ltd. (UK), VisiConsult X-ray Systems & Solutions GmbH (Germany), Smiths Detection, Inc. (UK), Mettler-Toledo International Inc. (Switzerland), and General Electric Co. (US).

These players adopted various strategies such as product launches, partnerships, acquisitions, expansions, agreements, collaborations, and contracts to grow in the X-ray inspection system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of Study

1.2 Definition

1.3 Scope of Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in X-Ray Inspection System Market

4.2 Market, By Dimension

4.3 Market in APAC, By Technique and By Country

4.4 Market, By Vertical

4.5 Country-Wise Analysis of Market

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Government Regulations Due to Security Concerns

5.2.1.2 Growing Consumer Awareness Raising the Bar of Safety and Quality Standards

5.2.1.3 Demand From Both Developed and Developing Economies

5.2.2 Restraints

5.2.2.1 Risk of Radiation Exposure

5.2.2.2 High System Cost

5.2.3 Opportunities

5.2.3.1 Automation in Digital X-Ray Inspection Systems

5.2.3.2 Miniaturization of Products of the End-User Industries

5.2.3.3 Availability of Customized Solutions

5.2.4 Challenges

5.2.4.1 Lack of Skilled and Qualified Personnel

5.2.4.2 Availability of Substituent Technologies for Inspection

5.3 Value Chain Analysis

6 Market Analysis, By Technique (Page No. - 46)

6.1 Introduction

6.2 Film-Based Imaging

6.3 Digital Imaging

6.3.1 Computed Tomography

6.3.2 Computed Radiography

6.3.3 Direct Radiography

7 Market Analysis, By Dimension (Page No. - 58)

7.1 Introduction

7.2 2D

7.3 3D

8 Market Analysis, By Vertical (Page No. - 63)

8.1 Introduction

8.2 Manufacturing

8.3 Oil & Gas

8.3.1 Natural Gas Liquefaction Plants

8.3.2 Subsea Pipelines

8.3.3 Refining

8.3.4 Transmission Pipelines

8.3.5 Storage Tanks

8.4 Aerospace

8.4.1 Engine Part Production

8.4.2 Composite Airframe Manufacturing

8.4.3 Aircraft Maintenance

8.4.4 Material Analysis

8.5 Government Infrastructure

8.5.1 Military and Defense

8.5.2 Airport Security

8.5.3 Railways

8.5.4 Bridges and Tunnels

8.5.5 Border Crossing Security

8.6 Automotive

8.7 Power Generation

8.7.1 Nuclear Power

8.7.2 Wind Power

8.7.3 Solar Power

8.7.4 Fossil Fuel Energy

8.8 Food & Pharmaceuticals

8.9 Others

9 Geographic Analysis (Page No. - 82)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.2.4 Brazil

9.2.5 Rest of Americas

9.3 Europe

9.3.1 UK

9.3.2 France

9.3.3 Germany

9.3.4 Italy

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Rest of APAC

9.5 Rest of the World

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.2 Market Rank Analysis: X-Ray Inspection System Market

10.3 Competitive Leadership Mapping: Market

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Business Strategy Excellence (25 Companies)

10.4.2 Strength of Product Portfolio (25 Companies)

*Top 25 Companies Analyzed for This Study are - 3D X-RAY Ltd., Anritsu Infivis Inc., Ars S.R.L. Socio Unico, Creative Electron, Inc., Dandong Aolong Radiative Instrument Group Co., Ltd., Electron-X Ltd., General Electric Co., Glenbrook Technologies, Inc., Ishida Co., Ltd., Loma Systems, Mettler-Toledo International Inc., Nikon Metrology NV, Nordson DAGE, North Star Imaging, Inc., Scienscope International Corp., Sesotec GmbH, Shenzhen Zhuomao Technology Co., Ltd., Shimadzu Corp., Smiths Detection, Inc., Toshiba It & Control Systems Corp., Viscom Ag, VisiConsult X-ray Systems & Solutions GmbH, Vision Medicaid Equipments Pvt., Ltd., VJ Group, Inc., Yxlon International GmbH

10.5 Competitive Scenario

10.5.1 Product Launches

10.5.2 Agreements, Collaborations, Contracts, and Expansions

11 Company Profile (Page No. - 104)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments.)*

11.1 Introduction

11.2 North Star Imaging, Inc.

11.3 Nikon Metrology NV

11.4 Nordson DAGE

11.5 Yxlon International GmbH

11.6 VJ Group, Inc.

11.7 3DX-RAY Ltd.

11.8 VisiConsult X-ray Systems & Solutions GmbH

11.9 Smiths Detection, Inc.

11.10 Mettler-Toledo International Inc.

11.11 General Electric Co.

11.12 Key Innovators

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 134)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (63 Tables)

Table 1 X-Ray Inspection System Market, By Technique, 20152023 (USD Million)

Table 2 Types of Films Used for Inspection

Table 3 Market for Film-Based Imaging, By Vertical, 20152023 (USD Million)

Table 4 System Market for Film-Based Imaging, By Region, 20152023 (USD Million)

Table 5 Market for Digital Imaging, By Vertical, 20152023 (USD Million)

Table 6 Market for Digital Imaging, By Region, 20152023 (USD Million)

Table 7 Market for Digital Imaging, By Type, 20152023 (USD Million)

Table 8 Digital Imaging Market for Computed Tomography, By Vertical, 20152023 (USD Million)

Table 9 Digital Imaging Market for Computed Tomography, By Region, 20152023 (USD Million)

Table 10 Digital Imaging Market for Computed Radiography, By Vertical, 20152023 (USD Million)

Table 11 Digital Imaging Market for Computed Radiography, By Region, 20152023 (USD Million)

Table 12 Digital Imaging Market for Direct Radiography, By Vertical, 20152023 (USD Million)

Table 13 Digital Imaging Market for Direct Radiography, By Region, 20152023 (USD Million)

Table 14 Market, By Dimension, 20152023 (USD Million)

Table 15 Market for 2D, By Vertical, 20152023 (USD Million)

Table 16 Market for 2D, By Region, 20152023 (USD Million)

Table 17 Market for 3D, By Vertical, 20152023 (USD Million)

Table 18 Market for 3D, By Region, 20152023 (USD Million)

Table 19 Market, By Vertical, 20152023 (USD Million)

Table 20 Market for Manufacturing, By Technique, 20152023 (USD Million)

Table 21 Digital Imaging Market for Manufacturing, By Type, 20152023 (USD Million)

Table 22 Market for Manufacturing, By Region, 20152023 (USD Million)

Table 23 Market for Manufacturing, By Dimension, 20152023 (USD Million)

Table 24 Market for Oil and Gas, By Technique, 20152023 (USD Million)

Table 25 Digital Imaging Market for Oil and Gas, By Type, 20152023 (USD Million)

Table 26 Market for Oil and Gas, By Region, 20152023 (USD Million)

Table 27 Market for Oil and Gas, By Dimension, 20152023 (USD Million)

Table 28 Market for Aerospace, By Technique, 20152023 (USD Million)

Table 29 Digital Imaging Market for Aerospace, By Type, 20152023 (USD Million)

Table 30 Market for Aerospace, By Region, 20152023 (USD Million)

Table 31 Market for Aerospace, By Dimension, 20152023 (USD Million)

Table 32 Market for Government Infrastructure, By Technique, 20152023 (USD Million)

Table 33 Digital Imaging Market for Government Infrastructure, By Type, 20152023 (USD Million)

Table 34 Market for Government Infrastructure, By Region, 20152023 (USD Million)

Table 35 Market for Government Infrastructure, By Dimension, 20152023 (USD Million)

Table 36 Market for Automotive, By Technique, 20152023 (USD Million)

Table 37 Digital Imaging Market for Automotive, By Type, 20152023 (USD Million)

Table 38 Market for Automotive, By Region, 20152023 (USD Million)

Table 39 Market for Automotive, By Dimension, 20152023 (USD Million)

Table 40 Market for Power Generation, By Technique, 20152023 (USD Million)

Table 41 Digital Imaging Market for Power Generation, By Type, 20152023 (USD Million)

Table 42 Market for Power Generation, By Region, 20152023 (USD Million)

Table 43 Market for Power Generation, By Dimension, 20152023 (USD Million)

Table 44 Market for Food and Pharmaceuticals, By Technique, 20152023 (USD Million)

Table 45 Digital Imaging Market for Food and Pharmaceuticals, By Type, 20152023 (USD Million)

Table 46 Market for Food and Pharmaceuticals, By Region, 20152023 (USD Million)

Table 47 Market for Food and Pharmaceuticals, By Dimension, 20152023 (USD Million)

Table 48 Market for Others, By Technique, 20152023 (USD Million)

Table 49 Digital Imaging Market for Others, By Type, 20152023 (USD Million)

Table 50 Market for Others, By Region, 20152023 (USD Million)

Table 51 Market for Others, By Dimension, 20152023 (USD Million)

Table 52 Market, By Region, 20152023 (USD Million)

Table 53 Market for Americas, By Vertical, 20152023 (USD Million)

Table 54 Market in Americas, By Dimension 20152023 (USD Million)

Table 55 Market in Americas, By Country, 20152023 (USD Million)

Table 56 Market for Europe, By Vertical, 20152023 (USD Million)

Table 57 Market in Europe, By Dimension, 20152023 (USD Million)

Table 58 Market in Europe, By Country, 20152023 (USD Million)

Table 59 Market in APAC, By Country, 20152023 (USD Million)

Table 60 Market in APAC, By Vertical, 20152023 (USD Million)

Table 61 Market for RoW, By Vertical, 20152023 (USD Million)

Table 62 Market in RoW, By Region, 20152023 (USD Million)

Table 63 Top 5 Players in Market: Market Rank (2016)

List of Figures (37 Figures)

Figure 1 Market: Research Design

Figure 2 Process Flow

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Computed Tomography to Hold Largest Share of Digital Imaging Market Between 2017 and 2023

Figure 8 Market for 3D to Grow at Higher CAGR Between 2017 and 2023

Figure 9 Market for Manufacturing to Grow at Highest CAGR Between 2017 and 2023

Figure 10 Market in APAC to Grow at Highest CAGR Between 2017 and 2023

Figure 11 Growing Industrial Automation Driving Market During the Forecast Period

Figure 12 2D to Hold Larger Size Market During Forecast Period

Figure 13 Computed Tomography in Imaging Technique and Japan to Hold Largest Market Shares in APAC in 2016

Figure 14 Market for Manufacturing to Grow at Highest CAGR During Forecast Period

Figure 15 US to Account for Largest Share of Market in 2017

Figure 16 Demand From Both Developed and Developing Countries Drives Market

Figure 17 Value Chain Analysis: Major Value Added During Raw Material Suppliers and Original Equipment Manufacturers Phases

Figure 18 Market for Digital Imaging to Grow at Higher CAGR Between 2017 and 2023

Figure 19 Market for Digital Direct Radiography to Grow at Highest CAGR Between 2017 and 2023

Figure 20 Market for 3D X-Ray Inspection Systems to Grow at Higher CAGR Between 2017 and 2023

Figure 21 Market for Manufacturing to Grow at Highest CAGR Between 2017 and 2023

Figure 22 Market: Geographic Snapshot

Figure 23 Overview of X-Ray Inspection System Market in Americas

Figure 24 Overview of Market in Europe

Figure 25 Overview of Market in APAC

Figure 26 Overview of Market in RoW

Figure 27 Key Growth Strategies Adopted By Top Companies Between January 2015 and May 2017

Figure 28 Product Launch as Key Strategy Between January 2015 and May 2017

Figure 29 North Star Imaging, Inc.: Company Snapshot

Figure 30 Nikon Metrology NV: Company Snapshot

Figure 31 Nordson DAGE.: Company Snapshot

Figure 32 Yxlon International GmbH: Company Snapshot

Figure 33 Scorecard: Business Strategy

Figure 34 3D X-Ray Ltd.: Company Snapshot

Figure 35 Smiths Detection, Inc.: Company Snapshot

Figure 36 Mettler-Toledo International Inc.: Company Snapshot

Figure 37 General Electric Co.: Company Snapshot

Growth opportunities and latent adjacency in X-ray Inspection System Market

I'd like to see sample before deciding payment. So please share the sample of the report.